Challenger annuities and the various Centrelink means tests

Challenger annuities and the various Centrelink means tests

Download the full article below.

In addition to other eligibility requirements, Centrelink uses various means tests to determine an individual’s entitlement to social security income support payments and concession cards.

Many payments have both an income and an assets test to determine the amount of income support an individual is entitled to whereas concession cards such as the Commonwealth Seniors Health Card (CSHC) and Low Income Health Card (LIHC) have only an income test to determine eligibility.

The Challenger Tech team receives a few queries on how Challenger lifetime and fixed term annuities are assessed for various Centrelink income support payments and concession cards. This month’s technical paper discusses how Challenger annuities are assessed for:

- Age Pension

- Disability Support Pension

- Carer Payment

- JobSeeker Payment

- Commonwealth Seniors Health Card

- Low Income Health Card.

Age Pension/Disability Support Pension/Carer Payment income and assets tests

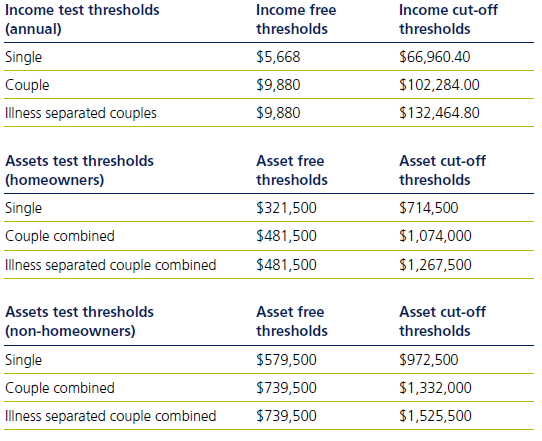

The income and assets test for the Age Pension, Disability Support Pension (DSP), and Carer Payment (the pension income and assets tests) are broadly the same. Assessable income and assets above the income and asset free thresholds will reduce these payments under their respective means test. Payments are reduced to nil once assessable income and assets reach the cut-off thresholds.

The tables below summaries the income and assets test thresholds as at 20 September 2025.

Assessment of Challenger annuities under the pension assets test

The social security assessable asset value of Challenger annuities (whether the annuity is funded from superannuation or non superannuation money) can be based on:

- The deduction method, or

- A fixed amount equal to 60% of the purchase price until age 85 1 (subject to a minimum of 5 years), and then 30% thereafter.

The deduction method

Under the deduction method, the assessable asset value equals:

- The purchase price is the investment amount less any lump sum commutations and residual capital value (RCV). For lifetime annuities, the RCV is nil.

- The deduction amount equals the purchase price divided by the relevant number.

- The relevant number is the nominated term for term annuities and the investor’s life expectancy2 for lifetime annuities.

- Term elapsed is the number of whole years that have elapsed since commencement.

Where annuity payments are made more frequently than annually (e.g. monthly), the purchase price is reduced by half of the deduction amount every 6 months.

The deduction method applies to:

- Challenger Guaranteed Annuity (Fixed Term),

- Challenger Guaranteed Annuity (Liquid Lifetime) – Regular (15 year) income option that commenced prior to 1 July 2019,

- Challenger Guaranteed Annuity (Liquid Lifetime) – Flexible income option that commenced prior to 1 July 2019, and

- Challenger CarePlus (Annuity component) that commenced prior to 1 July 2019.

Fixed amount method

These rules were introduced on 1 July 2019 and calculates the assessable asset value as 60% of the purchase price until 85 (subject to a minimum of 5 years), and then 30% thereafter.

The fixed amount method applies to:

- Challenger Guaranteed Annuity (Liquid Lifetime) – Flexible income option that commenced on or after 1 July 2019

- Challenger Lifetime Annuity (Liquid Lifetime) – Immediate, Deferred, and Market-linked options that commenced on or after 1 July 2019

- Challenger CarePlus (Annuity component) that commenced on or after 1 July 2019

Example:

On 1 January 2015, Jane (age 65 at the time) invested:

$100,000 in a 5-year Challenger Guaranteed Annuity (Fixed Term) with a RCV of 50% ($50,000 returned to Jane at the end of the term). Regular payments were $12,500 p.a. paid monthly (not indexed)

– The deduction amount = ($100,000 less $50,000) / 5 = $10,000

- $200,000 in a Challenger Guaranteed Annuity (Liquid Lifetime) – Regular income option. Regular payments were $12,000 p.a. paid monthly (not indexed)

– The deduction amount = $200,000 / 22.05 = $9,070.29

On 1 January 2017, Jane’s annuities had the following assessable asset values:

- 5-year term annuity assessable asset value = $100,000 less ($10,000 x 2 years) = $80,000

- Lifetime annuity assessable asset value = $200,000 less ($9,070.29 x 2 years) = $181,859.42

On 1 January 2020, Jane invested $100,000 into Challenger Lifetime Annuity (Liquid Lifetime). The assessable asset value of her annuity for social security purposes is $60,000.

Assessment of Challenger annuities under the pension income test

Social security assessable income from Challenger’s annuities (whether the annuity is funded from superannuation or non-superannuation money) can be based on:

- the deeming rules,

- the deduction method, or

- a fixed amount equal to 60% of regular payments.

Deeming rules

Under the deeming rules, the assessable asset value (see above) of the annuity is included with the investor’s other financial investments for social security purposes and deemed based on the relevant deeming rate.

Deeming rules apply to Challenger Guaranteed Annuity (Fixed Term) policies with a term of 5 years or less and where the term is not equal to or greater than the investor’s life expectancy3 at the time they invest.

The deduction method

Assessable income under the deduction method is calculated as:

- The deduction amount equals the purchase price (investment amount less any lump sum commutations and RCV) divided by the relevant number. For lifetime annuities, the RCV is nil

- The relevant number is the nominated term for term annuities and the investor’s life expectancy4 for lifetime annuities.

The deduction method applies to:

- Challenger Guaranteed Annuity (Fixed Term), with a term of greater than five years, or a term of five years or less and is equal to or greater than the person’s life expectancy5.

- Challenger Guaranteed Annuity (Liquid Lifetime) – Regular (15 year) income option that commenced prior to 1 July 2019,

- Challenger Guaranteed Annuity (Liquid Lifetime) – Flexible income option that commenced prior to 1 July 2019, and

- Challenger CarePlus (Annuity component) that commenced prior to 1 July 2019

Fixed amount method

Assessable income value under the fixed amount method is equal to 60% of the regular payments. For deferred lifetime annuities, there is no assessable income during the deferral period.

The fixed amount method applies to:

- Challenger Guaranteed Annuity (Liquid Lifetime) – Flexible income option that commenced on or after 1 July 2019

- Challenger Lifetime Annuity (Liquid Lifetime) – Immediate, Deferred, and Market-linked options that commenced on or after 1 July 2019

- Challenger CarePlus (Annuity component) that commenced on or after 1 July 2019

JobSeeker Payment income and assets tests

The income and assets tests for JobSeeker Payment is different to the pension income and assets test, however the amount of assessable income and asset values of Challenger annuities are calculated in the same way as discussed above.

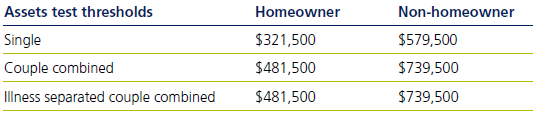

Care needs to be taken under the JobSeeker assets test. There is no tapering of JobSeeker payments and will reduce immediately to nil once assessable assets exceed the below thresholds.

Under the income test, JobSeeker payments generally start to reduce once the individual’s own income exceeds $150 per fortnight. The amount it reduces by and when JobSeeker payments cease depends on the person’s family situation and what payment their partner (if any) receives from Centrelink. A summary can be found on the Centrelink public website.

Commonwealth Seniors Health Card income test

Broadly, the Commonwealth Seniors Health Card (CSHC) income test assesses an individual’s adjusted taxable income (ATI) and deemed income from non-grandfathered account-based income streams. There is no assets test.

Adjusted taxable income (ATI)

ATI for the purposes of the CSHC income test includes:

- taxable income, disregarding the individual’s assessable First Home Super Savers (FHSS) scheme released amount,

- total net investment loss,

- target foreign income,

- employer provided fringe benefits, and

- reportable superannuation contributions, including income that is salary sacrificed to superannuation.

Account-based income streams

Since 1 January 2015, account-based income streams have been deemed for the CSHC income test unless the grandfathering provisions apply. The balance of a person’s account-based income streams which are not grandfathered will be deemed and added to their ATI. Account-based income streams which are grandfathered will not be assessed for the income test.

A person must meet the following conditions for the grandfathering provisions to apply:

- The account-based income stream must have commenced before 1 January 2015 and retained; and

- the person must have been a holder of the CSHC on 31 December 2014 and continuously thereafter.

If a person with a grandfathered account-based income stream ceases to be a holder of the CSHC for any period of time, the grandfathering provisions will no longer apply if they become a CSHC holder again.

If a person rolls over an existing grandfathered account-based income stream to a new account-based income stream, the grandfathering provisions will not apply to the new account-based income stream.

If a grandfathered account-based income stream reverts to a reversionary beneficiary, the grandfathering provisions will continue to apply if the beneficiary was a holder of the CSHC on the date of reversion and continuously thereafter.

Income limits

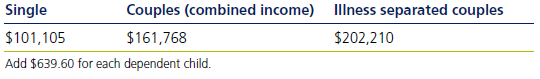

To qualify for the CSHC, an individual’s total assessable income (ATI plus deemed income from non-grandfathered account-based income streams) needs to be below the relevant income limits. The following table shows the CSHC annual income limits applying from 20 September 2025. These income thresholds are indexed on 20 September each year.

Assessment of superannuation sourced annuities

Regular payments from superannuation annuities (without an untaxed element) are generally tax-free for individuals aged 60 and over and are excluded from the individual’s ATI. Challenger annuities are also non-account-based and as such are also not subject to deeming.

This means, an individual can reduce their assessable income for the purposes of the CSHC by investing in an annuity using funds from a non-grandfathered account-based pension or contributing funds to super to commence a superannuation annuity.

Assessment of non-superannuation sourced annuities

For individuals, regular payments from non-superannuation sourced annuities can be assessable for tax purposes and as such can have an amount included in the ATI component of the CSHC’s income test. However, non-superannuation annuities have a deductible amount (DA) that reduces the amount that is assessable.

The deductible amount is calculated as follows:

- For Challenger lifetime annuities the DA = Purchase price / relevant number

- For Challenger fixed term annuities the DA = (Purchase price - any commutations - any residual capital value) / relevant number

The relevant number for fixed term annuities is the original term at commencement. For lifetime annuities it is the life expectancy of the individual at commencement (or the longer life expectancy for joint policies or policies with a reversionary beneficiary) based on the life tables from the Australian Government Actuary.

Example:

On the 8 October 2025, Bill age 70 invests $300,000 into Challenger lifetime annuity that pays $17,827.80 p.a. indexed to CPI and another $100,000 into a 10-year fixed term annuity with no residual capital value that pays $12,551.28 p.a. not index.

Assessable income for the purposes of the CSHC for Bill’s annuities is calculated as follows:

Challenger lifetime annuity:

DA = $300,000 / 16.32 = $18,382.35

Assessable income for tax and CHSC = $17,827.80 - $18,382.35 = nil

Challenger term annuity:

DA = ($100,000 – 0 – 0) / 10 = $10,000

Assessable income for tax and CHSC = $12,551.28 - $10,000 = $2,551.28

Low Income Health Card income test

Similar to the CSHC, the Low Income Health Card (LIHC) only has an income test and does not have an assets test.

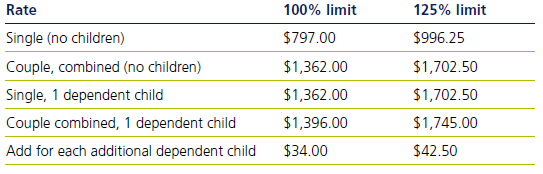

When an individual initially makes a claim for the LIHC, eligibility is generally based on their average weekly assessable income for the 8-week period before the claim. Their income needs to be below the ‘100% limit’ to qualify or renew. To retain the card, their income will need to be below the ‘125% limit’.

The table below shows the 100% and 125% income limits per week as at 20 September 2025.

Assessable income for the LIHC

The LIHC income test uses the same assessable income under the pension income test but also includes other types of income even though they are generally not assessable as income under the pension income test. These additional income types include6:

- A social security pension or benefit paid to the customer or their partner within the meaning to the Social Security Act 1991

- If the person is receiving a social security pension or benefit within the meaning of the Social Security Act 1991 - the person’s maintenance tested amount

- An ABSTUDY payment

- A pension payable under the Veterans’ Entitlements Act 1986

- A payment received by a trainee in full-time training under a Labour Market Program, who is receiving JobSeeker Payment (JSP) or Youth Allowance (YA) (JobSeeker)

- Payment of Self-Employment Allowance

- A payment of compensation within the meaning of section 17 of the Social Security Act 1991 (that is a lump sum and/or periodic payments, though they are assessed differently - see below)

- Language, Literacy and Numeracy Supplement (LLNS)

- Department of Employment and Workplace Relations, Pensioner Education Supplement (PES)

- Parental Leave Pay (PPL)

- Pharmaceutical Allowance (PhA)

- Pension Supplement (all 3 components)

- Rent Assistance (RA)

- Remote Area Allowance (RAA) (including RAA paid with ABSTUDY)

- Telephone Allowance (TAL)

- Training Supplement

- Work for the Dole (WFD) Supplement

- ABSTUDY PES

- Assistance for Isolated Children (AIC) Scheme PES

- Additional components of ABSTUDY, such as Boarding School Supplement and Additional Assistance

- Farm Household Allowance (FHA)

Assessment of Challenger annuities under the LIHC income test

The assessment of Challenger annuities for the purposes of the LIHC is the same as their assessment under the pension income test above.

1Age 85 is linked to the Australian Government Actuary life expectancy of a 65 year old male and can change when new life tables are released.

2Life expectancy based on the Australian Government Actuary life tables at commencement of the policy. For joint or policies with a reversionary, the longer life expectancy is used.

3Life expectancy based on the Australian Government Actuary life tables at commencement of the policy.

4Life expectancy based on the Australian Government Actuary life tables at commencement of the policy. For joint or policies with a reversionary, the longer life expectancy is used.

5Life expectancy based on the Australian Government Actuary life tables at commencement of the policy.

6Source: Low Income Health Care Card (LIC) income test 101-06040030

Related content

Stay informed

Sign up to our free monthly adviser newsletter, Tech news containing the latest technical articles, economic updates, retirement insights, product news and events.