Subscribe to Horizons

Horizons is our newsletter designed for retirees or those planning their retirement. Subscribe now to receive our latest information to help you live well in retirement in Australia.

The tide is turning on Australia’s world leading retirement system.

On the back of compulsory superannuation savings, Australians have accumulated a pool of money that dwarfs even our own national GDP. However, as more and more of us retire, we are struggling with a shift in psychology – moving from saving as much as possible to spending and living a lifestyle commensurate with our super savings.

There are two goals when it comes to retirement – and the second one is most often overlooked.

The first goal, maximise retirement savings, is well understood. Accumulating as big a pie as possible through contributions and investment performance has been the focus of the superannuation sector, and the government.

The performance test introduced as part of the Australian Government’s Your Future, Your Super (YFYS) reforms focuses solely on investment performance. It is an important guide to outcomes in super, however, it is only measuring how we are making the pie bigger. Good performance does not help if there is not the return of the capital to spend in retirement.1

With the increasing focus on retirement, there is a growing awareness that performance alone is not enough. What matters in retirement is the income that retirees can spend, not necessarily the starting balance. This is why the Retirement Income Covenant (RIC) refers to maximising retirement income, subject to managing risks and providing flexibility. It is the key output of super.

The second, and equally important goal is to maximise retirement income. Retirees need to convert their savings into an income stream over retirement, enabling confidence to spend. This requires a shift in psychology, a plan that adapts for market cycles and is measurable in real time so adjustments, if any, can be made.

Measuring super outcomes

The challenge for retirees is managing both goals simultaneously.

The YFYS performance test only considers investment risk, so using benchmarks enables a calculation of risk-adjusted returns as the appropriate measure, not absolute return. In retirement, while performance remains important, it needs to be considered alongside longevity risk, sequencing risk, and inflation risks. This can’t be done by using a single benchmark but rather a range of possible investment and longevity outcomes, which are more realistic than a single measure.

David Bell and Geoff Warren of the Conexus Institute explain how a real-time test can give a reliable indicator of performance and propose using a checklist and/or a quantitative measure, as required, to measure performance in retirement.2

Retirement tools, such as the Challenger Retirement Illustrator 3, can be used to consider the different outcomes for retirement income (and estate balances) for retirement income approaches.

The role of a retirement income tool is to identify a retirement income strategy that can help maximise the income available for the retiree. Importantly, this must consider all sources of income – Age Pension entitlements, superannuation, annuities and other investments.

A combination of income steams

A combination of income streams can be a better strategy to help solve the challenges Australians are exposed to in retirement. Take this case study below:

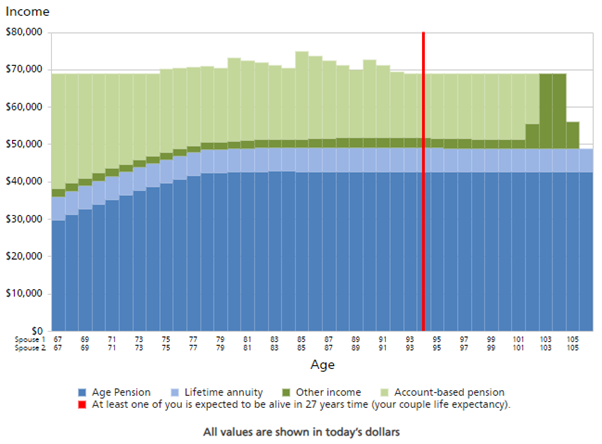

Helen and Hamish each have $300,000 in super and share $50,000 in cash/ term deposits and $20,000 in non-financial assets. They are both 67 and want to be able to spend as much as they can, ‘confidently’ while always having income to meet the ASFA modest living standard of $46,6204 a year.

With a combined $600,000, Helen and Hamish might expect to be able to spend at the ASFA comfortable standard of $71,724 for their lifetime. However, modelling out the range of outcomes highlights they only have a 66% chance to be able to spend $71,724 a year (increasing with inflation). On average, this should be okay, but the probability is not high enough to give them confidence to spend.

Further, the range of outcomes highlights the increased risk to retirement outcomes. From the scenarios, Helen and Hamish have only a 68% chance of receiving the modest standard out to their combined life expectancy if they try to sustain the comfortable lifestyle.

To get an 80% chance of maintaining their lifestyle, Helen and Hamish need to reduce their spending to $69,000 a year but there are still circumstances where they will miss out on the modest level of spending. Ultimately, it will only be achieved in 83% of scenarios.

A potential solution for Helen and Hamish is to invest 20% into a guaranteed lifetime income stream.5

This will increase the probability of sustaining $69,000 from 80% to 87% while delivering the modest standard for as long as they both live in 100% of the scenarios modelled. The chart shows the income sources in the average scenario.

Confidence to spend

With 2.5 million Australians approaching retirement over the next 10 years, ensuring sufficient retirement income to last through the golden years is crucial. Understanding the change in goals and priorities, consideration of multiple income streams, and an active approach to measuring risks will help retirees maximise their lifestyle spending without fearing a loss of living standards dropping too far.

Originally published in FS Advice Journal, https://www.fsadvice.com.au/blogs/the-changing-goals-of-retirement.

1 Assessing-retirement-strategies-Final-20221202-Updated.pdf (theconexusinstitute.org.au) (accessed 17 January 2024)

2 Madoff provides an extreme example where high ‘investment returns’ without the return of capital can be catastrophic.

3 For adviser use only. It can assist the advice they provide to retiree clients.

4 As at September 2023.

5 Source: Challenger Retirement Illustrator (19/01/2024) using Social Security rates and thresholds effective 1 January 2024. 67-year-old female/male client couple. $350,000 each in super income streams. Assumes returns of 4.5% p.a. for defensive assets and 8.0% p.a. for growth assets before fees. $50,000 cash/TDs earning 4% p.a. interest. Non-financial assets of $20,000. Target income includes $46,620 p.a. essential income. Amounts shown are in today’s dollars. CPI of 2.5% p.a. See Challenger Retirement Illustrator for all assumptions.

Related content

Boosting confidence in retirement

Five facts everyone needs to know about life expectancy