Monthly Report May 2025

Fund objective

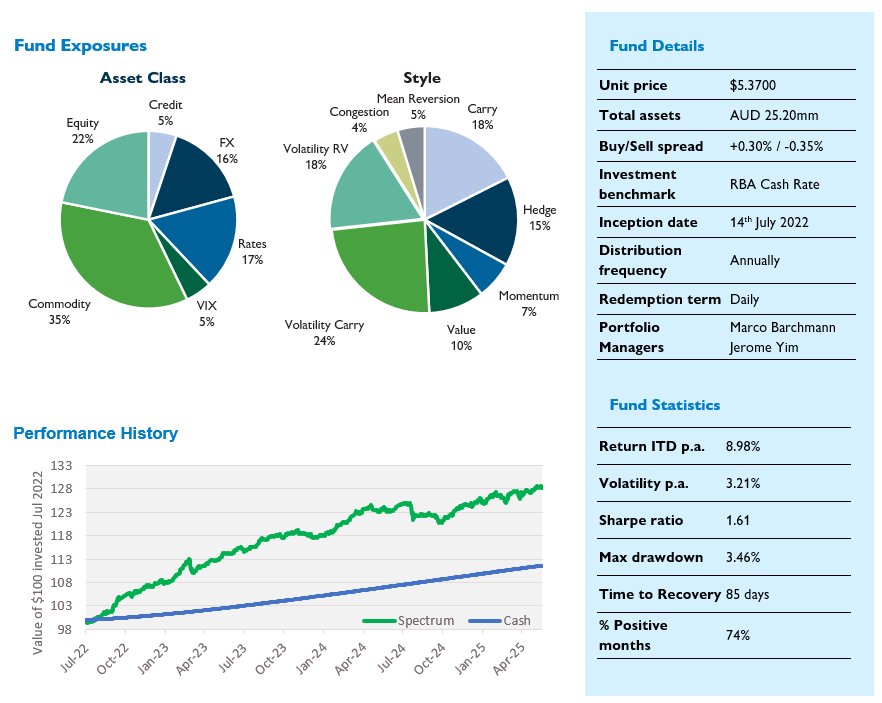

Spectrum Systematic Alpha Fund (Spectrum) is a multi-strategy systematic investment fund that aims to deliver positive absolute returns in excess of cash over the medium to long term with low correlation to traditional asset classes such as equities and fixed income.

Performance1

| 1 Month (%) | 3 Month (%) | 1 Year (%) | 2 Years (% p.a.) | Inception (% p.a.) |

|---|---|---|---|---|---|

| Challenger Solutions Spectrum Systematic Fund –Class I | 0.67 | 1.72 | 3.46 | 5.99 | 8.98 |

| RBA cash | 0.32 | 1.00 | 3.91 | 4.24 | 3.81 |

1Returns are gross of fees. No allowance is made for tax when calculating these figures. The Inception date for Class I is 14 July 2022. Past Performance is not a reliable indicator of future performance. Source: Fidante Partners Limited, 31 May 2025

Monthly commentary

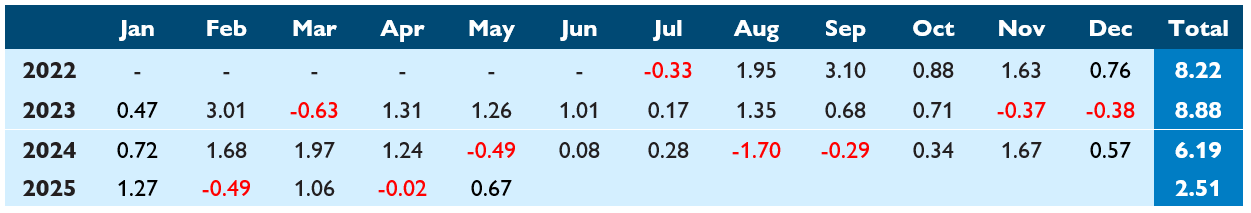

Spectrum returned 0.67% in May, taking YTD gross performance to 2.51%. Since inception, gross performance is 8.98% p.a. versus 3.81% p.a. for the Fund’s cash benchmark, an outperformance of 5.17% p.a. Annualised volatility has been 3.21%, for a gross since-inception Sharpe ratio of 1.61.

Short volatility strategies were the top contributor to performance in May, mainly driven by Commodity Vol (+0.39%) partially reversing the April losses. Rates Vol RV (+0.19%) and VIX Vol RV (+0.14%) also recouped some of the previous month’s losses. Hedge (-0.39%) was the main negative for the month, along with Rates Momentum (-0.28%).

The ongoing recovery from the April lows has taken many market participants by surprise as the “TACO trade” (short for Trump Always Chickens Out) takes hold. However, there is still reason to remain cautious with the “One Big Beautiful Bill Act” entrenching as much as a $3 trillion increase in the US budget deficit over the next decade. Meanwhile, debt servicing costs on outstanding US government debt are consuming an increasing portion – projected to grow to 16% in FY25 – of the budget. Rising debt issuance and higher financing costs are keeping the bond vigilantes very interested, driving a 50bp steepening the 2s30s Treasury curve and pushing 30y yields back to the top of the range at around 5% despite the Fed having lowered Fed Funds by 100bp easing and further cuts priced by year end.

We have exposure to long end US rates in our portfolio in our Rates Vol RV strategies. In those strategies we are long interest rate volatility on the long end of the interest rate curve, and there is sometimes a relationship between the level of rates and the level of volatility, driven by dealer hedging flows. While it’s not one-for-one, we would expect large outright moves in long end US rates to impact performance – positively in the case of higher rates and negatively in the event of sharply lower rates – of those Rate Vol RV strategies.

The parts of the portfolio which were the worst performers in April, were the best performers in May, not surprisingly given the recovery in risk. On the other hand, the best performing strategy group in April (Hedge) was the worst performing in May – again, unsurprisingly given market moves. However, the nature of the systematic hedge strategies we hold meant that although we have been experiencing some losses in that category in May as vol repriced lower, the realised gains from long gamma positions have held meaning that we have held onto most of April’s Hedge gains despite the recovery in markets which was an important driver of May’s performance.

Sometimes avoiding a bad outcome in a difficult market can be as important as delivering positive returns in more favourable times. In the first instance, we rely on diversification amongst the strategies in our portfolio for risk management, and our current set of systematic strategies has largely worked, avoiding large losses in April while posting modest gains in May. Therefore, we see no immediate need to adjust our exposures in response to recent market moves. On the other hand, we are always on the lookout for orthogonal strategies to add to the portfolio, and for tweaks to existing strategies which we think can improve overall performance without compromising diversification and this is an ongoing area of focus for us.

Monthly returns (%)1

1 Past performance is not an indicator of future performance.

For further information, please contact:

Liam McDermott | p: +614 66 563 890 | e: lmcdermott@fidante.com.au | w: www.fidante.com