How much can a client afford to spend in retirement?

.png?h=360&iar=0&w=640)

How much can a client afford to spend in retirement?

Download the full article below.

“How much can I afford to spend in retirement?” is a question many Australian pre-retirees and retirees find challenging to answer. While many retirees may well understand the value of their retirement savings available to fund their retirement, converting those lump sum savings into a sustainable level of drawdown in retirement, in combination with other retirement income including (where applicable) income from the Age Pension, can be difficult. The consequences of getting the answer to this question wrong can also be significant where clients either under or overspend and don’t fully enjoy their retirement. Not surprisingly, answering this question will be the prompt for many Australians to seek financial advice.

Calculating a “safe” level of retirement spending for a client requires understanding a whole lot of variables, making a whole lot of assumptions and answering a whole lot of other questions. How safe is “safe”? How long will a client live? How will a client’s spending change over time? Will a client be eligible for the Age Pension? How will investment returns change from year to year?

It is appropriate at this point to highlight that there isn’t a definitive answer to this question of ‘what is a safe level of retirement spending?’ It is likely only a question that can be answered with absolute certainty in hindsight, with perfect knowledge of exactly how long a client lives and exactly how investment markets have performed the entire period of a client’s retirement.

However, an estimate of a “safe” level of spending can still be an incredibly useful piece of additional data to assist clients in their retirement spending decisions and in the following discussion we provide an example of a framework for calculating “safe” retirement spending levels for clients.

Calculating a “safe” level of retirement spending

The following analysis has been undertaken using Challenger’s Retirement Illustrator as at 1 October 2025.

Clients are assumed to be retired, aged 67, homeowners and with all savings in superannuation. Confidence of spending may differ for retirees with different characteristics e.g. non-homeowners, risk profiles and asset allocations, different ages, or if they have savings held outside super.

All retirement savings are invested via a 50% growth risk profile within the account-based pension (ABP).

In this analysis a “safe” level of retirement spending is based on a 9 out of 10 chance that the spending amount (increasing annually with inflation) will be sustainable to the life expectancy of the client (or client couple). Different levels of spending confidence (what is “safe”) could be appropriate for different clients. For example, a client with an ongoing advice arrangement may be comfortable with a higher initial level of retirement income (a less “safe” level) knowing that their spending will be re-tested regularly through retirement.

The likelihood that spending will be sustainable is tested to life expectancy and 3 and 6 years past life expectancy in the analysis. Life expectancy is calculated based on the AGA 2020-22 life tables with 25 year mortality improvements.

Annual spending is assumed to increase annually with price inflation.

Each retirement strategy is analysed over 2,000 simulations of market returns and inflation from the Moody’s Analytics Scenario Generator. Age Pension is modelled based on October 2025 Age Pension rates and thresholds.

Income to meet annual spending requirements is sourced from the estimated Age Pension, income from the ABP, subject to the minimum pension requirements. If income exceeds the target spending amount the excess income is assumed to be

saved outside super in cash and is used to fund future spending once the ABP is exhausted. The modelling does not make any allowance for tax payable on income earned on non-superannuation cash balances. All other fees and assumptions are as per the default assumptions in the Retirement Illustrator. Detail on assumptions and methodology can be found in the Retirement Illustrator Assumptions guide dated July 2025. The use of Challenger’s Retirement Illustrator is further subject to all the terms of use and assumptions provided by Challenger to licensees and/or advisers and must be read and understood prior to the use of this tool.

Additional scenarios, specific to your client’s situation, could also be considered by utilising Challenger’s Retirement Illustrator.

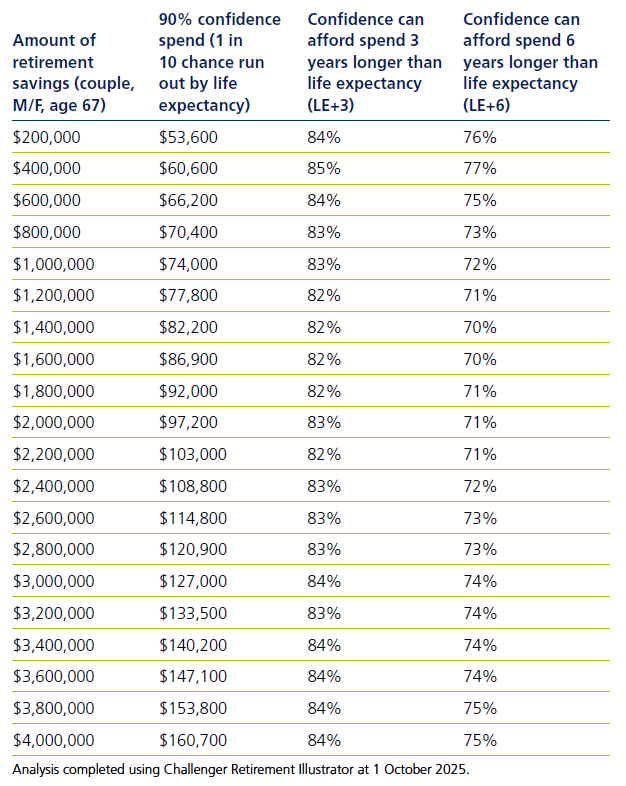

Couple, male and female, aged 67, homeowners

The below table shows the “safe spending” amount for a 67-year-old homeowner couple with retirement savings, all in ABPs, of between $200,000 and $4,000,000 (split evenly between the couple).

The analysis shows, for example, that a client couple with combined retirement savings of $1,000,000 could spend $74,000 p.a. indexed to inflation and have approximately 90% confidence that their funds would last to life expectancy. A client couple with combined retirement savings of $2,000,000 could spend $97,200 p.a. indexed to inflation and have approximately 90% confidence that their funds would last to life expectancy.

It is no surprise that when we look at time periods beyond life expectancy that confidence drops significantly. In the case of a client couple with combined retirement savings of $1,000,000 spending $74,000 p.a. indexed to inflation, looking 6 years beyond life expectancy, the confidence of still being able to afford the $74,000 lifestyle reduces to 72% meaning that about 3 in 10 households would fail.

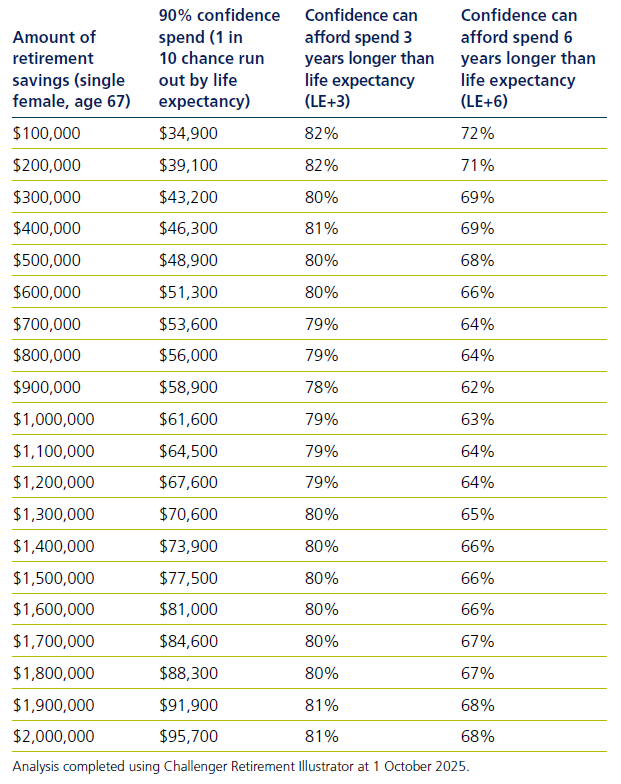

Single, female, aged 67, homeowner

The below table shows the “safe spending” amount for a 67-year-old homeowner single female with retirement savings of between $100,000 and $2,000,000.

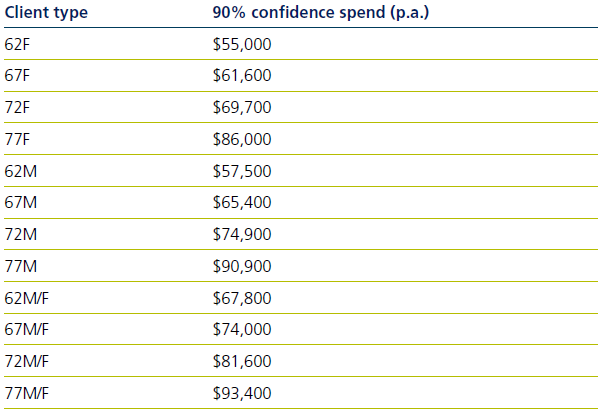

But not all clients are aged 67

As described above, levels of “safe” spending may differ for clients with different characteristics. The below table shows different “safe” spending levels for different clients with the same $1,000,000 of retirement savings, but different ages, sex and relationship status. This is not intended to be an exhaustive but, instead, illustrative of the variability of outcomes based on different client criteria.

“Safe” spending in practice

Serena, single, female, aged 67, homeowner

Serena is a 67-year-old, single female homeowner. She has $700,000 in super, $50,000 cash/term deposits and $30,000 of non-financial assets. She requires retirement income equal to the ASFA Modest Retirement Standard of $35,199 p.a. (September 2025) and wants to spend quite a bit more each year, but “safely”.

Serena’s adviser, Sarah, has used the Challenger Retirement Illustrator to prepare the following analysis to determine the chance of different levels of spending being sustained to life expectancy.

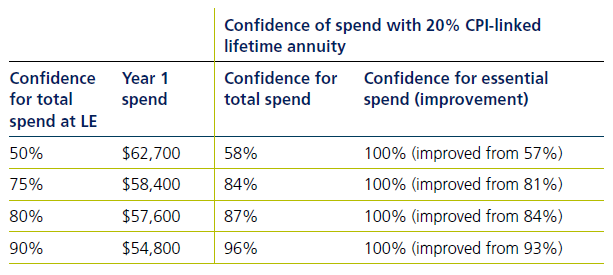

If Serena were comfortable with a 50% chance of meeting her retirement income goal to life expectancy she could spend $62,700 p.a. (adjusted for inflation each year). If she preferred a higher chance of meeting her retirement income goal to life expectancy she could afford to spend less each year.

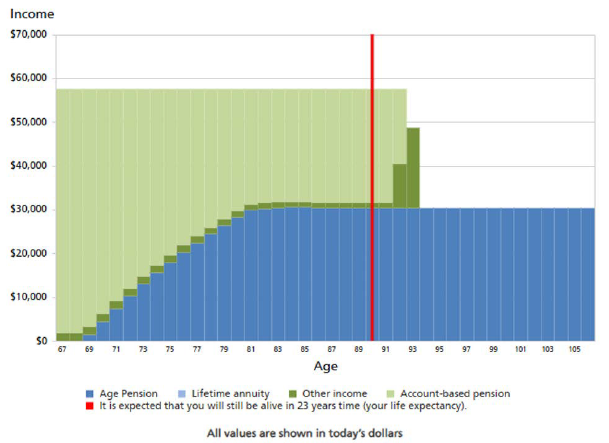

After a conversation with Serena discussing retirement spending Sarah models out a retirement projection where Serena draws $57,600 p.a. (adjusted for inflation each year) with an 80% chance of meeting her retirement income goal to life expectancy. This projection is shown in the graph below.

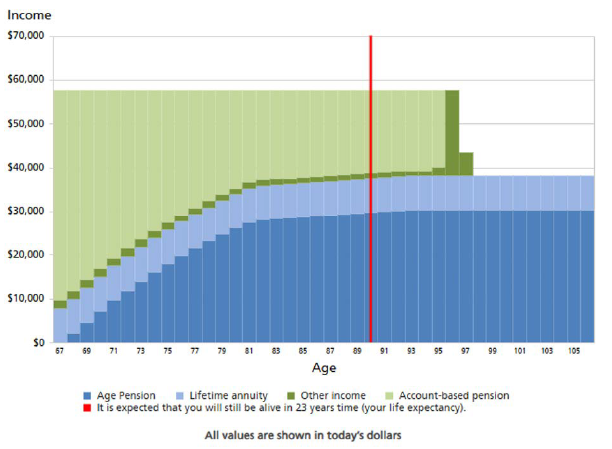

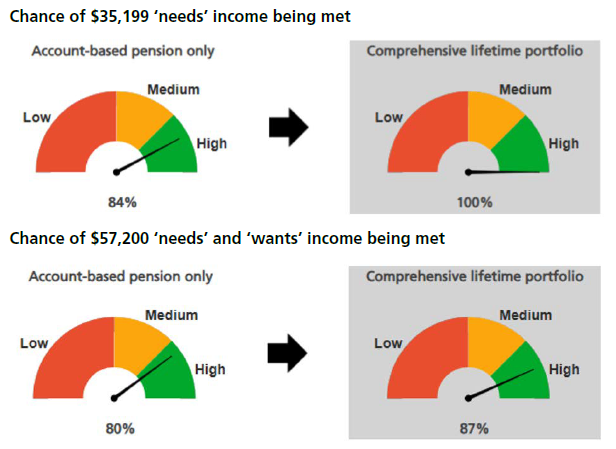

Sarah also models for Serena the impact of allocating 20% of her retirement savings to a CPI-linked lifetime annuity with the same total retirement income drawdown of $57,600 p.a. (adjusted for inflation each year). This modelling is shown in the images below and changes to “safe” spending as a result shown in the chart above.

Portfolio and estate outcomes:

In this modelling, the 20% allocation to a CPI-linked lifetime annuity provides:

- Lifetime income for as long as Serena lives, in addition to any Age Pension she may receive. The lifetime income amount in the first year is $7,796.

- A 100% chance of meeting the $35,199 p.a. income ‘needs’ objective (an increase of 16% over the non-lifetime portfolio).

- An 87% chance of meeting desired ‘needs and wants’ (an increase of 7% over the non-lifetime portfolio) with Serena’s income goal of $57,600 p.a. projected to be met for an additional 2 years.

- A portfolio or estate value at Serena’s life expectancy (23 years) increased by $34,353 (in today’s dollars).

Source: Challenger Retirement Illustrator, 1 October 2025, RIC251204000872.

Related content

Stay informed

Sign up to our free monthly adviser newsletter, Tech news containing the latest technical articles, economic updates, retirement insights, product news and events.