Retire with Confidence tool

Estimate how long your super savings might last in retirement, possible Age Pension payments and the impact of including a guaranteed income stream as part of your portfolio.

Investors and advisers are no doubt aware that 2022 represented a significant inflection point for markets. Inflation emerged as a big risk, which drove interest rates higher. At the same time, growth became less certain and stock markets became more volatile. Consumer confidence around having a comfortable retirement has reached generation lows.

It became apparent that in this uncertain environment, growth would no longer be enough to deliver reliable returns and investors needed to rethink where returns are going to come from.

The good news is that if we consider a wider suite of income options, rising rates are now setting up a range of compelling opportunities that can generate consistent income and deliver greater peace of mind and certainty for investors.

The growing structural importance of income

Current market and macroeconomic factors are raising the importance of income, but so too are longer-term structural factors. Australian households have $17.2 trillion in assets at June 2022, including land and dwellings ($9.5 trillion) and financial assets of $6.5 trillion.1 Excluding liabilities of $2.8 trillion, the net worth of Australian households was $14.4 trillion, which gives them a substantial base from which to generate income from investments.

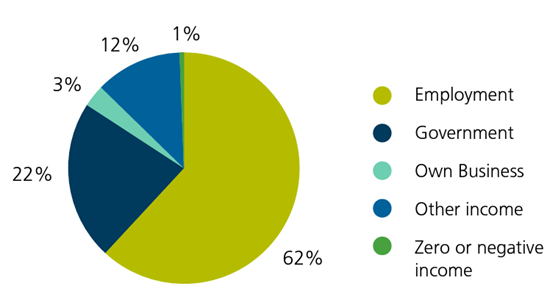

Yet a relatively small proportion of Australian households currently rely on investments for income. Some 62% of Australian households’ main source of income comes from employment, according to the Australian Bureau of Statistics (ABS).2 A further 22% rely on government pensions and allowances, and 4% rely on their own business income.3 That leaves just 12% reliant on their investments for income as shown in Figure 1.

Figure 1: Main source of household income, Australia 2019-20

Source: ABS Survey of Income and Housing 2019-20

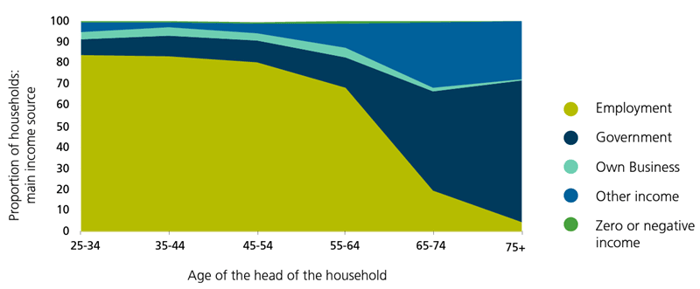

But if we consider the full life cycle, income becomes increasingly vital as Australians age. Later in life, most Australians rely on either government payments or income from investments, shown in Figure 2.

Figure 2: Main source of household income by age

Source: ABS Survey of Income and Housing 2019-20

As the nation’s superannuation system continues to mature, a greater proportion of income for retirees will be coming from investments and super. More of Australia’s household spending is likely to require more income from investments.

That will particularly be the case with a greater proportion of Australians in the age bracket 65+ who are more reliant on income and super rather than work. According to the Australian Government 2021 Intergenerational Report, the proportion of the population aged 65-84 will increase from 14.3% in 2019-20 to 17.8% by 2060-61.

Exploring a wider suite of income investments

While the ‘income’ label is often applied to some defensive assets to differentiate them from growth assets, there are many growth assets that can provide a reliable income stream to investors.

There are five broad ways that income can be generated from an investment:

Table 1: Source of Income

Income | Description | Typical asset classes |

|---|---|---|

| Interest | Known, or pre-determined payments for the use of capital over a certain period. This is a contractual payment that must be made regardless of underlying profitability. | Cash Bonds Mortgages Hybrids Term annuities |

| Rent | Payment for the use of an asset, which is owned by the investor. This payment is usually contractual (i.e. not dependent of profitability), and the investor needs to maintain the asset over time to keep renting it out. | Property Infrastructure |

| Dividends | Payment from profits to an investor that has provided capital to an enterprise. These payments will vary with the underlying profitability of the enterprise. In some cases, this could entail the whole profit of the enterprise. | Stocks Private equity Hybrids |

| Capital conversion | Some investments use derivatives to generate income partially transforming the capital in different market scenarios. | Equity option funds Structured products |

| Capital consumption | Regular cashflows for income can be generated through the consumption of capital in addition to the earnings on the investment. | Lifetime annuities RCV0 annuities Innovative annuity products |

The challenge in this environment for investors who are seeking income is to generate income that is relatively stable and sufficient.

That will require investors and advisers to explore a full range of income options, including:

Cash and mortgage funds

These funds often represent secure investments that make income payments that reflect the level of the Australian cash rates.

Australian fixed interest

Investors in fixed interest aim to generate higher income than a cash investment, capturing a term premium for the duration risk and/or a credit risk premium.

Term annuities are fixed interest investments that provide regular income for a fixed term chosen by the investor, regardless of how share markets perform. The most common structure (known as an RCV100 annuity) provides regular payments based on a fixed rate over the period and returns the full capital amount at maturity. The capital is locked away for the period and, unlike a bond fund, there is usually no updated pricing for swings in the market.

Global and diversified fixed interest

This enables an Australian investor to tap into a broader range of assets that can provide regular income, though there is an additional risk to manage from different currencies.

A diversified fixed interest investment provides scope for the investment manager to add value by adjusting the exposure of the portfolio to improve the overall return and income.

Other income funds

A range of managed funds and ETFs in Australia are not based on traditional income asset classes but are still managed and marketed as income funds. Some of these are multi-sector funds that include traditional income assets and income strategies from growth assets.

While the underlying investments can be more volatile than traditional income assets, the income stream provided by the ‘growth’ assets is often not as volatile as expected. Dividend payments are more stable as companies seek to avoid cutting dividends unless absolutely necessary – resulting in dividend growth that is more stable but still aligned to the long-term growth in earnings and share prices.

Property and infrastructure income

Income from property investments is provided by the rental return less the cost of managing the property. In a managed fund, the capability of the property manager can impact the level of income that is available to the investor. Leverage is often used for property investments so investors don’t need to provide the full capital amount of the investment. This can be quite an effective strategy in accumulating wealth, with the ability of negative gearing to help an investor reduce their tax liability. It is generally a long-term strategy due to the lower liquidity in property and infrastructure assets.

Equity income strategies

An equity income fund with a dividend focused approach might invest in shares with high dividend yields and aim to capture more of the average returns from dividends than from capital gains. Investors need to consider if they are comfortable that the long-term growth and volatility of this type of investment will likely be close to the market return while generating higher dividend payments for income.

Another option for an equity portfolio is to use derivatives to generate income instead of the potential capital gains from the portfolio. This option can avoid the style drift of a dividend-focused approach, but execution depends on the available depth of options and derivatives available on the stocks. This approach may also work well for retirees for account-based pensions with a 0% tax rate. Derivatives can add additional risks to a portfolio so additional care is required with a derivative-based strategy to ensure that the investor is not leveraged to market exposures.

Annuities with RCV0 (zero residual capital value)

Another way to convert capital to income is to use a product that has no residual capital value on maturity such as some term annuities. A lifetime annuity can also have this feature, although it usually doesn’t have a maturity date. The RCV0 Annuity returns the capital to the investor over time to provide a smooth payment profile (that can be indexed to inflation). This provides a direct method of converting capital to income. The annuities market in Australia is growing in sophistication with new annuity-style products being introduced with dynamic features.

Start looking to reallocate

The investment environment has changed.

Inflation in Australia and around the world has hit new generational highs. Even modest increases in inflation can have a significant impact on the lifestyle of retirees, who don’t have a rise in wages to balance out the loss in purchasing power of their investments.

At the same time, market volatility has increased and the outlook for growth is less certain. Rates have risen significantly, providing more options investors and advisers who are looking to reallocate more of their portfolio to income investments that generate a reliable income.

To find out more about the range of income solutions provided by Challenger and Fidante, contact your financial adviser or contact us on 13 35 66.

1 Australian National Accounts, Household Balance Sheets, Australian Bureau of Statistics (June 2022)

2 ABS Survey of Income and Housing 2019-20

3 Small business are a larger proportion of the economy, as payments to owner/managers of businesses are considered to be employment income reflecting their time commitment to the business

The information on this webpage is current as at 3 April 2023 unless otherwise specified and is provided by Challenger Life Company Limited ABN 44 072 486 938, AFSL 234670 (Challenger, our, we), the issuer of the Challenger annuities. The information on this webpage is not intended to constitute financial product advice. Any examples shown on this webpage are for illustrative purposes only and are not a prediction or guarantee of any particular outcome. Past performance is not an indicator of future performance. This webpage may include statements of opinion, forward looking statements, forecasts or predictions based on current expectations about future events and results. Actual results may be materially different from those shown. This is because outcomes reflect the assumptions made and may be affected by known or unknown risks and uncertainties that are not able to be presently identified. To the maximum extent permissible under law, neither Challenger nor its related entities, nor any of their directors, employees or agents, accept any liability for any loss or damage in connection with the use of or reliance on all or part of, or any omission inadequacy or inaccuracy in, the information on this webpage.

Related content

Boosting confidence in retirement

Five facts everyone needs to know about life expectancy