Aged care questions you’ve asked in 2024

The Challenger Technical team provides advisers with specialist technical support focusing on both pre and post-retirement related advice issues including aged care. Each year we receive thousands of questions from advisers and this article addresses some commonly asked aged care questions in 2024. Unless otherwise stated, rates and thresholds used in this article are as of 1 July 2024.

1. My client is in residential aged care. His partner wants to temporarily move out of their principal home during home renovations and live with their daughter for 12 months. Does the social security exemption for vacating the principal home in temporary situations extend to aged care assessment as well?

For social security purposes, if the principal home is temporarily vacated for any reason for up to 12 months, then the home continues to be the principal home and the income support recipient continues to be considered a homeowner (the temporary vacation exemption can be extended up to a further 12 months where the home is lost or damaged or where the person goes overseas and is unable to return, due to reasons beyond their control).

However for aged care purposes, only under limited circumstances, temporary absence from the principal home can be relied on by a protected person to continue to exempt the home. These can be situations where a temporary absence is not intentional, and the situation may be beyond the person’s control. Examples include:

- respite care

- hospital patient

- mental or psychiatric institution patient

- boarding school student

- incarceration in certain cases

For other reasons like home renovations, the home is no longer exempt and therefore the home is assessed for that period of absence. Once the partner moves back to the principal home, the principal home exemption is regained.

2. I have some clients who reside in a retirement village. If they decide to move into an aged care facility, how is the retirement village assessed for aged care purposes?

Where the retirement village is vacated in order to enter into a residential aged care facility, the assessment can depend on whether the client is single or a member of a couple. If only one member of the couple moves into an aged care facility and the partner continues to reside in the retirement village, then the refundable amount of the entry contribution is exempt.

If the retirement unit is vacated by a single person or both the members of the couple, they are generally required to sell their unit (or share in the village). As part of a resident’s contract, an exit fee or deferred management fee may be payable upon exit. However, the sale of the unit may take weeks or even months in some cases before it can be sold. For the duration of the time between moving to the aged care facility and the unit being sold, the refundable amount of the entry contribution is assessed as an asset (50% for each member of a couple) subject to the home cap amount of $201,231.201.

Note that the assessment of the retirement village for aged care differs to that for social security purposes. The above assessment applies irrespective of whether the entry contribution was greater or lesser than the Extra Allowable Amount.

3. My client receives a home care package and currently pays an income tested care fee. If they are to move to residential aged care, does that amount count towards their means tested care fee annual cap and when does the annual cap reset?

Income Tested Care Fee (ITCF) and Means Tested Care Fee (MTCF) combined are subject to an annual cap over the 12-month period. ITCFs count towards the means tested care fee annual cap. The 12 month period commences and resets on the anniversary date on which the resident started receiving care for the first time across both Home Care and residential aged care.

As a result, the MTCF annual cap is reduced by any ITCF your client has already paid while receiving home care in the anniversary year they move into residential care. These fees also count towards the lifetime cap in residential care. Once the resident reaches the lifetime cap, they will not have to pay any MTCF/ITCF for the remainder of their time in care.

The current annual cap and lifetime cap for a residential aged care recipient is $33,309.29 and $79,942.44 respectively. These caps are indexed on 20 March and 20 September each year and are applied to residents based on the effective cap amount on the date it is reached.

Example

Jeremy receives a Level 4 Home Care Package. He is a homeowner and owns financial assets worth $2 million. He pays a daily ITCF of $14.73. Four months after being on a Home Care Package his health deteriorates and he moves into an aged care facility. The total amount of ITCF he pays for 7 months amounts to $1767.60 (120 days x $14.73). This amount will count towards his annual cap and as a result he will not be required to pay a MTCF of more than $31,541.691 (ignoring any indexation on 20 March and 20 September) during the remaining 245 days of the year.

4. My client will need to move to a resident aged care facility before completing his means test assessment with Centrelink due to his ill health. The facility will charge him a Daily Accommodation Payment (DAP) based on the Refundable Accommodation Deposit (RAD) for the room he will occupy. If he is subsequently assessed as a low means resident, will the DAP be refunded?

A facility may agree for a resident to move in before they are assessed by Services Australia. In such cases, the client may agree to disclose their means to the facility in order to understand the fees payable.

If it is established that the facility did not have the correct information at the date of entry and subsequently it is found that the client is a low means resident after being assessed, then any amount of accommodation payment (RAD/DAP) paid by the person will need to be refunded.

Similarly, if a resident is initially assessed as low means and then it is determined that they were in fact not low means (i.e. eligible to pay an accommodation payment at date of entry into care), then any amount of accommodation contribution paid by the person will need to be refunded. The resident can then be asked to pay an accommodation payment based on the advertised and agreed room price.

5. My client who is assessed as a low means resident, wants to move to an aged care facility which is close to her daughter’s home, but the facility won’t accept him? Can the facility deny a place to a low means resident?

Being assessed as a low means residents where some or all of their accommodation costs are subsidised by the Government can be an important financial consideration. Unlike other residents, a low means resident cannot be asked to pay the published price for a particular room. Instead, based on their assets and income, low means residents can be asked to contribute an amount towards their accommodation costs. However, it can be easy to focus on the financials for aged care clients given it can be articulated and measured. As can be appreciated, clients in aged care wish to lead a comfortable life as much as possible and therefore there are other non-financial, emotional and lifestyle based considerations that are noteworthy for these residents.

Aged care facilities can choose not to accept low means residents which makes the selection process for prospective low means residents more limited. There could be a possibility that the client may set their heart on a room, or a facility located at a specific place or equipped with specific features, but the chosen facility may not have a room available for low means residents. This can result in the resident compromising with a facility based on the availability of ‘low means’ rooms instead of entering a facility they choose.

Low means residents may also not have a choice of which room they occupy in the aged care facility. Whilst some facilities will try and facilitate the wishes of residents, they may reserve single rooms or nicer rooms with better features for accommodation payment (RAD/DAP paying) residents. They may also be required to share a room with one, two, three or more other residents which may not feel like a comfortable arrangement for some residents. Therefore, despite the financial support available by being a low-means resident, the client may not get the choice of the desired facility or room.

6. My client entered an aged care facility a year ago. Although he owns a home as tenants in common with his brother, he is unable to sell it as his brother does not want to sell the home. Can he apply for hardship assistance?

Financial hardship rules exist in aged care to allow for a framework whereby Services Australia pays the client’s basic daily care fee, daily accommodation payment contribution and MTCF. Besides disclosing their means, to be eligible to apply for financial hardship assistance your client will need to meet certain criteria including:

- having assets valued at $43,535.70 or less (excluding unrealisable assets like a house listed on market for six months or more, jointly owned property or frozen assets)

- having an income of less than 15% of the basic Age Pension amount (excluding supplements per fortnight) after essential expenses are deducted

- no gifts being made of more than the allowable gifting amount of $10,000 a year (subject to a maximum of $30,000 on a five-year rolling basis).

If the home is assessed as an unrealisable asset and the client meets other eligibility criteria2, he may be eligible for hardship assistance. Note that a paid RAD/RAC is an assessable asset for financial hardship application.

7. I have a few high net worth aged care clients and I have been looking at tax-effective investment options for them, how can Challenger CarePlus help?

Challenger CarePlus can be an attractive investment for those receiving or eligible to receive government subsidised aged care services. It can not only help pensioners improve their Age Pension entitlements and reduce aged care costs but can also prove to be a tax effective option for high net worth clients with Home Care or residential aged care needs. Unlike other types of investment income, only part of the regular payment from CarePlus is subject to tax.

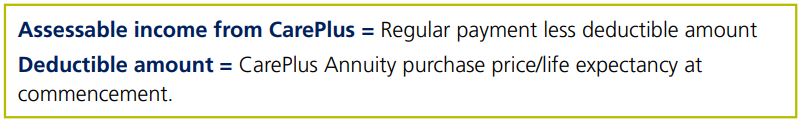

As income is being provided from a lifetime annuity (outside the superannuation environment), only the amount in excess (if any) of the deductible amount for the annuity is included in an individual’s assessable income for tax purposes.

Example

$100,000 invested in CarePlus3 (split up between a CarePlus Annuity of $31,211 and CarePlus Insurance of $68,789) will have a regular payment of $4,895 p.a. and a deductible amount of $4,235 p.a. ($31,211 / 7.37). Therefore, the assessable income for tax purposes will only be $660 p.a.

Case study

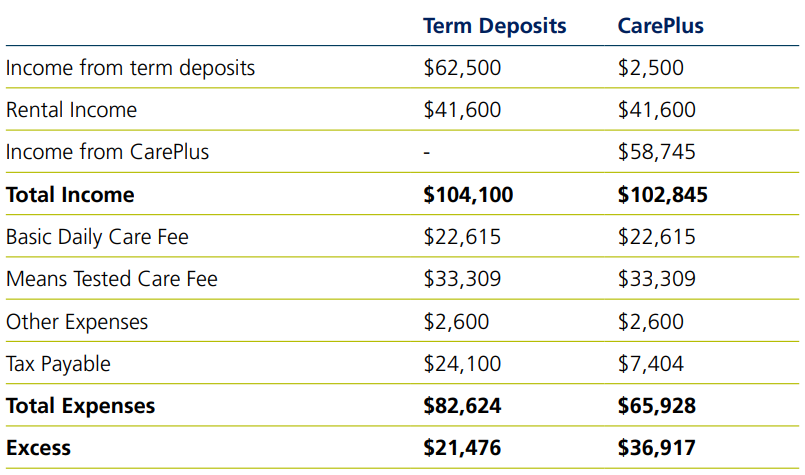

Arabella, age 85, is currently residing in an aged care home. She has paid a RAD of $700,000. She is renting out her former home (worth $1,000,000) which is not resided by a protected person and is receiving net rental income of $800 per week. Her other assets include $1,250,000 in cash and term deposits. Table 1 summarises Arabella’s cashflow and estimated tax across two investment options – $1,200,000 invested in term deposits or CarePlus. The quotes and calculations are based on Challenger’s Aged Care Calculator as at 29/07/2024.

As outlined in the table above, Arabella has been able to improve her personal income tax by $16,696 ($24,100 - $7,404) as a result of investing in CarePlus.

1 Threshold as at 1 July 2024.

2 Aged Care financial hardship assistance eligibility criteria.

3 eQuote as on 29/07/2024 for a female, age 85, residing in NSW. Term Deposits at the rate of 5% p.a.

Related content

Stay informed

Sign up to our free monthly adviser newsletter, Tech news containing the latest technical articles, economic updates, retirement insights, product news and events.