Monthly Report August 2025

Fund objective

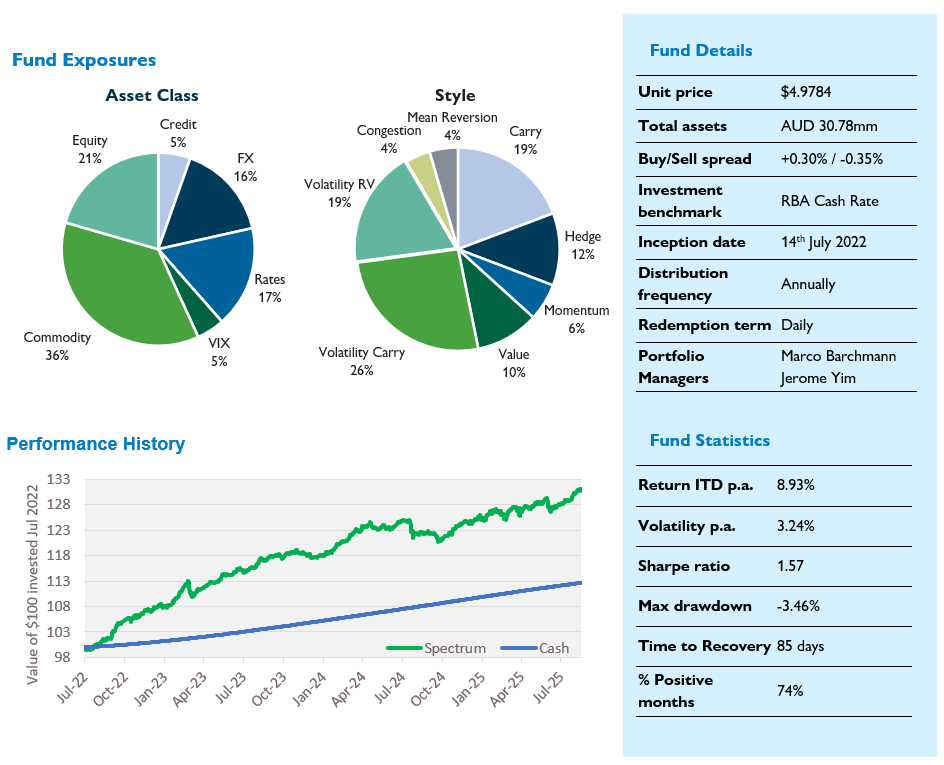

Spectrum Systematic Alpha Fund (Spectrum) is a multi-strategy systematic investment fund that aims to deliver positive absolute returns in excess of cash over the medium to long term with low correlation to traditional asset classes such as equities and fixed income.

Performance1

| 1 Month (%) | 3 Month (%) | 1 Year (%) | 2 Years (% p.a.) | 3 Years (% p.a.) | Inception (% p.a.) |

|---|---|---|---|---|---|---|

| Challenger Solutions Spectrum Systematic Fund –Class I | 1.49 | 2.01 | 6.98 | 5.72 | 8.77 | 8.93 |

| RBA cash | 0.29 | 0.93 | 4.12 | 4.21 | 3.91 | 3.81 |

1Returns are gross of fees. No allowance is made for tax when calculating these figures. The Inception date for Class I is 14 July 2022. Past Performance is not a reliable indicator of future performance. Source: Fidante Partners Limited, 31 August 2025

Monthly Commentary

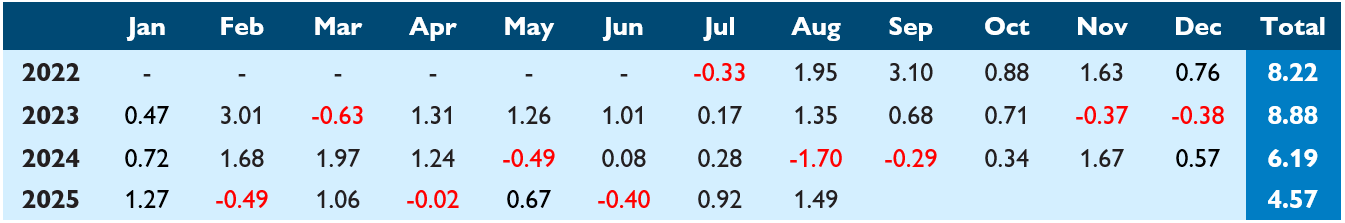

Spectrum returned +1.49% gross in August, taking YTD gross performance to +4.57%. Since-inception gross performance stands at 8.93% p.a. versus 3.81% p.a. for the Fund’s cash benchmark, an outperformance of 5.12% p.a. Annualised volatility has been 3.24%, for a since-inception gross Sharpe ratio of 1.58.

Commodity Vol (+0.68%) was the best performing strategy group this month, continuing a strong performance run since June as concerns over a Middle East conflagration involving Iran eased. Commodity Carry (+0.16%), Commodity Congestion (+0.11%) and Rates Vol RV (+0.10%) also contributed positively. Rates Momentum (-0.14%) was the worst performing strategy group in August, continuing to struggle in the absence of a clear trend in monetary policy.

Risk assets remained supported in August, with S&P 500 continuing its march higher, briefly topping 6500 toward the end of the month. Weak US employment data caused a subsequent repricing lower of front-end rates early in the month, and while the implications for growth initially pushed equities lower, the sell-off was brief. Ultimately, the expectation for lower rates supported equities and it was onward and upward for most of the month after that.

We’re always on the lookout for orthogonal strategies to include in the portfolio, and we have a healthy pipeline of new strategies currently under consideration. We derive considerable diversification benefits from our multi-strategy approach, and the main challenge is finding strategies that are both different (diversifying) to what we already have in the portfolio and can incrementally add to overall portfolio returns. It’s no use adding a diversifying strategy that just cancels out returns elsewhere in the portfolio.

We flagged last month that our exposure to commodity strategies has increased slightly as a result of a re-jigging of that part of our portfolio. While there are some additional commodity strategies in our research pipeline, we are trying to focus on other areas to maintain good diversification across asset classes. To this end we added a new FX strategy in August. The strategy aims to earn alpha from known and measurable FX flows.

Diversification is both a key part of our investment approach and a key part of our value proposition. Spectrum is specifically designed to be diversifying to equities and bonds, and in practice it is diversifying to many other alternative investments as well. For example, CTAs are widely held as a defensive diversifier, however, returns over the past year or so have been negative, with the SG Trend Index down -6.2% over the past 12 months. Spectrum, on the other hand, has delivered positive performance (+7.1% gross) with lower correlation to equities (0.16 correlation to S&P 500 for Spectrum versus 0.24 for SG Trend). Spectrum can therefore be a good complement to existing diversifiers within portfolios, as well as a diversifier to equity and fixed income exposure.

Monthly returns (%)1

1 Past performance is not an indicator of future performance.

For further information, please contact:

Liam McDermott | p: +614 66 563 890 | e: lmcdermott@fidante.com.au | w: www.fidante.com