How are the new aged care reforms reflected on the Aged Care Calculator?

How are the new aged care reforms reflected on the Challenger Aged Care Calculator?

Download the full article below.

The aged care reforms commenced on 1 November 2025. From this date, anyone accessing government funded aged care (Support at Home and Residential care) for the first time are subject to the new rules. Grandfathering provisions apply to those who accessed government funded aged care prior to 1 November and Challenger Tech has detailed these provisions in a previous technical update here.

Challenger Tech has also updated the Aged Care Calculator (ACC) to reflect the new rules and this month’s FAQ article summarises how users can navigate the new rules on the tool.

Retention amounts

The aged care reforms introduced retention amounts, which will be deducted from Refundable Accommodation Deposits (RADs) and Refundable Accommodation Contributions (RACs) for new residents from 1 November 2025. Retention amounts will be calculated daily on the RAD/RAC balance at 2% per annum and deducted at least once a quarter but cannot be more frequently than once per month or after five years from the date a RAD/RAC was first paid. If a resident pays a RAD/RAC to an aged care facility and then changes to another aged care facility, the five years will not restart.

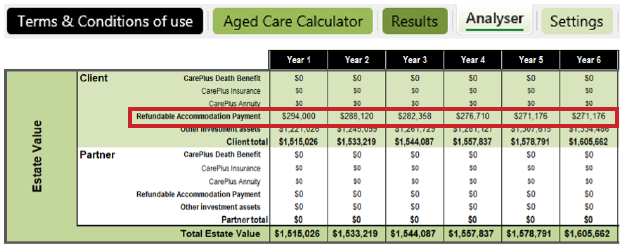

In the ACC, retention amounts are reflected in the Refundable Accommodation Payment balances within the ‘Estate Value’ section of the ‘Analyser’ tab (see below). The tool will cease deducting retention amounts after year 5 for those who are ‘new to care’. Note as the calculator assumes annual retention amount deductions, projected RAD balances on the tool will be slightly lower than what RAD balances are in practice.

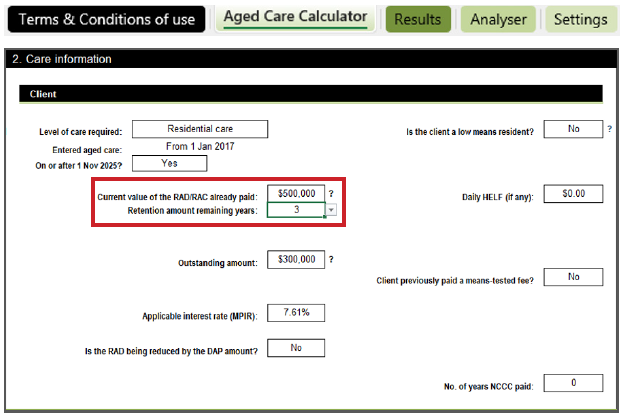

Users can adjust the number of years retention amounts are to be deducted under the ‘Care information’ section of the ‘Aged Care Calculator’ tab. This can be useful in the future when modelling residents who have been under the new rules for a few years and already had retention amounts deducted.

Indexation of Daily Accommodation Payments (DAPs)

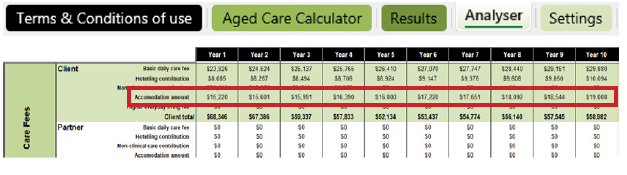

The aged care reforms introduced the indexation of DAPs for new residents from 1 November 2025. DAPs will be indexed inline with changes to the consumer price index (CPI) twice a year on 20 March and 20 September. The ACC reflects the indexation of DAPs annually under ‘Accommodation amount’ within the ‘Care Fees’ section of the ‘Analyser’ tab (see below).

The new rules also stipulate that retention amounts deducted from the RAD balance cannot increase DAPs as the RAD balance decreases. The ACC reflects this and ensures DAPs does not increase as retention amounts are deducted. However, where users choose to have DAPs deducted from the RAD, the ACC will increase DAPs as the outstanding RAD increases and reduce retention amounts deducted as the RAD balance decreases from year 2.

Non-clinical care contribution (NCCC) lifetime cap

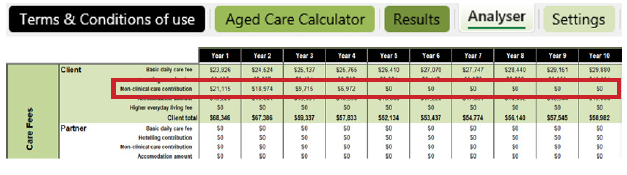

The aged care reforms replaced the means tested care fee with the NCCC. The NCCC is subject to a daily cap and an indexed lifetime cap. The lifetime cap is currently $135,318.69 with the NCCC not payable after four years, whichever occurs first.

The ACC reflects this in the ‘Non-clinical care contribution’ amounts within the ‘Care Fees’ section of the ‘Analyser’ tab (see below).

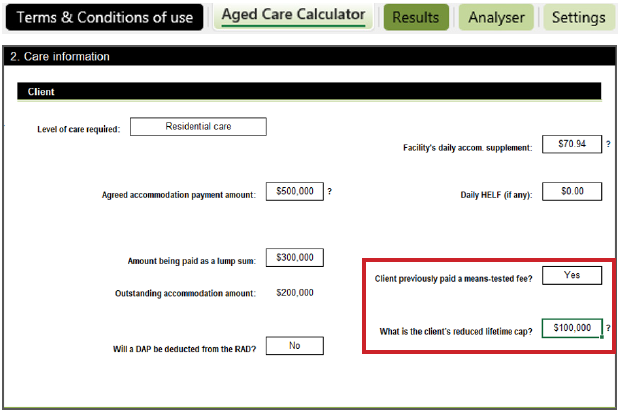

Participant contributions paid under the Support at Home program also count towards the lifetime cap for NCCCs. Residents who have previously paid participant contributions can reduce the lifetime cap for NCCCs under the ‘Care information’ section of the ‘Aged Care Calculator’ tab (see below).

Those who entered residential care before 1 November 2025

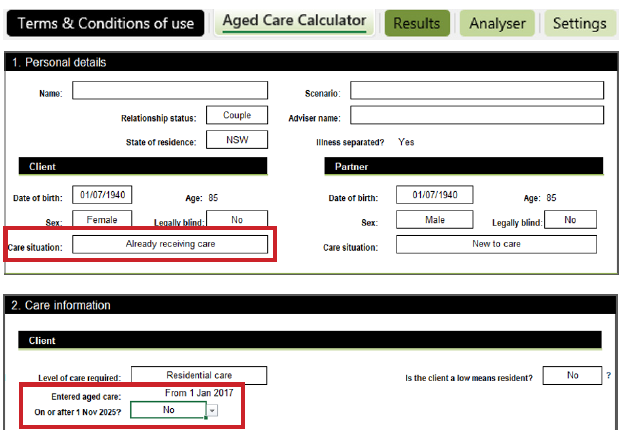

Residents grandfathered under the pre-1 November residential care rules can still be captured in the ACC. The ACC can also model scenarios where one member of a couple is subject to the pre-1 November rules and the other member is subject to the new rules.

To capture a resident under the pre-1 November rules in the ACC, ensure ‘Already receiving care’ is selected under the ‘Personal details’ section of the ‘Aged Care Calculator’ tab (see below). Then under the ‘Care information’ section of the same tab, ensure ‘On or after 1 Nov 2025?’ is set to ‘No’.

Support at Home

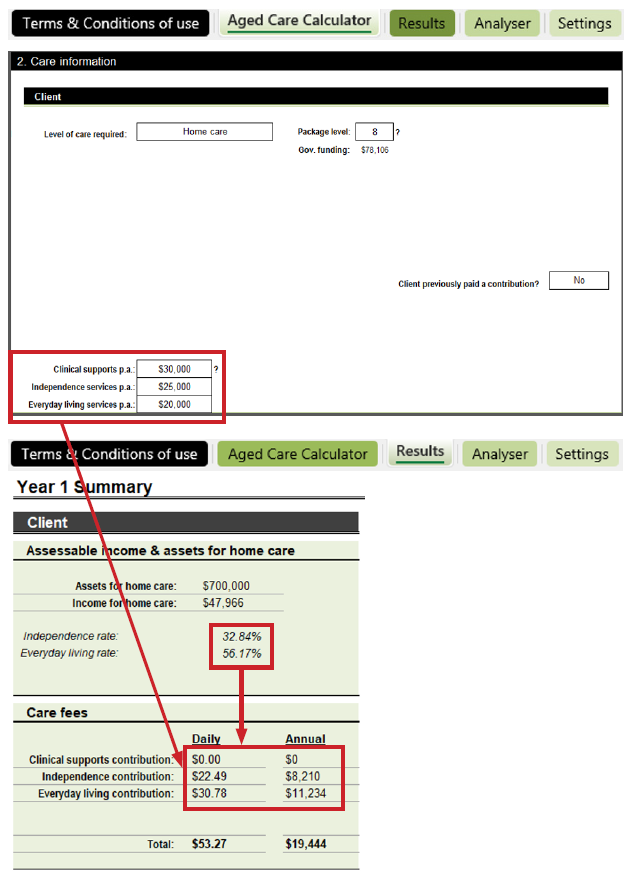

The aged care reforms replaced the Home Care Packages program with the Support at Home program. More information on the Support at Home program can be found in Challenger Tech’s previous technical paper here. Participant contributions under the Support at Home program are based on contribution rates calculated using the participant’s assessable assets and income. Contribution rates are then applied to the cost of services across three categories: ‘clinical care’, ‘independence’ and ‘everyday living’. Services under the ‘clinical care’ category will not attract participant contributions but services under the ‘independence’ and ‘everyday living’ categories will.

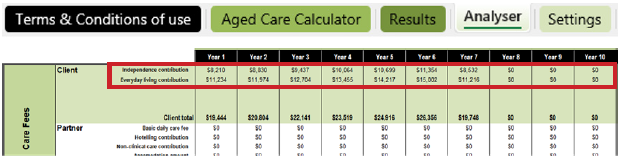

The ACC allows users to capture and allocate government funding under the Support at Home program across the three categories in the ‘Aged Care Calculator’ tab (see below). The tool then uses the asset and income details entered by the user to calculate participant contribution rates and the amount payable for each category in the ‘Results’ tab. The ‘Analyser’ tab projects these contributions (subject to the lifetime cap) and cashflows for up to 10 years (see below).

Limitations of the tool

The aged care reforms are significant, and the Challenger Tech team has tried to capture as much of the reforms as possible in the ACC. However, as the ACC is a tool and not full financial planning modelling software, there are certain aspects of the reforms the tool is unable to capture at this time. One noteworthy aspect of the reforms that the tool is unable to model is partial grandfathering for residential care and participant contribution rates under the ‘no worse off’ principle for the Support at Home program.

The ‘no worse off’ principle applies to those who, on 12 September 2024, were approved for a Home Care package, on the national queue or already utilising a Home Care package. These participants will transition over to the Support at Home program on 1 November 2025 but their participant contributions will not exceed what they were paying prior to 1 November.

Where these participants later enter residential care on or after 1 November, they will be grandfathered under the pre-1 November 2025 ongoing fee arrangements (means tested care fee) but will be subject to the new accommodation arrangements (retention amounts and DAP indexation).

Please refer to the ACC’s user guide for details of all the assumptions and limitations of the tool.

Related content

Stay informed

Sign up to our free monthly adviser newsletter, Tech news containing the latest technical articles, economic updates, retirement insights, product news and events.