Monthly Report February 2025

Fund objective

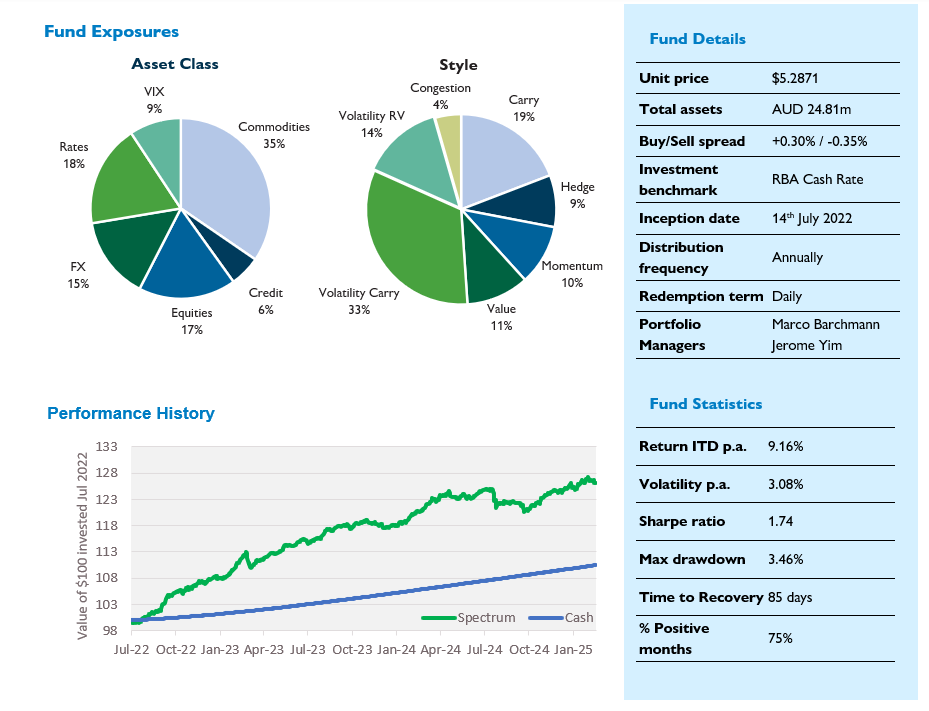

Spectrum Systematic Alpha Fund (Spectrum) is a multi-strategy systematic investment fund that aims to deliver positive absolute returns in excess of cash over the medium to long term with low correlation to traditional asset classes such as equities and fixed income.

Performance1

| 1 Month (%) | 3 Month (%) | 1 Year (%) | 2 Years (% p.a.) | Inception (% p.a.) |

|---|---|---|---|---|---|

| Challenger Solutions Spectrum Systematic Fund –Class I | -0.49 | 1.35 | 4.49 | 6.10 | 9.16 |

| RBA cash | 0.32 | 1.06 | 4.33 | 4.18 | 3.78 |

1Returns are gross of fees. No allowance is made for tax when calculating these figures. The Inception date for Class I is 14 July 2022. Past Performance is not a reliable indicator of future performance. Source: Fidante Partners Limited, 28 February 2025

Monthly commentary

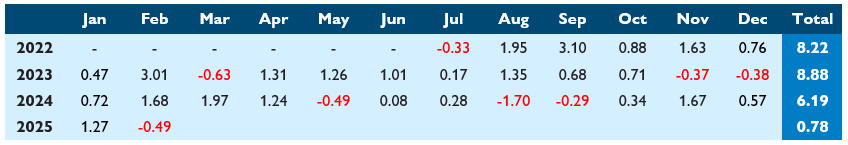

Spectrum returned -0.49% in February, taking CYTD performance to 0.78%, slightly ahead of the cash benchmark. Since inception, gross performance stands at 9.16% p.a. versus 3.78% p.a. for the Fund’s cash benchmark, an outperformance of 5.38% p.a. Annualised volatility stands at 3.08%, for a gross since-inception Sharpe ratio of 1.75.

Rates strategies were the main source of negative performance for the month, with Rates Vol RV (-0.58%) the main detractor. Commodity Value (-0.19%) and Commodity Carry (-0.11%) also reversed some of the recent gains. On the positive side of the ledger, Commodity Vol (+0.38%) was the top performing strategy in February.

Volatility around the “Trump trade” continued to move markets. An uptick in inflation initially pushed US Treasury yields higher, but growth concerns relating to tariffs hit risk appetite and yields headed meaningfully lower into month-end. Similarly, S&P 500 posted new all-time highs mid-month, before reversing lower as risk sentiment soured.

Our Rates Vol RV strategies can be sensitive to outright yield movements over shorter time horizons, and that was notably the case in February. While the strategies are not explicitly long or short US rate markets, they do maintain a fairly constant (long) exposure to long dated / “bottom-right” USD interest rate volatility. This long vega exposure offers an element of defensiveness, since cross-asset volatilities tend to move higher in tandem during periods of extreme market stress. However, under more normal circumstances, the drivers of bottom right vol can be more technical in nature. For example, dealers’ net vega positions can vary with the level of rates, meaning dealers dynamically adjust their volatility exposure as interest rates move up and down. This can result in a relationship between the level of long-dated interest rates and the level of bottom-right rate vol, and this dynamic was clearly at work this month. Lower yields led to dealer vol selling which pushed bottom-right rate vol lower, driving negative performance in our Rates Vol RV strategies.

We speak regularly of the twin objectives of Spectrum, firstly to provide positive absolute returns over time; and secondly, for those returns to be uncorrelated to other asset classes. To date, our “defensiveness” track record has been good – we’ve pointed out previously that Spectrum performance had been positive in all 10 months that S&P 500 performance has been negative since we started trading in July 2022. We’ve also pointed out that we didn’t expect that to always be the case, and this month, for the first time, it wasn’t, with both S&P 500 (-1.42%) and Spectrum (-0.49%) both posting negative performance in February. It’s important to recognise that uncorrelated does not mean Spectrum will always go up when equities go down, and this month it didn’t. Still, 10 out of 11 isn’t bad.

Monthly returns (%)1

1Past performance is not an indicator of future performance.

For further information, please contact:

Liam McDermott | p: +614 66 563 890 | e: lmcdermott@fidante.com.au | w: www.fidante.com