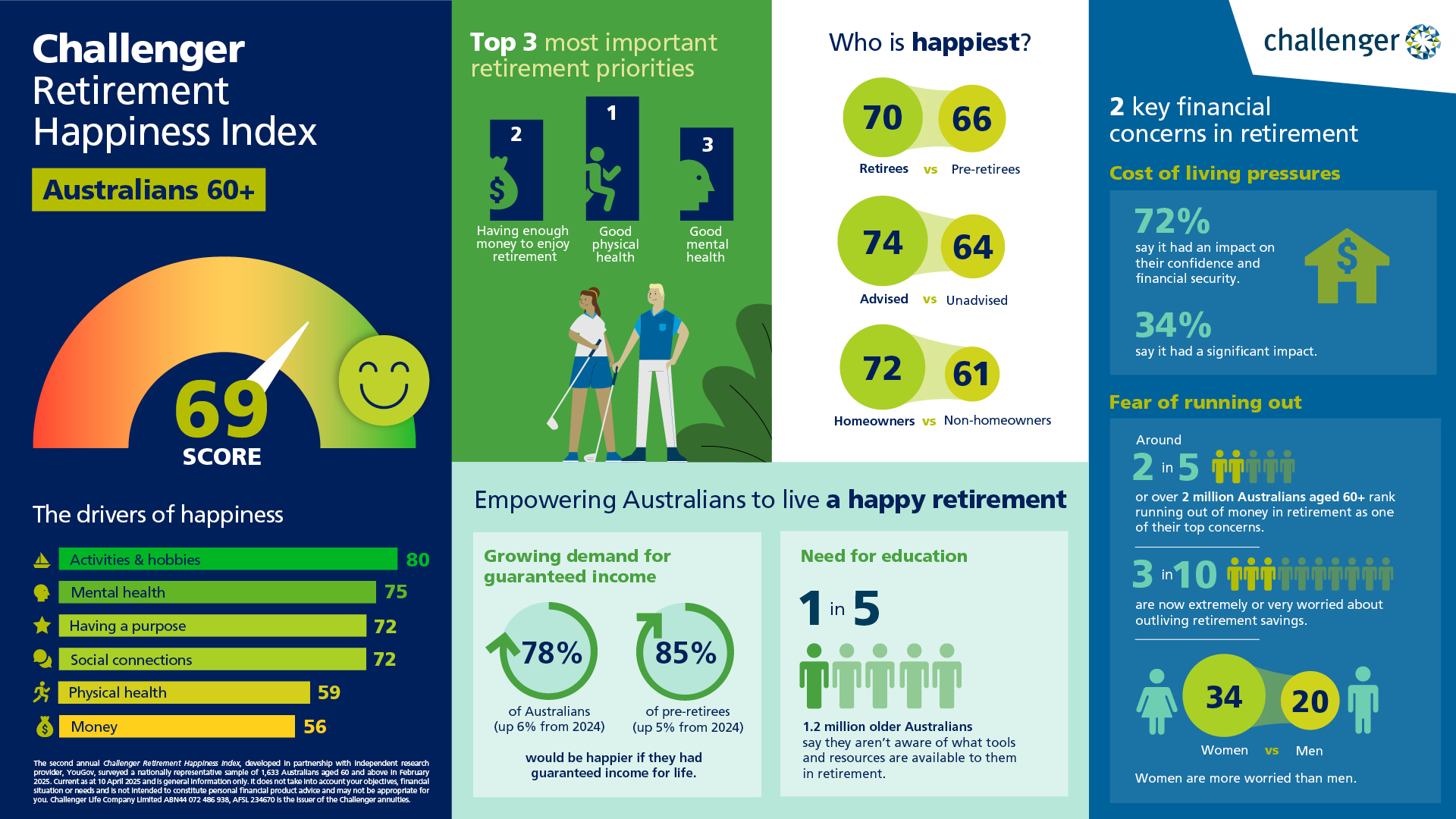

Demand for financial security in retirement is growing – with 85% of pre-retirees seeking greater certainty about their financial future.

In total, 78% of Australians say they’d be happier with a guaranteed income for life.

Mandy Mannix

Hear from Mandy Mannix: Chief Executive, Customer

“We know retirement can be one of the most rewarding stages of life—but confidence is key. When people feel uncertain about their finances, they tend to hold back. That’s led to a chronic underspending problem in retirement, with many Australians living more cautiously than they need to.”

“Retirees go from a steady pay cheque to a lump sum, and that sudden shift makes it hard to budget with confidence. That’s why a guaranteed, regular income for life is so powerful—it replaces that pay cheque, can keep up with inflation, and gives retirees the freedom to actually live their best life in retirement.”

Index reveals drivers of retirement happiness

The 2025 Challenger Retirement Happiness Index revealed a retirement happiness score of 69.

Activities

Health - Mental

“I consider myself to be healthy mentally”

Purpose

People

Health - Physical

“I consider myself to be healthy physically”

Money

‘Life. Well lived.’

Our customer stories celebrate the joy that can come from financial security in retirement.

Amanda

70, retired, Lifetime annuity investor

“I like that I receive an income for as long as I live. It’s consistent. And that’s a real comfort to me. I get a part-age pension as well which I mainly to use to pay the bills and everyday things. The annuity money is for “extras” like birthday presents or going out for a special occasion. It allows me to enjoy my retirement.”

What makes Australians 60+ happy

Discover more

What is an annuity?

A guide to income in retirement