Monthly Report June 2025

Fund objective

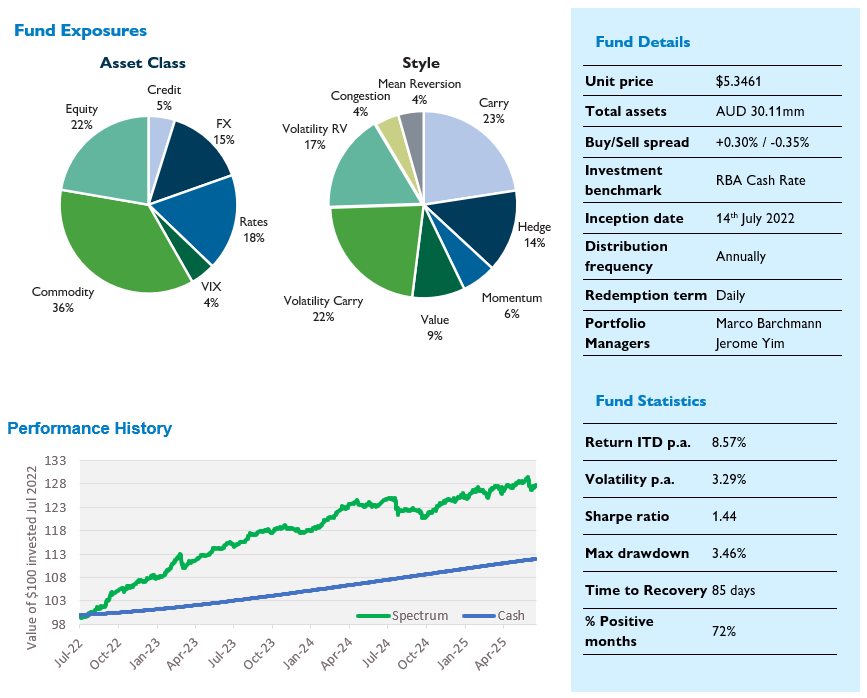

Spectrum Systematic Alpha Fund (Spectrum) is a multi-strategy systematic investment fund that aims to deliver positive absolute returns in excess of cash over the medium to long term with low correlation to traditional asset classes such as equities and fixed income.

Performance1

| 1 Month (%) | 3 Month (%) | 1 Year (%) | 2 Years (% p.a.) | Inception (% p.a.) |

|---|---|---|---|---|---|

| Challenger Solutions Spectrum Systematic Fund –Class I | -0.40 | 0.25 | 2.97 | 5.24 | 8.57 |

| RBA cash | 0.32 | 0.98 | 4.25 | 4.23 | 3.81 |

1Returns are gross of fees. No allowance is made for tax when calculating these figures. The Inception date for Class I is 14 July 2022. Past Performance is not a reliable indicator of future performance. Source: Fidante Partners Limited, 30 June 2025

Monthly commentary

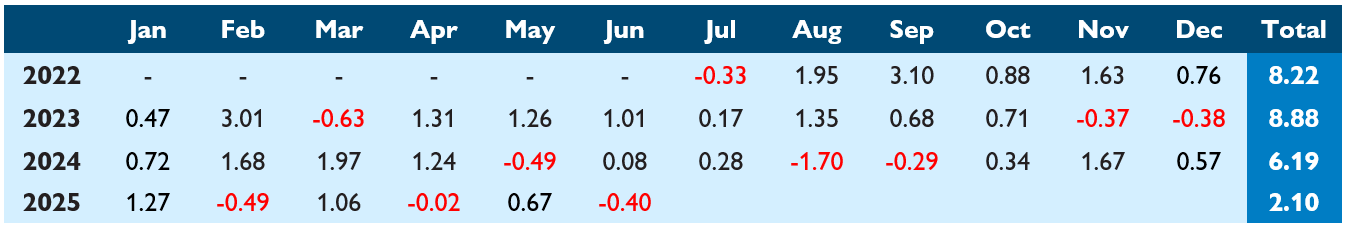

Spectrum returned -0.40% in June, taking YTD gross performance to +2.10%. As we approach our three-year anniversary, our since inception gross performance stands at 8.57% p.a. versus 3.81% p.a. for the Fund’s cash benchmark, an outperformance of 4.76% p.a. Annualised volatility has been 3.29%, for a gross since-inception Sharpe ratio of 1.44.

Commodity Vol was the worst performing style group in June (-0.80%), while Hedge (-0.33%), FX Value (-0.18%) and Commodity Mean Reversion (-0.10%) were also negatives. FX Carry (+0.25%), Rate Vol RV (+0.11%) and Commodity Value (+0.11%) were the top performing styles.

The Israeli (and subsequent US) military action in Iran, and the resulting spike in both oil prices and implied volatility, was the main driver of negative performance. While the spike in geopolitical risk had a large impact in oil markets, the flow on effects into broader risk sentiment was relatively muted. As a result, although our oil volatility strategies were negatively impacted, short volatility strategies elsewhere held up quite well, with non-oil commodity vol, credit vol and equity vol all posting modest positive performance in June.

We carefully size our short vol exposures taking into account the inevitability of occasional short, sharp drawdowns. Although there is some degree of correlation between volatility spikes in different assets and asset-classes – especially in more extreme market events such as the global financial crisis or COVID – we do believe that by spreading out our short volatility exposure across different underliers we reduce the risk at the portfolio level.

Furthermore, as evidenced in April, we do endeavour to balance our short vol exposures with explicit hedge strategies to further mitigate the risk from more systemic events. The isolated nature of this particular shock meant only our oil volatility strategies were impacted. In many ways that’s a good thing – we did indeed benefit from diversification in our vol strategies – however, it also means that there was no corresponding gain in any of our hedge or defensive strategies to offset the loss. In fact, the swift resolution to hostilities was a significant positive catalyst for equities, with the S&P 500 posting new all-time highs by month end, meaning that in this instance our hedge strategies actually contributed to losses.

Our multi-strategy approach means there’s always a risk we have exposure, either positive or negative, to idiosyncratic events. We seek to address this through careful position sizing and (easier said than done) by aiming to embed sufficient positive return bias in the portfolio such that over time the upward return trajectory cancels out any bumps in the road along the way. Therefore, another risk we face is that the strategies we deploy simply stop working, either flat-lining or drifting lower over extended periods. We address this risk by actively managing our exposures to make sure we are appropriately positioned for prevailing market conditions, and benchmarking performance of individual strategies to style benchmarks to ensure strategy performance is consistent with our intended exposure.

To this end, we have slightly restructured our commodity carry exposure this month, switching out of one of our existing strategies entirely, and reducing our position in another. We have introducing three new strategies to replace the exposure, which we hope will address some underperformance in that part of the portfolio. We are firm believers that by actively managing the portfolio we can improve performance by adapting to changing market conditions and incorporating new sources of alpha, and we believe the recent changes will help to achieve this.

Monthly returns (%)1

1 Past performance is not an indicator of future performance.

For further information, please contact:

Liam McDermott | p: +614 66 563 890 | e: lmcdermott@fidante.com.au | w: www.fidante.com