'Low means' resident technicalities and the changes from 1 July 2025

Low means resident technicalities and the changes from 1 July 2025

Download the article.

Aged care residents assessed as ‘low means’ are eligible to receive Government support for their accommodation costs in addition to their ongoing care costs. Low means resident situations can be common in couple scenarios particularly where one member of the couple enters residential aged care before the other and if combined assessable assets are less than $413,326.

There are additional rules for these residents which can be complex, leading to the Challenger Tech team receiving many queries around the technicalities of low means residents.

In this month’s article, we address these technicalities as well as discuss how the new aged care rules that are taking effect from 1 July 2025 applies to these residents.

Any rates and thresholds used are as at 20 March 2025 unless otherwise stated.

Who can qualify as a low means resident?

A resident will be classified as ‘low means’ if their means tested amount (MTA) is less than the maximum accommodation supplement (MAS) at the time of entry.

The resident’s MTA is based on their assessable assets and assessable income for aged care purposes. Assessable assets and income for aged care purposes is broadly the same as assessable assets and income for social security pension purposes but also includes:

- The value of any lump sum accommodation payments in assessable assets;

- The person’s social security payment in assessable income (such as their Age Pension or Service Pension) but excluding the Energy Supplement and minimum pension supplement;

- The value of their former home up to $206,663.20 (each for couples) in assessable assets if there is no protected person1 occupying the home. The entire value of the home will be excluded from aged care means testing if a protected person occupies the home.

For couples, each member’s assessable assets for aged care purposes is half of the couple’s total assessable assets for aged care. Each member’s assessable income is half of the couple’s total combined assessable income plus their own assessable social security payment.

Advisers are able to use Challenger’s Aged Care Calculator to work out a resident’s MTA (under current rules as well as from 1 July 2025) and determine whether they are low means. The Aged Care Calculator is available to all advisers through Challenger’s Adviser Online portal.

Where a resident’s MTA is equal to or greater than the MAS, they will not be assessed as a low means resident.

This would occur if:

- Their assessable assets for aged care are equal to or greater than $206,663.20 (each for members of a couple);

- Their assessable income for aged care is equal to or greater than $84,656.52 per annum for singles or $83,980.52 per annum for each member of a couple; or

- A combination of both assessable income and assets that produces an MTA equal to or greater than the MAS.

Example – Beryl and Barry

Beryl and Barry, both age 85, own their home (worth $1.5 million) and have been providing each other with support for several years. However, Barry’s health has deteriorated recently and Beryl is not able to provide him with the care that he needs. They chose an aged care facility nearby and Barry has now moved in.

Apart from their family home, they have $260,000 in the bank and $10,000 in personal assts at the time Barry entered residential aged care. They are currently receiving the maximum rate of Age Pension ($1,149 per fortnight each, based on illness separated rates).

Barry’s assessable assets for aged care purposes = $135,000 (half of combined assets)

Barry’s assessable income for aged care purposes = $30,224 (half of the couple’s deemed income plus his Age Pension entitlement less the energy supplement of $14.10/fn and minimum pension supplement of $45/fn)

Based on Barry’s assessable income and assets for aged care purposes, Barry’s MTA is $35.33 per day using Challenger’s Aged Care Calculator.

As Barry’s MTA is below the MAS of $69.79 per day at the time of entry, he is assessed as a low means resident.

Can a low means resident’s status change after entry?

When a person enters residential aged care, their low means status is based on assessable income and assets at the time of entry. If assessed as a low means resident, they will remain a low means resident whilst they continue to receive services from the same aged care facility.

This is the case even if their assessable income and assets increase and their means tested amount (MTA) subsequently exceeds the maximum accommodation supplement (MAS).

What if they change facilities?

Residents who move to a new aged care facility will generally have their assets and income reassessed and a new MTA determined. Their new MTA will be based on assessable assets and income at the time of entry to the new facility and if this amount exceeds the MAS at that time, they will no longer be assessed as a low means resident.

Residents who leave an aged care facility for more than 28 days (for example to return to their former home) but then re-enter residential aged care will also need to have their means reassessed to determine whether they will be a low means resident.

This is the case even if they re-enter the same facility.

What fees can a low means resident be asked to pay?

Residential aged care costs are broadly broken up into accommodation and ongoing care costs.

Accommodation costs

Unlike other residents, a low means resident cannot be asked to pay the published price for a particular room. Instead, low means residents can be asked to contribute an amount towards their accommodation costs.

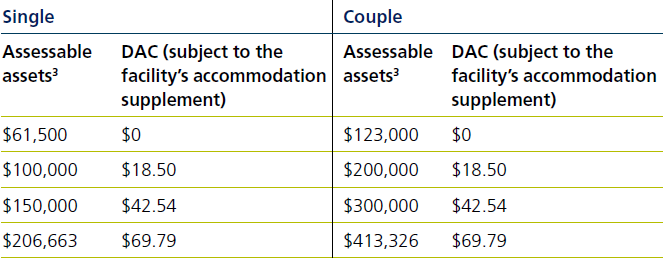

This amount, known as the daily accommodation contribution (DAC) is the lower of their means tested amount (MTA) or the accommodation supplement received by the aged care facility.

Prospective residents can check with aged care facilities as to which supplement applies to them.

Example: Beryl and Barry

In Beryl and Barry’s example, Barry’s MTA was calculated to be $35.33. His DAC will therefore be the lower of:

- $35.33 per day, or

- the aged care facility’s accommodation supplement.

What accommodation supplement can the aged care facility receive?

A low means resident’s DAC is capped at the accommodation supplement amount which the aged care facility receives from the Government.

Currently the highest accommodation supplement is $69.79 per day (MAS), however depending on whether the aged care facility meets certain building requirements or if the facility currently accommodates more than 40% of their residents as ‘low means’, the amount they receive can be lower.

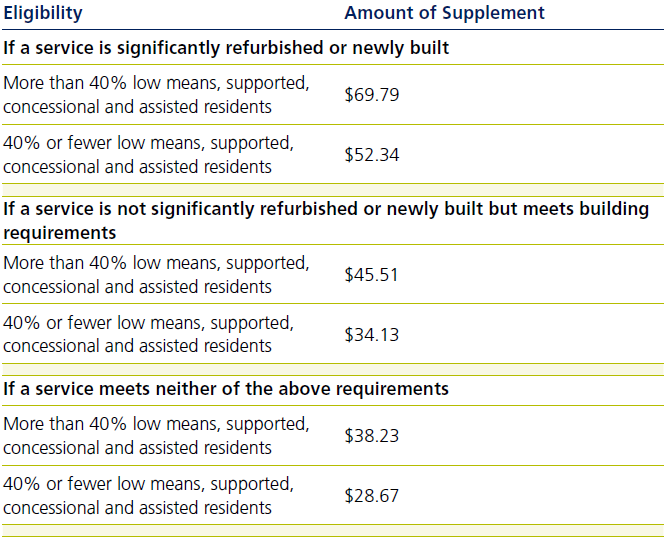

Different accommodation supplement amounts that an aged care facility can receive are summarised in the table below.

Source: Department of Health, aged care subsidies and supplements payment rates from 20 March 2025.

Can a low means resident’s DAC change?

A low means resident’s DAC is based on their assessable assets and income on a articular day and can change over time as their means change.

Residents are required to report changes to their circumstances to Centrelink / DVA within 14 days however their DACs generally change on a monthly basis in line with monthly reviews. If the resident’s DAC reduces through the month, a refund is due and generally applied in the next month.

A low means resident’s DAC can also change if the aged care facility’s applicable accommodation supplement changes (for example, they may have increased the percentage of low means residents to more than 40%) or when the Government indexes the accommodation supplement on 20 March and 20 September.

Ongoing care costs

Like other residents, low means residents will need to pay a basic daily care fee that covers the cost of daily living such as meals, laundry and power.

Can a low means resident be asked to pay a means tested care fee (MTCF)?

Low means residents can also be asked to pay a MTCF towards the cost of their ongoing care, subject to an annual and lifetime cap.

The MTCF is the lower of:

a resident’s MTA above the MAS (regardless of the accommodation supplement received by the aged care facility)

the sum of basic and primary supplements payable in respect of the individual (referred to as their cost of care).

Residents who are classified as ‘low means’ are not required to pay this fee as long as their calculated MTA remains below the MAS.

However, if their means increase after entry and their MTA increases above the MAS by $1 or more, they will be required to pay a MTCF.

This generally occurs when the second member of a couple enters residential aged care and the former home becomes assessable for aged care purposes.

For completeness, some facilities may provide extra services. Although not generally a consideration for a low means resident, when these are taken up ongoing extra services or additional fees are also payable.

Can a low means resident pay a lump sum for their accommodation instead of a daily amount?

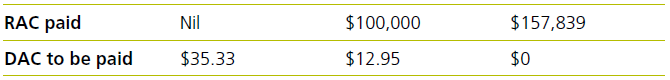

A low means resident can only pay an accommodation amount that is based on their means. When this is paid as a daily amount it is called a daily accommodation contribution (DAC). An alternative is to pay the aged care facility an equivalent lump sum amount known as a refundable accommodation contribution (RAC).

The RAC is worked out as follows:

Example: Beryl and Barry

In Beryl and Barry’s example, Barry’s DAC was calculated to be $35.33, the equivalent RAC would be calculated as:

RAC = ($35.33 x 365) / 8.17% = $157,839

Beryl and Barry could choose to use part of the funds in the bank to pay the RAC instead of a DAC. Amounts paid as a RAC will reduce the annualised DAC by 8.17% of the lump sum amount paid.

Can low means residents have their DACs paid from their RAC?

Where the resident has paid a RAC for their accommodation and there is also a DAC payable, the resident can request (in writing) that the aged care facility deduct the DAC from the RAC balance. In these cases the facility can increase the DAC to compensate for the reduction in the RAC balance.

What impact does the 1 July 2025 aged care reforms have on low means residents?

Low means residents who enter care before 1 July 2025 will be grandfathered under the current rules. This means everything discussed so far in this article will continue to apply to these residents from 1 July 2025. This also includes situations where a resident changes facilities from 1 July 2025 and remain low means.

What’s not changing?

Those that enter residential care from 1 July 2025 will have new rules apply to them. However, for low means residents, a lot of the new rules remain the same as current rules:

- Assessable income and assets for aged care purposes including the assessment of the former home remains unchanged from 1 July 2025.

- Despite changes to the MTA formula, the part of the formula applicable to low means remains unchanged. This means that (indexation of thresholds aside) if a resident is assessed as low means based on today’s rules, they will also be assessed as low means under the new rules.

- The calculation of a low means resident’s DAC (including being capped at the facility’s accommodation supplement) remains unchanged.

- The ability to pay a RAC and its calculation is also unchanged. Where a DAC remains after paying a RAC, the resident will continue to have the option to have the DAC deducted from the RAC

- Low means residents will continue to be liable for the basic daily care fee (indexed).

What will change?

The differences for low means residents entering from 1 July 2025 who are not grandfathered under current rules are:

Where a low means resident pays a lump sum RAC, a 2% retention amount will be deducted from the RAC balance. Retention amounts are only applicable for 5 years from the date they first paid a RAC.

If the low means resident’s MTA exceeds the MAS (due to an increase in assessable assets and/or income after entry), they can be asked to pay a Hotelling Supplement Contribution (HSC) and Non-Clinical Care Contribution (NCCC). Refer to our November 2024 article on Aged Care reforms FAQs for more information on the calculation of the HSC and the NCCC.

Also, from 1 July 2025, the DAC cannot be greater than the published DAP for the room. This was an anomaly when the MPIR was relatively low where low means resident’s DAC could be higher than the DAP dependent on the facility’s RAD.

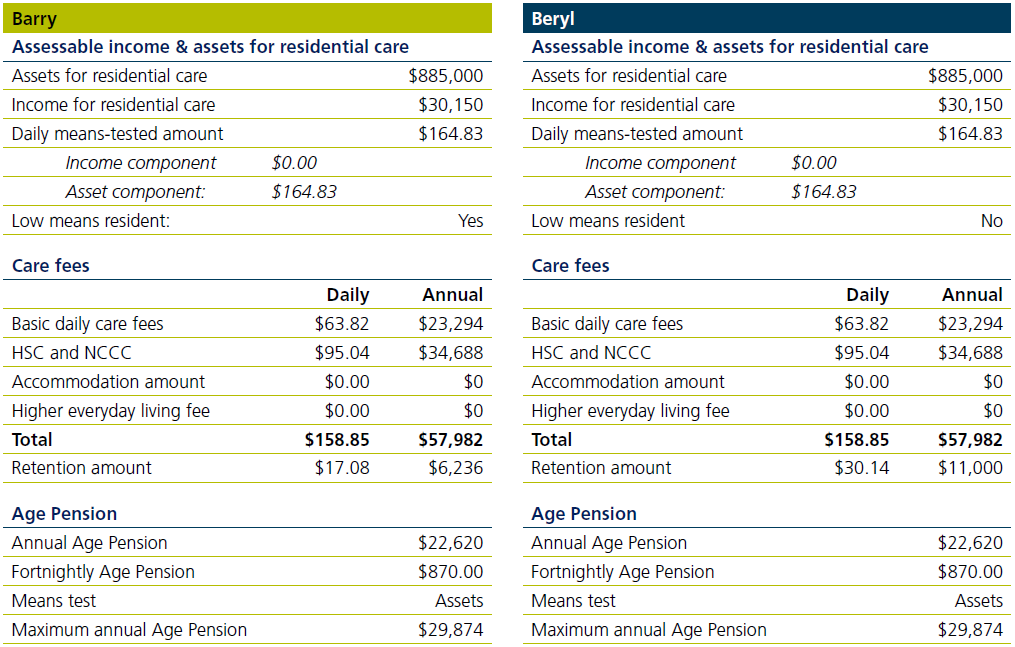

Example: Beryl and Barry

In Beryl and Barry’s example above, if Barry instead entered residential aged care on or after 1 July 2025, his MTA (based on the same level of assets and using today’s thresholds) will still be $35.33 per day. His DAC will also be $35.33 per day and his equivalent RAC would also still be $157,839.

However, if Beryl also requires residential aged care, Barry’s assessable assets would increase by an additional $206,633 (due to the home being assessable) and therefore his DAC would increase but capped at the facility’s accommodation supplement. If we assume the highest accommodation supplement applies, his DAC would increase to $69.79 per day. This means his equivalent RAC would also increase to $311,791.

If Beryl and Barry decide to sell their home to pay Beryl’s Refundable Accommodation Deposit (RAD) assumed to be $550,000 and\ Barry’s RAC of $311,791, they would have $898,209 left in savings and $10,000 in personal effects.

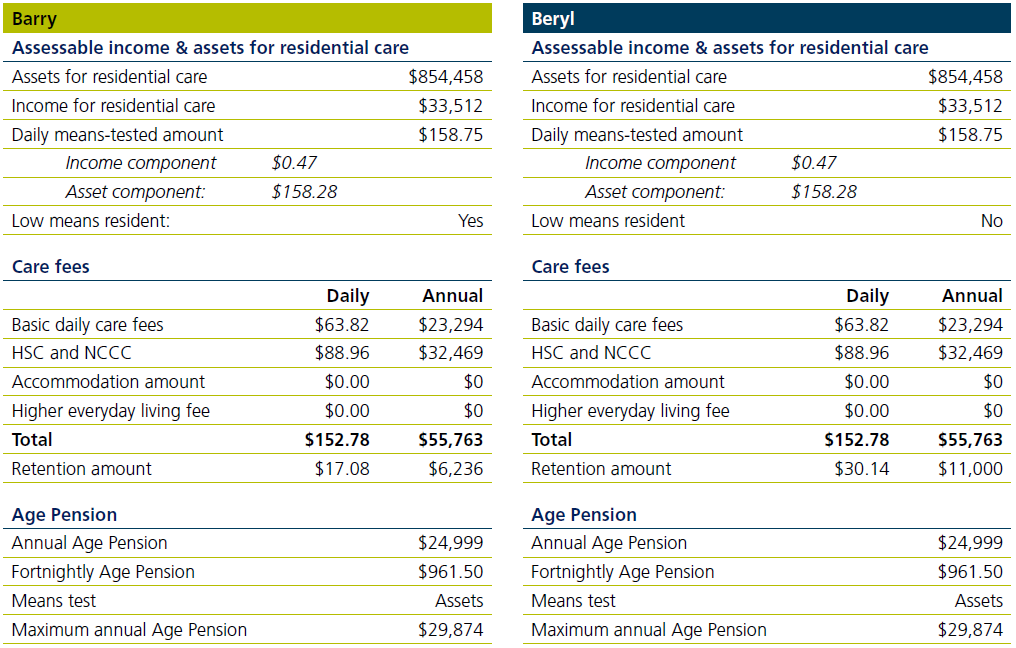

The couple’s aged care and Age Pension position would be as follows:

Source: Challenger aged care calculator as at 9 April 2025

Both Barry and Beryl would be eligible for an Age Pension of $22,620 p.a. each under the assets test as illness separated couples.

Despite Barry being low means, as his assessable assets for aged care purposes has increased and his MTA now exceeds the MAS, he would also be liable to pay a combined HSC and NCCC of $95.04 per day – the same as Beryl.

However, Barry’s 2% retention amount is based on his RAC of $311,791 or $6,236 in the first year. Whilst Beryl’s retention amount is based on her RAD of $550,000 or $11,000 in the first year.

Improving Beryl and Barry’s outcomes using Challenger CarePlus

Barry and Beryl can consider investing some of their remaining savings of $898,209 into Challenger CarePlus to improve their aged care and Age Pension outcomes. If they each invest $300,000 into CarePlus, and the leave the remaining $298,209 in the bank earning 4%, their aged care and Age Pension position would be as follows:

By investing $300,000 each into Challenger CarePlus5, they each reduced their combined HSC and NCCC from $95.04 per day to $88.96 per day. They also increased their Age Pension from $22,620 p.a. per person to $24,999 p.a. per person.

CarePlus is also a tax effective investment due to the availability of a deductible amount usually reducing most (if not all) of the amount of income that is subject to tax. In Barry and Beryl’s case, it has help reduced their tax by an estimated $3,524 combined in the first year.

1 A protected person includes: a spouse or dependent child; a carer eligible for an income support payment who has been living in the home for the past 2 years; or a close relative eligible for an income support payment who has been living in the home for the past 5 years.

2 As at 20 March 2025 this is $33,849.40 for singles and $33,173.40 for couples (each).

3 Assumed to be all financial assets.

4 Maximum permissible interest rate. For residents who entered care between 1 April 2025 and 30 June 2025 (inclusive), the MPIR is 8.17%

5 Provides fixed regular payments of $12,784 p.a. for Barry and $12,993 p.a. for Beryl based on Challenger’s Aged Care Calculator on 9 April 2025.

Challenger 30 January 2025

UPDATE: On 4 June 2025, the Australian Government announced its intention to defer the commencement of the new Aged Care Act to 1 November 2025 and has recommended that the Governor-General formally proclaim this revised start date. While the details and examples provided in this article remain accurate for the legislation as enacted, advisers should be aware that the effective date is now proposed as 1 November 2025.

Challenger Technical will provide further updates once the formal proclamation is issued. In the meantime, please consider this timing change when preparing aged care strategies for clients planning to enter care in the second half of 2025.

Related content

Stay informed

Sign up to our free monthly adviser newsletter, Tech news containing the latest technical articles, economic updates, retirement insights, product news and events.