Centrelink granny flat arrangements – your questions answered

Centrelink granny flat arrangements – your questions answered

Download the article below.

Granny flat arrangements are often established to enable clients looking to maintain some independence and have support and assistance from family and friends.

There are various ways a client can establish a granny flat arrangement and, if set up correctly, it won’t affect Centrelink entitlements. In some cases, using an appropriate granny flat strategy may even enhance Centrelink entitlements in addition to providing funds to help family members.

Our team has previously produced a technical paper on Centrelink granny flat arrangements covering:

- How granny flat arrangements are defined and assessed by Centrelink,

- How homeowner status is determined, and

- What the reasonableness test is and how it is calculated.

Since that paper, our team has received a number of interesting questions, and we thought we would share some of these in this month’s technical paper to assist with the provision of advice to clients who may be in similar situations.

Which extra allowable amount threshold do I use?

The extra allowable amount (EAA) is the difference between the homeowner and non-homeowner lower pension assets test thresholds. Where the value of the granny flat (generally what is paid to establish the granny flat interest, also known as the entry contribution) is greater than the EAA, the client is considered a homeowner for social security purposes, and the entry contribution (EC) is exempt from assessment. Otherwise, they are considered non-homeowners, and the value of the EC is assessed under the assets test but is not income tested.

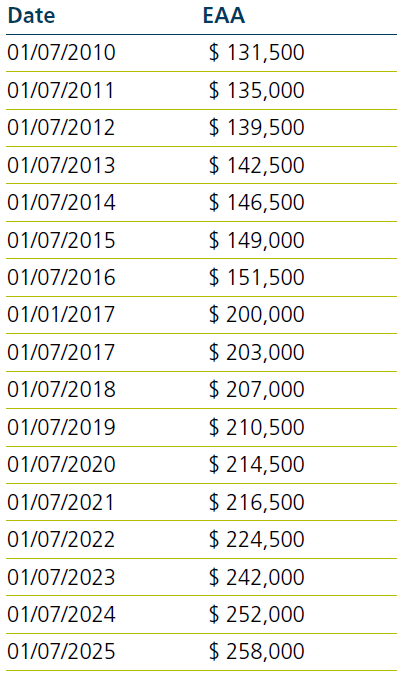

Importantly, homeowner status is determined based on the EC and EAA at the time the granny flat is established. The EAA has been gradually increasing in line with the indexation of the lower assets test thresholds on 1 July each year and from 1 July 2025, it is $258,000.

For example, if the EC for a granny flat arrangement established between 1 July 2020 and 30 June 2021 was $220,000, the client would be considered a homeowner and the $220,000 would not be assessable for social security purposes.

However, if a granny flat arrangement was established today with the same amount, the client would be considered a non-homeowner for social security purposes and the amount assessable under the assets test.

The table below summarises historical EAA thresholds since 1 July 2010.

Can a granny flat arrangement be established by transferring funds to two or more children?

For many clients the family home is their largest asset, with some having it earmarked for beneficiaries as part of their estate plans. As such, those looking to establish a granny flat arrangement may want to sell the home and transfer the proceeds to multiple children/beneficiaries instead of only one. While possible, the Centrelink treatment of such an arrangement can be complex.

If a granny flat interest is only established with one of the children, the funds transferred to the other children would be considered a gift and assessed as a deprived asset for 5 years.

If a granny flat interest is established with each child, then Centrelink would apply the reasonableness test.

- If the total funds transferred is not more than the reasonableness test amount, there is no deprivation.

- Where a client pays more than the reasonableness test amount for their granny flat interests, the amount paid for the principal granny flat interest (the accommodation provided where they spend the most time) is assessed as the granny flat arrangement, with the amount paid for the other life interests assessed as gifts. However, where the client spends equal amounts of time in each granny flat accommodation, the most expensive granny flat interest is assessed as the granny flat arrangement, with the amounts paid for the other interests assessed as a gift.

Example

Scott (age 70) sells his home for $900,000 and distributes the proceeds evenly between his three children. In return he has a right to accommodation with each of them.

The reasonableness test amount is $745,816 ($45,037.20 x 16.56). As the total amount paid for the granny flat interests exceeds the reasonableness test amount, the granny flat interest where he will spend the most amount of time is treated as the granny flat arrangement and the amount provided for the other interests is treated as a gift.

If Scott spends equal amounts of time at all the properties for which he has paid $300,000 each, he is treated as gifting $600,000 ($900,000 – $300,000).

If Scott spends equal amounts of time at each property but had paid $500,000 to one child and split the $400,000 balance between the remaining children (also with a right to accommodation), he would only be treated as gifting $400,000 ($900,000 – $500,000).

Alternatively, if Scott pays a total amount of $745,816 or less to his children, deprivation does not occur, and only the remaining sale proceeds of $154,184 are assessable, depending on where those funds are invested.

Can a granny flat arrangement be established with someone other than a family member and does the accommodation need to be in Australia?

Granny flat arrangements are typically established with family members. However, the rules do not require that it needs to be with a family member or a relative. Guidance received previously from Centrelink confirms that it can be established with friends or even with an entity or charitable organisation. In these scenarios it is recommended that there is a legal agreement for the accommodation provided. Additionally, the accommodation does not necessarily need to be located in Australia.

Does a client need to pay the entire sale price of a home or all the construction costs when establishing a granny flat interest?

A common approach when establishing a granny flat interest is to buy a home or pay for the construction of a new home in the name of a family member. However, it is not a requirement that the full sale price or all the construction costs are paid by the client. A granny flat interest can be established by paying part of the costs of purchasing the home or part of the construction costs. In these situations, the EC would be the contribution towards the purchase or construction of the home and the reasonableness test would not be triggered.

However, the client creating the granny flat interest must not have any ownership interest, even as little as 1%, in the new home. If they have an ownership interest, Centrelink would determine that their right to occupy the home is due to the ownership interest and a granny flat interest is not established.

Will deprivation apply if the client transfers their home and adjacent land greater than 2 hectares?

Those who meet the requirements of the extended land use test have their adjacent land greater than 2 hectares treated as part of their main residence and exempt from the assets test.

If Centrelink is exempting the land under the extended land use test, then the transfer of the home and land on the one title (with no additional assets transferred) would be treated as the value of the granny flat interest (EC) and no deprivation would occur. The reasonableness test would not be triggered.

Where the land in excess of 2 hectares is not exempt under the extended land use test, typically because the client has not lived there for 20 years or not making effective use of the land, then the value of the granny flat interest is the greater of:

- The value of the home and surrounding land up to 2 hectares, and

- The reasonableness test amount.

The value in excess of the above is assessed as a deprived asset for 5 years.

Example

Mary (age 72) transfers her home that is situated on 10 hectares of land on the same title. The value of her home and surrounding 2 hectares of land is worth $1.2 million. The value of the remaining 8 hectares is $500,000 and is not exempt under the extended land use test. The reasonableness test amount for Mary is $676,008 ($45,037.20 x 15.01). As the reasonableness test amount is lower than the value of the home and surrounding 2 hectares, the value of the granny flat in this case is $1.2 million and deprivation of $500,000 would apply.

What happens if clients need to enter aged care after establishing a granny flat arrangement?

It is not uncommon for a client to enter aged care after establishing a granny flat arrangement. How the granny flat is subsequently assessed and whether there is any deprivation applied, depends on whether the client is a member of a couple and whether it has been more than 5 years since they established the granny flat arrangement.

If the client’s partner still lives in the granny flat interest, the couple homeowner status for social security purposes remains as it was prior to the member of the couple entering aged care. Non-homeowner couples will continue to have the EC for their granny flat interest assessed under the pension assets test. For aged care purposes, the client is considered a non-homeowner after entering care and there is no further assessment of the EC.

If the client is single, has terminated the granny flat interest after entering aged care, and the value of their EC has been returned, deprivation rules would not apply. The client would then be a non-homeowner for social security and aged care purposes, and the returned contribution will be assessable based on how it is subsequently invested.

However, it is more common for the EC to not be returned. In these situations, the client is a non-homeowner for both social security and aged care purposes and the previously paid EC no longer assessable. Depending on when the client vacates their granny flat interest to enter aged care, there may be deprivation. Deprivation would occur if the granny flat interest was created less than 5 years ago and entering aged care or the reason for vacating the granny flat interest was foreseen at the time of creating the granny flat interest. For example, deprivation may occur if the client had an ACAT approval to receive government funded residential aged care at the time they created the granny flat interest.

Where deprivation applies, the assessment will start from the date the granny flat interest was vacated and ends 5 years after the granny flat interest was created.

What evidence does Centrelink require?

Centrelink will usually need evidence that a granny flat interest has been established. Supporting documents that can be provided include the written agreement, contract of sale, transfer documents and bank statements showing funds transferred.

Although Centrelink does not require a formal legal agreement to accept that a granny flat interest has been established, it is generally a good idea to have one drawn up to protect the elderly client. A legal agreement can help protect the client’s security of tenure while also addressing any change in family dynamics or a breakdown in the relationship.

Related content

Stay informed

Sign up to our free monthly adviser newsletter, Tech news containing the latest technical articles, economic updates, retirement insights, product news and events.