Monthly Report September 2024

Fund objective

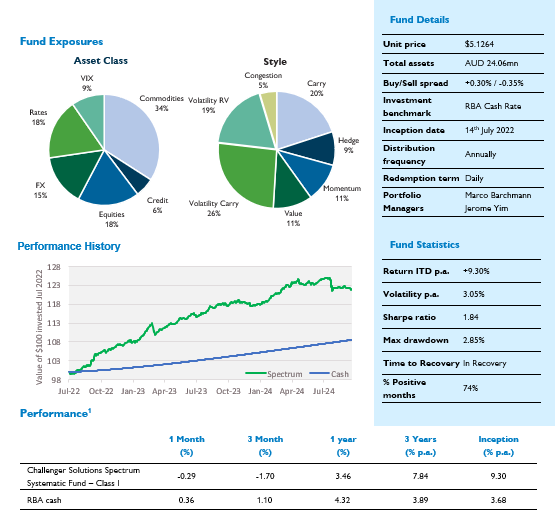

Spectrum Systematic Alpha Fund (Spectrum) is a multi-strategy systematic investment fund that aims to deliver positive absolute returns in excess of cash over the medium to long term with low correlation to traditional asset classes such as equities and fixed income.

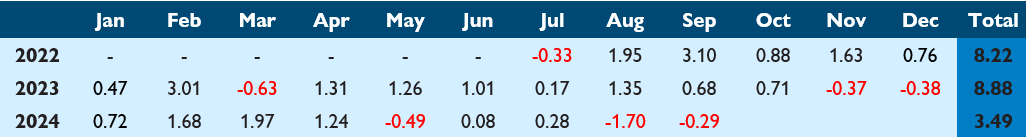

1 Returns are gross of fees. No allowance is made for tax when calculating these figures. The Inception date for Class I is 14 July 2022. Past performance is not a reliable indicator of future performance. Source: Fidante Partners Limited, 30 September 2024

Monthly commentary

Spectrum posted a loss of -0.29% in September, reducing CYTD gross performance to 3.50%. Since inception, performance stands at 9.30% p.a. versus 3.68% p.a. for the Fund’s cash benchmark, an outperformance of 5.62% p.a. Annualised volatility has been 3.05% over the same period, for a gross since-inception Sharpe ratio of 1.84.

Commodity strategies were the main source of negative performance, with Commodity Carry (-0.39%), Commodity Vol (-0.24%), Commodity Value (-0.23%) and Commodity Congestion (-0.16%) all posting losses for the month. These were somewhat offset by modest gains elsewhere, for example Rates Vol RV (+0.11%), Rates Trend (+0.11%) and FX Carry (+0.06%), but not enough to flip overall performance into positive territory.

As a general observation, we like including commodity strategies in the portfolio for one simple reason: many of the market inefficiencies observed in commodity markets are driven by completely different market participants and/or factors than those observed in other asset classes. This is often also true between different underlying commodities, making commodity strategies a great source of diversification within our multi-strategy portfolio, as well as a great source of return.

In fact, taken as a stand-alone group, commodity strategies have contributed a total of 5.16% to the 21.94% cumulative performance since inception, posting positive aggregate performance in 17 of 27 months. Unfortunately, even uncorrelated strategies will sometimes post coincident negative performance, as was the case last month. While not a complete “one-off” – this has also happened in two other months since we started – we are confident that over the medium-term our commodity strategies will be additive to performance.

Finally (and still on commodities!), we further diversified our commodity exposure in September with the inclusion of Copper and Corn Vol strategies into the portfolio. In the first instance, we think these strategies are complementary to our existing Commodity Vol exposures – as noted above, the drivers of individual commodity prices can be highly idiosyncratic. In addition, we carefully size any volatility strategies to ensure that the portfolio is not overly exposed to very large price shocks. In this way we can earn modest returns from short volatility strategies (with some degree of regularity) without unduly endangering long-term performance.

Monthly returns (%)1