Monthly Report March 2025

Fund objective

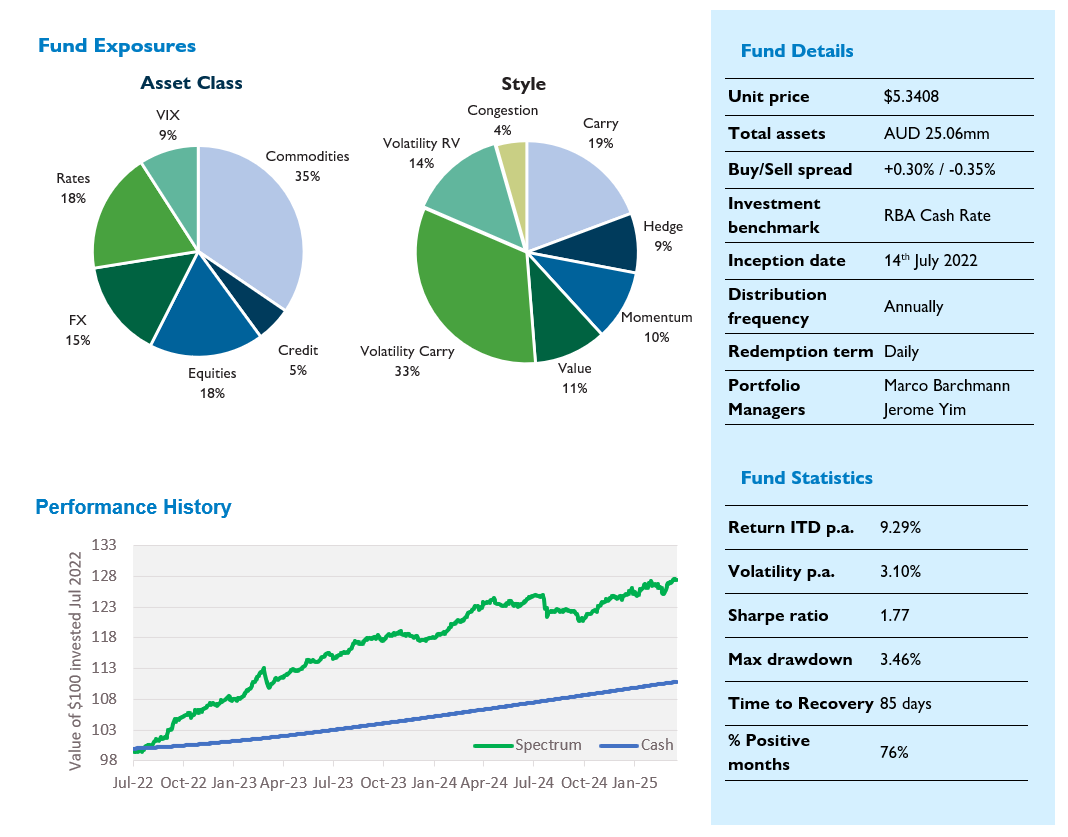

Spectrum Systematic Alpha Fund (Spectrum) is a multi-strategy systematic investment fund that aims to deliver positive absolute returns in excess of cash over the medium to long term with low correlation to traditional asset classes such as equities and fixed income.

Performance1

| 1 Month (%) | 3 Month (%) | 1 Year (%) | 2 Years (% p.a.) | Inception (% p.a.) |

|---|---|---|---|---|---|

| Challenger Solutions Spectrum Systematic Fund –Class I | 1.06 | 1.85 | 3.56 | 7.00 | 9.29 |

| RBA cash | 0.34 | 1.03 | 4.33 | 4.21 | 3.79 |

1 Returns are gross of fees. No allowance is made for tax when calculating these figures. The Inception date for Class I is 14 July 2022. Past Performance is not a reliable indicator of future performance. Source: Fidante Partners Limited, 31 March 2025

Monthly commentary

Spectrum returned 1.06% in March, taking CYTD performance to 1.85%. Since inception, gross performance stands at 9.29% p.a. versus 3.79% p.a. for the Fund’s cash benchmark, an outperformance of 5.50% p.a. Annualised volatility stands at 3.10%, for a gross since-inception Sharpe ratio of 1.77.

Despite the strong risk-off tone (S&P500 was down -5.75% for the month) strategies we would usually associate with risk-on, such as FX Carry (+0.17%), performed strongly. Commodity Vol (+0.20%) was also a strong performer, and remarkably, even Equity Vol (+0.09%) posted positive performance in March. The best performing strategy was Rates Vol RV (+0.28%) – which, as we discussed last month, does have some defensive qualities owing to its overall long vega positioning. Commodity Value (-0.20%) was the main negative.

Trump and associated tariff news remains the main source of risk in markets, and concerns around the economic impact of tariffs are increasing. VIX is back above 20 and risk sentiment is low as a result. However, performance of our short volatility strategies remains resilient – in aggregate short vol strategies contributed +0.14% return in March. A large part of this is driven by Commodity Vol, which makes up a larger (but still carefully limited in terms of sizing) part of the portfolio than both Equity and Credit Vol combined. This is because the idiosyncratic nature of commodity markets means short commodity vol strategies are less susceptible to the day-to-day ups and downs of other (eg equity) markets. Put another way, Commodity Vol exhibits low correlation to equity beta, and less exposure to left-tail equity events than Equity and Credit Vol, which are also included in the portfolio.

We seek to reduce the left-tail impact of short vol strategies in three main ways. Firstly, we pay very close attention to trade sizing to ensure we are not overly exposed to extreme market moves. Secondly, many of the short vol strategies we employ have some in-built risk mitigation measures such as long puts/calls to “close off” the wings of the distribution. Thirdly, we balance short volatility (and other strategies which exhibit any pro-risk qualities) with long vol and other more defensive strategies.

With respect to the third approach, we have now launched our own proprietary long equity gamma strategy in the portfolio. We had been testing the strategy – both the exposures and execution – since late November 2024 and increased the sizing last month once we were confident of both the return characteristics and execution methodology. It has been a particularly nice exposure to have in the portfolio recently given the increasing frequency of large equity market moves. The strategy is long vega, long gamma and flat delta. This delivers a highly defensive profile because: 1) volatility tends to go up when equities go down; and 2) the strategy inherits an intraday short position when equities sell-off.

The name “Spectrum” is an allusion to the way we build our portfolio by combining systematic strategies across the risk spectrum and balancing our exposures to achieve our low correlation objective. This allows us to include a broader range of systematic strategies in our investment universe. Adding our proprietary long gamma strategy into the mix provides explicit balance against some of the short volatility strategies in the portfolio and is a clear example of this approach, which, we hope, will contribute to delivering consistent and consistently uncorrelated returns over time.

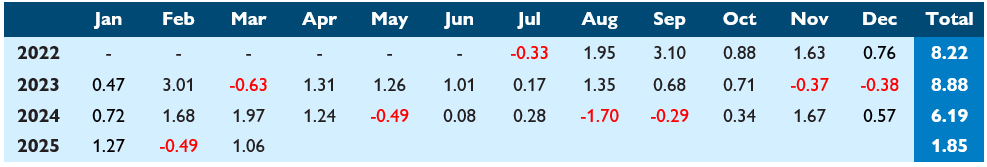

Monthly returns (%)1

1 Past performance is not an indicator of future performance.

For further information, please contact:

Liam McDermott | p: +614 66 563 890 | e: lmcdermott@fidante.com.au | w: www.fidante.com