IMF 2025 growth forecasts show resilience amid tariff impacts

Subscribe to Macro Musing

To stay up to date on the latest economic insights, subscribe to Macro Musing on LinkedIn.

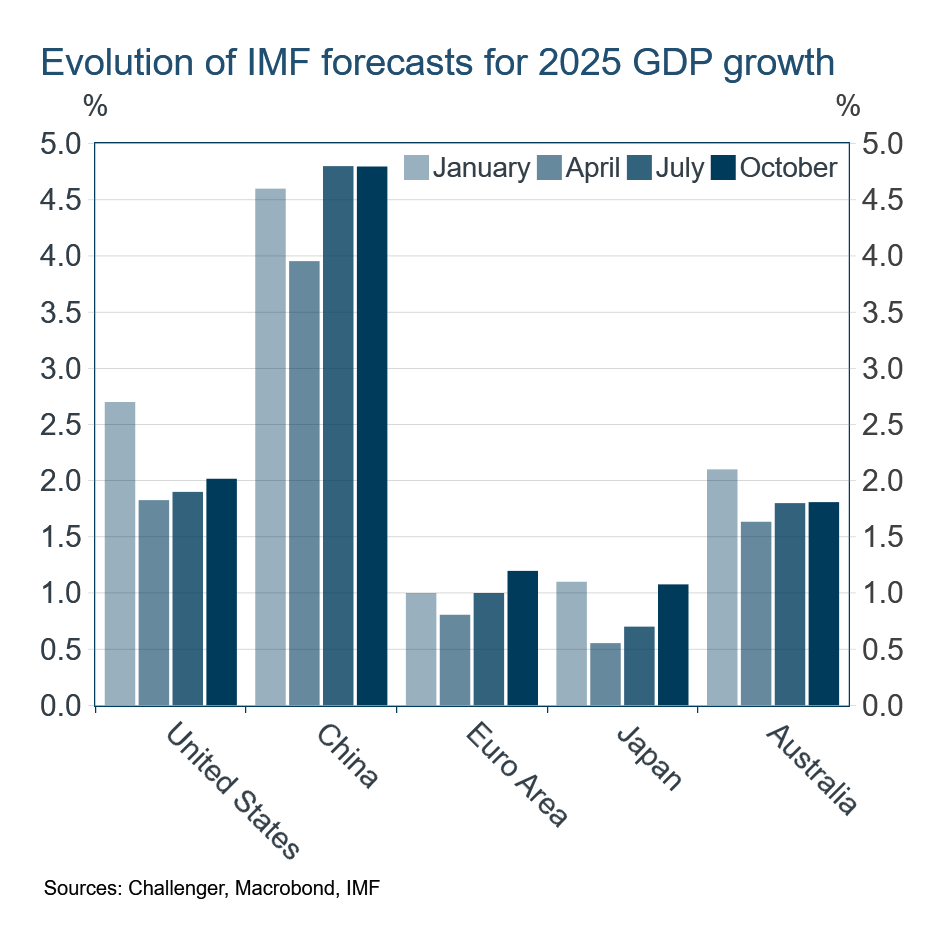

The evolution of the International Monetary Fund’s (IMF) forecasts for global growth over the course of 2025 neatly summarises the narrative of surprisingly resilient economic growth. The announcement of large and broad tariffs by President Trump in early April, with a particular focus on China, resulted in a significant reduction in expected growth of the US and Chinese economies as seen comparing the IMF’s April forecasts to their January forecasts. Expected growth in the Euro area, Japan and Australia were also revised lower.

However, negotiated deals reduced tariff rates on some economies and economic growth has been more resilient than expected in most economies. By July, the IMF significantly increased its forecast growth for China given their fiscal stimulus and success in growing exports to non-US markets.

In the October forecasts released this morning, the IMF have again increased their projections for 2025 GDP growth in China, Japan and Europe. The United States is the only major economy with significantly lower growth projected for 2025 now than was the case at the start of the year highlighting the negative impact on US growth of the imposition of tariffs.

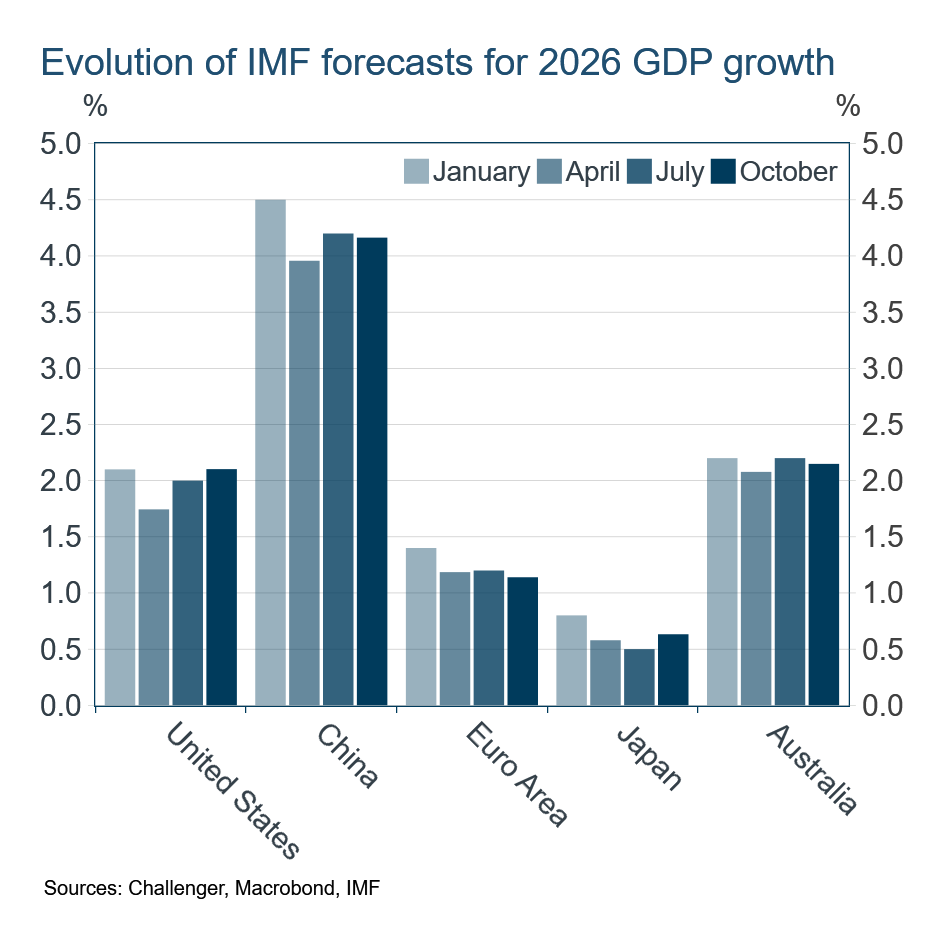

However, the revision to forecasts for 2026 highlights that the disruption to the US economy from tariffs is expected to be short-lived. The October forecast for the US’ 2026 GDP growth is identical to the January forecast made before the announcement of tariffs. For other economies the changes to forecasts for 2026 growth have also been small. The disruption to economic growth from tariffs is expected to be short-lived and not large.

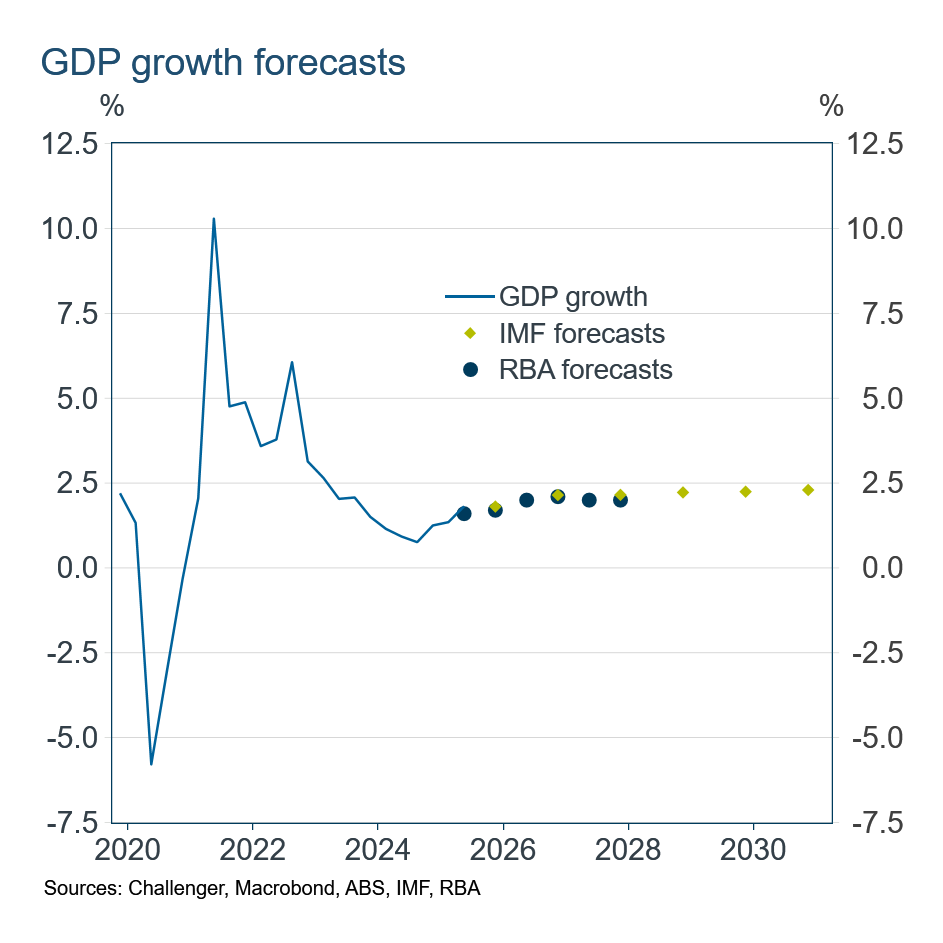

For Australia, the IMF is in broad agreement with the RBA about the outlook for the Australian economy with GDP forecasts indistinguishable from the RBA’s forecasts made in August. The IMF has fewer staff devoted to forecasting the Australian economy, but it can draw on a large pool of experienced PhD trained economists with expertise across different parts of economies. The confirmation of the RBA’s forecasts is reassuring, if not surprising.

The IMF optimistically expects GDP growth to eventually pick up a touch to 2.3%, slightly stronger than the average growth of the Australian economy over the past decade. With productivity growth and the contribution from increased labour force participation having slowed, average real GDP growth going forward is more likely to be closer to 2%, as the RBA noted this week.

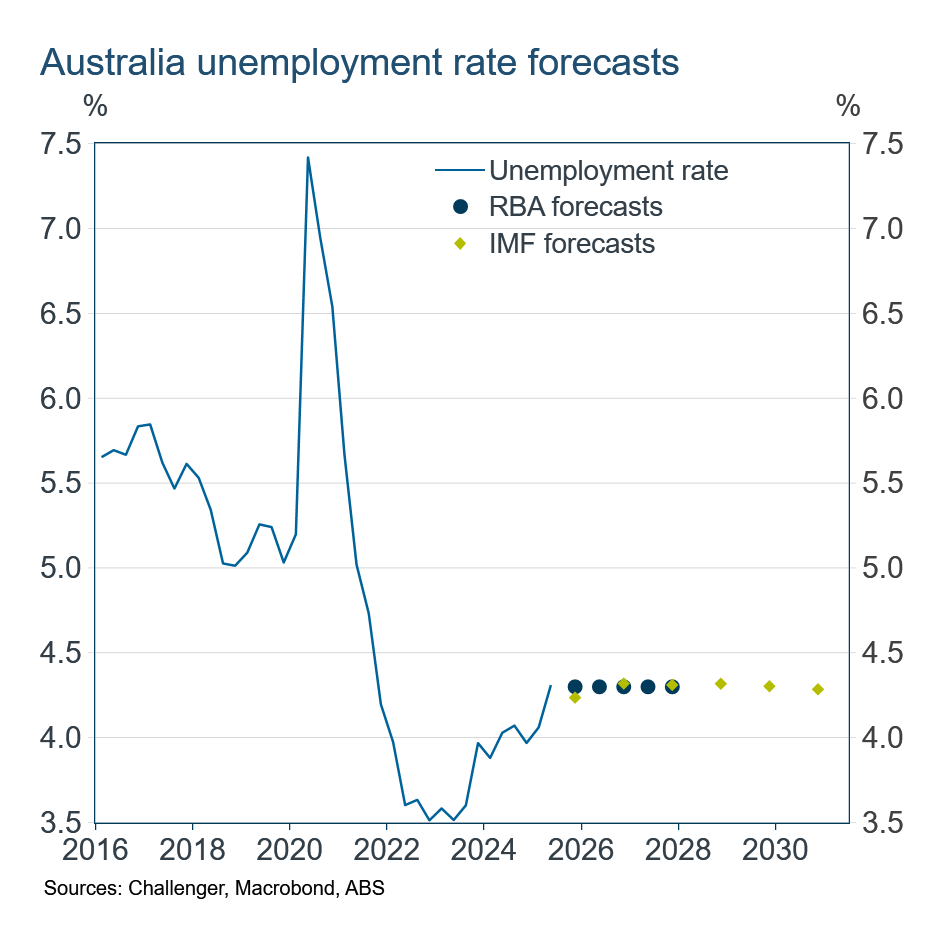

The IMF expects Australia’s unemployment rate to peak at 4.3%, essentially the current unemployment rate, meaning the labour market is not expected to deteriorate any further. That’s good news for workers, businesses depending on household spending and banks that depend on households repaying their loans.

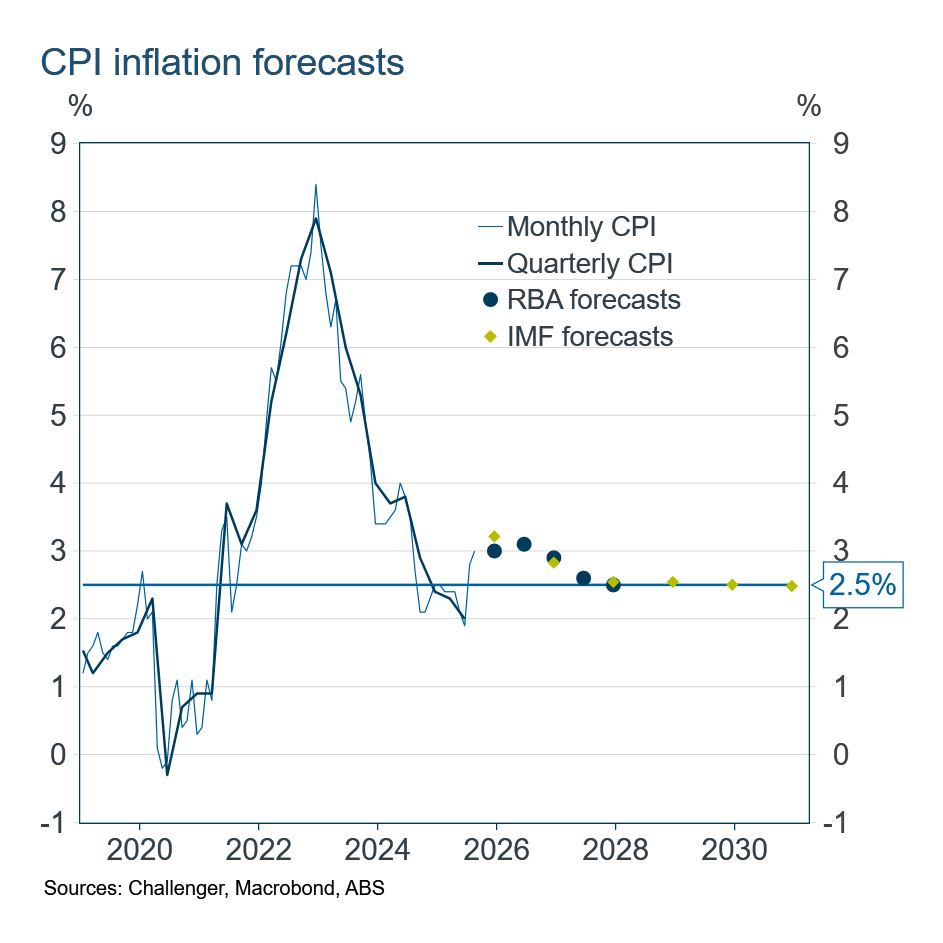

The IMF forecasts CPI inflation to end the year above 3% as the energy rebates come to an end and electricity prices jump back up to their unsubsidised levels. They then expect inflation to gradually ease with the RBA achieving its 2.5% target in 2027.

The IMF only forecasts inflation for each year, and so it hides the strength in monthly CPI in July and August. Inflation for Q3 currently looks like it will be higher than the RBA’s most recent forecast, and so surprisingly soft September inflation data will be needed to see the RBA cut rates in November. Most likely rates are on hold until further evidence of slowing inflation in 2026.