Monthly Report July 2025

Fund objective

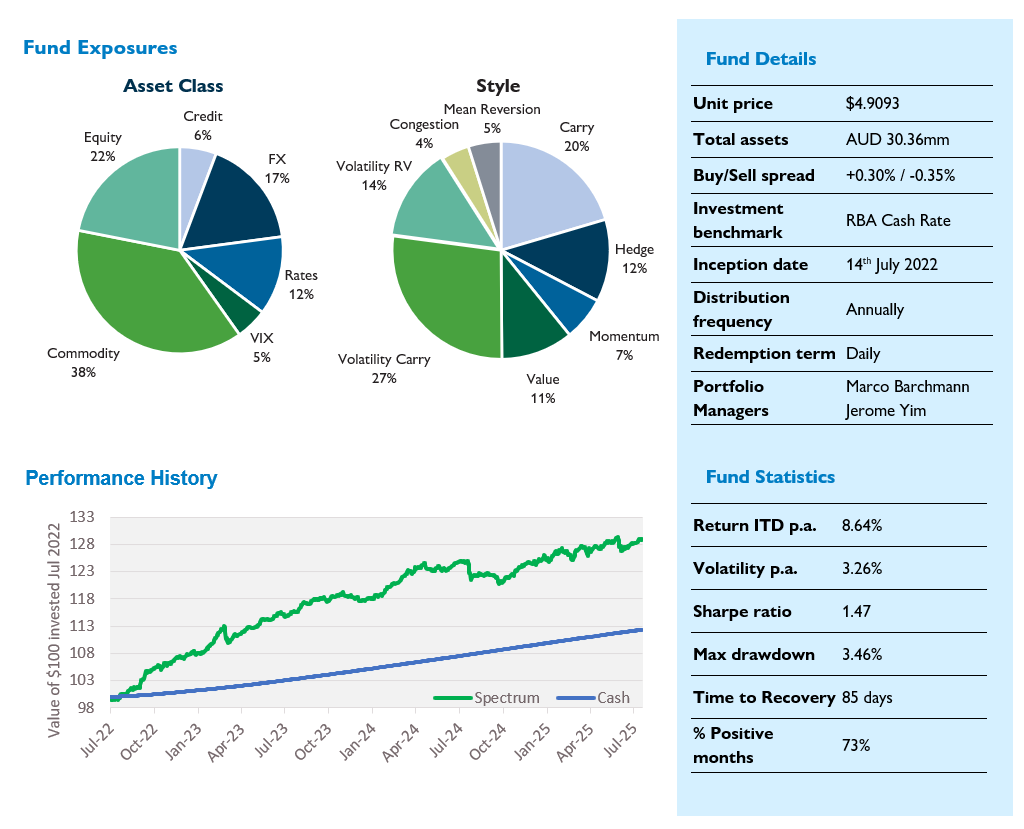

Spectrum Systematic Alpha Fund (Spectrum) is a multi-strategy systematic investment fund that aims to deliver positive absolute returns in excess of cash over the medium to long term with low correlation to traditional asset classes such as equities and fixed income.

Performance1

| 1 Month (%) | 3 Month (%) | 1 Year (%) | 2 Years (% p.a.) | Inception (% p.a.) |

|---|---|---|---|---|---|

| Challenger Solutions Spectrum Systematic Fund –Class I | 0.92 | 1.19 | 3.62 | 5.64 | 8.64 |

| RBA cash | 0.32 | 0.97 | 4.18 | 4.22 | 3.81 |

1Returns are gross of fees. No allowance is made for tax when calculating these figures. The Inception date for Class I is 14 July 2022. Past Performance is not a reliable indicator of future performance. Source: Fidante Partners Limited, 30 June 2025

Monthly Commentary

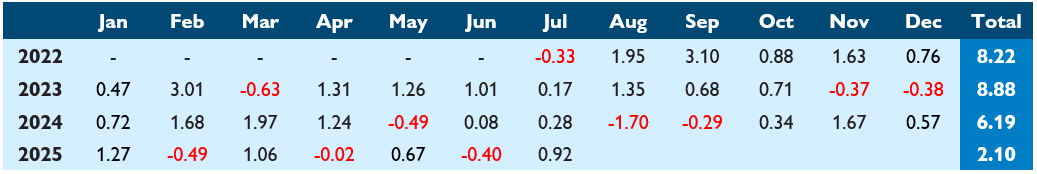

Spectrum returned +0.92% in July, taking YTD gross performance to +3.04%. We have now reached our three-year anniversary with a since-inception gross performance of 8.64% p.a. versus 3.81% p.a. for the Fund’s cash benchmark, an outperformance of 4.83% p.a. Annualised volatility has been 3.26, for a since-inception gross Sharpe ratio of 1.4.

Our cumulative gross return since inception now stands at 28.92%, and performance has been positive in 73% of months (27 out of 37). Although the cumulative performance hasn’t been able to keep up with equities – not surprising given the almost 20% annualised total return in the S&P 500 over the same period – volatility has been much lower (3.26% vs 17.07%), as is the maximum drawdown (-3.46% vs -18.75%). More to the point, our objective isn’t to beat equities, rather it’s to deliver consistent returns that are diversifying to equities (and bonds), and we’re proud that over the last three years we have delivered on both those objectives (correlation to S&P 500 was -0.08).

FX Carry (+0.36%) was the top performer in July. Commodity Vol (+0.32%) recovered after taking a hit last month, while Commodity Value (+0.26%) and Commodity Carry (+0.17%) also contributed to performance. On the other side of the ledger, Equity Hedge (-0.32%) and Commodity Mean Reversion (-0.14%) were the main detractors.

July was mainly about ongoing support for risk assets, with S&P 500 posting a series of record closing highs throughout the month. Not surprising, then, that our Equity Hedge strategies didn’t perform. However, the positive risk tone, alongside the Fed’s ongoing resistance to pressure to cut rates, led front end US rates to drift higher, with higher rates in turn supporting USD more broadly. FX Carry in particular, which is currently net long USD, benefited from this move.

Commodity strategies also contributed nicely in July. Commodity strategies currently make up quite a large part of the portfolio, partially because we think there are good opportunities in the commodity space, and partially because those opportunities tend to be orthogonal to both market direction and opportunities elsewhere. However, one of the reasons for the slightly lower fund-level return over the past 12 months is that, in aggregate, our commodity strategies have been doing a whole lot of not much.

That has prompted some adjustments on our side, where we have moved out of some strategies and into others, the net result being a) slightly higher proportion of commodity strategies in the Fund, and b) we hope more diversified exposure to commodity strategies with more consistent overall return properties. Time will tell whether b) plays out, but in July at least, the signs are good.

The challenge for us when considering new strategies is to identify those with both attractive return profiles and that play nicely with the other strategies in the Fund. We need to take care that the inclusion of new strategies doesn’t inadvertently concentrate risk in a particular area or otherwise impair our dual return and correlation objectives. This is a key part of our investment process, and we are confident that even where individual strategies may not always work, our approach will continue to give us the best chance of meeting our investment objectives and delivering high quality returns to our investors.

Monthly returns (%)1

1 Past performance is not an indicator of future performance.

For further information, please contact:

Liam McDermott | p: +614 66 563 890 | e: lmcdermott@fidante.com.au | w: www.fidante.com