Consumption drives Australia's Q2 economic growth

Subscribe to Macro Musing

To stay up to date on the latest economic insights, subscribe to Macro Musing on LinkedIn.

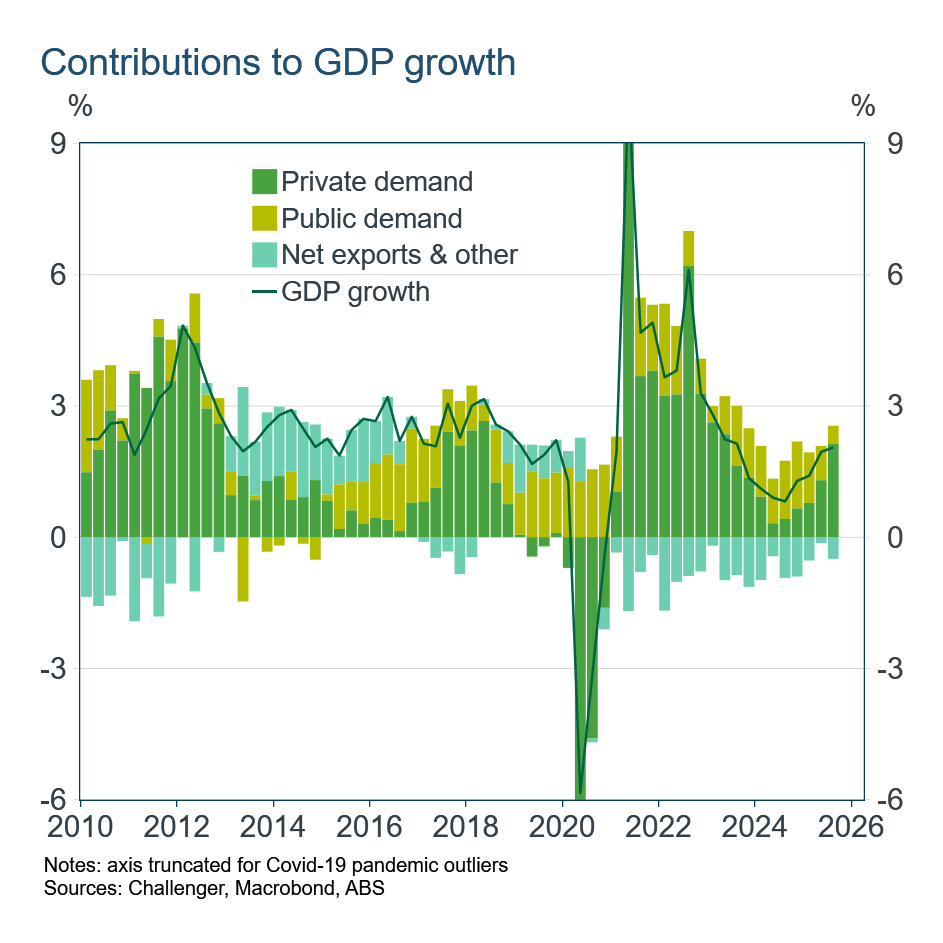

Growth in Australia picked up a little in the second quarter this year as lower interest rates gradually stimulate activity and the corrosive effects from earlier high inflation fall away. GDP grew by 0.6% in the quarter and by 1.8% over the year. Government consumption, and increasingly household consumption, are driving growth. There has been virtually no growth in private investment, either business or dwelling. That needs to pick up for more balanced and resilient growth in the Australian economy.

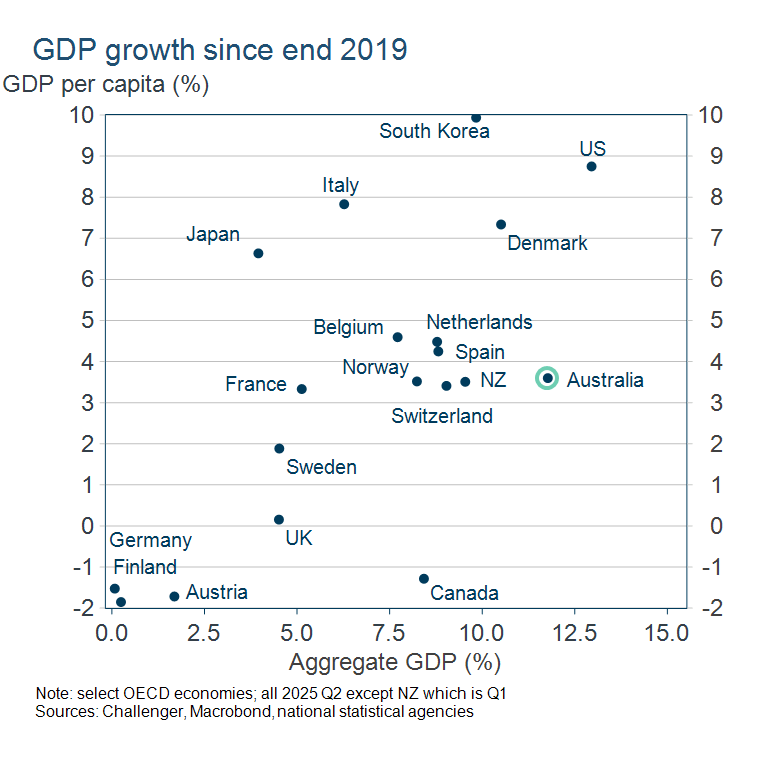

As much as we think of growth in Australia as having been weak, aggregate growth in the economy since the eve of the pandemic has been stronger in Australia than most comparable wealthy economies. Among the wealthy countries in the graph below, only the United States has had stronger aggregate GDP growth since 2019 (Australia is second from the right in the graph).

However, Australia has also had much stronger population growth than other countries, and on a per capita basis growth Australia has been weaker (around the middle of the pack). At least it has been better than in Canada and Germany where GDP per capita has fallen.

Per capita growth in Australia is, however, picking up. GDP growth has outpaced population growth in two of the past three quarters after over two years of GDP per capita falling.

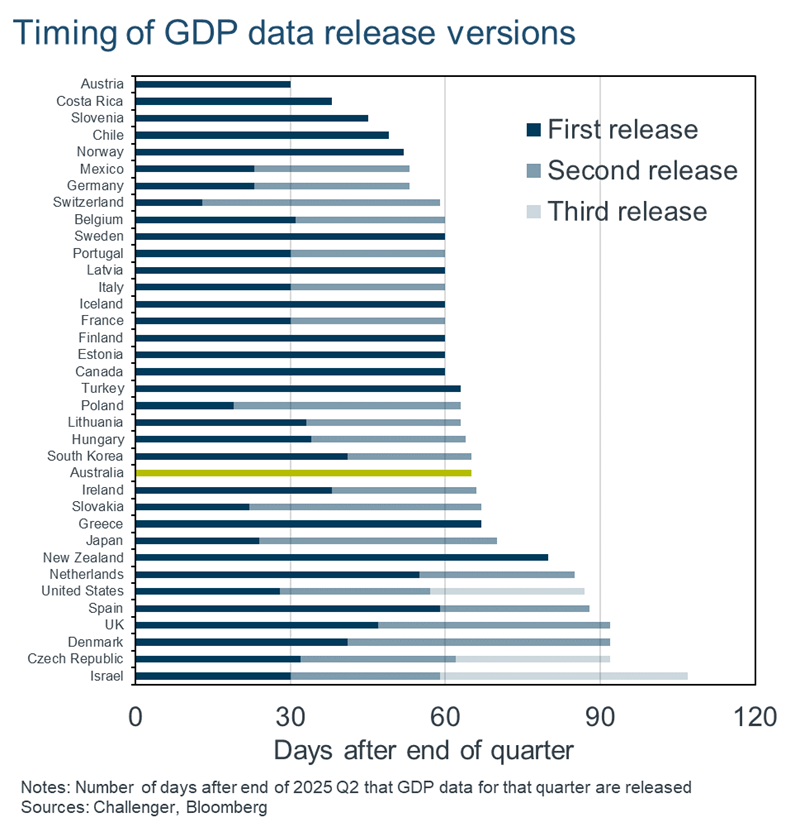

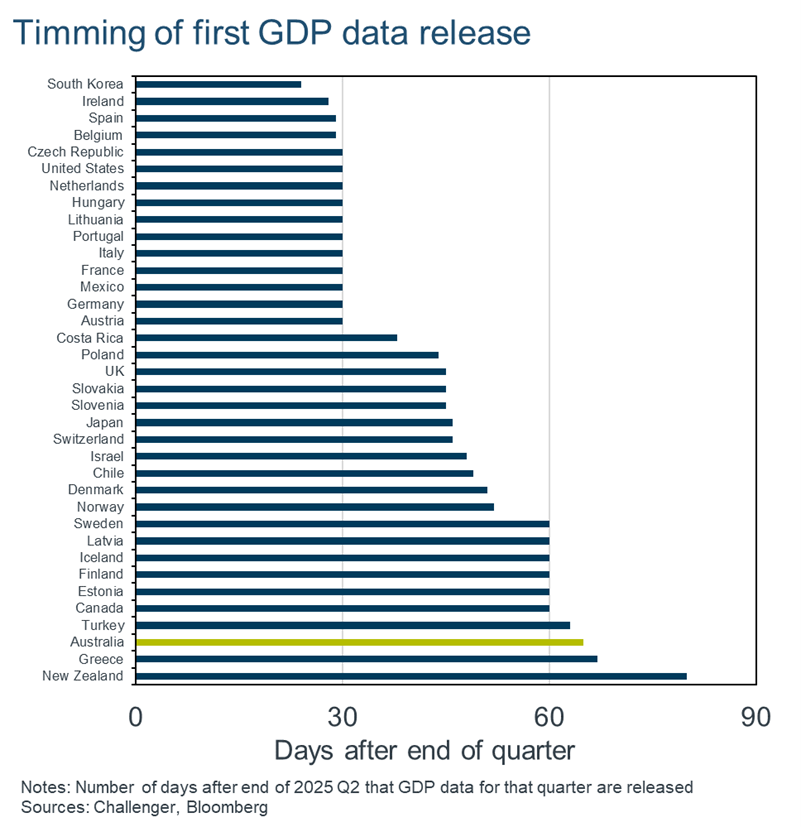

GDP data are the broadest report card on the economy and so critical for policy makers and analysts considering how economic activity impacts financial assets. In Australia we have to wait much longer to receive our first report on GDP data, only Greece and New Zealand among OECD economies wait longer. Our data take more than two months to be released, in many economies it’s only one month.

However, for many countries the first GDP release is a preliminary, and incomplete, data release that is followed by a more complete final release. If we look at when final GDP data are released Australia is more around the middle of the pack.

The delay in receiving GDP data used to be a bigger problem when the RBA met each month to determine interest rates. Frequently GDP data came out the day after the RBA had met meaning they were deprived the latest information to make their decision. The schedule with the RBA now having 8 meetings per year means the timing for GDP data is less unfavourable. Earlier data, even if incomplete and indicative, would still help policy makers and others in their understanding of economic developments. Perhaps that will be a future project for the Australian Bureau of Statistics once they deliver a monthly CPI later this year.