Designing an intelligent and scalable retirement income solution

Part 1: The role for protection strategies in balancing flexibility with capital protection.

How have older members’ retirement income preferences changed following the sustained high inflation environment?

National Seniors Australia, in partnership with Challenger, sought to find out how increased living costs were affecting older Australians through a set of questions in the annual National Seniors Social Survey (the Survey).

Financial preferences in retirement

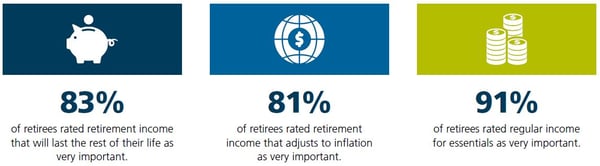

Feeling financially comfortable is important for ensuring quality of later life. The Survey included a set of questions asking respondents to rate the importance of various financial outcomes with the aim of providing a snapshot of the financial priorities and needs that contribute to financial comfort.

The preferences of retirees were consistent with the preferences noted in 2018 when a similar question was asked in the Survey. There has been an increased focus on income that adjusts for inflation, which is likely to have arisen due to the material uptick in cost of living.

Stable vs variable income preferences

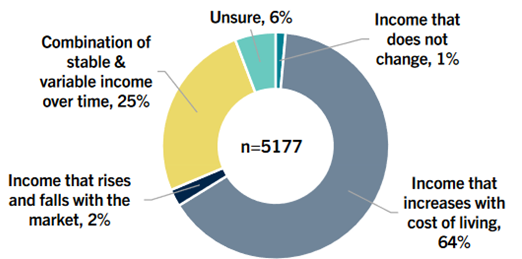

The Survey also asked about income preference and changes in investment markets. The chart below shows the proportion of respondents who nominated each of the income preference options.

The findings bring to life three dominant themes. The majority of respondents prefer an income that increases with the cost of living. Some respondents have expressed a preference for an income stream that combines a layer of stable income with a layer of variable income over time. Interestingly, only 2% of respondents expressed a preference for income that rises and falls with markets.

Statistical analysis then tested associations with levels of savings and the long-term cost of living concerns. It found that respondents with less savings were more likely to prefer an income that increases with the cost of living. Conversely, wealthier respondents were more likely to want a combination of stable and variable income.

Alignment to the priorities of the Retirement Income Covenant

The preference of respondents for income that adjusts for inflation and money that lasts a lifetime align with two of the three risk mitigation priorities of the Retirement Income Covenant.

The third risk identified in the Covenant relates to income instability due to market movements. Protecting income from market forces was rated as important by most but was not prioritised in comparison to most other options.

As seen above, there was a strong preference for income that increased with the cost of living. Very few opted for income linked to market swings.

What super funds can do

Protection from the rising cost-of-living is highly sought by retirees and those approaching retirement. The Age Pension provides some inflation protection but is inadequate as a sole income source. It is also not the solution for most retiree households, whose income is drawn from super.

However, there is the potential for super funds to provide a better outcome that ensures retirees’ peace of mind in the face of increasing living costs. Financial wellbeing is essential to quality of life in older age and rapidly increasing living costs are undermining the financial wellbeing of retirees.

Simplicity is a key success factor in delivering retirement outcomes for members that address the cost of living challenges. Most retirees will not seek comprehensive advice, but trustees can provide guidance that can help members achieve their retirement goals. Keeping it simple by incorporating the cohort-based strategies inside a guided choice framework can deliver outcomes to members that can maximise the income they will have in retirement.

Source: National Seniors Australia and Challenger (2023) The cost of living and older Australians’ financial wellbeing. Canberra: National Seniors Australia and Challenger.

Related content

Defined Benefit de-risking

Capital Preferences roundtable outcomes