Macro Musing: The RBA can see productivity clearly now the pandemic is gone

Subscribe to Macro Musing

To stay up to date on the latest economic insights, subscribe to Macro Musing on LinkedIn.

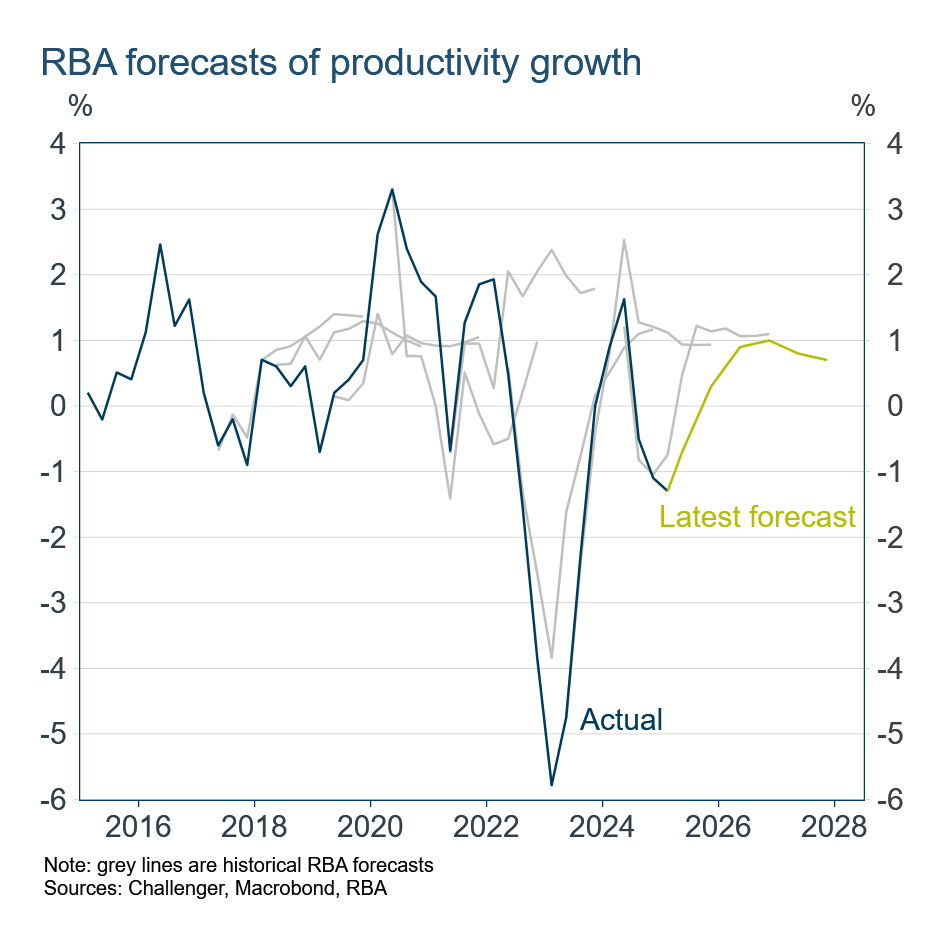

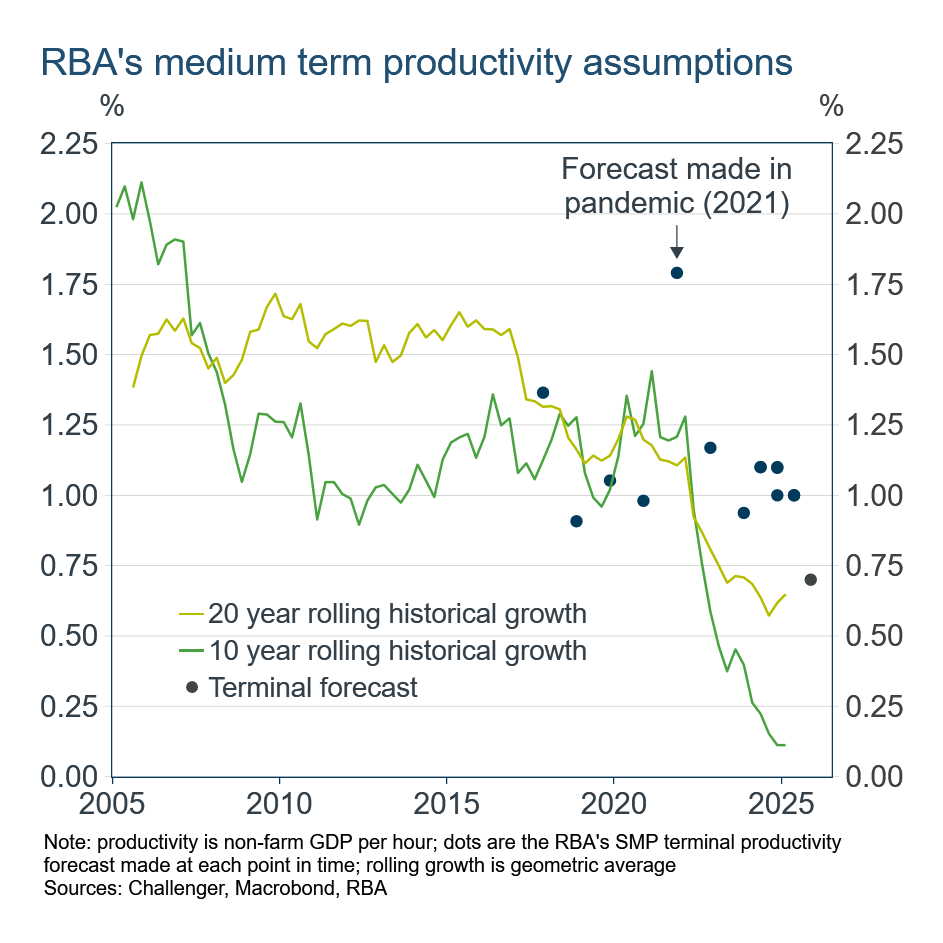

The RBA rate cut this week was widely expected but its update of the outlook for the economy generated interesting discussion. The topic of the day was productivity, with 59 mentions in the Governor’s press conference. The RBA’s productivity growth assumption was revised down from 1% to 0.7%. Looking at how volatile productivity growth has been, and the RBA’s historical projections, at first pass this change seems innocuous.

However, the change is important. The Governor emphasised that it is an assumption about medium term productivity growth not a forecast about long-run productivity. Those semantics are really about not being seen to pass judgement on likely growth under the Government’s policies. Governor Bullock also emphasised that the change “doesn’t have an impact on our inflation or our unemployment forecasts”.

In the economy everything is related and so the productivity assumption is a key input into the RBA’s forecasts. The consequence of the RBA missing its productivity forecasts in recent years is that it had also been too optimistic in forecasting GDP and wages growth. Lowering its productivity assumption – to be based on the 20-year average growth – is also an admission that future growth in GDP and wages will be weaker, and that matters for people’s actual and perceived standard of living. The focus on productivity was not surprising ahead of the Government’s “Economic Reform Roundtable” next week.

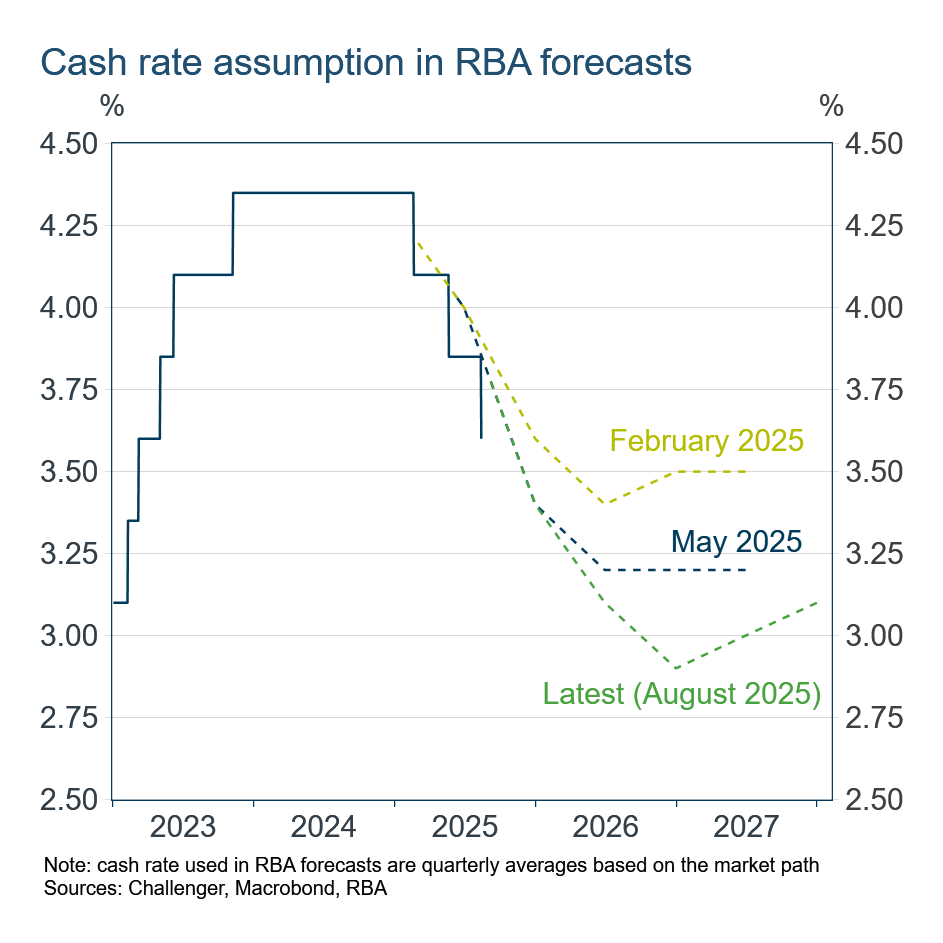

Taking a step back, while the RBA’s forecasts for inflation and the unemployment rate didn’t change, an important change this year has been the assumption for the cash rate used to produce those forecasts. The RBA’s assumption is based on the market’s expected path for the cash rate.

Back in February when the RBA first cut rate, the RBA’s assumption for the cash rate in December 2026 was 3.5%. In May when it cut again, the cash rate assumption was lowered to 3.2%. In the RBA’s latest forecasts, it assumes the cash rate will be 2.9% by the end of next year.

While the RBA has delivered Goldilocks forecasts with inflation flatlining around its 2.5% target and the unemployment rate plateauing at 4.3%, the lowering of the assumed cash rate used to generate those forecasts shows that the underlying economy is weak. But that does not mean it will need to cut at a faster rate than the cash rate assumption that delivered those Goldilocks forecasts. As the RBA gets closer to a neutral cash rate setting it can afford to take its time to assess how the economy is responding to financial conditions.