Is your retiree client eligible for a Centrelink concession card?

Retirees have access to a range of concession cards, and some are able to access more than one card at a same time. These cards offer a variety of concessions to the card holder. Benefits can include medicines being available at a lower cost under the Pharmaceutical Benefits Scheme or access to subsidised hearing devices.

This article:

- Outlines the eligibility and portability rules for the Pensioner Concession Card (PCC), Low Income Health Care Card (LIHCC) and the Commonwealth Seniors Health Card (CSHC); and

- Compares the benefits available with each of them.

Eligibility

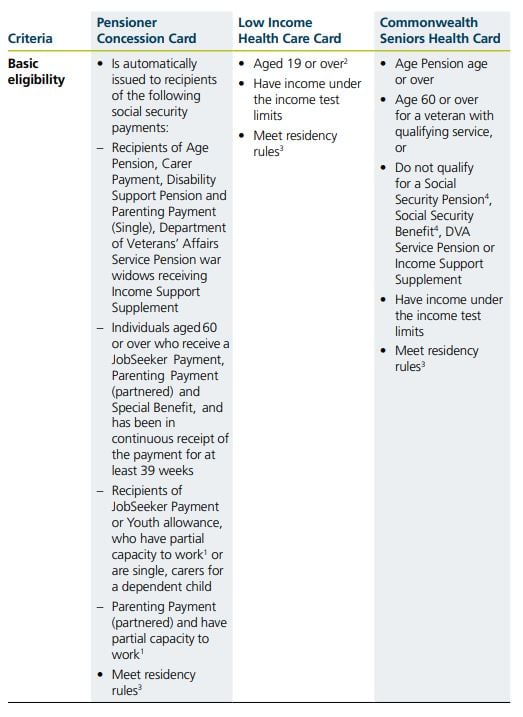

The type of concession card your client will be eligible for will be based on their age and specific circumstances. Broadly, a PCC is issued to pensioners, a LIHCC to those on lower income regardless of their age and a CSHC to those above Age Pension age and who do not qualify for any social security payment. These cards are issued by Centrelink/Department of Veterans' Affairs (DVA) based on the eligibility criteria as explained in Table 1 below.

Table 1: Eligibility criteria issued by Centrelink/Department of Veterans' Affairs

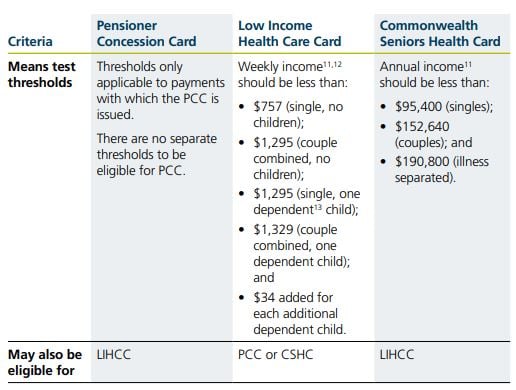

Means test cut-off limits for the concession cards

The following tables outline the various income and asset cut-off thresholds for the concession cards. Note, that means tests differ across all the three concession cards.

Pensioner Concession card

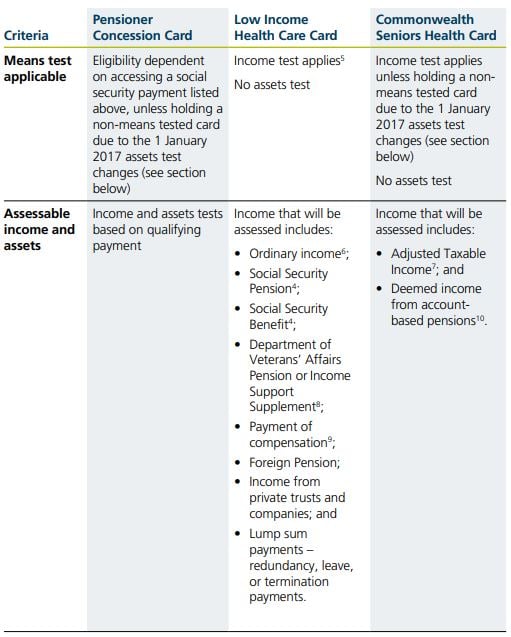

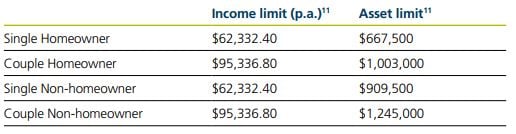

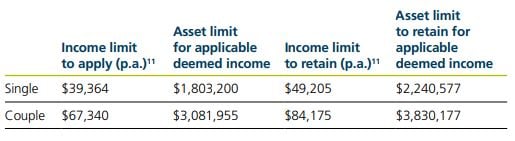

Table 2 below lists the upper income and assets test thresholds beyond which an individual loses their pension and as a result their PCC. Different cut-off thresholds apply to PCC recipients receiving an allowance.

Table 2: Upper income and assets test thresholds

Where an individual loses their pension due to an increase in their or their partner’s employment income, they can generally retain the PCC for two years after the end of the installment period in which the pension ceases.

Low Income Health Care Card

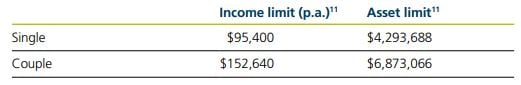

Unlike PCC, the assessment for the LIHCC is only based on an income test. Table 3 below includes the income limit and the level of financial assets (subject to deeming) beyond which an individual:

- does not initially qualify for the LIHCC; and

- cannot retain the LIHCC

Table 3: The income limit and the level of financial assets for the LIHC

Commonwealth Seniors Health card

Although the CSHC is based solely on the income test like LIHCC, the definition of income differs significantly. The income assessed for CSHC is based on Adjusted Taxable Income and deemed income from account-based pensions.

Table 4 below shows the income limit beyond which an individual is not eligible to receive or lose their CSHC. The right most column also shows the level of assets on which the calculated deemed income equates to the income limit depicted on the left below.

Table 4: Income limit beyond which an individual is not eligible to receive or loses their CSHC

Assumptions: All assets are subject to deeming and includes account-based pension of $400,000 for singles and $800,000 for couples. The remaining assets earn taxable income of 2.25%.

Benefits

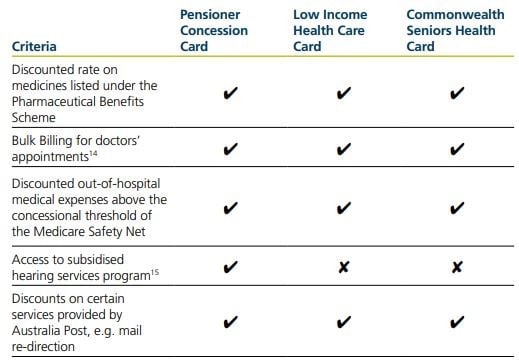

Table 5 below explains the common concessions available in all states. Generally, the PCC offers the most benefits.

State, territory and local governments may provide additional concessions to card holders like concessional fares on public transport, discounted property and utility rates or discount on motor vehicle registration charges. These differ from state to state. For more detailed information on the benefits, please refer to the article ‘How much is a pensioner concession card worth’.

Table 5: Common concessions available in all states

Note: Individuals can get a digital copy of their health or concession card on their smart device by downloading the Express Plus Centrelink mobile app.

Renewal

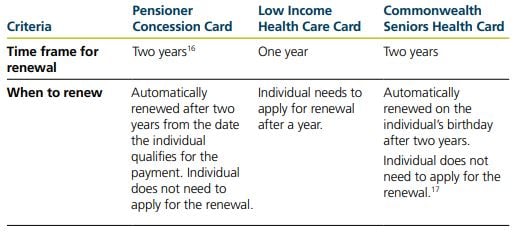

The rules differ based on time frame and process when it comes to renewal of these cards. These are outlined in Table 6 below.

Table 6: Renewal of cards

Portability

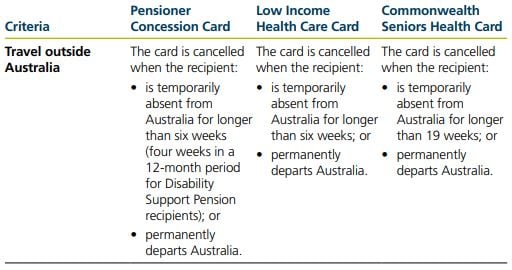

A person leaving Australia permanently should have their concession card cancelled immediately upon departure. If the recipients depart Australia temporarily, their cards are generally cancelled after the non-cancellation period.

Recipients must notify Centrelink about their departure and if known, their expected return date before leaving Australia. After returning, recipients must notify Centrelink of their date of arrival to ensure their concession entitlement continues. Table 7 outlines when cards are cancelled when travelling outside Australia.

Table 7: Cancellation of cards when travelling outside Australia

Non-means tested cards

On 1 January 2017 when changes were made to the pension assets test, some individuals lost their pension and their PCC. As a result, Centrelink issued a non-income tested LIHCC to those who were under pension age or CSHC to those who were pension age and over. However, on 9 October 2017, they reinstated the PCC those who were impacted.

When the non-income tested PCC was reinstated, the non-income tested LIHC was cancelled. However, those that were issued the non-income tested CSHC were allowed to retain the card in order to continue receiving the energy supplement.

Recipients who hold the non-income tested CSHC and the PCC do not need to meet any income test rules. They will receive these cards indefinitely irrespective of the change in their income. However, these recipients may lose the card temporarily if they depart Australia for a time frame that exceeds the non-cancellation period. On return to Australia, their cards will be reinstated.

Notification for change of circumstances

The cardholders have a responsibility to inform Centrelink if there is any change in their personal, business or financial circumstances. If there is a change, they have an obligation to notify Centrelink within 14 days of the change.

Related content

1 Having a physical, intellectual or psychiatric impairment that prevents them from working for at least 30 hours a week at the minimum wage or above within the next two years.

2 Those under age 19 are eligible if they are independent or eligible for Family Tax Benefit.

3 Broadly, needs to reside in Australia and either be an Australian citizen or is a permanent visa holder or Special Category visa (SCV) holder who is a protected SCV holder. For more information refer to the residency rules explained in the guide to social security law.

4 Social security pension includes Age Pension, Disability Support Pension, Carer Payment; Parenting Payment (single). Sole Parent Pension; and Special Needs Pension. Social Security Benefit includes JobSeeker Payment, Youth Allowance, Austudy Payment, Benefit PP (partnered), Special Benefit and Parenting Allowance (other than non-benefit allowance).

5 Gross income is assessed using the average assessable weekly income for eight weeks before the date on which the claim is submitted.

6 For social security purposes.

7 Adjusted Taxable Income includes taxable income, (disregarding any First Home Super Savers Scheme released amounts), total net investment losses, target foreign income, employer provided fringe benefits and reportable superannuation contributions.

8 Under Veterans' Entitlement Act 1986.

9 As defined in section 17 of the Social Security Act 1991.

10 Excludes pensions commenced before 1 January 2015 that meets the eligibility for grandfathering rules

11 Current threshold as at 20 September 2023.

12 To retain the card, the weekly income should be less than 125% of the above thresholds.

13 Generally, under age 16, however the definition can vary based on circumstances. See 1.1.D.70 in the Guide to Social Security Law

14 The Government provides financial incentives for GPs to bulk-bill concession cardholders however this is at the discretion of the doctor.

15 Includes free hearing test, subsidised hearing aids, maintenance of hearing aids and ongoing support from qualified professionals.

16 Generally, if the qualifying payment is stopped, the card will be cancelled.

17 Continuing eligibility is checked when Centrelink and the Australian Taxation Office (ATO) match records twice a year.

The information in this article is current as at 1 September 2023 unless otherwise specified and is provided by Challenger Life Company Limited ABN 44 072 486 938, AFSL 234670 (Challenger, our, we), the issuer of the Challenger annuities (Annuity(ies)) and Challenger Retirement and Investment Services Limited ABN 80 115 534 453, AFSL 295642 (CRISL). The information in this article is general information only about our financial products and is intended solely for licensed financial advisers or authorised representatives of licensed financial advisers, and is provided to them on a confidential basis. It is not intended to constitute financial product advice. This information must not be distributed, delivered, disclosed or otherwise disseminated to any investor, without our express prior approval. Investors should consider the applicable Annuity Target Market Determination (TMD) and Product Disclosure Statement (PDS) available at challenger.com.au and the appropriateness of the applicable product to their circumstances before making an investment decision. This information has been prepared without taking into account any person’s objectives, financial situation or needs. Neither Challenger and/or CRISL, nor any of its officers or employees, are a registered tax agent or a registered tax (financial) adviser under the Tax Agent Services Act 2009 (Cth) and none of them is licensed or authorised to provide tax or social security advice. Before acting, we strongly recommend that prospective investors obtain financial product advice, as well as taxation and applicable social security advice, from qualified professional advisers who are able to take into account the investor’s individual circumstances. Each person should, therefore, consider its appropriateness having regard to these matters and the information in the Target Market Determination (TMD) and Product Disclosure Statement (PDS) for the applicable Annuity before deciding whether to acquire or continue to hold the product. A copy of the TMD and PDS is available at challenger. com.au or by contacting our Adviser Services Team on 13 35 66. Any examples shown in this article are for illustrative purposes only and are not a prediction or guarantee of any particular outcome. Age Pension benefits described in this article will not apply to all individuals. Age Pension outcomes depend on an individual (or couple’s) personal circumstances and may change over time. This article may include statements of opinion, forward looking statements, forecasts or predictions based on current expectations about future events and results. Actual results may be materially different from those shown. This is because outcomes reflect the assumptions made and may be affected by known or unknown risks and uncertainties that are not able to be presently identified. Where information about our products is past performance information, past performance is not a reliable indicator of future performance. Challenger and CRISL relied on publicly available information and sources believed to be reliable, however, the information has not been independently verified by Challenger and CRISL. While due care and attention has been exercised in the preparation of this information, Challenger and CRISL gives no representation or warranty (express or implied) as to its accuracy, completeness or reliability. The information presented in this article is not intended to be a complete statement or summary of the matters to which reference is made in this article. To the maximum extent permissible under law, neither Challenger, CRISL, nor its related entities, nor any of their directors, employees or agents, accept any liability for any loss or damage in connection with the use of or reliance on all or part of, or any omission inadequacy or inaccuracy in, the information in this article. Challenger Life and CRISL are not an authorised deposit-taking institution for the purpose of the Banking Act 1959 (Cth), and its obligations do not represent deposits or liabilities of an authorised deposit-taking institution in the Challenger Group (Challenger ADI) and no Challenger ADI provides a guarantee or otherwise provides assurance in respect of the obligations of Challenger Life

Stay informed

Sign up to our free monthly adviser newsletter, Tech news containing the latest technical articles, economic updates, retirement insights, product news and events.