Macro Musing: Highway to the Inflation Target Zone

Subscribe to Macro Musing

To stay up to date on the latest economic insights, subscribe to Macro Musing on LinkedIn.

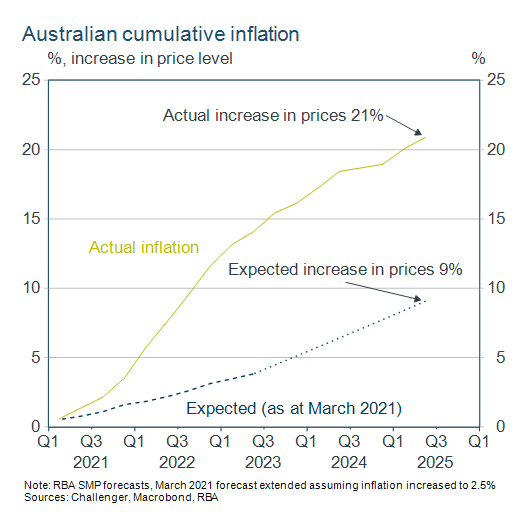

Inflation has slowed, as expected, removing the last hurdle for the RBA to cut interest rates.

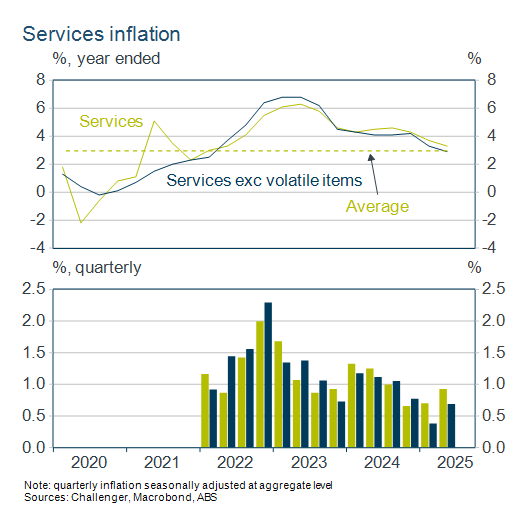

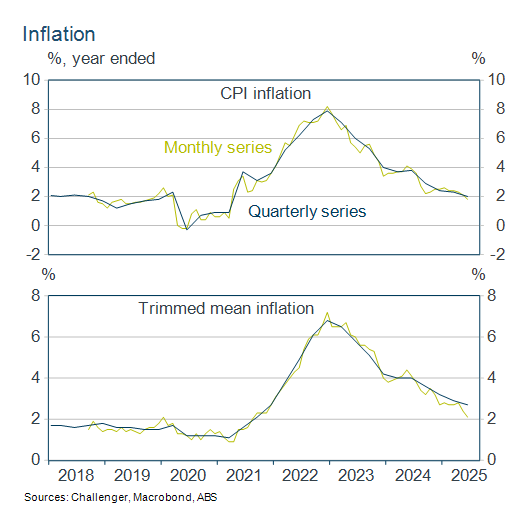

Inflation in the June quarter was 0.7%, but earlier electricity rebates are still depressing the annual rate of inflation which came in at 2.1%. The RBA will be paying much more attention to the trimmed mean measure of inflation which abstracts from temporary shocks and has slowed to 2.7%, well on its way to the RBA’s 2.5% target. Pleasingly for the RBA, services inflation, which had remained higher, has slowed to around its historical average. This will give the RBA confidence that domestic price pressures coming from wages have eased.

The Australian Bureau of Statistics (ABS) has announced that from November it will be publishing a full monthly CPI. For the past three years the ABS has been publishing a month CPI indicator. However, this did not reprice all items each month and so the RBA has continued to emphasise the quarterly CPI. It was waiting for the quarterly CPI that led the RBA to hold off from cutting last month.

The monthly indicator did a reasonable job of tracking annual CPI inflation. However, because all items were not priced each month, the monthly trimmed mean had to be calculated with annual price changes rather than monthly price prices. This resulted in fairly significant differences to quarterly trimmed mean inflation which uses quarterly price changes.

The RBA Governor recently said the RBA would continue to emphasise quarterly CPI inflation for some time because of less confidence in the seasonality and volatility of monthly inflation. The biggest benefit of the full monthly CPI for now is likely to be the ability to calculate trimmed mean inflation using monthly price changes for all items in the CPI basket.

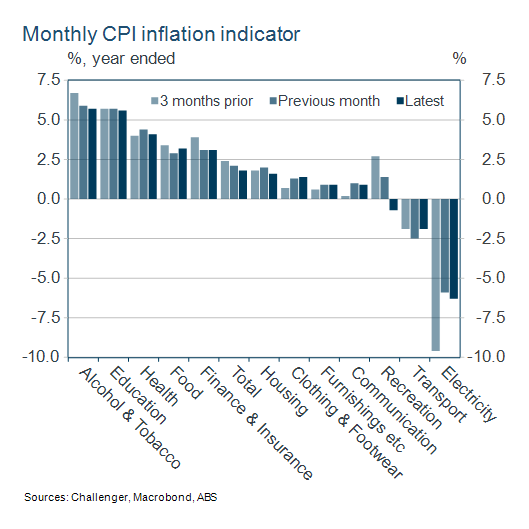

The monthly CPI will progressively become more important in the RBA’s cash rate decisions as the RBA gains confidence with its information content. Even now, the imperfect monthly CPI indictor contains important information on changing price trends, such as the weakening subtraction on electricity prices as subsidies are phased out.

The monthly CPI will progressively become more important in the RBA’s cash rate decisions as the RBA gains confidence with its information content. Even now, the imperfect monthly CPI indictor contains important information on changing price trends, such as the weakening subtraction on electricity prices as subsidies are phased out.