Aged Care reforms FAQ

Aged Care reforms FAQ

Download the article below.

On 12 September 2024 the Government responded to the Aged Care Taskforce and introduced the Aged Care Bill 2024 into Parliament. The aged care reforms will make significant changes to the cost of residential aged care and home care from 1 July 2025.

In this month’s article, we answer the most common questions Challenger Tech has received from advisers about the aged care reforms. There are thresholds used throughout this article which will be subject to routine indexation by 1 July 2025. Where available, we have used current thresholds and where not available, we have used thresholds quoted in Government material.

The answers below are based on our understanding of the information to date, noting that over time there will be a released of further information. It is also worth noting that the proposed measures have not yet been legislated and may be subject to change as the Bill progresses through Parliament.

How will grandfathering work for residential aged care?

Existing aged care residents on 30 June 2025 will have their current fee arrangements grandfathered until they leave care. The changes to accommodation payments from 1 July 2025 including the retention amount and indexation of the DAP will not apply to existing residents.

It is unclear how grandfathering will work for existing aged care residents on 30 June 2025 who change aged care facilities from 1 July 2025. This detail is not in the new Aged Care Bill 2024 and we will need further information with progression of time

on this aspect.

How will the retention amount be calculated?

The retention amount will be calculated daily at a rate of 2% p.a. on the refundable accommodation deposit (RAD)/refundable accommodation contribution (RAC) balance. The retention amount cannot be deducted more than once per month or after 5 years from the date the RAD/RAC was first paid.

If the daily accommodation payment (DAP)/daily accommodation contribution (DAC) is deducted from the RAD/RAC balance, retention amounts will be calculated on the reducing balance. Retention amounts deducted from the RAD/RAC balance will not

reduce the calculation of the amount.

How is the DAP going to be indexed?

The daily accommodation payment (DAP) will be indexed twice per year on 20 March and 20 September in line with changes to the consumer price index. The DAP will continue to be calculated using the maximum permissible interest rate at the date of entry.

The daily accommodation contribution for low-means residents will not be subject to indexation as it will continue to be calculated based on the resident’s means.

Are RADs still being phased out under the new rules?

The Government will commission an independent review of sector readiness in 2029-30 to confirm the sector’s financial state and access to capital before considering phasing out RADs by 2035.

The review will consider:

- financial performance of the aged care sector, including reliance on RADs for

capital raising, - the impact of steps taken since the conclusion of the Aged Care Taskforce,

- capital financing arrangements, including for rural and remote providers,

- the impact of the RAD phase out on affordability for residents and,

- if the RAD phase out is recommended, a path to an orderly transition.'

What is the Hotelling Supplement Contribution?

The Hotelling Supplement Contribution (HSC) is an additional amount payable for everyday living costs in residential aged care. The HSC will be payable when assessable assets exceed $238,000 or, if assets are less than $61,500, assessable income exceeds $95,400 p.a. up to a daily limit of $12.55.

The HSC will be calculated as 7.8% of assessable assets over $238,000 or 50% of assessable income over $95,400 p.a. (or a combination of both). Assessable assets and assessable income will be the same as that assessed for aged care purposes under the current rules.

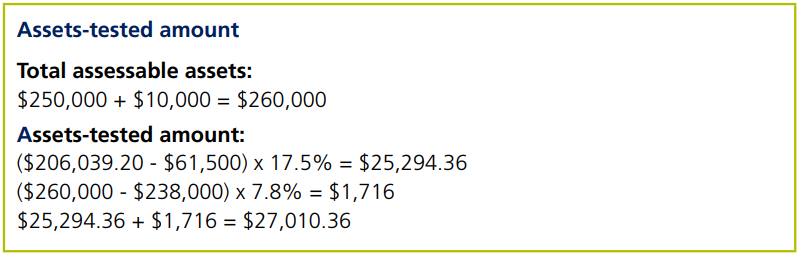

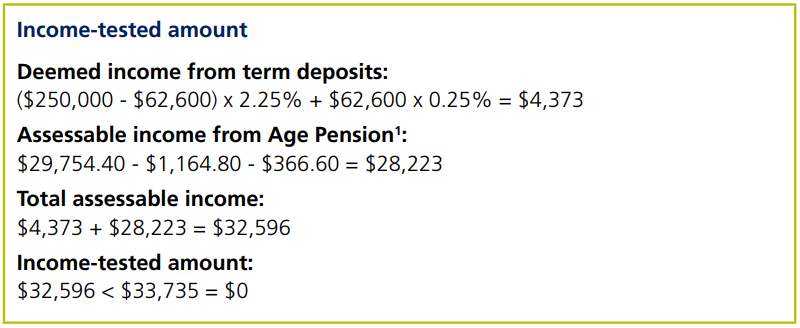

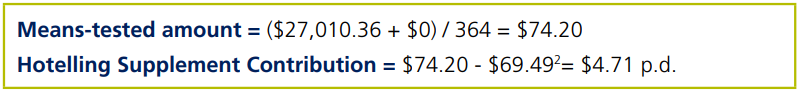

Example

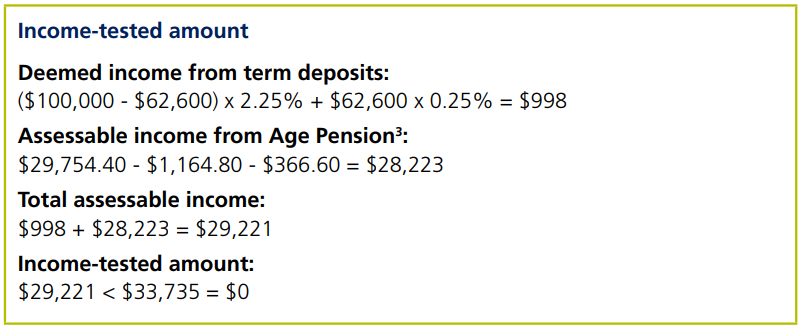

Yvonne is single, 85 years old and has been approved for residential aged care. She has $250,000 invested in term deposits and $10,000 of personal assets. She receives the maximum rate of Age Pension of $29,754.40 p.a. What is the calculation of her HSC?

How will residents be means tested for residential aged care under the new rules?

The means-tested care fee will be replaced by a non-clinical care contribution (NCCC) for residential aged care from 1 July 2025. The NCCC will be payable when assessable assets exceed $502,981 or, if assets are less than $61,500, assessable income exceeds $131,279 p.a. up to a daily limit of $101.61.

The NCCC will also have a lifetime limit where it will be no longer payable if:

- the resident has been in care for over four years; or

- the resident has paid $130,000 (indexed) in total NCCCs.

The NCCC will be calculated as 7.8% of assessable assets over $502,981 or 50% of assessable income over $131,279 p.a. (or a combination of both). Assessable assets and assessable income will be the same as that assessed for aged care purposes under the current rules.

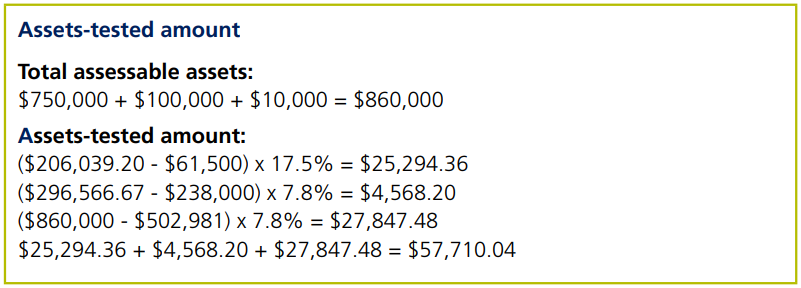

Example

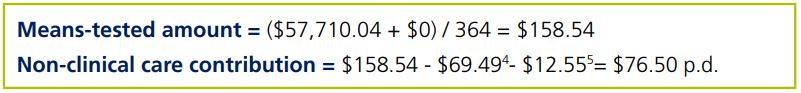

Caroline is single, 85 years old and has been approved for residential aged care. After paying a RAD of $750,000 she will have $100,000 invested in term deposits and $10,000 of personal assets. She receives the maximum rate of Age Pension of $29,754.40 p.a. What is the calculation of her NCCC?

How does grandfathering work for existing home care recipients?

Grandfathering arrangements for existing home care recipients will be separated into fees and funding with the relevant dates being 12 September 2024 and 30 June 2025 respectively.

Existing Home Care Package recipients on 12 September 2024 who do not currently pay an income-tested care fee will continue to pay no fees under the Support at Home Program.

Existing Home Care Package recipients on 12 September 2024 who currently pay an income-tested care fee will pay the lower of the new fees and their current fees from 1 July 2025 and then pay the new fees under the Support at Home Program from 1 July 2027.

These grandfathering arrangements for fees will also apply to individuals who were in the National Priority System or assessed as eligible for a Home Care Package on 12 September 2024.

Existing Home Care Package recipients on 30 June 2025 will receive the same funding from 1 July 2025. If these recipients require higher funding they will need to be reassessed under the Support at Home program at a higher classification funding level.

How will recipients be means tested for home care under the new rules?

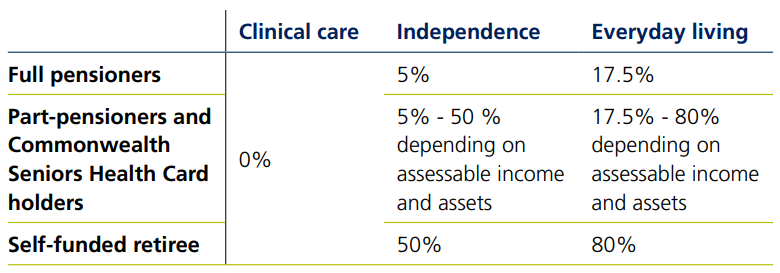

The income-tested care fee will be replaced by a percentage contribution for home care services from 1 July 2025. The percentage contribution will depend on the type of service and pensioner status of the recipient.

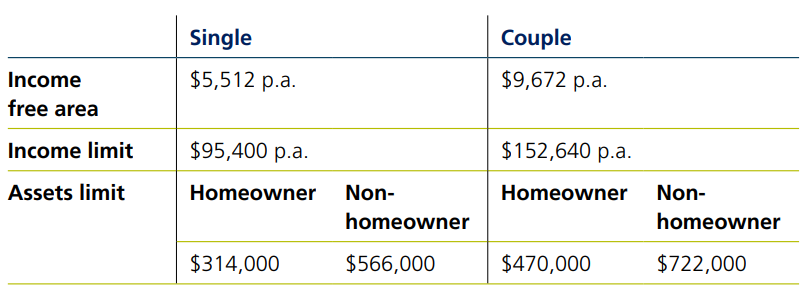

Independence and everyday living services for part pensioners and Commonwealth Seniors Health Card holders will be means-tested as follows6:

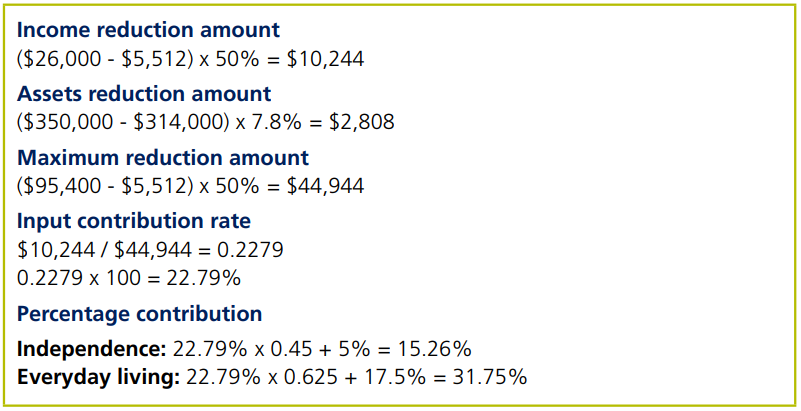

Step 1: Work out the income reduction amount (Assessable income - income free area) x 50%

Step 2: Work out the assets reduction amount (Assessable assets - assets limit) x 7.8%

Step 3: Work out the maximum reduction amount (Income limit - income free area) x 50%

Step 4: Work out the input contribution rate (Greater of Step 1 and 2 / Step 3)

Step 5: Work out the percentage contribution Independence (Step 4 x 0.45 + 5%) Everyday living (Step 4 x 0.625 + 17.5%)

Unlike residential aged care, assessable income and assessable assets for home care will be the same as that assessed for Centrelink purposes.

The Department of Health and Aged Care provides the following example

Brett is single, homeowner and has been approved for home care. He has $26,000 p.a. of assessable income and $350,000 of assessable assets. He receives a part Age Pension of $18,779.80 p.a. What is the calculation of his percentage contribution?

What is the Restorative Care Pathway?

The Restorative Care Pathway will replace Short-Term Restorative Care (STRC) from 1 July 2025. STRC provides services to reverse or slow functional decline to delay or avoid long term care. STRC can be provided for up to 8 weeks in the individual’s

home, an aged care facility or both.

The Restorative Care Pathway will provide similar services to STRC however, will be provided for up to 12 weeks with an additional 4 weeks extension. Existing STRC recipients on 30 June 2025 will receive the same service level from 1 July 2025.

What is the Assistive Technologies and Home Modifications Scheme?

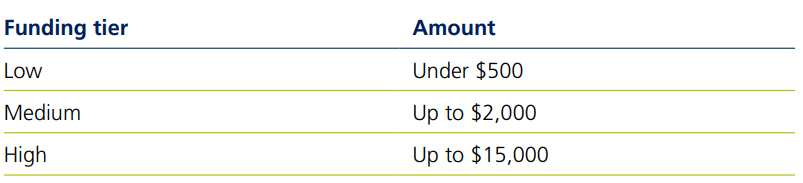

The Government will introduce an Assistive Technologies and Home Modification (AT-HM) Scheme from 1 July 2025. The AT-HM Scheme will provide funding at increasing tiers for individuals to access assistive technology and home modifications without needing to save from their budget.

The Government is working on a detailed list of items that the AT-HM Scheme will cover and wraparound supports to ensure items are used safely and effectively.

1 Excludes Minimum Pension Supplement and Energy Supplement.

2 Maximum Accommodation Supplement

3 Excludes Minimum Pension Supplement and Energy Supplement

4 Maximum Accommodation Supplement

5 Maximum Hotelling Supplement

Challenger 30 January 2025

UPDATE: On 4 June 2025, the Australian Government announced its intention to defer the commencement of the new Aged Care Act to 1 November 2025 and has recommended that the Governor-General formally proclaim this revised start date. While the details and examples provided in this article remain accurate for the legislation as enacted, advisers should be aware that the effective date is now proposed as 1 November 2025.

Challenger Technical will provide further updates once the formal proclamation is issued. In the meantime, please consider this timing change when preparing aged care strategies for clients planning to enter care in the second half of 2025.

Related content

Stay informed

Sign up to our free monthly adviser newsletter, Tech news containing the latest technical articles, economic updates, retirement insights, product news and events.