Effectiveness of CarePlus from 1 November 2025

Effectiveness of CarePlus from 1 November 2025

Download the full article below.

As part of the 1 November 2025 aged care reforms, there have been changes to the means testing for ongoing costs in residential care. The assessment of assets and income are the same however the calculation of the means-tested amount has changed.

CarePlus has been an effective investment solution for many clients who entered residential care before 1 November 2025. The means test treatment of CarePlus has reduced residential care fees, and being tax effective, has reduced tax payable.

In this month’s article, we look at the effectiveness of CarePlus for clients who enter residential care from 1 November 2025. We will use examples to demonstrate the cash flow and estate benefits of investing in CarePlus as part of an aged care strategy.

What is Challenger CarePlus?

Challenger CarePlus (CarePlus) is a combined lifetime annuity (CarePlus Annuity) and life insurance policy (CarePlus Insurance) that can be purchased by clients who receive or plan to receive Government subsidised aged care services. CarePlus Annuity provides guaranteed regular payments for life and CarePlus Insurance provides a guaranteed death benefit, up to 100% of the amount invested, payable to nominated beneficiaries or the estate in the event of the client’s death.1

CarePlus can increase estate planning certainty for clients and reduce the time taken for death benefits to be paid to beneficiaries. Clients can nominate multiple beneficiaries to receive the death benefit directly from Challenger without the need for probate. CarePlus works effectively with Centrelink and aged care means testing to reduce assessable assets. 60% of the CarePlus Annuity purchase price is assessed until age 85 (with a minimum of 5 years) and then 30% is assessed thereafter. If the client

is Age Pension age or over at the time of investment, the greater of the CarePlus Insurance premium and surrender value is assessed.

CarePlus works tax effectively to reduce assessable income. CarePlus Annuity receives a deductible amount which reduces assessable income from the regular payments. The deductible amount is calculated as the CarePlus Annuity purchase price divided by the client’s life expectancy at the time of investment.2 For further information on CarePlus, see Challenger CarePlus Product Disclosure Statement and Technical Guide.

Changes to ongoing costs for residential care

The hotelling contribution (HC) has been introduced and the non-clinical care contribution (NCCC) has replaced the means-tested care fee (MTCF). Both the HC and NCCC will be payable depending on the resident’s assessable assets and income.

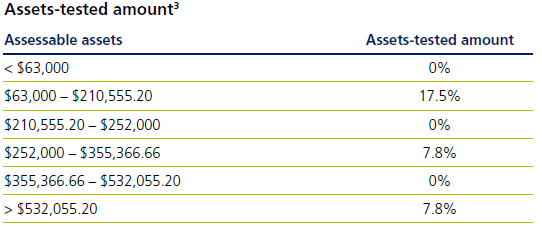

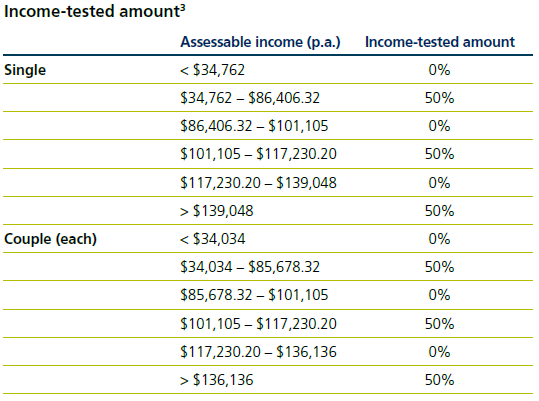

Assessable assets and income for the HC and NCCC will be the same as that previously assessed for the MTCF. The resident’s means-tested amount (MTA) will continue to be compared to the maximum accommodation supplement (MAS) however, the calculation of the MTA has changed.

MTA = Assets-tested amount + Income-tested amount

The HC will be payable when the resident’s MTA exceeds the MAS (currently $70.94 per day) subject to a cap of $22.15 per day. The NCCC will be payable when the resident’s MTA exceeds the MAS + maximum HC (currently $93.09 per day) subject to a cap of $105.30 per day. The NCCC will no longer be payable after 4 years or when the resident reaches the lifetime cap (currently $135,318.69).3

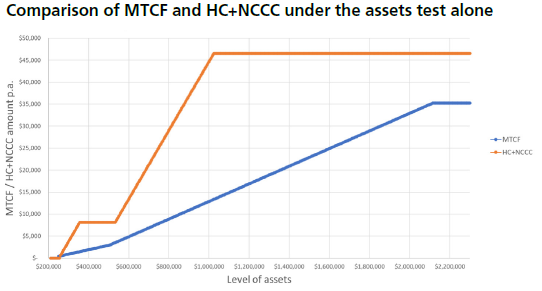

Comparing the HC and NCCC to the MTCF, as assessable assets increase with the higher taper rate, the HC and NCCC will reach the maximum amount at lower asset levels. The maximum HC and NCCC will be payable when assessable assets reach $1,023,460 compared to the MTCF reaching the annual cap when assessable assets exceed $2,115,100.4

For further information on the MTCF, see June 2024 Challenger Tech article ‘Quantifying the technical benefits of Challenger CarePlus’.

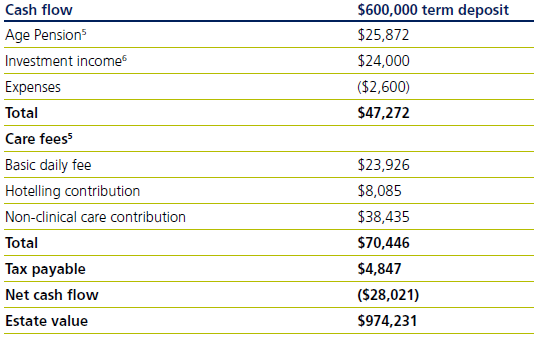

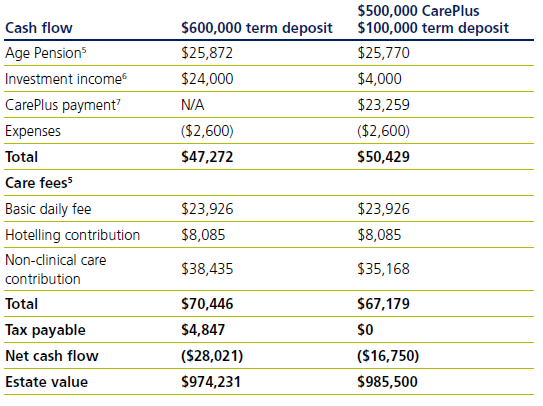

Case study - Age Pensioner

Susan is single, 85 years old, a non-homeowner and has been approved for residential care. Her chosen aged care facility has an advertised accommodation price of $400,000. She has $1,000,000 invested in term deposits and $10,000 of personal assets. Susan pays $400,000 as a refundable accommodation deposit (RAD) and keeps $600,000 invested in term deposits. She will have $50 per week of other expenses while she is in residential care. What will be her cash flow and estate value in the first year?

Susan seeks financial advice to reduce her residential care fees and tax payable. Her financial adviser recommends investing $500,000 in CarePlus. CarePlus will make regular payments of $23,259 per annum and pay a death benefit of $500,000.7 What will be her comparative cash flow and estate value in the first year?

There is a reduction in her non-clinical care contribution because the investment in CarePlus has reduced assessable assets. There is also a reduction in her tax payable because the regular payment from CarePlus receive a deductible amount, which reduces assessable income. Susan has improved her cash flow and increased her estate value by $11,269 in the first year.

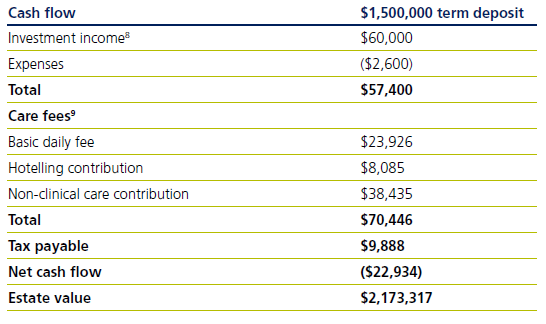

Case study - self funded aged care resident

Jane is single, 85 years old, a non-homeowner and has been approved for residential care. Her chosen aged care facility has an advertised accommodation price of $700,000. She has $2,200,000 invested in term deposits and $10,000 of personal assets.

Jane pays $700,000 as a refundable accommodation deposit (RAD) and keeps $1,500,000 invested in term deposits. She will have $50 per week of other expenses while she is in residential care. What will be her cash flow and estate value in the first year?

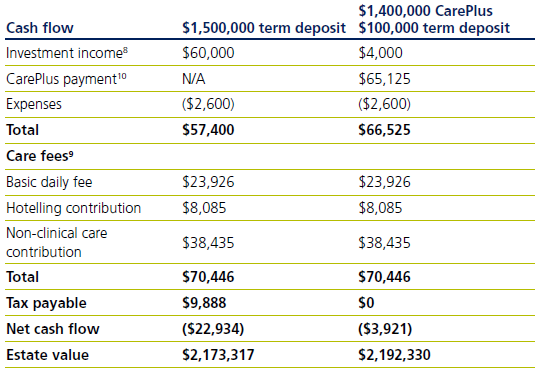

Jane seeks financial advice to reduce her tax payable and ensure her beneficiaries receive their inheritance. Her financial adviser recommends investing $1,500,000 in CarePlus with nominated beneficiaries. CarePlus will make regular payments of $65,125 per annum and pay a death benefit of $1,500,000. What will be her comparative cash flow and estate value in the first year?

There is a reduction in her tax payable because the regular payment from CarePlus receive a deductible amount which has reduces assessable income. Jane has improved her cash flow and increased her estate value by $19,013 in the first year.

Jane has ensured her beneficiaries will receive their inheritance because they are nominated and the death benefit will be paid directly to them without the need for probate.

Conclusion

CarePlus continues to be an effective investment solution for clients who enter residential care from 1 November 2025. Although the calculation of the MTA has changed, assessable assets and income for the HC and NCCC have remained the same. CarePlus will continue to provide cash flow and estate benefits by reducing ongoing costs for residential care.

1Stamp duty (1.5% of CarePlus Insurance premium) will be deducted from the death benefit for South Australian residents.

2Based on 2020-22 Life Expectancy tables from the Australian Government Actuary (Income streams commenced from 1 January 2025).

3Aged care rates and thresholds as at 1 November 2025.

4Assuming assessable income is less than $34,762 (single) or $34,034 (couple each).

5Centrelink and aged care rates and thresholds as at 1 November 2025.

6Term deposit and bank account assumed interest rate of 4%.

7Challenger Aged Care Calculator 03/11/2025, 85 year old female, NSW resident, nil adviser fees.

Related content

Stay informed

Sign up to our free monthly adviser newsletter, Tech news containing the latest technical articles, economic updates, retirement insights, product news and events.