Table of Contents

Maximising Age Pension payments with a Lifetime Annuity

The social security assessment of lifetime income streams may help some clients improve their Age Pension eligibility. From 1 July 2019, under the social security income test, only 60% of any payment your client receives from a new lifetime income stream is assessable as income for social security purposes. And, under the social security assets test, generally only 60% of the purchase price of a lifetime income stream (including a lifetime annuity) will count as an asset through to age 85, subject to a minimum of five years. From that point onwards only 30% of the purchase price counts as an asset. This is different to many other types of investments, where 100% of the asset is assessable.

Many advisers use lifetime annuities to improve portfolio outcomes for their retiree clients, as well as maximise Age Pension entitlements.

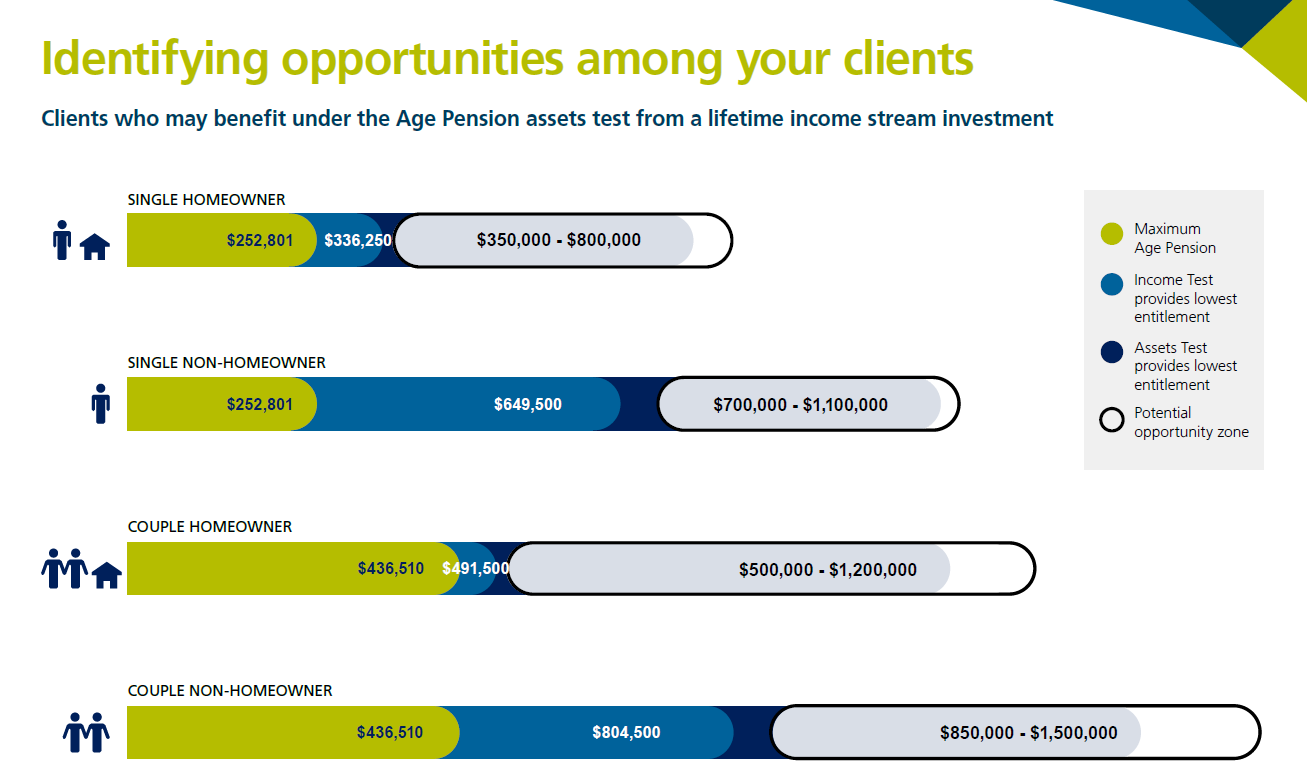

Taking into account the means testing of lifetime income streams, we developed a ‘strategy zones’ chart. This chart provides a useful snapshot of the areas where advice strategies could improve Age Pension outcomes for different clients. Clients in the income test strategy zone, for example, could benefit from strategies which reduce assessable income for the purposes of means testing. Clients in the assets test strategy zone or outside the assets test zone, could benefit from strategies which minimise their assessable assets.

Technical paper

Read this technical paper which demonstrates how a lifetime annuity can provide better outcomes for clients looking to maximise their income from the Age Pension.

Other tools

Modelling scenarios

Generate quotes

Finding knowledge

Our Distribution team can help

Stay informed

Sign up to our free monthly adviser newsletter, Tech news containing the latest technical articles, economic updates, retirement insights, product news and events.