Monthly Report April 2025

Fund objective

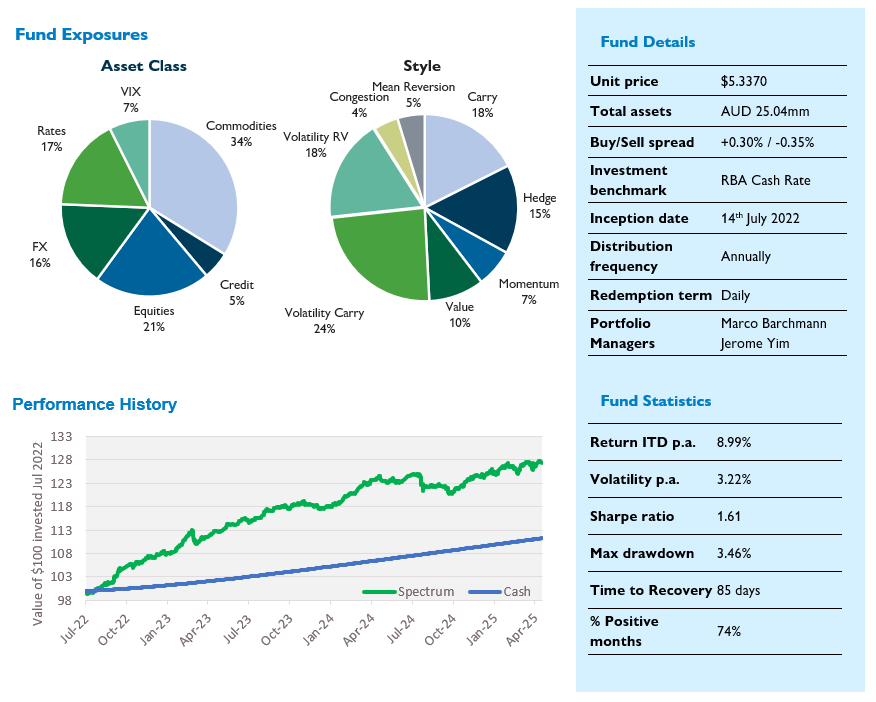

Spectrum Systematic Alpha Fund (Spectrum) is a multi-strategy systematic investment fund that aims to deliver positive absolute returns in excess of cash over the medium to long term with low correlation to traditional asset classes such as equities and fixed income.

Performance1

| 1 Month (%) | 3 Month (%) | 1 Year (%) | 2 Years (% p.a.) | Inception (% p.a.) |

|---|---|---|---|---|---|

| Challenger Solutions Spectrum Systematic Fund –Class I | -0.02 | 0.55 | 2.27 | 6.27 | 8.99 |

| RBA cash | 0.33 | 0.99 | 4.29 | 4.23 | 3.80 |

1Returns are gross of fees. No allowance is made for tax when calculating these figures. The Inception date for Class I is 14 July 2022. Past Performance is not a reliable indicator of future performance. Source: Fidante Partners Limited, 30 April 2025

Monthly commentary

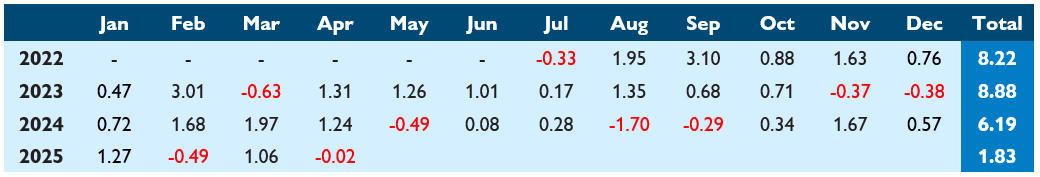

Spectrum returned -0.02% in April, taking CYTD performance to 1.83%. Since inception, gross performance stands at 8.99% p.a. versus 3.80% p.a. for the Fund’s cash benchmark, an outperformance of 5.19% p.a. Annualised volatility has been 3.22%, for a gross since-inception Sharpe ratio of 1.61.

Unsurprisingly, Hedge (+2.87%) was the best performing strategy group in April, benefiting from the extraordinary market moves in the first half of the month. Commodity Carry (+0.19%) was the next best contributor. On the other side of the ledger, Commodity Vol Carry (-1.67%) and Equity Vol Carry (-0.47%) were negatives and the choppy nature of the price action also hurt Vol RV strategies with Vix Vol RV (-0.64%) and Rates Vol RV (-0.32%). Risk-off moves also hurt FX Carry (-0.48%), which up until this point had been holding in quite well despite the equity drawdown.

Markets have been experiencing heightened levels of volatility, culminating with Trump’s “Liberation Day” tariff announcement and subsequent climb-down. At the lows on 7 April, S&P 500 had fallen -21.3% from the recent all-time highs, and US high yield spreads had widened almost 200bp. US Treasuries initially rallied as risk-sentiment soured but unusually began to sell-off as the equity drawdown deepened and confidence in US assets was eroded.

When even the ultimate risk-free asset is subject to large sentiment swings, additional sources of diversification can be invaluable. This is where a diversifying alternative such as Spectrum can play an important role in an investment portfolio. Spectrum’s April performance was a negligible -0.02%, compared to -1.74% for MSCI World (AUD), and +0.95% for Bloomberg Global Agg (AUD Hedged). However, whereas MSCI World was down more than 8% at one point during the month and some indices such as S&P 500 even more, at the low point in April Spectrum was only down -1.25%.

Spectrum is not explicitly defensive. It is not intended to be a “hedge”, nor is it specifically designed to deliver positive performance during risk-off environments. Nevertheless, the uncorrelated and low volatility nature of the returns allow Spectrum to serve as a defensive component of an investment portfolio by: 1) offering the potential for positive absolute performance when other investments are negative, 2) by lowering overall portfolio volatility and 3) by reducing portfolio drawdowns.

Spectrum’s multi-strategy approach employs systematic strategies spanning the full risk spectrum, actively balancing hedging, defensive, uncorrelated and risk-seeking elements into a single portfolio. This approach allows us to navigate periods of higher-than-usual volatility without relying on the ability to perfectly time markets. April was a good example of this where Volatility Carry strategies lost -1.50%, Volatility Relative Value strategies lost -0.89% and Hedge strategies gained +2.87%.

Losses from strategies at one end of the risk spectrum (e.g. those which have some kind of short volatility exposure) were more than offset by gains in hedging strategies at the other end of the risk spectrum. This is an intentional design feature and while it may not always work perfectly – every “crisis” is different – we are confident it will always serve to reduce overall portfolio risk and help us deliver more consistent returns in many different market environments.

Monthly returns (%)1

1 Past performance is not an indicator of future performance.

For further information, please contact:

Liam McDermott | p: +614 66 563 890 | e: lmcdermott@fidante.com.au | w: www.fidante.com