HSC and NCCC: Change of fees from 1 November 2025

.png?h=540&iar=0&w=680)

HSC and NCCC: Change of fees from 1 November 2025

Download the article below.

From 1 November 20251, the means testing of aged care fees will change significantly. Amongst the changes, there will be the introduction of two new fees – Hotelling Supplement Contribution (HSC) and Non-Clinical Care Contribution (NCCC). These two fees are ongoing aged care costs which will be important to understand when considering cashflow and funding of aged care fees as well as thinking of strategic opportunities to minimise the fees when possible.

Currently, a Means Tested Care Fee (MTCF) is payable as a co-contribution towards cost of care for those who have available means over certain thresholds. With the Government fully funding clinical care from 1 November 2025, MTCF will be abolished for non-grandfathered residents. Instead, clients who have available means will be required to pay HSC as a co-contribution towards everyday living such as food, cleaning, laundry and utilities and NCCC as a co-contribution for non-clinical care costs such as bathing, mobility assistance and lifestyle activities.

This article examines the NCCC and HSC in more detail. Unless stated otherwise, the thresholds used throughout the article have been taken from materials released by Department of Health and Aged Care and apply as at 20 September 2024. The thresholds used throughout this article are routinely indexed and will change on 1 November 2025.

Who is liable for HSC & NCCC and is there grandfathering for existing residents?

Clients who enter residential aged care for the first time from 1 November 2025 (an exception applies for grandfathered Home Care recipients moving to residential aged care) may be liable for the HSC and NCCC. Grandfathering, unless the client opts-in to the new rules, applies to the following cohort:

- Anyone in residential aged care as at 31 October 2025

- Anyone in residential aged care as at 31 October 2025 changing facilities from 1 November 2025.

- Anyone who was either approved, receiving or waiting for a Home Care Package as at 12 September 2024 entering residential aged care from 1 November 2025

If a client is grandfathered, they will not be liable for HSC and NCCC and instead may be liable for a MTCF. While perhaps rare to see given the average stay in aged care, clients who were in residential aged care prior to 1 July 2014 will retain their current contribution arrangements such as the income-tested fee.

Please note, grandfathering described above refers to the liability towards HSC and NCCC compared to MTCF. Slightly different rules apply to grandfathering for accommodation payment changes such as retention amounts and indexation on Daily Accommodation Payments (DAP), which will be covered in a future article. Broadly, there is grandfathering for accommodation payment changes so that retention amounts and indexation on DAPs do not apply to those who are already in aged care as at 31 October 2025 or existing residents on 31 October 2025 who change facilities from 1 November 2025 within 28 days.

For further information on grandfathering for contribution and accommodation, please refer to the Aged Care Reforms grandfathering rules article.

Means Tested Amount (MTA) determines HSC and NCCC

The liability towards HSC and NCCC is dependent on the MTA, which is a calculation based on assets and income. Assessment of assets and income for MTA calculations is unchanged, including 50% of the combined assets and income for partners being assessed. For example:

- Refundable Accommodation Deposit (RAD) is an assessable asset

- Family home is exempt if occupied by a protected person or assessed at the home cap value ($206,039) if not occupied by a protected person.

- Social security payments such as the Age Pension are included as income less Minimum Pension Supplement and Energy Supplement.

However, the thresholds used in the MTA calculation and the liability rate when certain thresholds are exceeded have changed from the current MTA calculation.

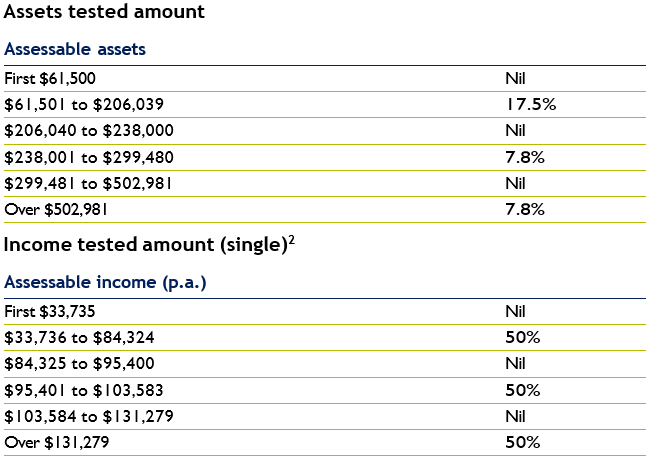

To work out the MTA, based on the client’s assets and income, a calculation is done on both assets and income and then the assets tested amount and income tested amount are added together. The above calculation provides an annual MTA and then to work out the daily figure, the annual amount is divided by 364.

Once we have worked out the MTA, the HSC and NCCC are calculated as the following:

Hotelling Supplement Contribution – capped at $12.55 per day

HSC only applies if the MTA is greater than the MAS - $69.49 per day. If the MTA is greater than $69.49, the HSC is the lower of:

- MTA minus MAS

- Maximum Hotelling Supplement ($12.55 per day, indexed)

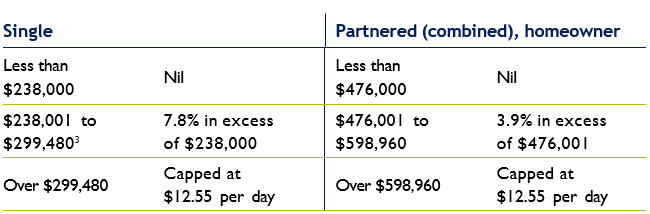

In an attempt to simplify the application of HSC, focusing specifically on assets, the HSC will apply at the following level of assets:

Non-Clinical Care Contribution – capped at $101.16 per day

NCCC only applies if the MTA is greater than MAS ($69.49) and Hotelling Supplement ($12.55). Therefore, it only applies if the MTA is greater than $82.04 per day and is capped at $101.16 per day (indexed). If the MTA is greater than $82.04 per day, the NCCC is the lower of:

- MTA minus MAS minus Hotelling Supplement

- Maximum NCCC ($101.16 per day, indexed)

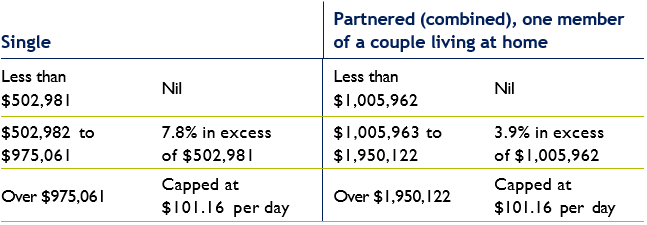

In an attempt to simplify application of NCCC, focusing specifically on assets, the NCCC will apply at the following level of assessable non-deemed assets:

The NCCC will have a lifetime cap of $130,000 (indexed) or 4 years of NCCC payments (including any fee reductions under financial hardship), whichever is earlier.

Given that the maximum HSC and NCCC on a daily basis applies at assessable assets of around $1 million for a single person and $2 million for partnered clients, as a change of dynamic compared to pre 1 November 2025 rules, there may not be any financial detriment in not disclosing means for aged care purposes once the daily cap is reached.

If an individual does not disclose their means, they are classified as ‘means not disclosed’ and are liable for the daily capped HSC and NCCC.

Challenger’s Aged Care calculator

Challenger’s Aged Care calculator has been updated to work out a snapshot of aged care fees under the new rules. It can be used to calculate the HSC and NCCC.

Example

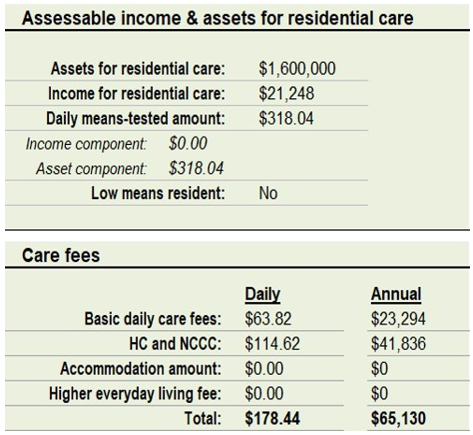

Jane (85) sold her home and has paid a RAD of $600,000. She has $1 million left in a bank account. Using Challenger’s Aged Care calculator, we can establish that the daily MTA is $318.04 per day.

Due to the capped HSC and NCCC, combined HSC ($13.464 * 365 = $4,913) and NCCC are ($101.16 * 365 = $36,923) $41,836 p.a.

You can download Aged Care calculator from Adviser Online or by reaching out to your Challenger Business Development Manager.

When is there an exemption from paying HSC and NCCC?

Similar to the current framework for MTCFs, a client is exempt from paying HSC and NCCC if:

- The HSC or NCCC are less than $1 per day

- They pass away before they are notified of their HSC and NCCC liability

- It has been more than 6 months before they are advised of their means tested amount

- They have a dependent young child. For this purpose, dependent child refers to a child under 16 or over 16 and under 25 and in full-time education

- They are a former prisoner of war

Examples of HSC and NCCC based on assets and income for a single person

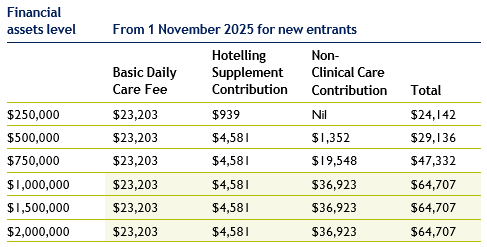

The following table describes the Basic Daily Care Fee (generally paid by all residents), HSC and NCCC for a single person.

It assumes that all the assets are held in financial investments and deemed. Thresholds used in this table are for the period from 20 September 2024 until 19 March 2025 and thresholds quoted in the Explanatory Memorandum and Rules.

The lightly shaded rows indicate when the HSC ($12.55 per day) and NCCC ($101.16 per day) reach their maximum cap. It does not include DAP on unpaid RADs, Higher Everyday Living Fee or retention amounts on RADs which will be covered in a future article.

Using Challenger’s CarePlus to add value

Challenger’s CarePlus offering is purpose built for aged care clients. Due to its unique structure, it can assist when relevant in:

- Improving social security entitlements

- Reducing aged care fees

- Reducing tax

- Providing guaranteed regular income often more competitive than bank interest on savings

- Ability to nominate beneficiaries and taking assets out of the estate pool

- 100% return of purchase price5 irrespective of when death happens

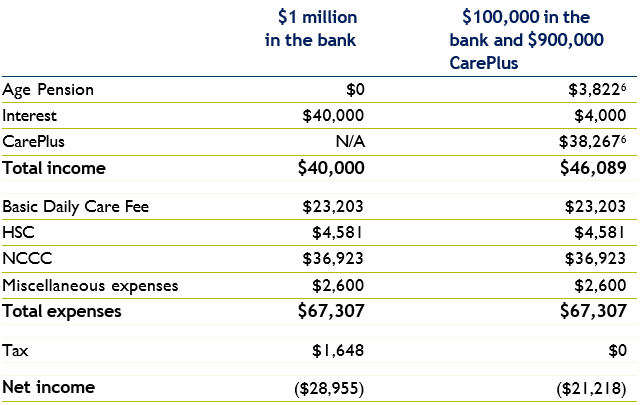

Going back to Jane’s example, if we assume that rather than leave $1 million in the bank, if she considers leaving $100,000 in the bank and investing the remaining $900,000 in Challenger CarePlus, her year 1 cashflow summary will look like the following:

The NCCC will be subject to a lifetime cap of $130,000 (indexed) which the client is projected to reach in ~3.5 to 4 years at which point the NCCC will no longer apply. Once the lifetime cap is reached, the client will likely be in a surplus cashflow position.

By investing $900,000 into CarePlus, Jane has been able to improve her position by $7,737 in the 1st year. This benefit has come from Age Pension increasing by $3,822, tax reducing by $1,648 and more cashflow from CarePlus $2,267 compared to 4% interest from bank account.

Some common frequently asked questions

Under the Support at Home program from 1 November 2025, the current income- tested fee will change to Participant Contributions for those who are not grandfathered. Will those Participant Contributions count towards the NCCC lifetime cap when a Home Care recipient moves to residential aged care?

Yes, they will.

Any income tested fees paid in Home Care until 31 October 2025 and Participant Contributions from 1 November 2025 (when relevant) will count towards the NCCC $130,000 lifetime cap. This may be particularly relevant for those Home Care recipients who are NOT grandfathered because they were approved for a Home Care Package after 12 September 2024.

Grandfathered Home Care recipients, that is, those who were approved, receiving or waiting for a Home Care Package on or before 12 September 2024 who move to residential aged care from 1 November 2025, won’t be liable for NCCC nor HSC and instead, depending on their assets and income will be liable for MTCF (unless they opt-in to the new rules). Those who are liable for MTCF continue to be subject to the MTCF lifetime cap of $82,347 (indexed) with any income-tested fees and grandfathered participant contributions counted towards MTCF lifetime cap.

We know that the NCCC lifetime cap applies to paying $130,000 (indexed) of NCCCs or 4 years of NCCC liability, whichever is earlier. If a person is already in aged care, can they opt-in to the NCCC lifetime cap and when does the 4-year period start?

An individual can opt-in to the NCCC and HSC payment rules from 1 November 2025. Such a decision to opt-in should be carefully considered as the new rules can generally be more expensive than the pre-1 November 2025 means testing arrangements.

The 4-year period starts from the day of opting in to the new arrangements rather than the initial entry date to residential aged care.

Can the HSC and NCCC be deducted from the RAD?

Similar to the current framework, the facility must agree to a direction by the resident to deduct DAP from the RAD. However, upon agreement, albeit not compulsory, the facility can also allow deductions of all other periodical fees such as basic daily care fee, HSC and NCCC.

1 On 4 June 2025, the Government announced deferral of the commencement of the changes to the Aged Care Act 2024 from 1 July 2025 to 1 November 2025.

2 At the point of writing, the income thresholds for partnered clients have not yet been released. While the thresholds will be different compared to single clients, the tapering rate remains at 50%.

3 $299,480 is the threshold provided by the Department of Health and Aged Care based on thresholds which applied on 20 September 2024. The maximum Hotelling Supplement provided was $12.55 per day but noting that if the MTA calculation is done on assessable assets of $299,480, it leads to a Hotelling Supplement of $13.17 per day. We have assumed that the maximum Hotelling Supplement is $12.55 per day in the above table.

4 $13.46 is the Hotelling Supplement as at 20 March 2025.

5 For South Australian investors, 1.5% stamp duty applies on the CarePlus Insurance premium.

6 Age Pension based on 20 March 2025 thresholds. Based on CarePlus investment for a 85-year female on 7 May 2025.

Related content

Stay informed

Sign up to our free monthly adviser newsletter, Tech news containing the latest technical articles, economic updates, retirement insights, product news and events.