Change brings complexity, but also opportunity and the need for advice – what’s changed due to 1 November 2025 aged care reforms

.png?h=540&iar=0&w=680)

Change brings complexity, but also opportunity and the need for advice – what’s changed due to 1 November 2025 aged care reforms

With the 1 November 2025 aged care reforms coming into play, they herald some new dynamics for clients and advice considerations. While there’s a significant change to the aged care fee structure, once understood, the many advice levers in adding value to the client’s situation remain largely unchanged.

Advisers will continue to play a key role in helping clients make informed decisions when considering common advice points around cashflow, social security entitlements, aged care fees, tax and estate planning.

For existing advisers in the aged care space, familiarity with the previous framework will likely continue to aid in the provision of advice as while many things have changed, there are many similarities. For new advisers in this space, while there is some complexity when learning the different facets of aged care advice, with appropriate support, upskilling and regularity of providing advice, the knowledge gaps usually become easier with progression of time.

In this article, we take you through some key insights when it comes to the 1 November 2025 residential aged care changes. Unless stated otherwise, the numbers used throughout this article apply from 20 September 2025 to 19 March 2026 and will be subject to change with routine indexation.

Key changes

The following components of residential aged care fees have changed:

- Hotelling Supplement Contribution

- Non-Clinical Care Contribution and its lifetime cap of $135,319 (indexed) or four years of such payments, whichever is earlier

- 2% retention amounts on Refundable Accommodation Deposit (RAD) / Refundable Accommodation Contribution (RAC) for a maximum of 5 years

- Indexation of Daily Accommodation Payment (DAP) when RAD is unpaid

- Higher Everyday Living Fee (HELF) for extra services and user pays additional services

You can read more on these changes through the various articles available from the Technical articles section available from this page.

Advice relating to the family home

The decision on what to do with the family home is usually different for single and partnered clients. Given the reliance on the family home as a source of funding for aged care fees, dealing with the family home continues to be a significant advice consideration.

The means testing of the family home remains unchanged. For social security purposes, for single clients, it continues to be assets test exempt for two years after they leave the home. After two years, the client is treated as a non-homeowner, and the net value of the home is assessable. If the home is rented out, broadly, the net rental income is assessed1. For partnered clients, if the spouse is living in the home, it continues to be exempt.

For aged care purposes, if the home is not occupied by a protected person2, it continues to be assessed but capped at the home cap value (currently $210,555). If occupied by a protected person, it continues to be exempt.

Given that for many aged care clients, the family home is usually the most significant asset, it continues to play a key part in funding discussions and considerations around aged care fees. Based on many interactions with advisers over the years, we find that families generally either want to hold onto the home while the aged care resident is alive or have firmly made up their mind to sell the home given the complexities of retaining the home, including renting to third parties.

While the means testing of the family home can be a factor in the decision making, often the cashflow requirements and desire to keep or sell the home will likely continue to be key considerations. Where a client is liable for a RAD, if most of the wealth is in the family home, the DAP (periodical payments on unpaid RAD) is usually a significant component of the aged care fees and can place greater pressures on cashflow.

Advisers typically highlight to clients the funding of aged care fees when considering keeping the home, renting and selling the home and the associated issues with these options. This dynamic is likely to continue in discussing the numbers with different options, the impact on strategic considerations how they form part of the bigger picture in funding aged care fees.

Means tested fees reach their maximum cap at assessable assets of around $1 million

The two new ongoing means tested fees from 1 November 2025 are the Hotelling Supplement Contribution (HSC) and Non-Clinical Care Contribution (NCCC). Liability towards these fees is based on the means tested amount (MTA) which is dependent on the client’s assessable assets and income.

Focusing specifically on assets, the HSC applies once assets exceed $252,000 and reaches the daily cap of $22.15 per day when assets are ≥ $355,366.

Conversely, the NCCC applies once assets exceed $532,055 and reaches the daily cap of $105.30 per day when assets are ≥ $1,023,454. It’s likely not far fetched to imagine that with inclusion of the RAD, which based on averages is increasing, many clients may be liable for capped HSC of $8,085 p.a. and capped NCCC of $38,435 p.a. Perhaps it is then of small relief that the NCCC has a lifetime cap of $135,319 (indexed) or four years of NCCC payments, whichever occurs earlier.

While it’s not the focus of this article, it’s worth noting that Participant Contributions paid under the Support at Home program for non-grandfathered recipients will also count towards the $135,319 (indexed) NCCC lifetime cap. Given that around 2 in 53 Home Care recipients enter residential aged care and there is a significant reform of means testing for care at home, it may mean that affected clients have a reduced lifetime cap when they enter residential aged care.

Tempered with the fact that the median stay in residential aged care is around 19 months, for those who live longer than four years in aged care and have either been paying maximum NCCCs or have paid four years of NCCCs, at least this component of the total aged care fees will reduce once the NCCC lifetime cap has been reached.

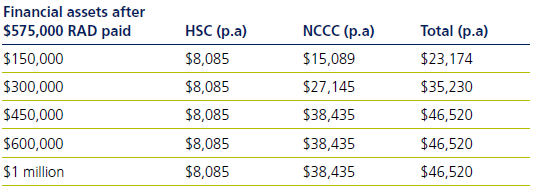

The table below outlines the HSC and NCCC for a single, non-homeowner who has paid a RAD of $575,000 with different levels of remaining financial assets. It highlights that with inclusion of the RAD, once assessable assets are approximately $1.023 million, clients are liable for the maximum, daily capped HSC and NCCC.

It’s worth noting that in addition to the above ongoing means-tested fees, clients will be liable for $23,926 p.a. for the Basic Daily Care Fee and HELF, if applicable. The combination of the total aged care fees can put significant pressure on cashflow for many clients and may mean clients with means over certain thresholds experience cashflow deficits, at least for the first four years.

Cashflow deficits

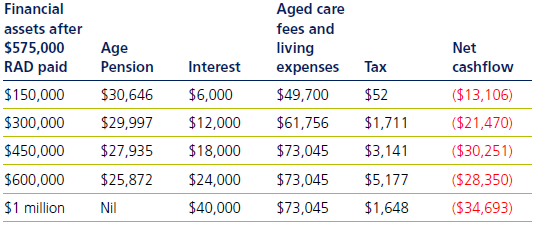

As discussed above, once a client’s assets exceed approximately $1.023 million, they are liable for the daily capped HSC and NCCC which equates to $46,520 p.a. combined. Should the client live longer than four years and if they have paid NCCCs of $135,319 (indexed) or have paid four years of NCCCs (whichever is earlier), the cashflow position will improve when the NCCC is no longer payable.

The below table outlines the cashflow position, taking into account 4% interest rate from financial assets, Age Pension where relevant, total aged care fees (inclusive of the basic daily care fee but no HELF), $2,600 miscellaneous expenses and tax for a single, non-homeowner who has paid a $575,000 RAD.

No change in assessable assets and income but change in the means tested amount calculation

There is no change to the assessment of assets and income in calculating the means tested amount. The high-level principle that aged care assessment of assets and income follows the social security means testing with the exception of RAD and the family home continues to apply. That said, the formula to calculate the means tested amount has changed.

The calculation can be somewhat complex and to reduce the complexity, Challenger’s Aged Care calculator can be used to model different common scenarios relating to aged care advice.

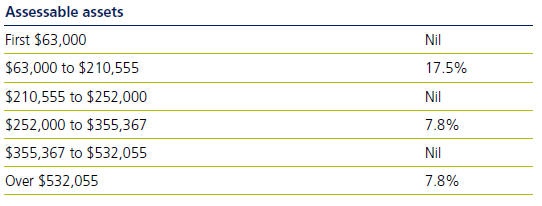

Assets tested amount

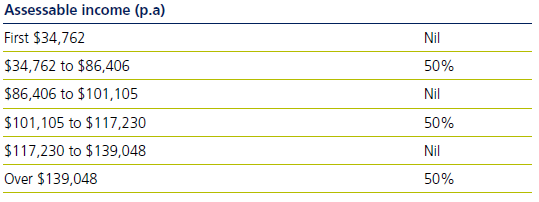

Income tested amount (single)4

To work out the MTA, a calculation is done on both assets and income, and then the assets tested amount and income tested amount are added together. The above calculation provides an annual MTA and then to work out the daily figure, the annual amount is divided by 364.

The MTA is a key concept to assess whether a client is a RAD payer or low means resident and whether they are liable for the HSC and NCCC.

RAD prices getting progressively higher

Prior to 1 January 2025, facilities did not need to seek Government approval if they were charging RADs of up to $550,000. Given that the amount of $550,000 had not been indexed since 1 July 2014, on 1 January 2025, the price at which no Government approval was required increased to $750,000, subject to further indexation on 1 July of each year. On 1 July 2025, the amount at which no approval is required indexed to $758,627.

While there is no Government data yet available, the conjecture is that we will see RAD prices continuing to increase closer to the maximum price at which no approval is required. Indeed, a report from an industry specialist points to increasing RAD prices of close to 9% by July 2025 compared to 31 December 2024.

Increasing RADs will likely affect perception around affordability of residential aged care and impact the decision to keep or sell the home. For clients changing facilities, higher comparative RAD prices may act as a deterrent to move but there are likely different considerations for voluntary moves as opposed to involuntary moves such as when the facility is closing down or cannot provide the required care.

Ensuring that advisers identify clients who are grandfathered – especially those who have been receiving Home Care Packages

One of the issues with the 1 November 2025 aged care changes is the complexity with understanding whether clients are grandfathered and therefore, are subject to the pre-1 November 2025 aged care rules.

Traditionally if a client moved into residential aged care for the first time, advisers would know the aged care means testing which applies to that client. Moving forward, there continues to be grandfathering for those who were in residential aged care prior to 1 November 2025 and subsequently changed facilities. However, if the client is entering residential aged care for the first time on or after 1 November 2025, advisers may also need to understand whether the client had an Aged Care Assessment approval for Home Care on or before 12 September 2024.

If the client did have an Aged Care Assessment approval for Home Care on or before 12 September 2024, they will be partially grandfathered for residential aged care, so that, unless they opted into the new rules:

- Not liable for the HSC or NCCC but liable for the means-tested care fee

- Liable for 2% retention amount for a maximum of five years and indexation on DAP (periodical payments on unpaid RAD).

Use of Challenger’s CarePlus in adding value to client’s position

Many advisers are aware that Challenger offers a purpose-built solution for aged care clients. Use of CarePlus could assist with improving the client’s position on the following dynamics:

- 100% return of purchase price5, irrespective of when death occurs

- Tax effectiveness

- Providing guaranteed regular income which is competitive compared to cash and term deposit rates

- Potentially increasing social security entitlements

- Potentially reducing aged care fees

Estate planning certainty and estate administration efficiency

Depending on the client, advisers typically look to push different levers in improving the client’s position.

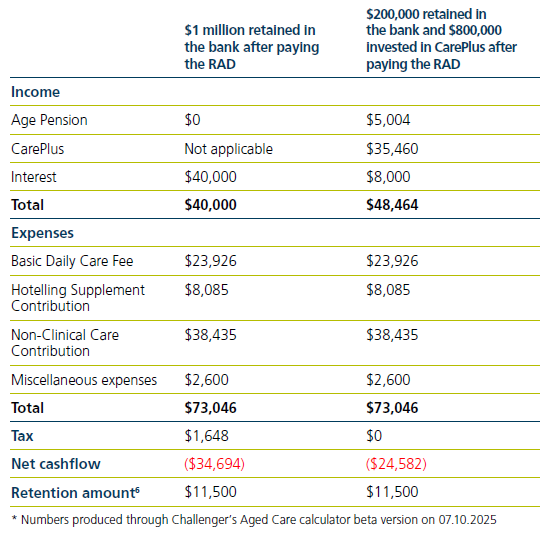

Case study – use of CarePlus to improve outcomes

Priya (85), single, has been living at home by herself. It has become apparent that things are proving very hard for her to remain at home. With failing health and losing capacity of mind, she moves to residential aged care. She sells her home and pays $575,000 as a RAD, leaving her with $1 million in the bank. The following table looks at keeping the $1 million in the bank compared to investing $800,000 in Challenger CarePlus and leaving $200,000 in the bank.

In Year 1, the benefits to Priya by using CarePlus in comparison to leaving the funds in the bank account are $10,112. The components of the $10,112 benefit are made up of:

- Age Pension increase of $5,004

- Higher payment of $3,460 from CarePlus compared to 4% bank interest

- Tax reduction of $1,648

Cumulative benefits over three years are projected to be $38,691 which will increase the longer Priya lives in residential aged care.

For further detail on CarePlus, please refer to this page or reach out to your Business Development Manager.

1The assessment of rental income depends on whether a tax return is completed. For further guidance, please refer to this link: 4.3.8.30 Income from real estate | Social Security Guide

2A protected person is a spouse, dependent child under 25, carer who has lived in the home for at least two years and receiving or eligible to receive a social security payment, a close relative who has lived in the home for at least 5 years and receiving or eligible to receive a social security payment.

3People-leaving-aged-care-fact-sheet_2024.pdf.

4For partnered clients, the income free area is $34,034. The first income threshold is $85,678. The second income threshold is $101,105. The third income threshold is $117,230 and the fourth income threshold is $136,136.

5For South Australian investors, 1.5% stamp duty applies on the premium paid for the CarePlus Insurance which is deducted from the death benefit.

6For simplicity, 2% retention amount is assumed to be deducted once at the end of the year.

Related content

Stay informed

Sign up to our free monthly adviser newsletter, Tech news containing the latest technical articles, economic updates, retirement insights, product news and events.