*Rates may vary. Annual income payment with capital returned at end of term. Issued by Challenger Life Company Limited ABN 44 072 486 938.

Table of Contents

How a fixed term annuity works

Fixed Term Rates

Rates are updated every Monday. The rates displayed are current and subject to change. Longer terms are available. For a tailored payment quotation, apply now, contact your financial adviser or call us on 13 35 66.

The rate for a Challenger term annuity is fixed for the term of your investment. Current annual payments for every $100,000 you invest in the Challenger term annuity are illustrated above. Choose from a term of one year up to 50 years*, with a minimum investment of $10,000. Annualised payments are not available for 1 year terms

*If you use your super to invest and ask for all of your initial investment to be repaid as part of your regular payments, super rules restrict the maximum term you can select - it cannot be greater than the number of whole years until you turn age 100.

Fixed term annuity options

If you’re not sure which options are best for you, we recommend you discuss it with your financial adviser who will be able to help.

1. Choose how much you want to invest

You can choose to use your personal or super savings to invest a minimum of $10,000.

2. Choose your term

Choose a term from 1 to 50 years.1

1If you use your super to invest and ask for all of your initial investment to be repaid as part of your regular payments, super rules restrict the maximum term you can select – it can’t be greater than the number of whole years until you turn age 100.

3. Choose how often you receive payments

Match the frequency of your payments to suit your income needs. You can decide to receive your payments monthly, quarterly, half-yearly or for terms longer than one year, yearly. If you’re using your super money to invest, your regular payments are tax-free if you’re aged 60 years and over.

4. Choose if you want your income payments to be indexed

Your income payments won’t change unless you choose the indexation option. Payments can increase annually in line with increases in the Consumer Price Index (CPI) or by a fixed percentage of up to 5%. This option is only available for terms of at least two years where you have chosen to have all of your capital returned to you as part of your payments (also known as RCV 0 - see below for more information). More information on the indexation options is available in the 'Will my regular payment amount change over time' section of the PDS.

5. Choose when you want your lump sum investment repaid

Choose how we pay you back the original amount you invested. It can all be repaid at the end of your chosen fixed term, or all or part of it can be repaid with your regular payments. The choice is yours.

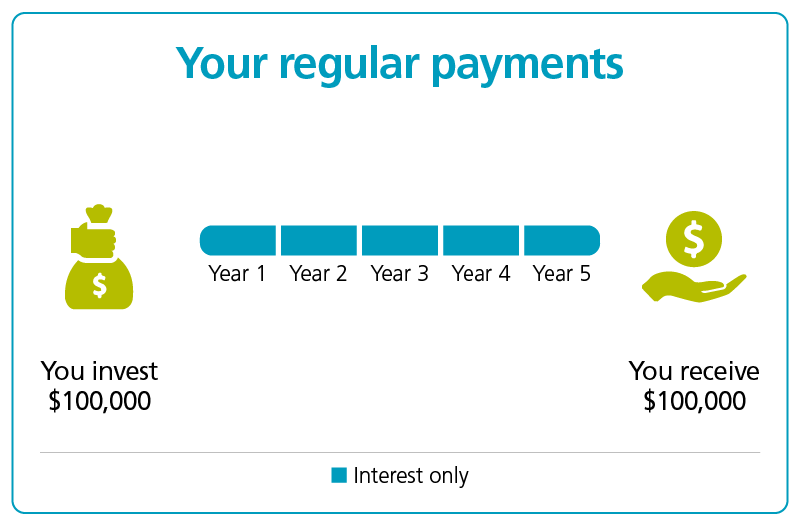

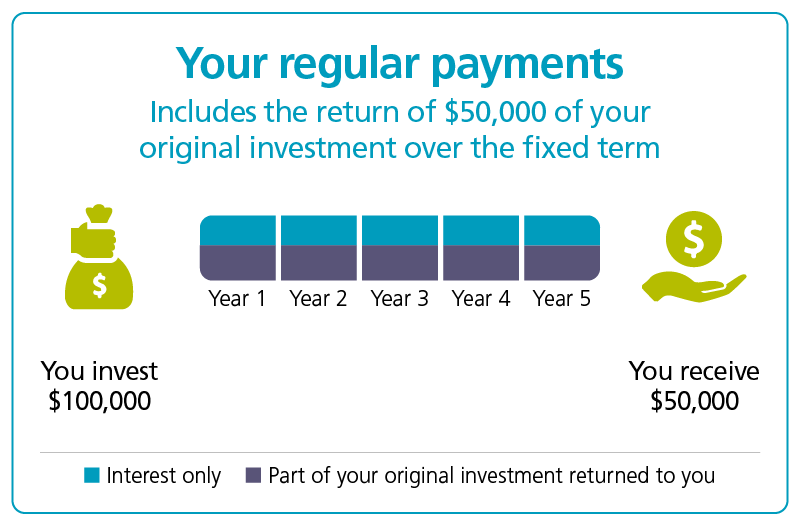

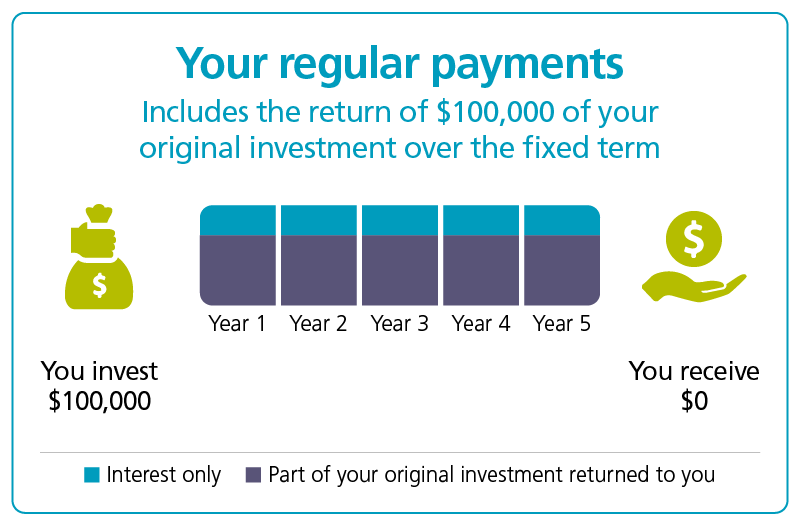

Here are a few examples using a five-year fixed term of $100,000 with annual payments

Example 1 Receive your original investment amount of $100,000 at the end of your term. | Example 2 Receive 50% of your original investment as part of your regular payments and the other 50% at the end of your term. | Example 3 Receive all of your original investment spread evenly through your investment term and no payment at the end of the term. |

|  |  |

Features

Fixed return

Know what you’re earning. Enjoy the certainty that your income won’t be impacted by the performance of the share market.

Choice of terms and payments

Select from a range of terms and income payment options all delivering guaranteed payments for the term you choose.

No fees

There are no product fees or charges payable to Challenger.

Access your money early if you need it

Nominate beneficiaries

Competitive rates

View our competitive rates below.

Risks of investing

All investments carry some risk. We've listed the key risks that you should consider when deciding whether a fixed term annuity is right for you.

Subscribe to Horizons newsletter

Horizons is our newsletter designed for retirees or those planning for their retirement. Subscribe now to receive our latest information to help you live and age well in retirement in Australia.

Additional reading

.png?h=400&iar=0&w=400)

What’s the difference between a term deposit and a term annuity?

Frequently asked questions

Is a fixed term annuity right for you?

Challenger Life Company Limited ABN 44 072 486 938, AFSL 234670 is the issuer of Challenger Annuities

Useful documents and links

Below we have provided information that you should consider before you make a decision to purchase a financial product. We also recommend that you speak to your financial adviser.