Social security exemptions for funeral bonds, prepaid funerals, and burial plots

Funeral bonds, prepaid funerals and burial plots - how much can be exempt for social security assessment?

Download the full article below.

Social security law allows certain exemptions when it comes to the assessment of funeral bonds and investments, prepaid funerals, and cemetery/burial plots. The availability and extent of these exemptions, however, depend on how the funeral costs are structured and funded. In this technical edition, we will:

- outline the key options for funeral funding expenses

- examine the nuances in how these options are structured, and

- detail the limit of assets test exemptions that may apply.

A funeral bond is an investment that can be individually or jointly owned and is designed to set aside money to cover future funeral costs.

Social security assessment - An exempt funeral investment/bond:

- is a funeral investment that matures on the death of the income support recipient or their partner, and

- the amount paid on maturity must be applied to funeral expenses on whose death it matures, and

- does not relate to a funeral for which funeral expenses have been paid in advance,

and - is not able to be redeemed, and

- has not had more than the Indexed Funeral Bond Allowable Limit (IFBAL) invested in it by the income support recipient.

An investment1 in up to 2 funeral bonds, up to the IFBAL is allowed. The IFBAL threshold is currently set at $15,750 as of 1 July 2025 and is adjusted on 1 July each year in accordance with movements in the CPI.

A prepaid funeral plan or prepaid funeral expenses cover an advance payment for future funeral services for the individual or their partner agreed by contract, outlining the scope of pre-arranged funeral services provided by the funeral director at a set amount.

Social security assessment - Prepaid funeral expenses are exempt from the income and the assets test. Unlike a funeral bond, there is no limit to the exemption available on the amount spent on prepaid funeral expenses. Note that for prepaid funeral expenses to be exempt for social security purposes, they must not be refundable2. Some prepaid funerals are paid for with a funeral bond assigned to a funeral director. If it meets prepaid funeral conditions, that is, a contract for future services, it is treated as a prepaid funeral, not a funeral bond.

A burial plot includes ownership or having the right to be buried in a specific place like a plot in a cemetery, an interment niche, family mausoleum, crypt or burial vault.

Social security assessment – A burial plot is exempt from social security assessment regardless of the amount paid. The exemption also applies whether or not the individual has a prepaid funeral plan or own a funeral bond investment. In the case of couples, each member of the couple can have the value of a plot exempt from the assets test assessment.

Can a couple invest in a joint funeral bond?

Each member of a couple can have up to the IFBAL exempted ($15,750 x 2) as long as both the members have a separate individual investment. If they invest in a joint funeral bond, the total amount invested jointly must not exceed $15,750 for the bond to be an exempt funeral investment.

My client who has prepaid $5,000 for their funeral with their (future) funeral home would also like to invest $15,750 into a funeral bond to maximise their Age Pension entitlements. Would the funeral bond be exempt from the social security assets test assessment?

In this scenario, the funeral bond will not be exempt from the Centrelink assets test. The funeral bond exemption of up to IFBAL threshold of $15,750 is only exempt if the individual does not have a prepaid funeral. Where an individual has both a prepaid funeral and a funeral bond, only the prepaid funeral is exempt unless the funeral bond is assigned to the funeral director of their future funeral home and is a part of their prepaid funeral plan. They will also lose their exemption if funeral expenses are later prepaid.

My client initially invested $13,000 in a funeral bond a few years ago which is now worth $16,000. Can they now make an additional exempt funeral bond investment?

Yes, as long as the investment amount (excluding earnings) for one or up to two bonds is equal to or under the current IFBAL threshold, they will remain exempt even if the growth or earnings makes the total balance exceed the threshold at a later date.

My client ended up investing in a funeral bond worth $16,000. Will the entire amount be assessed, or is the exemption only provided for the amount below the IFBAL threshold?

If the initial amount invested by your client exceeds the IFBAL, the entire balance (including earnings) of the bond is assessed for social security purposes as a financial asset subject to deeming.

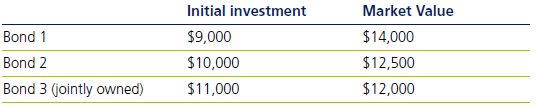

My client has 3 investment bonds of $9,000, $10,000 and a joint investment of $11,000 with their partner. Their market values as of today are $14,000, $12,500 and $12,000. How are these 3 investments assessed?

The social security exemption on funeral bonds is only limited to 2 investments not exceeding the IFBAL threshold of $15,750. The individual can choose to exempt up to 2 eligible bonds as long as the total initial investment for both the bonds does not exceed $15,750. The remaining investments will be assessed as an asset subject to deeming.

The total initial investment value of any two bonds exceeds the threshold of $15,750. Therefore, the client will need to choose any 1 of the 3 funeral bond to be exempted. The current market value of the remaining 2 bonds will be assessed. In this scenario, the client should consider choosing the bond with the highest market value to be exempt. Based on the highest market value, if the client chooses Bond 1 to be exempt, $12,500 of bond 1 plus $6,000 (client’s share) of bond 2, that is $18,500 will be assessed as an asset subject to deeming. In the future the client can choose to change their choice of the exempt bond at any time when the IFBAL increases and allows for a more advantageous option.

My couple clients purchased a joint funeral bond for $14,000 and one member of the couple passed away. The entire balance of the bond was used to pay for the funeral as the bond matured on the death of one member of the couple. Can the surviving member of couple purchase another funeral bond up to the exempt amount or is there a limitation to the exempt amount because of the original bond?

The social security law provides the investment bond exemption for up to two funeral bonds not exceeding the IFBAL threshold of $15,750. If the first joint funeral bond investment has been used to fund the funeral of the first person that passed away and the joint funeral bond investment no longer exists, another investment bond with an investment not exceeding the entire IFBAL threshold of $15,750 can be purchased.

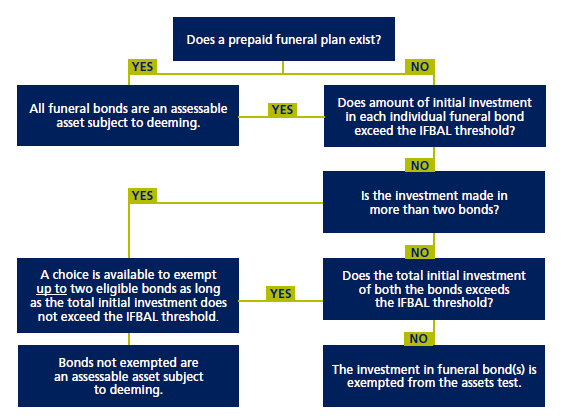

Flowchart outlining the social security assessment where the individual has multiple funeral bonds and has a prepaid funeral plan.

1Investment includes original purchase cost, and any additional funds contributed (for existing bonds) but not including investment earnings or bonuses.

2Unless the income support recipient moves outside the designated funeral service area.

Related content

Stay informed

Sign up to our free monthly adviser newsletter, Tech news containing the latest technical articles, economic updates, retirement insights, product news and events.