Monthly Report July 2024

Fund objective

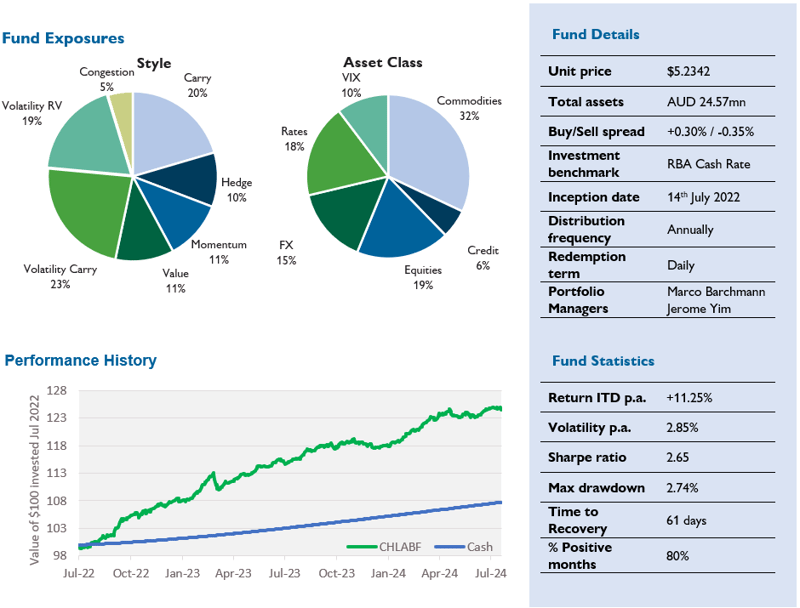

Spectrum Systematic Alpha Fund (Spectrum) is a multi-strategy systematic investment fund that aims to deliver positive absolute returns in excess of cash over the medium to long term with low correlation to traditional asset classes such as equities and fixed income.

Performance1

| 1 Month (%) | 3 Month (%) | 1 Year (%) | 2 Years (% p.a.) | Inception (% p.a.) |

|---|---|---|---|---|---|

| Challenger Solutions Spectrum Systematic Fund –Class I | 0.28 | -0.13 | 7.70 | 11.66 | 11.17 |

| RBA cash | 0.38 | 1.07 | 4.27 | 3.68 | 3.63 |

1 Returns are gross of fees. No allowance is made for tax when calculating these figures. The Inception date for Class I is 14 July 2022. Past performance is not a reliable indicator of future performance. Source: Fidante Partners Limited, 31 July 2024

Monthly commentary

Spectrum posted gains of 0.28% in July, taking CYTD gross performance to 5.59%. Since inception, performance stands at 11.17% p.a. versus 3.63% p.a. for the Fund’s cash benchmark, an outperformance of 7.54% p.a. Annualised volatility has been 2.86% over the same period, for a gross since-inception Sharpe ratio of 2.67.

Once again, it was a month of two halves, characterised by strong performance in the early part of July followed by losses in the latter parts of the month. Commodity Carry (+0.25%) and FX Value (+0.25%) were the standout performers in the month. However, a softer inflation print in the US combined with hawkish noises coming out of the BoJ led to strong gains in JPY, resulting in a more general position unwind in FX carry-type positions. Our FX Carry (-0.95%) strategy suffered a sharp reversal as a result. Rates Trend (-0.29%) was also a drag as the market repriced the Fed.

FX carry has been an increased area of focus for markets (and us!) given the large moves in USDJPY in particular. Simplistically, FX carry is predicated on the idea that investment capital flows into higher yielding currencies, therefore yield can be a predictor/driver of future spot FX moves. Capital flows into higher yielding currencies tend to be higher in pro-risk periods, as is the willingness of speculators to try and earn the carry. By contrast risk-off tends to lead to repatriation of funds and deleveraging for speculators. Therefore, performance of FX carry strategies can be somewhat correlated to risk sentiment.

Unusually, this relationship between risk sentiment and the performance of FX carry has been reversed over the past few years, with FX carry largely resilient to sell-offs in equities. This was because the steep tightening cycle from the Fed made USD a high yielding currency, and FX carry performed well when US yields were moving higher, even while higher yields hurt equity/risk-sentiment. While we think there’s a chance that the relationship between FX carry and risk-sentiment might revert to its more usual state, we expect the directionality with US rates to persist for the time being.

Put differently, the correlation between FX Carry and other strategies in our portfolio might change, but the fundamental driver of FX Carry will remain the same. The former point we are monitoring and may require some tweaks in our overall portfolio construction. However, the latter means since we don’t know which way US rates are going to move, we continue to hold FX Carry on a view-agnostic basis.

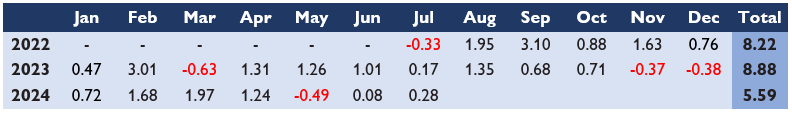

Monthly returns (%)1