More resources for advisers

Our Challenger Adviser Knowledge Hub has a large range of resources for advisers including product and technical information, articles and guides.

Federal Budget webinar

Hear from the Technical Services Team as they discuss and identify the impact of budget announcements on your retiree and pre-retiree clients.

Read Dr Jonathan Kearns, Chief Economist and Head of Regulatory Affairs, insights on the 2025-26 Federal Budget.

Pre-election tax cuts

With an election just weeks away, nobody expected this to be a fiscally tight budget. Given so many Budget details are now released to the media in the days leading up to the Budget, the surprise was the announcement of a tax cut. The lowest tax rate (applying to income from $18,201 to $45,000) will be reduced to 15% in July 2026, and 14% in July 2027, from the current rate of 16%. This tax cut at the bottom end of the tax brackets will provide a proportionately larger tax cut for low-income workers, although the full tax cut of $536 per year applies to anyone earning at least $45,000. The total cost of the tax cut will be $6.7 billion in 2026-27. The Coalition have announced that they will oppose the tax cuts.

Other spending measures

Most other spending initiatives had been announced in recent days. These include additional funding for Medicare ($8.5b), increased wages for aged care workers ($2.6b), additional funding for the Clean Energy Finance Corporation ($2b), the extension of subsidies on electricity bills ($1.8b) and funding for states for public hospitals ($1.7b). With an election coming up, not surprisingly there are also many small funding initiatives, right through to $3m for breeding the Maugean skate (a fish).

The net impact

A useful way to examine the impact of all of these policy initiatives, and other changes, on the Budget balance is with the so-called 'Table of Truth' (Table 1).1 Over the current and next four financial years the Budget deficit is now projected to total $180b, almost identical to the total projected deficit at the December budget update.

But that doesn't mean nothing has changed. Since the December update various changes, such as how the economy is affecting the Budget, have improved that total deficit by $36b. But the new policy stimulus measures have wiped out all of that, contributing to a deterioration of the Budget of $35b. Overall, the Budget deficit only improves slightly over the coming years to be 1.1% of GDP in 2028-29. Note that some initiatives don't even show up in these estimates as they are 'off balance sheet', such as the 20% cut in the balance of 'student loan' (HECS) balances.

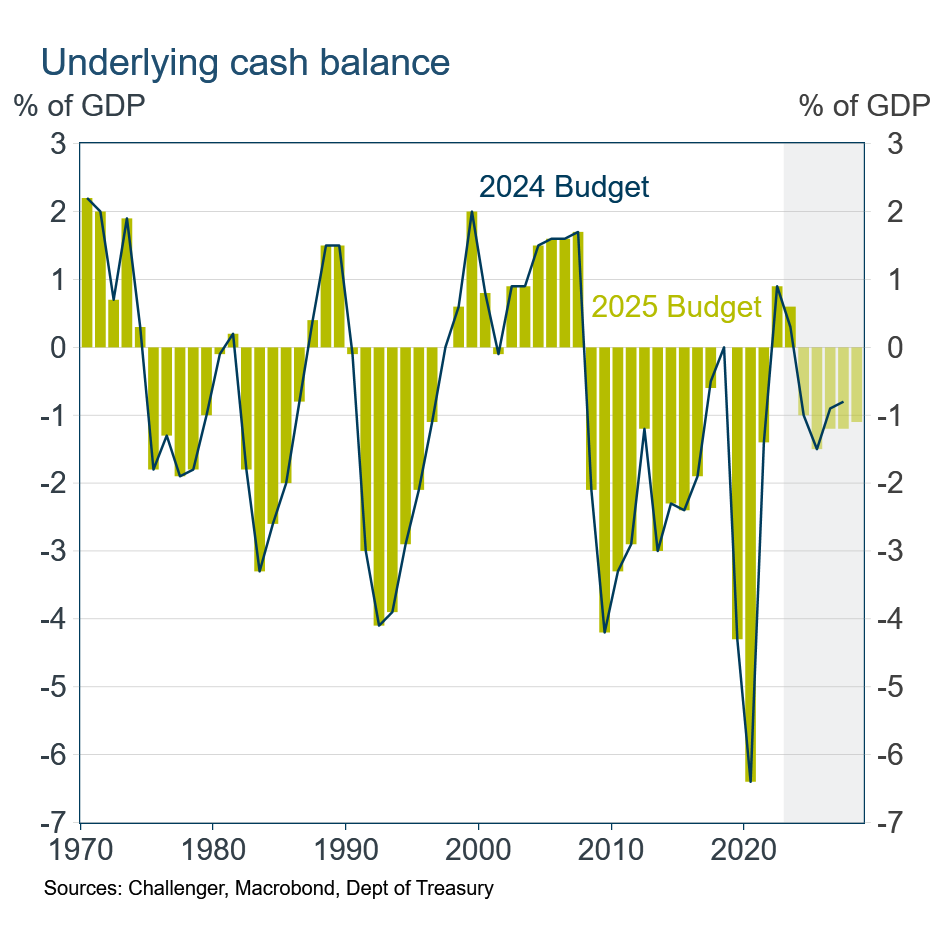

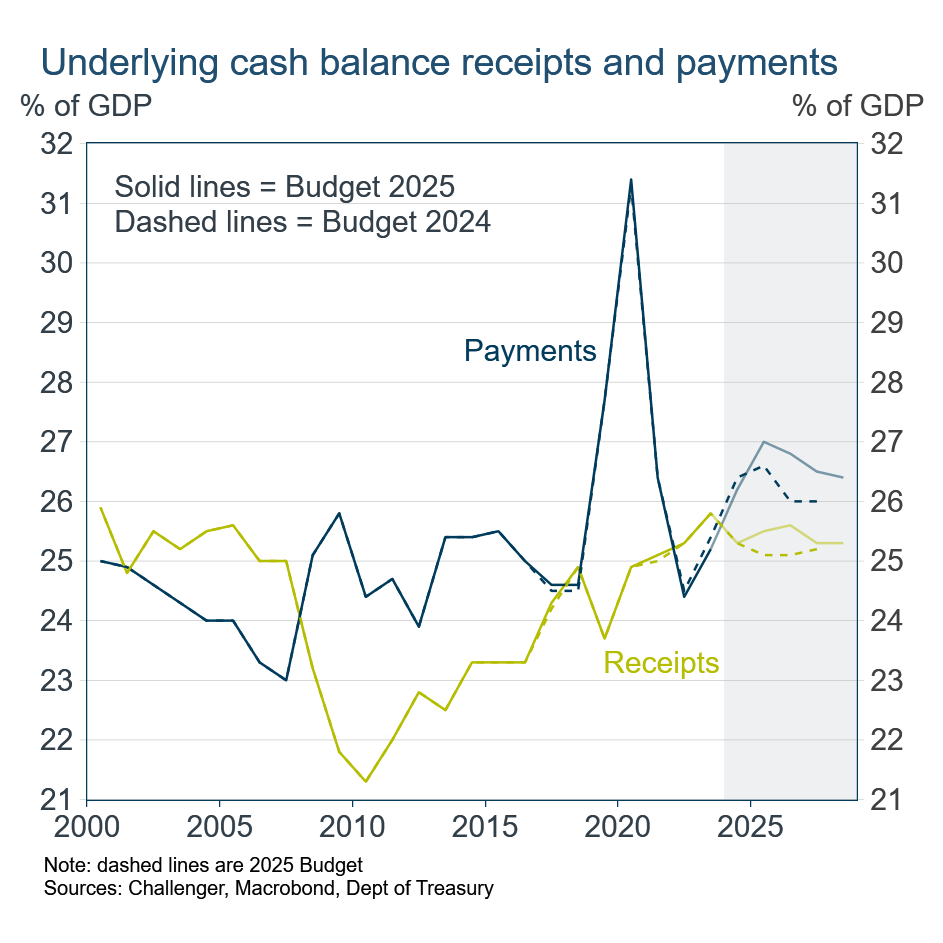

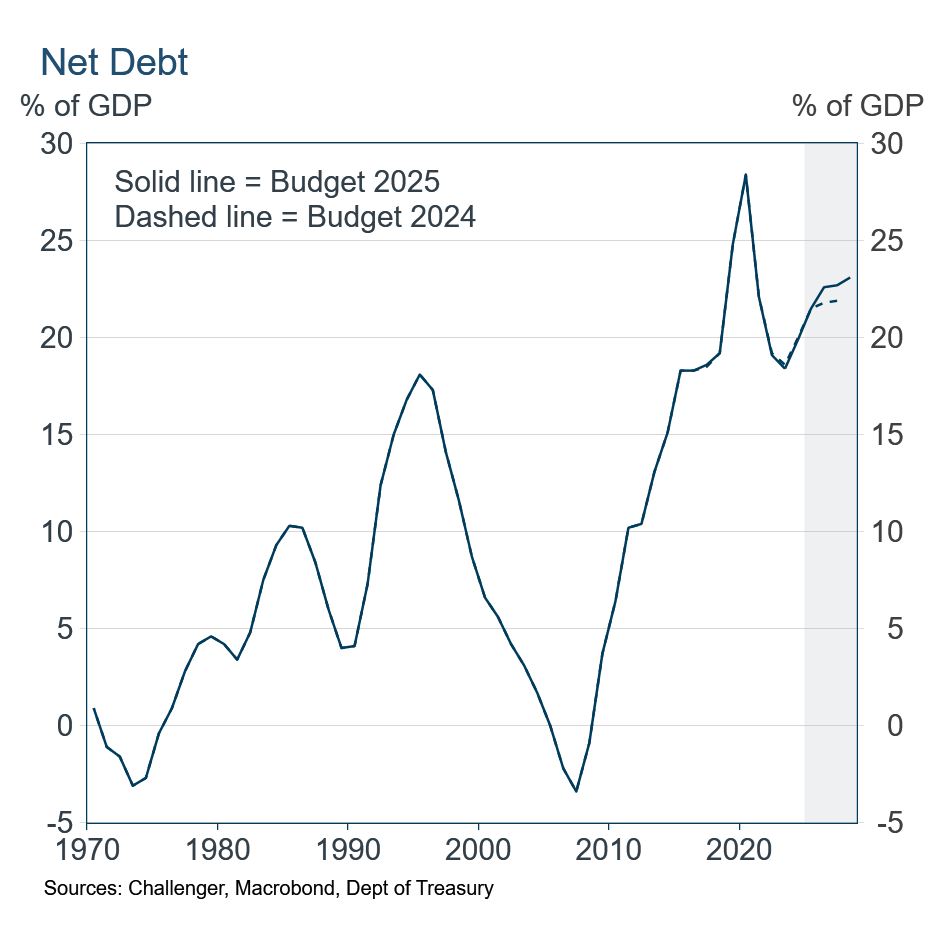

Overall, the underlying cash balance of the Budget is slightly larger at the tail end of the forecast period than in the previous Budget (Figure 1). This deterioration reflects the net effect of spending measures, with an increased in both receipts and payments (Figure 2). The increase in Budget deficits means that the Government's net debt is projected to be slightly higher, reaching 23% of GDP by 2028, still well below the COVID peak (which was inflated by the depressed GDP at the time) (Figure 3).

Table 1: Decomposing the Change in the Budget Deficit

2024-25 | 2025-26 | 2026-27 | 2027-28 | 2028-29 | |

|---|---|---|---|---|---|

| $ billion | -28.3 | -42.8 | -26.7 | -24.3 | |

| 2024-2025 Budget | -26.9 | -46.9 | -38.4 | -31.7 | -37.2 |

| Dec 2024 MYEFO | -0.5 | 12.0 | 10.3 | 5.1 | 9.5 |

| New stimulus | -0.1 | -7.2 | -7.7 | -10.7 | -9.2 |

| New projected budget surplus | -27.6 | -42.1 | -35.7 | -37.2 | -36.9 |

| %GDP | -1.0 | -1.5 | -1.2 | -1.2 | -1.1 |

Economic outlook

As expected, the Budget paints a picture of an economy slowly recovering from an extended malaise.

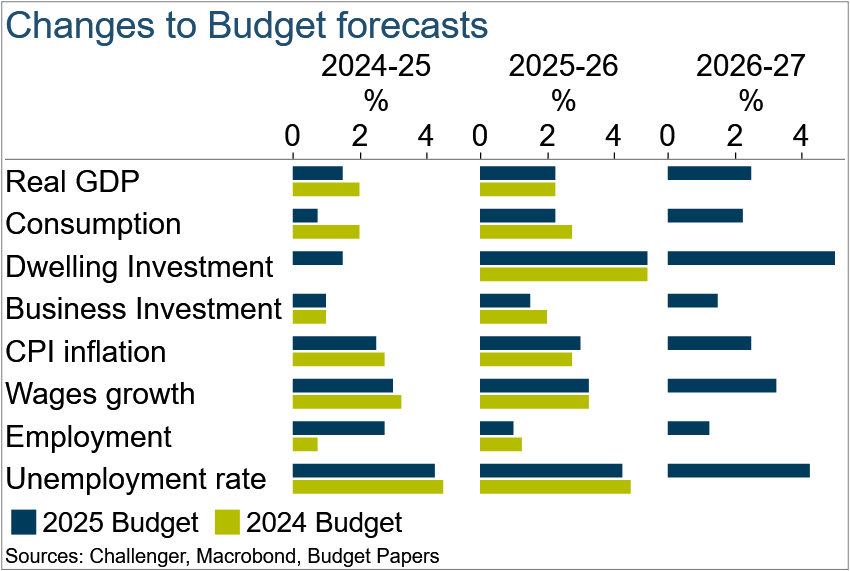

In the near-term, economic growth is weaker than the Government previously expected (Figure 5). Growth in GDP for the 2024-25 financial year is expected to be 1.5%, less than the 2% in the 2024 Budget. Ex-cyclone Alfred is estimated to have lowered GDP growth by 0.25%. In contrast, employment growth is expected to be substantially stronger, and the unemployment rate lower, than in the previous Budget. But the revisions to the Budget forecasts for the subsequent financial year, 2025-26, are very small. Growth slowly picks up with inflation returning to the RBA's inflation target in 2026-27.

The extension of the electricity rebates to the end of 2025 will delay the tick up in inflation that occurs when the subsidy comes to an end and electricity steps back up to its unsubsidised price (the subsidy was scheduled to end mid this year). This will see inflation temporarily above the RBA's 2-3% target range, but the RBA will look through these movements and so there will be no implications for monetary policy.

Migration

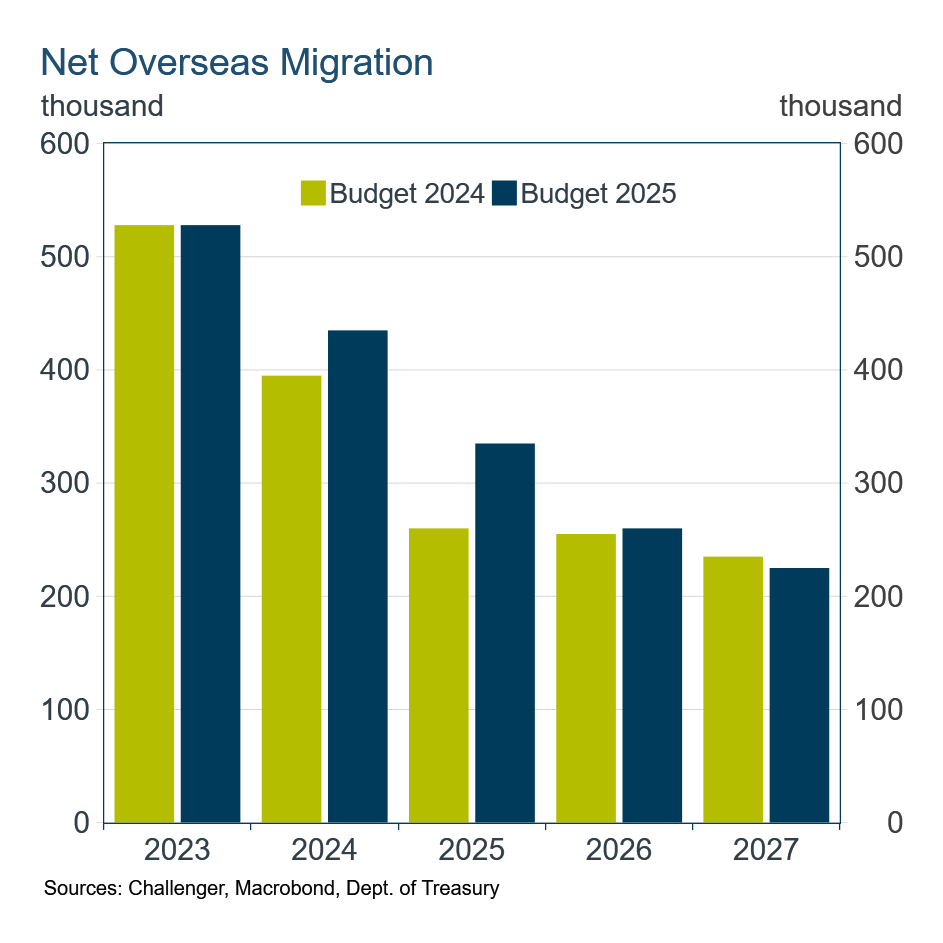

The Government has been less successful in bringing down Net Overseas Migration than it had anticipated (Figure 4). This is not surprising as there are many elements to migration that are out of the Government's control, including departures, the take up of visas issued and movements of New Zealanders. Over the year to June 2024, net migration was 40,000 stronger than the Government's previous forecast, while the forecast for the current financial year has been revised up by 75,000. The issue of migration and the impact on housing will not be going away.

Tariffs

The Budget points to the damaging impact of tariffs using model simulations. Consistent with other analysis, Treasury's work shows a 25% tariff by the US on durable manufactured goods lowers US GDP by around 0.4%, more than the 0.1-0.2% reduction for Australia and China. The decline in GDP is larger for all countries if retaliatory tariffs are imposed. The impact on inflation is significant also, peaking at 1.2% in the United States if retaliatory tariffs are imposed. Expect the Government to argue against tariffs but be circumspect in retaliating to any tariffs imposed on Australia.

1 This table has been named by, and made famous by, budget wonk Chris Richardson.

Related content

Is inflation higher for some households?

Inflation expectations: alert but not (yet) alarmed