Life

Life focuses on the retirement spending phase of superannuation, providing products that help customers convert retirement savings into safe and secure income in retirementAs Australia’s leading provider of annuities1, Challenger Life is expected to benefit from the long-term growth in Australia’s superannuation system and regulatory reforms designed to enhance the retirement phase.The Life business includes Challenger Life Company Limited (CLC), an APRA regulated life insurance company and Australia’s leading provider of annuities and guaranteed retirement income products. Challenger has been recognised as a retirement income product innovator and has won the Association of Financial Advisers ‘Annuity Provider of the Year’ for the last 13 years and remains the dominant retirement income brand in Australia. In Japan, Life has an annuity relationship with Mitsui Sumitomo Primary Life Insurance Company Limited, a leading provider of foreign currency annuities in Japan and a subsidiary of MS&AD Insurance Group Holdings Inc., to provide Australian dollar and US dollar annuities. |

|

"Our strategy to diversify sales and revenue is working. The Life business delivered record sales and is in a solid position. We remain very strongly capitalised and have solid foundations in place to support our next phase of growth."

Angela Murphy - Chief Executive, LifeLife’s 2021 financial performance

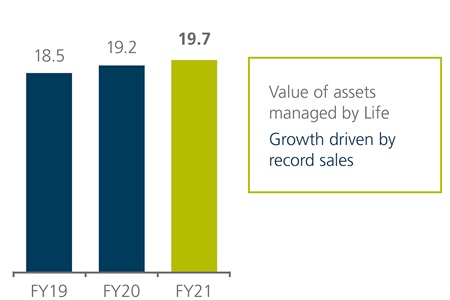

Average investment assets ($bn)

|

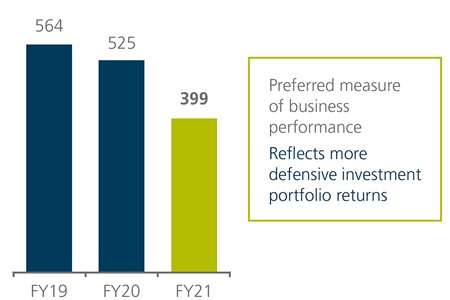

Normalised EBIT2 ($m)

|

Record Life sales

Challenger is focused on diversifying its sales in order to build a more resilient business

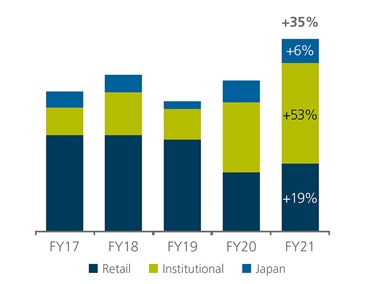

Sales increased across all key product categories, including domestic annuities (up 23%), institutional guaranteed business (up 54%), and Japanese annuity sales (up 6%).Total Life sales increased by 35%, benefiting from Challenger’s diversification strategy, which includes:

- Increasing focus on the institutional channel (refer below for more detail);

- Working with a wider range of independent financial advice networks following structural change in the domestic advice market; and

- Leveraging its MS Primary annuity relationship in Japan, including reinsuring US dollar denominated products.

Challenger has a reputation for providing an excellent customer experience, with a Net Promoter Score of 35%, and 91% of clients satisfied or very satisfied3.

Life sales ($m)

|

Institutional partnerships and collaboration

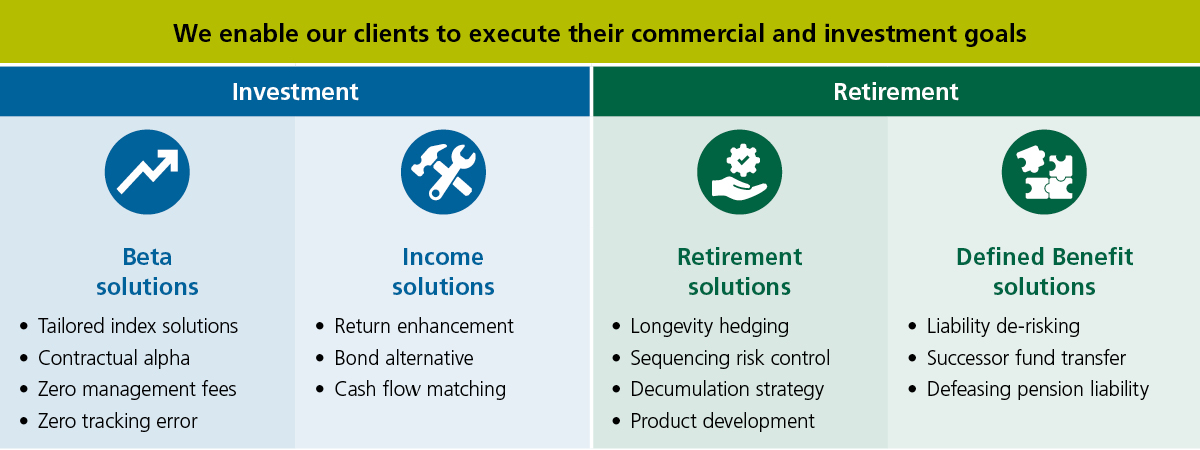

Challenger is focused on providing institutional investors with targeted retirement solutions and partnering with them to help provide their members with financial security in retirement

We support our partners by obtaining an understanding of the needs of their clients and take a solutions-based approach.

Life has four solution pillars to innovate creatively and assist clients. Our proposition is highly differentiated, and it is this differentiation that is driving strong growth.

We do this by offering innovative strategies catering to the needs of superannuation funds, insurance companies and multi-managers.

Life’s institutional business continues to grow strongly and increased by 81% over FY21, and has increased by an annual growth rate of 32% each year for the past five years.

Challenger Life Institutional offering has four solutions pillars

1) Plan for Life - March 2021 - based on annuities under administration.

2) Earnings before interest and tax (EBIT).

3) Fifth Quadrant, February 2021