How the US Government shutdown impacts the economy and markets

Subscribe to Macro Musing

To stay up to date on the latest economic insights, subscribe to Macro Musing on LinkedIn.

Some things never change. The US Government is currently shutdown after Congress failed to pass a bill to fund the Government before the end of the fiscal year on 30 September. The House of Representatives passed a continuing resolution to provide funding through to 21 November, but 60 votes are required in the Senate for a temporary funding bill and the Republicans only have 53 Senators. So continuing a tradition dating back decades, the US Government is shut.

During a shutdown many of the three million federal employees are directed not to work. Several hundred thousand ‘essential’ workers in defence, air traffic control and law enforcement are requested to work, but are not paid. Social Security, Medicare and other benefits continue to be paid, as they do not require annual approval.

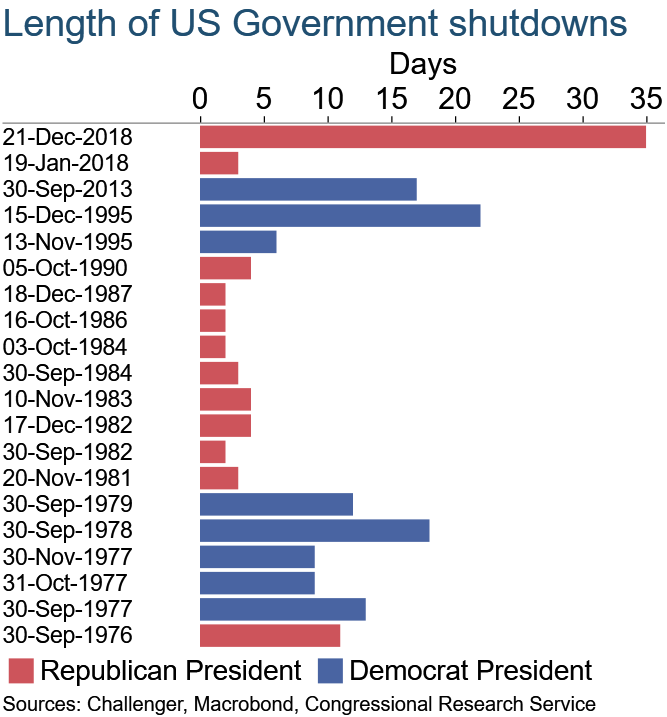

Shutdowns tend to cost, rather than save, the Government money because of lost revenue and preparation costs. Many services are disrupted and the reduction in Government spending, including paying wages, tends to reduce economic growth. Some estimates suggest each week of shutdown reduces annualised GDP growth by 0.1%. There is substantial uncertainty about how long this shutdown will last. Many shutdowns have only been a couple of days, but the 2018 shutdown lasted over a month.

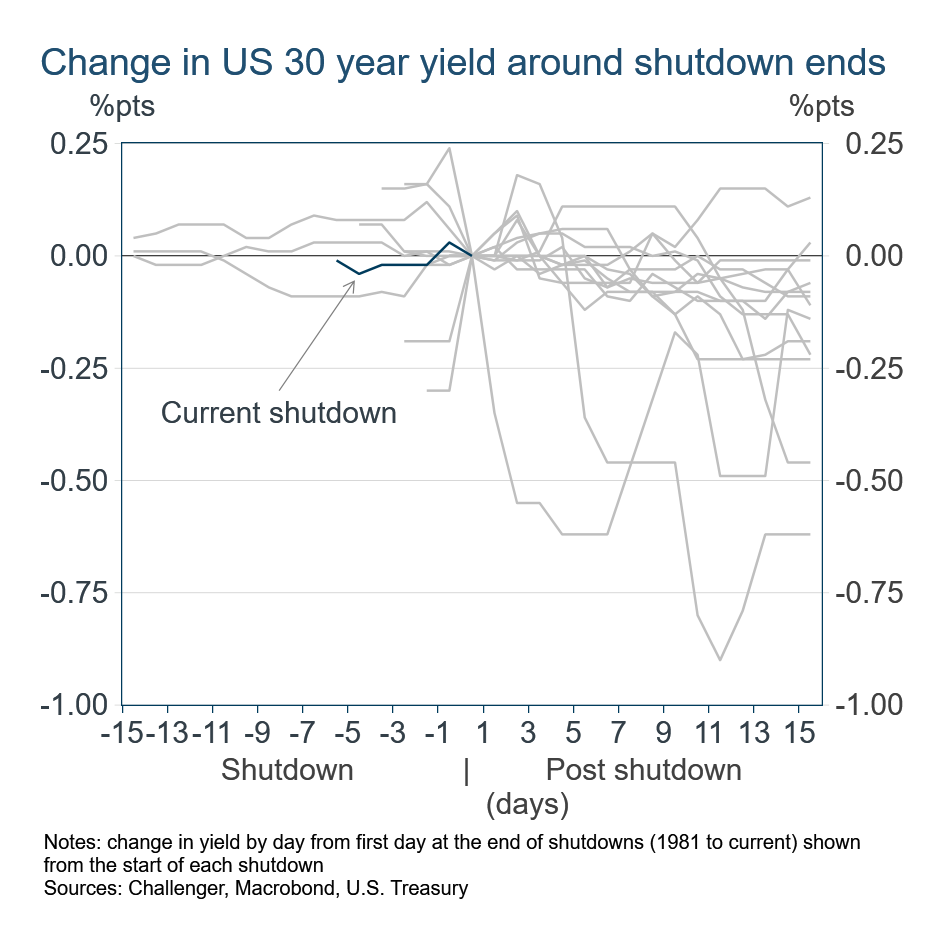

The end of a shutdown following the passing of a funding bill resolves uncertainty, removing a downside risk to the economy and Government financing. Historically, this has led to a fall in US Government long-term bond yields. Since 1980, in the two weeks after the resolution of a shutdown in all but two occasions 30-year yields have declined.

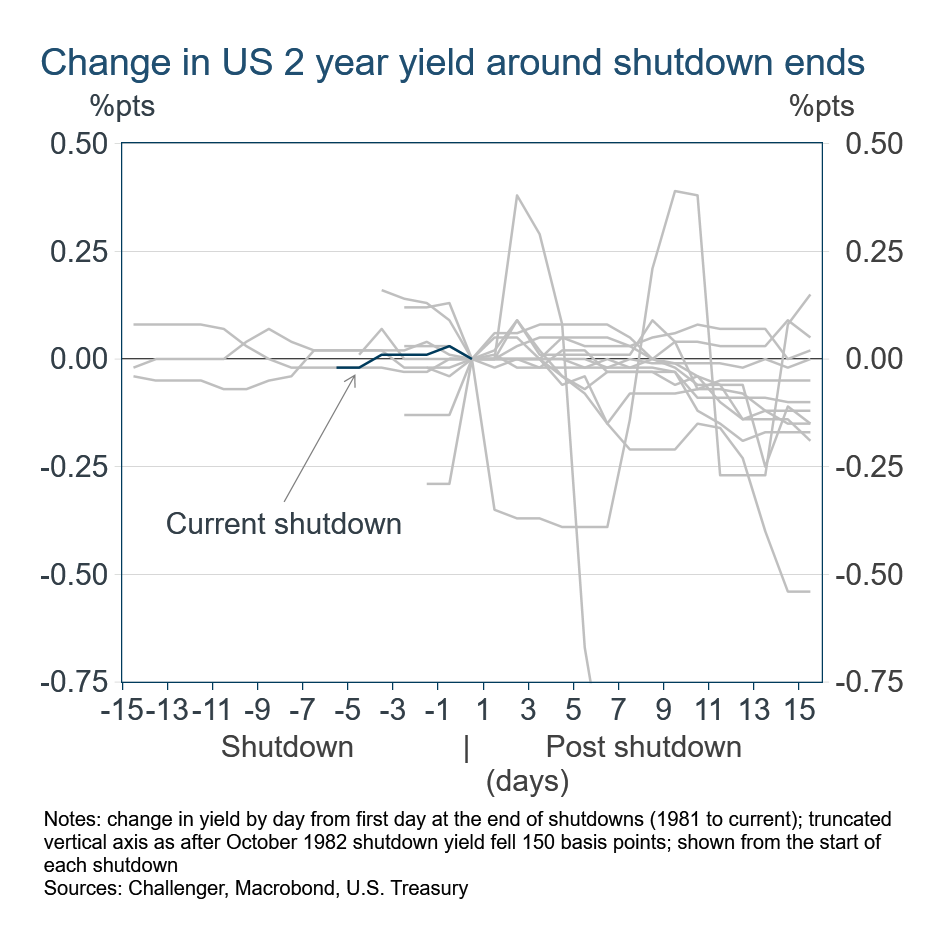

Similarly, two year yields, which also reflect Government risk but, to a larger extent, the expected path of interest rates, have tended to decline after the end of a shutdown.

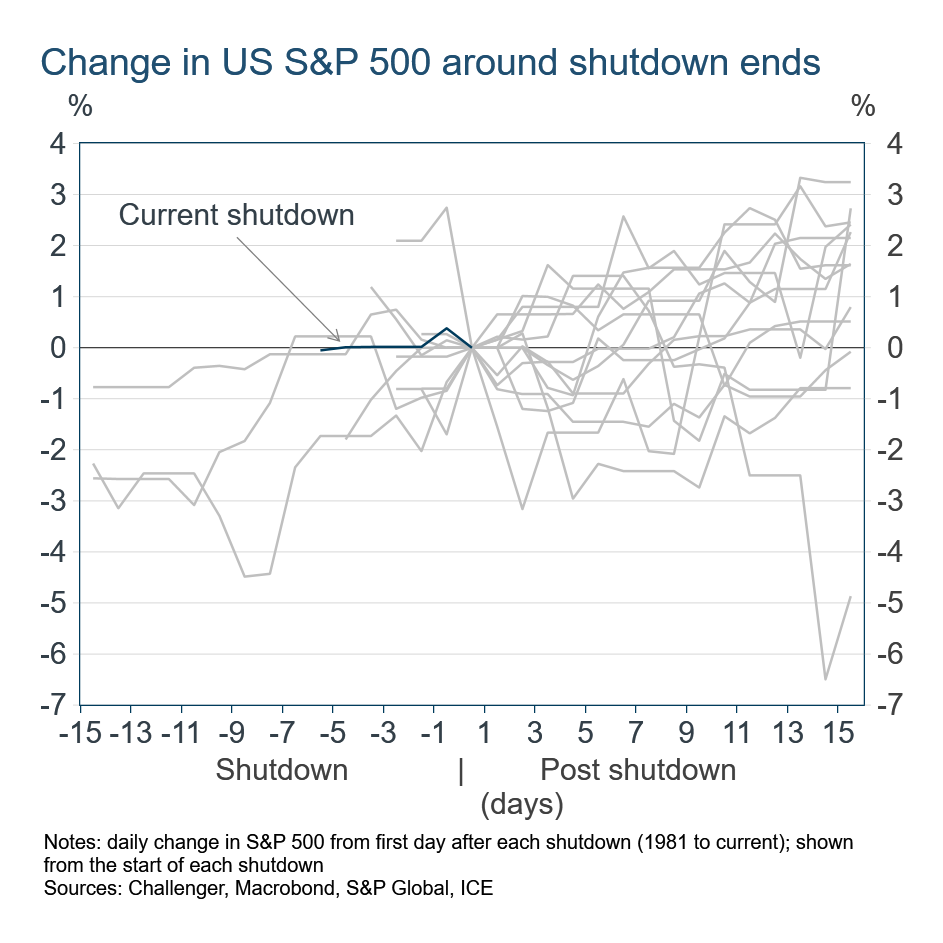

The end of uncertainty, and restraining impact on growth, from a new funding bill have seen the share market typically increase in the subsequent two weeks. The median increase in the share market in the two weeks after a shutdown is 1.6%.

In contrast, there is no consistent movement in the US dollar in the two weeks after a shutdown. As is typically the case for exchange rates, movements appear random. The US dollars depreciates as often as it appreciates.

Given the highly polarised state of US politics, the current US Government shutdown could last for several weeks beyond the one week to date. The resolution of uncertainty is likely to be good for financial markets if past experience is a guide, with the share market climbing higher and bonds rallying. Of course, in US politics today the end of the shutdown may not be enough to resolve uncertainty.

.png?h=943&iar=0&w=943)