Macro Musing: Will Artificial Intelligence revolutionise the economy and financial markets?

Financial wellbeing and rising costs of living

How have older members’ retirement income preferences changed following the sustained high inflation environment?

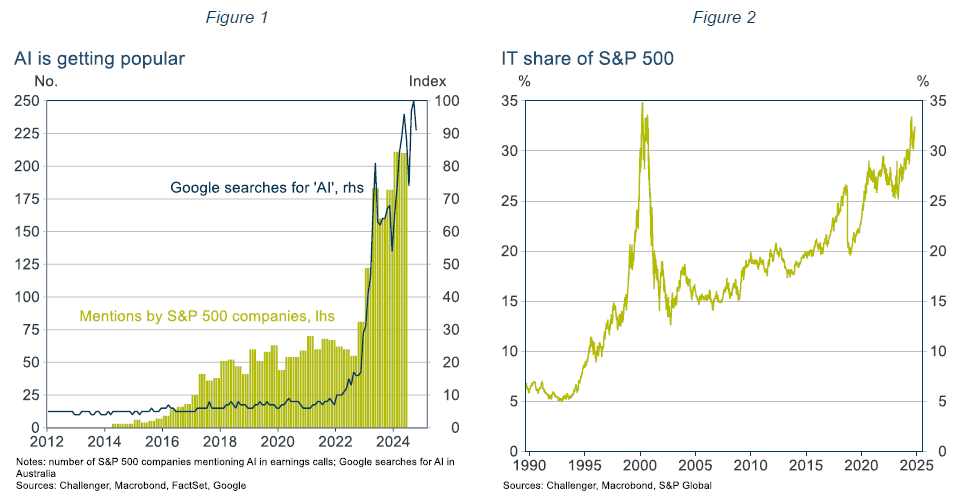

AI has the potential to be truly transformative, not only in the tech sector but for the economy and financial markets. The focus on AI has soared since the launch of ChatGPT and more recently DeepSeek (Figure 1) driving the IT sector’s share of the S&P 500 to close to the dot.com peak (Figure 2).1 AI is frequently front of mind for most Investment Committees.

This note addresses key questions for investors and finance professionals: How much will AI boost to firms’ output and profits? Or has the hype already exceeded its near-term potential? How will AI influence different assets’ absolute and relative returns? And closer to home, will AI upend financial sector work?

Developments in AI are making it more useful for businesses

Recent developments in AI have significantly increased its versatility, enhancing its capabilities across a range of work tasks. Large language models (LLMs), such as ChatGPT and DeepSeek, that underlie generative AI can be applied to many purposes, unlike earlier AI systems designed for a specific task or purpose. Innovations in multimodal capabilities (text, audio, video) have further broadened the scope of tasks where AI can match or even exceed human performance. As with many new technologies, no doubt there will be productive uses beyond what we can currently imagine.

AI’s recent achievements show just how fast it is evolving(see for example Furman and Seamans, 2019).

- In just the past decade, AI has matched human-level performance in: image recognition (2015), speech recognition (2017), reading comprehension and handwriting recognition (by 2018), language understanding (by 2019) before essentially matching on predictive reasoning (almost equal as at 2023) (see Our World in Data). An important caveat is of course that this performance is in specific environments.

- In a simulated bar exam Chat GPT-4 placed in the top 10%, a significant improvement from the previous iteration, Chat GPT-3.5, which was in the bottom 10%.2

The ability to deploy AI within closed corporate IT systems is enabling businesses to adopt AI and develop AI without sharing confidential material, accelerating both take-up and innovation.

Examples of the impact of AI on productivity

Various studies have measured how AI can boost productivity for a specific job. Brynjolfsson and co-authors (2023) analysed 5,000 customer support agents who were given an AI assistant trained using audio and performance metrics from agents’ interactions with customers.3

The AI assistant was able to increase agents’ productivity by 14% on average relative to a control group who did not get the AI assistant. Newer, less skilled, workers had a 34% improvement. Seemingly the AI assistant enabled all agents to perform as if they had the skills of the best performing agents used to train the AI assistant.

Similarly, Dell’Acqua and co-authors (2024), examining consultants’ ability to perform a simulated task, found a 17% increase for the top-half of skilled participants and a larger 43% increase in productivity for low skilled participants.

However, studies examining productivity gains have focused on jobs or tasks where output for which productivity can be directly measured and, presumably, for which AI is expected to improve productivity. We cannot extrapolate these results to all jobs or the whole economy.

Estimates of AI’s impact on aggregate productivity and economic growth

Barely a day goes by without a politician or business leader calling for productivity growth as the cure for some economic ailment. There has been no growth in productivity in Australia since before the pandemic, and nobody likes stagnating living standards.

An increase in productivity reduces the labour a firm needs for a given output, reducing the cost of production. That results in some combination of lower prices and higher returns to capital and labour. But increased efficiency does not mean reduced overall demand for labour. Higher aggregate income means more spending, adding to demand for labour in the economy. And productivity’s cost savings mean the economy can grow faster without stoking inflation. If the increase in productivity is uneven across the economy, there are also distributional effects as some sectors grow faster than others and some workers need to retrain for new jobs.

Widespread adoption of AI will increase productivity and output and drive investment to support AI, but how big will this effect be? To assess the economy-wide impact of AI requires a broader approach than the studies above.

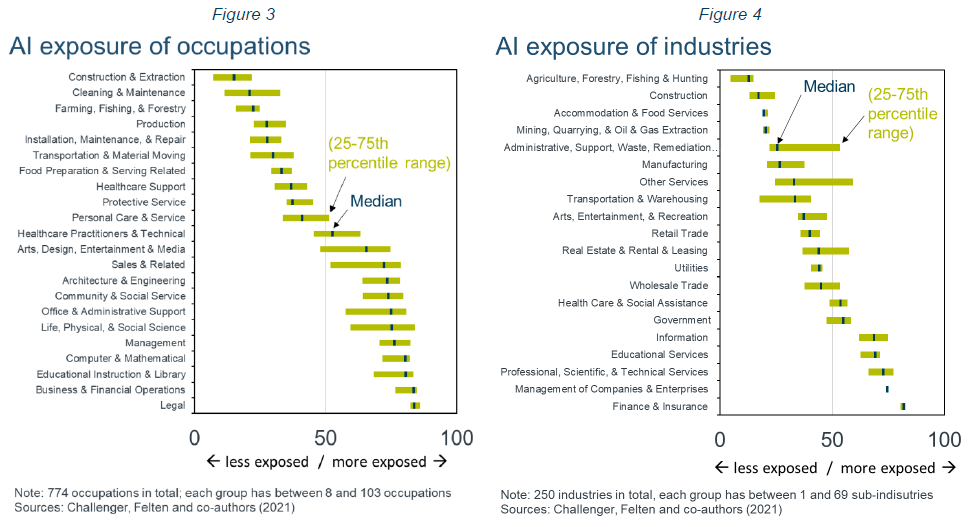

The impact of AI will vary across different types of jobs and so across different industries and sectors. It will be greatest on knowledge-based jobs and smallest on more physical jobs. Notably, this contrasts with historical technological advancements (such as mechanisation and IT) which have replaced manual jobs and simpler office jobs such as data processing. In one extensive study, Felton and co-authors (2021) considered 774 occupations across 250 industries and assessed how well 52 cognitive and physical abilities required in each of those occupations can be performed by 10 specific AI applications (such as image recognition, language modelling, and speech recognition). Estimates such as these can be aggregated to produce an economy-wide assessment of the increase in aggregate productivity and GDP growth from AI.

There is a wide range of estimates of the impact of AI, which depend on the underlying assumptions:

- At the high end, a prominent McKinsey report, Chui and co-authors (2024), estimates AI could increase labour productivity growth by 0.1% to 0.6% annually out to 2040. Combined with other forms of automation, they suggest AI could add 0.5% to 3.4% to annual productivity growth. Prominent studies, such as the BIS (Aldasoro and co-authors 2024), have based their work on the optimistic McKinsey estimates, assuming productivity will be 1.5% higher per year for a decade.

A similar optimistic assessment comes from Goldman Sachs who project that AI will lead to a 9% increase in the level of productivity, and a cumulative 6.1% increase in GDP, over the coming decade.

- A lower estimate, from the winner of last year’s economics Nobel prize, Daron Acemoglu (also in the Goldman Sachs), predicts that AI will only result in a cumulative 0.5% boost to productivity and 0.9% boost to GDP in total over the next decade.

Some part of the difference between high and low estimates depends on timing. Acemoglu believes that AI has the potential to lead to fundamental changes in research, innovation and work practices. But he believes that generative AI is not yet capable of fundamental productivity-boosting changes. Rather, over the next 10 years AI will only produce incremental improvements in existing production, hence the lower estimate. Other researchers are also sceptical AI’s short-term impact on productivity. As Manyika and Spence (2023) and others note, there are substantial short-term hurdles including the maturity of the technology, the speed of take-up, availability of workers with AI skills, availability of chips and other required hardware, regulatory barriers and internal operational processes.

- Acemoglu estimates that AI will automate only 4.6% of work tasks in the next decade (23% of ‘AI-exposed’ tasks). Even with a stronger response of investment, the boost to GDP would only be 1.6% in total. In contrast, the Goldman’s estimate assumes that AI will automate five times as many work tasks and, even in the near-term, will create new productive jobs (which have not been imagined yet).

Given the use of AI in businesses is new, history is not guide to the implications for productivity and growth. This highlights the huge uncertainty about the impact of AI on productivity and the economy.

The impact of AI on different jobs and industries

AI will reshape the economy as some sectors benefit more from AI, leading to shifts in relative prices, and importantly rising incomes and consumption. Indices that demonstrate the relative exposure to AI of different occupations (Figure 3) and industries (Figure 4) can be produced from the work of Felton and co-authors (2021).

These indices highlight that knowledge-based jobs are most exposed to AI. Of the 774 jobs that the authors analyse, the three most exposed to AI are financial examiners, actuaries and genetic counsellors. At the bottom of the list of professions impacted by AI, not surprisingly, comes dancers, fitness trainers and aerobics instructors.

When the 774 jobs are aggregated to the 22 job categories shown in Figure 3, it is Legal that is most exposed, closely followed by Business & Financial Operations. Given the greater impact of AI on knowledge-based jobs, the industries with a larger share of those jobs are most exposed to AI. Of the 250 industries the authors consider, seven of the top 10 are finance-related. When those 250 industries are aggregated to the 20 groups shown in Figure 4, it is the Finance & Insurance industry group that shows as most exposed to AI.

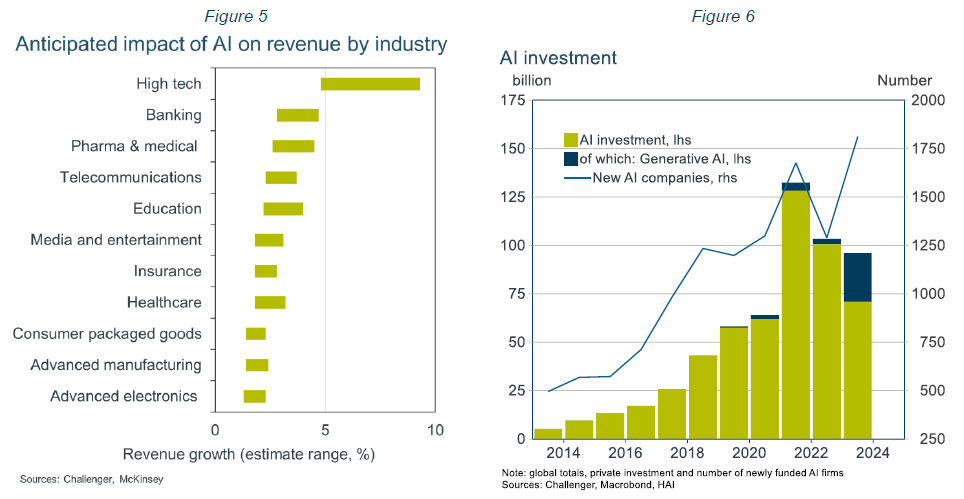

McKinsey have also estimated the impact that AI will have on the revenue of various sectors. In their study, banking ranks second only to high tech in the expected boost to revenue from AI (Figure 5).

AI and the financial sector

There are other reasons why AI will significantly affect the financial sector beyond the skills of finance workers:

- The financial sector is already tech heavy and so has the capability and experience to be early adopters of AI and widely disseminate its use.

- Many financial institutions are also large which gives them the scale to undertake the substantial investment required to develop AI for their own needs.

- Large financial institutions also have vast internal data, on customers, markets etc, to train AI models. For example, Morgan Stanley is building an internal AI assistant for their tens of thousands of wealth managers by drawing on their extensive accumulated internal information.

- At the other end of the size spectrum, Fintechs have been eagerly adopting AI to redesign various financial

tasks.

The financial sector is heavily regulated with substantial risk, compliance and legal responsibilities. AI could assist financial institutions to satisfy these regulations. It could also assist with fraud detection and risk management. But equally, there is a significant risk that automation and AI could result in inadvertently breaching regulations or realise financial or operational risks. Regulators will no doubt then be cautious on how financial institutions use AI, which could slow its uptake.

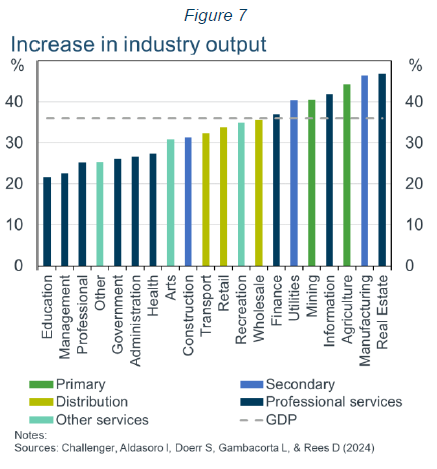

But the sectors most affected won’t necessarily grow the most

There is substantial investment in AI (Figure 6) and so even if only a portion of the claimed benefits materialise, structural change will produce winners and possibly losers. It is important to note that the sectors with the greatest exposure to AI will not necessarily have the largest increase in output. There are many different channels through which AI will impact the economy, as discussed by Acemoglu and Restrepo (2018) and Acemoglu (2024a). Industries that have an AI-induced productivity boom should experience a decline in their relative price and so see some increase in demand. In contrast, industries that get little boost to productivity from AI will have an increase in their relative price, and so if everything else is unchanged would experience a relative decline in output. This is the ‘substitution effect’.

There is also an ‘income effect’ because higher productivity increases aggregate output and demand across all sectors. However, this increase in demand will not be equal across all sectors. When we become richer, we don’t spend the additional income equally across all types of goods and services. For example, doubling our income will not induce us to spend twice as much on food. But we might spend more than twice as much on travel.

Authors at the Bank for International Settlements used a model of the whole economy, and the AI impact on industries as shown above, to assess each industry’s increase in output (see Aldasoro and co-authors (2024). Notably, while AI has a large impact on many service industries, the study projects that most service industries will have a smaller increase in output than the economy-wide increase (35% in their simulation). Rather, the biggest increases in output come, perhaps surprisingly, in primary industries (agriculture and mining) and a mix of some professional services and secondary industries, such as Manufacturing (Figure 7). Notably, even though finance is highly exposed to AI, finance sector output is projected to only increase in line with aggregate output.

AI, economic uncertainty and central banks

AI has great promise for central banks’ – ranking 15th out of 250 industries in terms of the impact of AI on their work – but their job of managing the economy will be made harder by the uncertain impact of AI on the economy.

Higher productivity will increase the potential growth of the economy, and so how fast the central bank can allow the economy to grow without stoking inflation. But uncertainty about how the adoption and use of AI will affect workers’ efficiency will add to uncertainty about productivity growth. We saw in the 1970s how high inflation and unemployment can result when central banks misinterpret potential output growth and the extent of spare capacity in the economy (‘output gaps’).

Interpreting the productivity, underlying inflation and full employment trends will also be complicated by the shifts in relative prices and employment across sectors. Substantial labour reallocation could increase the equilibrium unemployment rate as labour slowly retrains for different roles. The economic dynamics will also depend on how quickly different sectors adopt AI and how quickly households adjust their spending patterns in response to higher income.

The impact of AI on financial assets

As with any significant structural change AI brings opportunities and risks for investors. The extent of these changes will depend on the speed and breadth of the take-up and its efficacy.

- The aggregate impact is highly uncertain. The boost to productivity and output could be substantial or swamped by factors that have been constraining productivity for years. This significant uncertainty flows through to earnings and profit growth of AI firms and firms that will use AI.

- Optimists point to the strong equity returns that followed earlier significant technology innovations such as the train, automobile and computers.

- However, some analysts, such as Goldman Sachs’ Jim Covello, argue that in its current form AI is not designed to solve complex problems and so won’t boost profits sufficiently to deliver a significant return on the substantial investment. And even if optimists are right about past innovation, strong equity returns often came a decade or more after the innovation.

- Firms developing AI programs and hardware. Producers of chips, notably Nvidia, have already seen rapid price growth. But while other large tech firms, such as Microsoft or Meta, have an effective ring fence through network effects, firms producing chips or AI programs can easily be overtaken if an innovator can produce faster chips or a more efficient or advanced AI program. The fall in the share price of Nvidia with the release of DeepSeek highlighted this. Beyond substantial upfront investment, the barriers to competition are less permanent.

- Industries affected by AI. In sectors impacted by AI, such as tech and finance, firm performance is likely to be highly varied with both winners and losers. Even if overall output in these industries doesn’t grow faster than the total economy, firms that develops better products and leverage AI more effectively and efficiently (not necessarily using more AI) will see strong returns, while others struggle.

- Other sectors. In sectors such as manufacturing there may be a large increase in output, but to the extent those benefits come from stronger aggregate demand with a larger economy, rather than AI directly, the benefits will be more widely spread across firms with fewer big winners and losers.

- Interest rates. Given the combination of stronger productivity growth and significant investment to facilitate AI – including physical infrastructure such as building data centres and increasing power supply – interest rates are likely to be higher than they otherwise would be.

- Bubbles. Most bubbles start with a genuine fillip to earnings, but then exuberance takes over. Knowing whether AI-boosted valuations are fair is difficult given the revolutionary nature of AI makes it impossible to accurately predict future profitability. Even if AI is a bubble, bubbles can take time to burst and so even some sceptical analysts currently advocate maintaining some exposure to AI. AI has become such a big part of equity and other financial markets that having no exposure could result in significant underperformance for some time, before the bubble eventually bursts.

There are many risks to consider from AI and the resulting structural change

AI has great promise, but there are also many risks to consider.

- If AI is trained on information containing biases or misinformation so too will the AI output. That could lead to inefficient outcomes or resistance to the take-up of AI.

- A shortage of skilled workers could slow the adjustment process and delay productivity gains.

- There could be significant resistance to the up-take of AI if the spoils are not shared equally. Acemoglu and Johnson (2023) point to a potentially bleak future where few workers get the spoils. Like other structural change from automation, AI could increase inequality if there are very large returns to innovators and early investors, or from changes in relative wages and employment outcomes.

AI will have the greatest impact on high wage, high education workers doing knowledge-based jobs who historically have been less likely to experience unemployment. As many people with similar skills lose their jobs, reskilling and retraining programs will be critical to share the benefits and maintain social acceptance of AI (see Cazzaniga and co-authors, 2024).- A recent cautionary tale of the negative impact from structural change comes from the United States’ experience from opening to free trade and development in emerging market economies from the 1980s. Most economists thought that a strong and flexible domestic economy would be sufficient to ensure that workers would not be left behind. While some workers would lose their jobs when their employer could not compete with imports, export opportunities and stronger aggregate economic growth from greater specialisation would provide new and better paying jobs for redundant manufacturing workers. However, redundant workers didn’t have the skills for jobs with growing demand and they weren’t in the right locations. What followed was regions with depressed

economies and high unemployment.

- A recent cautionary tale of the negative impact from structural change comes from the United States’ experience from opening to free trade and development in emerging market economies from the 1980s. Most economists thought that a strong and flexible domestic economy would be sufficient to ensure that workers would not be left behind. While some workers would lose their jobs when their employer could not compete with imports, export opportunities and stronger aggregate economic growth from greater specialisation would provide new and better paying jobs for redundant manufacturing workers. However, redundant workers didn’t have the skills for jobs with growing demand and they weren’t in the right locations. What followed was regions with depressed

- There is a risk of economic stagnation, if as Acemoglu (2024b) notes, there is resistance to the creative destruction of AI. Destruction needs to be acknowledged as a cost of the creation, which is bringing advancements and increased incomes and wealth, at least for some.

- AI is likely to lead to more firm concentration. AI requires substantial investment, and large datasets are needed to train AI. That gives large, incumbent firms an advantage.

- Some see an even more existential threat from AI. In 2023 hundreds of AI industry leaders signed an open letter warning that action was needed to mitigate the “risk of extinction” from AI.

A cautionary lesson from the computer age

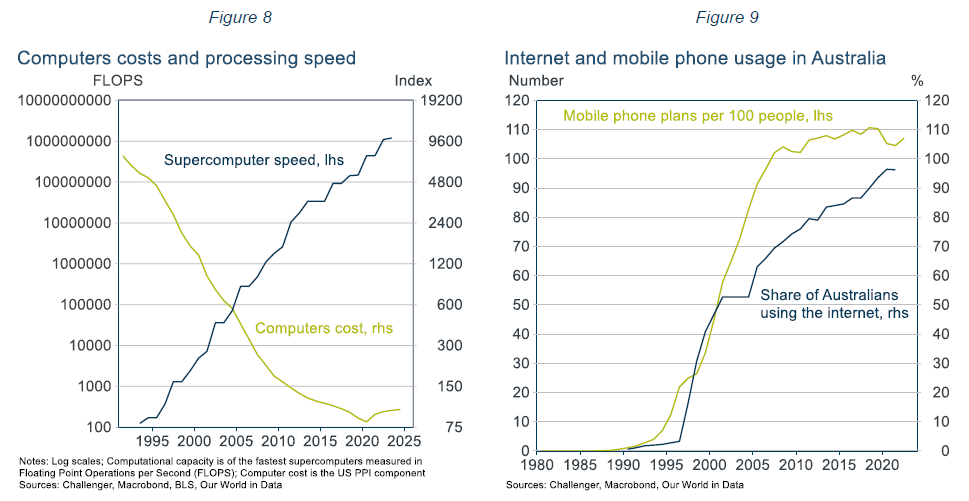

Outcomes in the computer age provide a cautionary perspective for AI exuberance. Advancements in computing over the past 30 or 40 years have been nothing short of phenomenal. The cost of computers has fallen by 99% since early 1990, measured on a quality adjusted basis (Figure 8). And the performance of today’s supercomputers, measured in FLOPS (Floating Point Operations per Second), is approximately 10 million times what it was in the early 1990s. It has been reported that an iPhone is more than 5,000 times faster than a supercomputer from the early 1980s, and 900 million times faster than the guidance computer that took Apollo 11 to the moon.

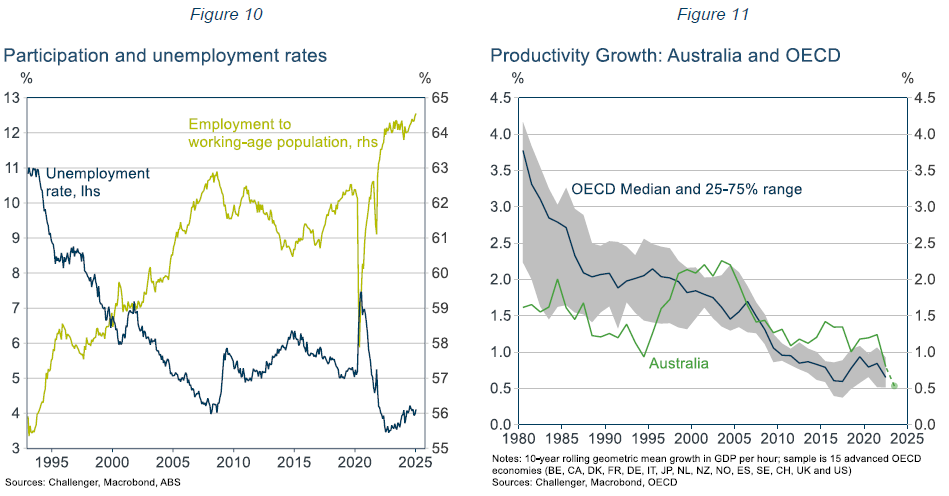

Technology is now deeply embedded in both our work and personal lives. Since the first mobile phones appeared in the late 1980s, the number of mobile phone plans in Australia have surpassed the total population (Figure 9). Likewise, internet access is universal today but was effectively non-existent in 1990.

With this remarkable surge in the capabilities and uptake of technology you might expect to see a reduction in the demand for workers, a perennial concern since the Luddites in the industrial revolution. Yet, the computer age in Australia has seen the unemployment rate decline and the share of the working-age population that is working reach record highs (Figure 10).

With productive computers and technology ubiquitous in our work lives you again would expect they have boosted productivity growth, improving living standards. As Nobel Laureate Paul Krugman (1997) noted, “productivity isn’t everything, but in the long run it is almost everything.”

But as another economics Nobel Laureate, Bob Solow famously wrote in 1987 “You can see the computer age everywhere but in the productivity statistics.” Today, his comment seems remarkably prescient. With annual productivity growth rates across OECD economies having declined from around 2% to ¾% over the computer age, it’s hard to see a benefit from computers and technology in the productivity statistics, a point also emphasised by Gordon (2014) (Figure 11). No doubt computers have boosted productivity, but not by nearly enough to offset factors that have pushed productivity lower including outsourcing manufacturing to Asia and the relative growth of service jobs.

A final thought

AI has immense potential, but like any structural shift, it will create winners and losers. Ensuring large numbers of society are not left behind will help reduce resistance to AI and will promote more equitable outcomes. Diverse outcomes across industries and firms also create huge opportunities, and risks, for investors.

One certainty is that AI will enable financial analysts and economists to produce a larger volume of work – swamping our inboxes. Fortunately, AI will be there to help, by summarising the flood of information. There’s a wonderful irony to the prospect of AI intermediating the work of AI. The key question is, does that leave us better informed?

1 AI has been brewing for a while. It’s history dates to the 1950s with Alan Turing’s development of a test to assess a machine’s ability to show intelligent behaviour. Indeed, ELIZA the first chatbot was developed in the 1960s at MIT, pre-dating Siri by decades.

2 However, AI’s performance can differ across fields, demonstrating its strengths and weaknesses. In a pre-requisite exam for graduate study (GRE), Chat GPT-4 scored best in the verbal component (99th percentile, up from 63rd in Chat GPT-3.5), ahead of the quantitative component (80th percentile, up from 25th) and last in the writing component (54th percentile, unchanged). In US college level tests (AP, Advanced Placement) Chat GPT-4 generally performed best in subjects dependent on accumulating a body of knowledge, such as history and psychology, but performed worst in English. Chat GPT-4 also did very well in economics (OpenAI).

3 To ensure they could identify a causal impact, different agents received the AI tool at different times and the authors used a ‘difference in differences’ assessment.

References

Acemoglu, D., (2024a) The Simple Macroeconomics of AI (No. w32487). National Bureau of Economic Research.

Acemoglu, D., (2024b) Are we ready for AI creative destruction? Project Syndicate

Acemoglu, D., & Johnson, S., (2023) What’s wrong with ChatGPT? Project Syndicate

Acemoglu, D., & Restrepo, P. (2018). Artificial intelligence, automation, and work. In The economics of artificial intelligence: An agenda (pp. 197-236). University of Chicago Press. NBER working paper version.

Aldasoro, I., Doerr, S., Gambacorta, L., & Rees, D. (2024). The impact of artificial intelligence on output and inflation (No. 1179). Bank for International Settlements.

Brynjolfsson, E., Li, D., & Raymond, L. R. (2023). Generative AI at work (No. w31161). National Bureau of Economic Research.

Cazzaniga, M., Jaumotte, M. F., Li, L., Melina, M. G., Panton, A. J., Pizzinelli, C., ... & Tavares, M. M. (2024). Gen-AI: Artificial intelligence and the future of work. International Monetary Fund.

Chui, M., Hazan, E., Roberts, R., Singla, A., & Smaje, K. (2023). The economic potential of generative AI. McKinsey and Co report.

Dell'Acqua, F., McFowland III, E., Mollick, E. R., Lifshitz-Assaf, H., Kellogg, K., Rajendran, S., ... & Lakhani, K. R. (2023). Navigating the jagged technological frontier: Field experimental evidence of the effects of AI on knowledge worker productivity and quality. Harvard Business School Technology & Operations Mgt. Unit Working Paper, (24-013).

Felten, E., Raj, M., & Seamans, R. (2021). Occupational, industry, and geographic exposure to artificial intelligence: A novel dataset and its potential uses. Strategic Management Journal, 42(12), 2195-2217.

Furman, J., & Seamans, R. (2019). AI and the Economy. Innovation policy and the economy, 19(1), 161-191.

Goldman Sachs (2024). Gen AI: Too much spend, too little benefit. Goldman Sachs Global Macro Research, (129), 25. Gordon, R. J. (2014). The demise of US economic growth: restatement, rebuttal, and reflections (No. w19895). National Bureau of Economic Research.

Haque, A., Milstein, A., & Fei-Fei, L. (2020). Illuminating the dark spaces of healthcare with ambient intelligence. Nature, 585(7824), 193-202.

Krugman, P. R. (1997). The age of diminished expectations: US economic policy in the 1990s. MIT press.

Manyika, J., & Spence, M. (2023). The Coming AI Economic Revolution: Can Artificial Intelligence Reverse the Productivity Slowdown?. Foreign Aff., 102, 70.