Designing an intelligent and scalable retirement income solution

Part 1: The role for protection strategies in balancing flexibility with capital protection.

Australian are living longer and retiring in record numbers.

Over the next decade, an estimated 2.5 million Australians1 will retire, approximately 10% of our population. The Federal Government is pushing superannuation funds to improve both advice and product options for retirees, including guaranteed income to last through the golden years.

We know the vast majority of Australians in or approaching retirement would be happier if they didn’t have to worry about finances2. According to Challenger’s Retirement Happiness Index, an independent survey of around 1,000 Australians over age 60, 70% of older Australians believe a guaranteed income in retirement would significantly boost happiness.

Rising cost-of-living and affordability is also starting to bite, with 2 in 3 older Australians2 saying it has impacted their confidence that they would have enough money to retire.

How superannuation funds can solve the retirement trilemma

The retirement trilemma provides superannuation funds a framework to ensure Australians in or approaching retirement are in the best position. This framework aims to strike a balance between maximising income, providing sustainability and stability of income, and flexible access to capital. However, these priorities are often conflicting and have differing levels of importance to every retiree.

Mercer’s latest actuarial modelling, Mercer’s Principles of Retirement Annuitisation3, commissioned by Challenger, highlights that substituting a portion of defensive assets for annuities in this environment will likely improve investment outcomes as annuity rates provide improved risk-return characteristics.

The Mercer research found that by substituting a proportion of defensive assets in a retirement portfolio for a guaranteed, CPI-linked lifetime annuity (or equivalent lifetime pension offered by a superannuation fund), investors/members can maintain their exposure to growth assets while providing a higher certainty of return and income, and when considering inflation-linked annuities, maintaining purchasing power over time.

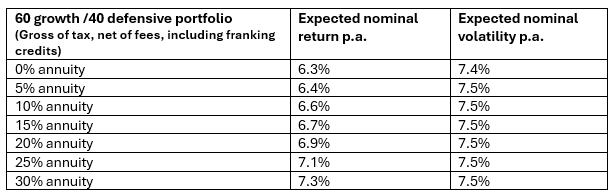

Expected return and risk of portfolios with annuities in nominal terms.

Maximising all three components of the retirement trilemma requires a comprehensive approach, as no individual retirement solution is sufficient. However, Mercer’s research found allocating a portion of retirement assets to guaranteed lifetime income would help address the retirement trilemma through:

- Maximising income: annuities in a portfolio are likely to generate higher returns and income than defensive assets

- Stability and sustainability of income: a longevity product ensures that retirees have a reliable and consistent income stream throughout their retirement years, addressing the concern of longevity risk and providing financial security.

- Flexible access to capital: annuities can provide access to capital on death or through withdrawal benefits within a set period up to life expectancy.

Providing more for members in retirement - modelling and outcomes

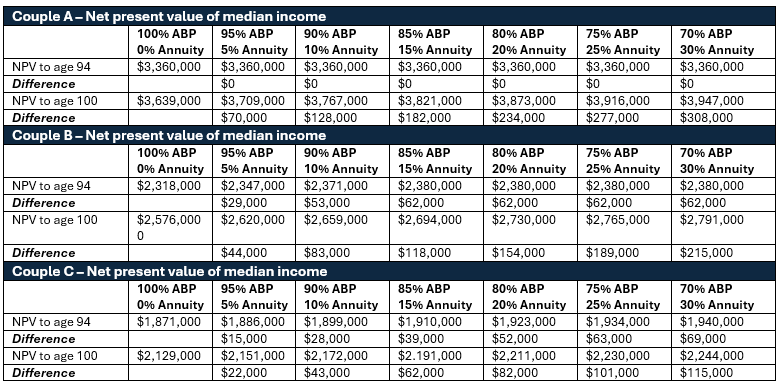

In practice, Mercer’s modelling suggests that a couple with a $1 million super balance and $85,000 target income may see an 8% increase in retirement income to age 100 through a 30% allocation to guaranteed lifetime income in current market conditions.

- High balance client (Couple A) that will not be eligible for an Age Pension at the start of their retirement. We have assumed that this couple has $2 million account balance and income needs of $120,000 per year (indexed to inflation).

- Medium balance client (Couple B) that will be eligible for a part Age Pension at the start of their retirement. We have assumed that this couple has $1 million account balance and income needs of $85,000.

- Low balance client (Couple C) that will be eligible for a full Age Pension most of their retirement. We have assumed that this couple has $500,000 account balance and income needs of $70,000.

Across each of these sample clients we have assumed the use of a ‘60/40’ portfolio with a 60% exposure to growth assets. In cases where annuitisation is modelled, it is assumed that the assets are reallocated from the defensive allocation in the portfolio. Assets that are not held in an annuity are assumed to be held in an account-based pension (ABP).

Further, at couple life expectancy of age 94, the probability of meeting target income can be uplifted by between 6% and 17% depending on the allocation to annuity. The likelihood of meeting target income is significantly increased at age 100.

Modern annuities provide access to capital through a withdrawal and death benefit for approximately the first 20 years of the annuity contract. This removes or significantly reduces the impact of early death or withdrawal drag on capital that annuities have traditionally had. For example, if Couple A with 15% in annuities: At couple life expectancy (age 94) there is a higher balance available (of approximately $70,000) as the portfolio without annuities depletes capital at a faster pace than a portfolio with annuities.

Time to rethink traditional portfolio construction?

The traditional 60/40 portfolio has stood the test of time and remains a core approach to investing for many retirees. However, the research shows it may be time for a rethink. By broadening the definition of ‘defensive’, retiree members can maximise benefits, while ensuring downside protection. For example, in the current environment, expected return rates for annuities are higher than government bonds and cash, with similar levels of volatility.

By broadening defensive allocations to incorporate a guaranteed income stream, the Mercer analysis found that real income for retiree members may be increased, while a range of non-investment benefits can be delivered, such as transferring investment risks and providing guaranteed, stable income payments. However, while Australians share a common goal in the accumulation phase, building wealth, retirement is unique for each client and one strategy does not suit all. Guaranteed lifetime income should not be the only line of defence but play an important role in a retiree member’s overall investment strategy.

Historically, there has been challenges in using guaranteed lifetime income, but many of the past issues have been addressed. This includes concerns such as reduced access to capital, lack of flexibility, withdrawal challenges, and death benefits. As the historic issues have been put to rest, we have seen demand for guaranteed lifetime income increase.

Superannuation funds today are helping more Australians prepare for retirement than ever before. Helping them solve the retirement trilemma - balancing maximising income, sustainability and stability of income, and flexible access to capital – is only becoming more common and complex. Guaranteed lifetime income streams have long been misunderstood and misrepresented but a strategic allocation in the defensive portion of a retiree portfolio is proven to help retiree members address sequencing risk, inflation risk, and market risk, giving them peace of mind, boosting happiness, and delivering financial confidence throughout their retirement years.

1 Australian Treasury: Superannuation in retirement

2 Challenger x YouGov Retirement Happiness Survey, February 2024

3 Mercer, Principles of Retirement Annuitisation, May 2024

Related content

Defined Benefit de-risking

Financial wellbeing and rising costs of living