Table of Contents

Challenger’s retirement planning tools and resources can help you learn how to take control of your financial future with confidence. From a retirement calculator to spending planners and comprehensive educational retirement guides, our tools are designed to support your retirement planning.

Use our retirement calculator to estimate how long your savings and super may last, assess your potential Age Pension eligibility or explore budgeting resources to help create a structured retirement plan. With user-friendly features and expert insights, these tools can empower you with relevant information to make more informed decisions when planning for a comfortable and confident retirement for a comfortable and confident retirement.

Our retirement planning tools

Learn

Education and helpful resources on topics that are relevant for people who are retired, planning their retirement, or who are planning for residential aged care.

Planning for a confident retirement

A key to retiring with confidence is knowledge. Use this guide to familiarise yourself with key topics to help you start building your retirement plan.

A guide to income in retirement

In this guide, we share five key steps to consider in building a comprehensive retirement income plan to provide you with regular payments for life. You’ll learn how to manage your income needs over time so you can feel comfortable with your spending throughout retirement.

Step 1: Changing with the times

Step 2: Your retirement ‘pay cheque’

Step 3: Navigating the risks

Step 4: Secure retirement income

Step 5: Enjoy your whole retirement journey

Guaranteed regular income for life

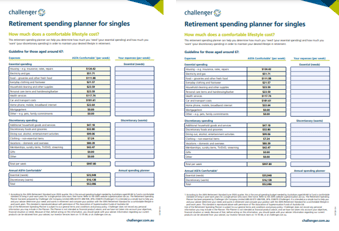

Our online interactive retirement spending planners for singles and couples can help you figure out how much income you may need in retirement. You should consider what your essential costs are and also what your discretionary expenses might look like so you can understand how much income you might need.