Downsizing your home, upsizing your super - your questions answered

Downsizing your home, upsizing your super - your questions answered

Download the article below.

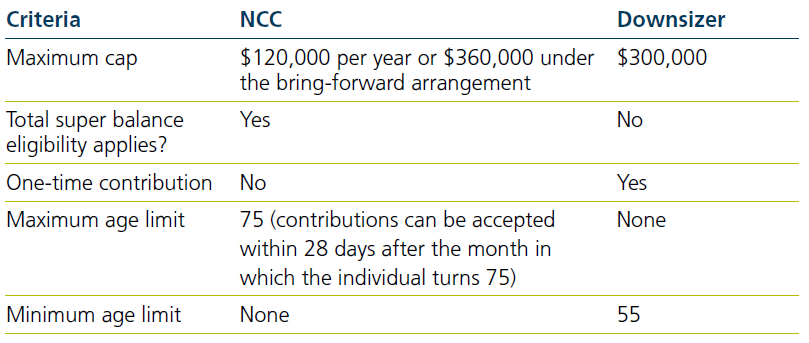

The introduction of NCC (non-concessional contribution) limits from 2007 presented challenges for many retirees in contributing large lump sums to superannuation. Among other alternative measures to contribute to super, the introduction of downsizer contributions in July 2018 emerged as an attractive option to contribute more to super due to its exclusion from the NCC cap and the lack of total super balance requirements or upper age limits.

Since its inception in July 2018 until June 2024, approximately 78,600 individuals made downsizer contributions totalling approximately $19.9 billion1. As a result, the rules governing downsizer contributions continue to be an area of focus for financial advisers. This article revisits frequently discussed areas of interest by the Challenger Technical Team.

Snapshot of the rules and eligibility requirements

Core eligibility

Sale of principal home, where proceeds are exempt or partially exempt from the main residence capital gains tax (CGT) exemption, or would be entitled to such an exemption if the home was a CGT rather than a pre-CGT asset.

Principal home criteria

Located in Australia and is not a caravan, houseboat, or other mobile home (no requirement to buy another home).

Ownership requirement

Owned by the individual or spouse for 10 years or more prior to the sale (ownership period is generally from the date of settlement of purchase to the date of settlement of sale).

Age of the individual

55 years old or older at the time they make a downsizer contribution (there is no maximum age limit).

Contribution amount

Up to a maximum of $300,000 per individual (cannot exceed sale proceeds).

Contribution timing

Within 90 days of receiving proceeds of sale (usually the date of settlement).

One-time contribution

No previous downsizer contribution has been made from the sale of another home.

Downsizer contribution form

Downsizer contribution into super form (NAT 75073-06.2018) must be submitted either before or at the time of making the downsizer contribution.

Refer to the ATO website for more information on eligibility and the application process.

Is there a preference between using a downsizer contribution cap or NCC cap?

Based on the above differences, the preference could depend on:

- Whether the individual intends to sell another home in future (assuming both meet downsizer eligibility). If the individual intends to sell another home in the future, particularly after 75, it might be worthwhile to utilise the NCC cap today.

- The amount of their remaining sale proceeds. If there are significant amounts of capital remaining after the sale of the home (and any purchase of another home), the individual may want to utilise both caps to maximise the amount they can contribute into super.

Can a downsizer contribution be made using ‘other’ monies if the entire sale proceeds are used to buy another home?

Downsizer contribution rules do not require the individual to use their actual sale proceeds to contribute or even require them to buy another home. If all other eligibility criteria are satisfied, individuals can use other monies to make the contribution. This is confirmed from the ATO’s LCR 2018/9 (paragraph 61) outlining that the contribution does not have to be made from the actual proceeds.

In fact, a downsizer contribution can be used as part of a cash-out and recontribution strategy to:

- increase the tax-free component of the individual’s super to help reduce potential tax to non-tax dependants,

- equalise super between spouses, which could result in maximising amounts a couple can transfer into retirement phase income streams by taking advantage of two transfer balance caps,

- help maximise Age Pension entitlements for an older spouse by making the contribution into the younger spouse’s super.

Note – Considerations should be given to the impact of losing any grandfathering status for social security purposes, where a recontribution strategy is considered using an existing account-based pensions.

Can a downsizer contribution be made if the home is transferred under a Centrelink granny flat arrangement in exchange for a life interest and there are no sale proceeds?

Downsizer contributions are limited to the lesser of $300,000 for each individual and the gross capital proceeds received (before any mortgage repayments or costs incurred from the sale such as agent fees). Therefore, if the home is gifted or transferred without any capital sale proceeds, a downsizer contribution cannot be made.

LCR 2018/9 (paragraph 62) confirms that capital proceeds for most cases are the money received, or entitled to be received, from the sale of the interest in the dwelling. An individual cannot apply the CGT market value substitution rules to increase the amount of the capital proceeds from the disposal of their ownership interest in the dwelling to equal the market value of the ownership interest.

A home with 25 hectares of land is sold for $700,000. If the main residence exemption only applies to the home and adjacent two hectares valued at $200,000, is a downsizer contribution limited to $200,000?

No - Even though the main residence exemption only applies to part of the property, the amount allowed as a downsizer contribution is not apportioned. The total proceeds from the disposal are used to determine the amount available for the contribution.

LCR 2018/9 (paragraph 50) confirms that it is not relevant how the main residence exemption is calculated or apportioned. The available amount of downsizer contribution relates to the proceeds from the disposal of the interest in a dwelling. It is not limited to the extent of CGT main residence exemption amount.

Can the contribution amount be more than the individual percentage share of sale proceeds where the property is owned as tenants in common between non-spouses?

No – Unlike in cases where a downsizer contribution can be made by a spouse from the sale proceeds in relation to the combined ownerships interests of both spouses (provided they meet all other requirements) as tenants in common, the same does not apply to property held as tenants in common by non-spouses.

Downsizer contributions are limited to the total capital proceeds that the individual, their spouse, or they both, receive from disposing of their ‘ownership interests’ in the dwelling, up to $300,000.

Example 1 of the LCR 2018/9 clarifies that where a non-spouse held an ownership interest of 20%, his contribution was limited to the 20% of sale proceeds being $140,000 (out of total sale proceeds of $700,000) in that example.

How is a downsizer contribution assessed for social security entitlements like the Age Pension?

For social security purposes, the principal home and the land adjacent to the home of up to two hectares held under the same title is generally exempt. If sold, the principal home sale proceeds exemption allows sale proceeds that are intended to be used to purchase, build, rebuild, repair or renovate a new principal home to be exempt from the social security assets test for a period of up to 24 months2.

Where the proceeds intended to buy or build a new home are held in a financial investment, a lower deeming rate (0.75% as of 20 September 2025), applies for income testing purposes.

For those Age Pension age or over, this assessment also applies where the sale proceeds are contributed to super. However, where there is no intention to buy another home, the above exemption does not apply and the contributed monies as a downsizer contribution is assessed as an asset subject to deeming.

Superannuation in accumulation phase for those under Age Pension age is disregarded for means test assessment.

Reducing the impact on social security payments from downsizer contributions

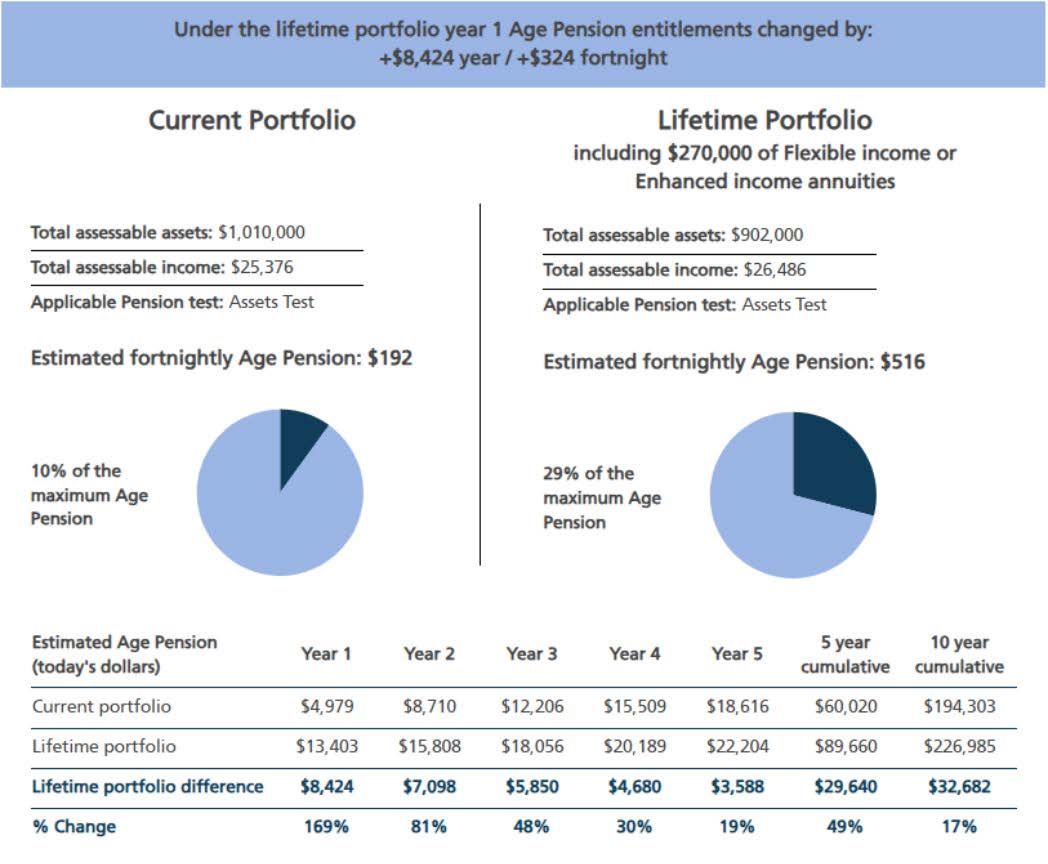

Where a downsizer contribution is assessable for social security purposes, clients can consider investing some of the downsizer contribution into a lifetime annuity to help reduce this impact.

Challenger’s lifetime annuity provides a concessional assessment under the assets test and can help reduce the impact for asset tested clients. Under the assets test, 60% of the investment amount is assessed until age 85 (subject to a minimum of 5 years) and then a 30% assessment thereafter.

Under the income test, 60% of the regular payments are assessed. For further information on Challenger’s lifetime annuity please refer to the Product Disclosure Statement and Target Market Determination.

Example: Amy and Justan are retirees (both are age 67) and wish to downsize their existing home. Apart from $250,000 each in account-based pensions (assessed under the deeming rules), they have $10,000 in personal assets and $100,000 in cash. They currently receive an Age Pension of 36,179 p.a. combined.

After purchasing their new home they expect to have surplus proceeds of $400,000 which they will each contribute $200,000 to top up their superannuation under the downsizer provisions. Their Age Pension is expected to reduce to $4,979 p.a. (combined) at that time. If they each invest 30% ($135,000 each) of their superannuation into Challenger’s lifetime annuity, their Age Pension is expected to increase to $13,403 p.a. in the first year.

Source: Challenger’s Age Pension Illustrator as at 22/09/2025 using default assumptions. The Age Pension illustrator and details of the default assumptions can be found on AdviserOnline.

Can a downsizer contribution be made by an individual in a residential aged care facility?

Yes - In cases where an individual sells their home to move to an aged care facility, a downsizer contribution can be considered from the former home sale proceeds as long as they meet the eligibility criteria. There is no requirement to purchase another property following the sale of their former home to be eligible to make a downsizer contribution as outlined in LCR 2018/9 (paragraph 9).

However, this can have an impact on their aged care assessment. For aged care purposes, the former home (if not occupied by a protected person) is assessed at a capped value (currently) $210,555.20. Where the former home is sold, the assessment of the proceeds depends on where those funds are reinvested. For instance, sale proceeds sitting in a bank account are assessed as an asset subject to deeming. In such cases, where there is an increase in assessable assets from the capped value of the home to potentially the entire sale proceeds, aged care costs may also increase. Before making a downsizer contribution, consideration should be given to whether or not a lump sum accommodation deposit should be paid (if not already done so) to avoid paying a high maximum permissible interest rate (currently 7.61%).

Although a downsizer contribution can be made, consideration should be given if it is worthwhile to do so and if there could be a better investment alternative. As an example, Challenger Tech has compared the advantages and disadvantages of making a downsizer contribution or investing the intended downsizer contribution in Challenger CarePlus. Refer to our Decision-making considerations of Downsizer contribution or Challenger CarePlus on adviser online for more details.

1Downsizer super contributions data | Australian Taxation Office.

2Possible extension of the exemption to 36 months in limited circumstances.

Related content

Stay informed

Sign up to our free monthly adviser newsletter, Tech news containing the latest technical articles, economic updates, retirement insights, product news and events.