Macro Musing: US imports - Signed, sealed, delivered

Subscribe to Macro Musing

To stay up to date on the latest economic insights, subscribe to Macro Musing on LinkedIn.

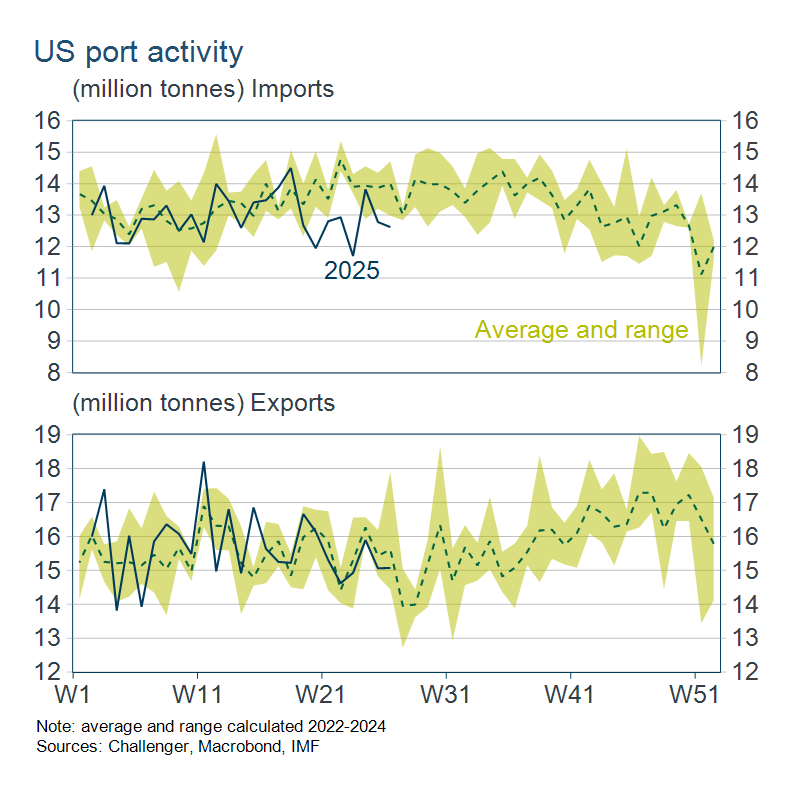

Timely, high-frequency data up to early June on the volume of goods being offloaded at US ports show volumes below previous years’ totals in recent weeks. This suggests tariffs are starting to impact US imports. In contrast, US exports seem unaffected to date, presumably because many countries have not imposed retaliatory tariffs and those that have, paused their tariffs while trade negotiations continue.

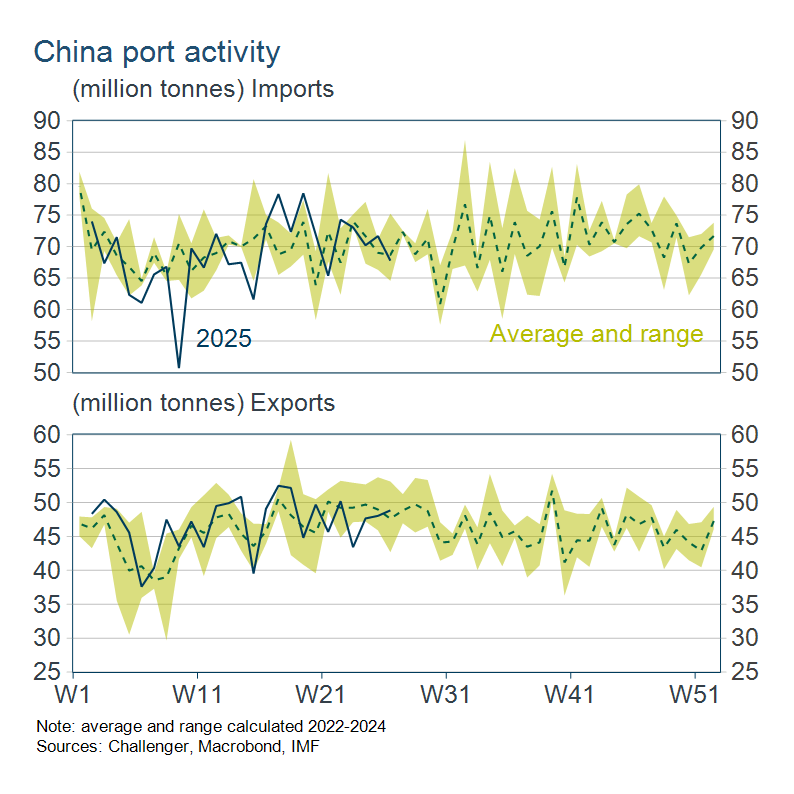

There has been no discernible impact on China’s trade from the US tariffs, with both exports and imports tracking broadly in line with previous years. While we know Chinese exports to the US have declined, these data indicate China has been able to find other markets for their exports. This suggests we may well see downward price pressure in other countries from the increased imports from China.

In contrast, the official US import data, which are only available up to May, are yet to show this drop in imports. Imports surged earlier in the year as companies rushed to beat the imposition of tariffs. Given this pull forward it is even more surprising that there hasn’t been a drop off in imports. Ports data don’t show the earlier surge, and since those imports needed to be rushed to beat the imposition of tariffs, many would have arrived by plane. This makes it more challenging to assess when and where the payback in import volumes may show up.

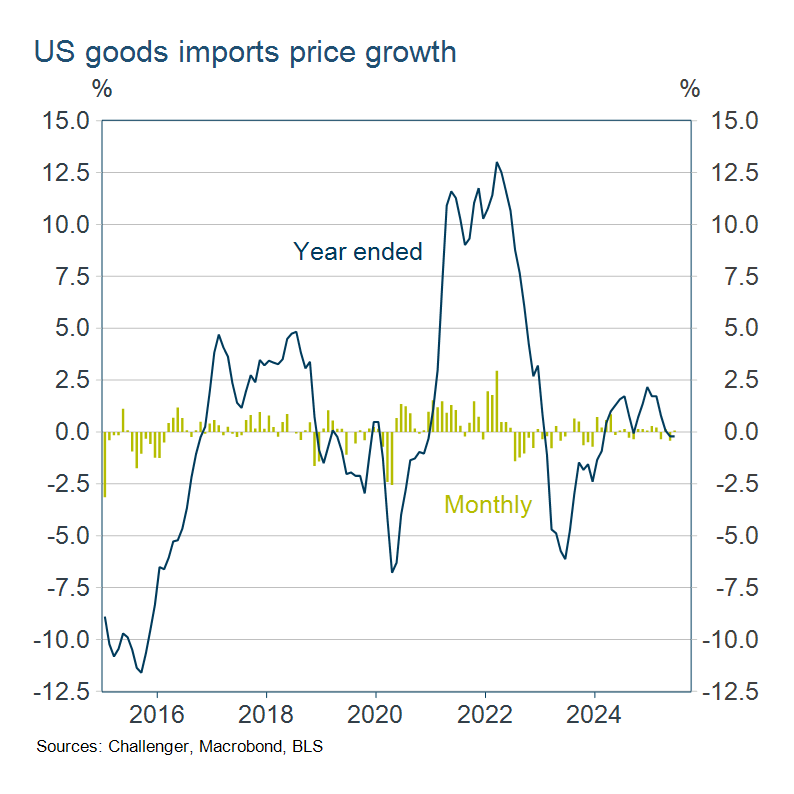

US import prices ticked up marginally in the month of June, but have fallen slightly over the year. Given average effective tariffs (tariff revenue divided by cost of imports) have increased to around 10% it is surprising that import prices have not shown more of a pickup. Economic data often contains many mysteries which makes the job of policy makers all the more difficult, adding to the uncertainty about policy decisions. The Fed in particular will be closely watching, and puzzling over these data.