Building out member pathways to deliver retirement income solutions

Designing an intelligent and scalable retirement income solution

Part 1: The role for protection strategies in balancing flexibility with capital protection.

Dr David Bell of the Conexus Institute was the special guest at the last Challenger’s retirement roundtables in March 2025. Interest in the discussion was high, and sessions were held in both Sydney and Melbourne. There was an active discussion in both sessions which were conducted with super fund executives and industry consultants under the Chatham House rule. This note provides a summary of the main points and key themes in the discussion.

The goal of super is to provide members with money to spend in retirement

One point that the session highlighted was that the best member outcomes depend on the interaction of support and guidance with the right retirement solutions for members. And this needs to be an iterative process.

An integrated retirement solution combines the asset allocation strategy with a drawdown strategy and can include specific options to manage longevity risk. Members need support to understand these solutions and guidance to select the appropriate retirement options (or at least when to start one). Member engagement has to start well before retirement and feedback from this guidance can help funds to better tailor their solutions to members.

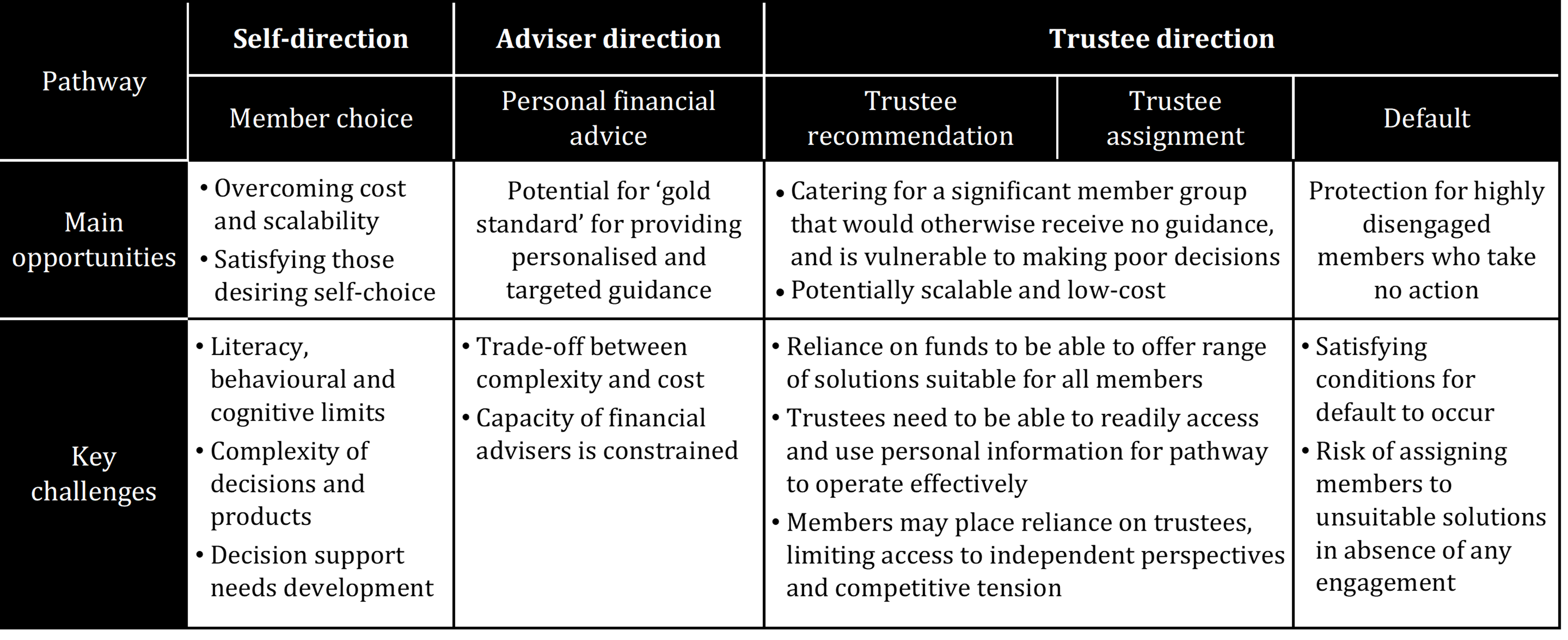

There are a range of ways that funds can assist their members. The Conexus Institute describes five different pathways, in three themes as depicted in the table below.

Source: Conexus Institute

Selecting the implementation pathway will depend on the capability of the fund and the engagement of their member base. To meet the needs of all members, funds will likely need to enable multiple pathways and some funds are already doing this with success. A critical element to delivering better member outcomes is a triage process that directs the member down the right pathway. This could be a path to financial advice (internal or external), or the member might be nudged toward the trustee-supported solutions, pending the implementation of the Delivering Better Financial Outcomes (DBFO) reforms. In any case, early interaction with the member is required to educate them on the available retirement options and how best to access them.

Current industry examples

The discussion included a range of funds that are already utilising the different pathways to help their members in and approaching retirement. The only pathway with no activity is the default approach. While some funds have considered if defaulting members into a retirement income solution would be possible with legislative reform, there has been limited action by any super fund to implement this concept (although the Account Based Pension can already be considered a soft-default solution). There has been a lot more activity on nudging members, with expectations that the DBFO reforms will help funds provide more guidance and assistance through nudges.

The role of financial advice is critical to help the members in many super funds. Some have used external advice models to deliver the best-in-class approach for their members, while others have adopted an internal advice approach, leveraging capabilities across the range of advice, from general to limited to full comprehensive advice offers. This investment across the entire advice spectrum allows super funds to offer multiple engagement points and meet their members’ preferences of interaction and decision making.

Future progress expected

There was a broad consensus that funds will continue to embrace the various pathways to engage members on retirement. With regulatory scrutiny on member outcomes, most funds are seeing the opportunity to engage more with their retiring members to deliver a better retirement outcome. A retirement solution that effectively manages the retirement risks and making it easily accessible remain important considerations.