Funds Management

Funds Management focuses on building savings for retirement by providing investment strategies that seek to deliver superior investment returnsFunds Management is Australia’s third largest active fund manager and is diversifying globally, with operations in Europe, Japan and Singapore.The Funds Management segment comprises two business divisions, Fidante Partners and CIP Asset Management (CIPAM). The Fidante Partners’ business model involves taking minority equity interests in separately branded boutique funds management firms, with Challenger providing distribution, administration and business support, leaving investment managers to focus entirely on managing investment portfolios. Fidante Partners’ business model has allowed it to attract and build successful active equity, active fixed income and alternative investment managers, while maintaining strong investment performance. CIPAM principally originates and manages fixed income and commercial real estate, along with providing investment solutions for leading global and Australian institutions, including Challenger Life. |

|

"Our Funds Management business is the third largest and one of the fastest growing active managers in the country. It’s a standout performer among its peers and has many avenues for ongoing growth."

Nick Hamilton - Chief Executive, Funds Management

Funds Management's 2021 financial performance

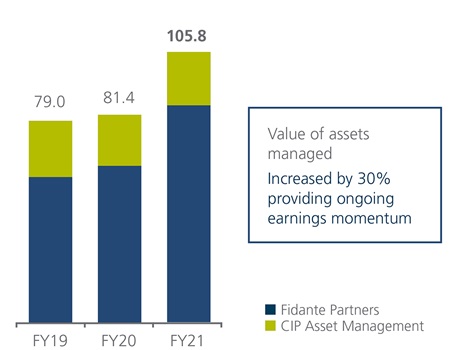

Funds Under Management (FUM) ($bn)

|

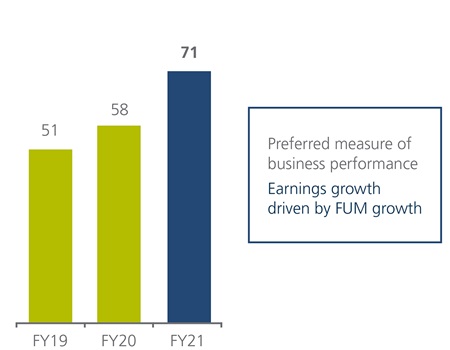

Funds Management EBIT2 ($m)

|

Expanding capability through partnerships with best-in-class investment managers

Fidante Partners is expanding its offering by developing new investment strategies for existing managers, adding new boutiques and forming partnerships with best-in-class investment managers.

|

Over the last two years, Fidante Partners has evolved its business model with the formation of partnerships with best-in-class asset managers, providing clients with differentiated investment products. |

|

In 2019, Fidante Partners and Ares Management Corporate (NYSE: ARES) formed a strategy joint venture, Ares Australia Management (AAM). Since then, AAM has designed and launched two new credit funds. |

|

In 2020, Fidante Partners’ European business partnered with Proterra Investment Partners, a leading private equity fund manager focused on the food and agribusiness sectors. |

|

Fidante Partners entered into a distribution partnership agreement with the number one Japanese investment trust manager, Nomura Asset Management. Fidante Partners has been selected to exclusively distribute the Nomura Global Dynamic Bond Fund and Nomura Global Multi-Theme Equity Fund products in Australia and New Zealand. |

|

In 2021, Fidante Partners and global specialist asset manager Impax Asset Management Limited (Impax) entered into a new distribution agreement, with Fidante Partners becoming Impax’s exclusive distribution partner in Australia and New Zealand. Impax is a global leader dedicated to investing in the transition to a more sustainable economy. |

CIP Asset Management fixed income product expansion and evolution

Challenger is Australia’s largest fixed income manager managing $57 billion across both Fidante Partners and CIP Asset Management (CIPAM)

Challenger Investment Partners was formed over 20 years ago, with the business evolving from servicing just Challenger Life only to providing solutions to a broad range of third party clients.CIPAM has significantly expanded its retail and high net worth fixed income offering. CIPAM now has three retail focused credit funds, providing investors with a range of return and risk options.

Return targets range from cash plus three percent per annum to cash plus eight percent per annum

CIPAM fixed income offering

| CIPAM credit income fund | Targets cash plus three percent per annum A floating rate, multi-sector credit strategy investing in public and private debt markets. The Fund aims to provide high net worth investors with capital stability and income on a regular basis accompanied by lower levels of volatility than traditional fixed income strategies. |

| CIPAM multi-sector private lending fund |

Targets cash plus five percent per annum A multi-sector credit strategy investing in Australian and New Zealand private securitised, corporate and real estate lending. |

| CIPAM private lending opportunities fund | Targets cash plus eight percent per annum A higher returning fund open to institutional investors, focusing on floating rate investments in mezzanine private lending opportunities, primarily within Australia and New Zealand percent. |

1) Consolidated FUM for Australian Fund Managers - Rainmaker Roundup, March 2021.

2) Plan For Life Wholesale Trust Data, September 2020, December 2020 and March 2021.

2) Earnings before interest and tax (EBIT).