Macro Musing: The country with the golden exports

Subscribe to Macro Musing

To stay up to date on the latest economic insights, subscribe to Macro Musing on LinkedIn.

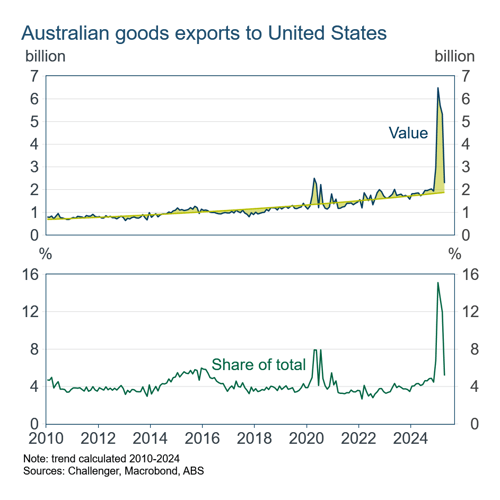

Australian exports to the United States surged in the first three months of this year, ahead of the expected imposition of US tariffs.

Americans rushed to import all sorts of goods before they would be subject to tariffs. Australian exports to the US jumped to around $6 billion in January from around $2 billion. At this peak, the United States accounted for 15% of Australia’s exports, up from around 4%. This raises the question: should we now expect a ‘payback’ period with a subsequent slump in exports.

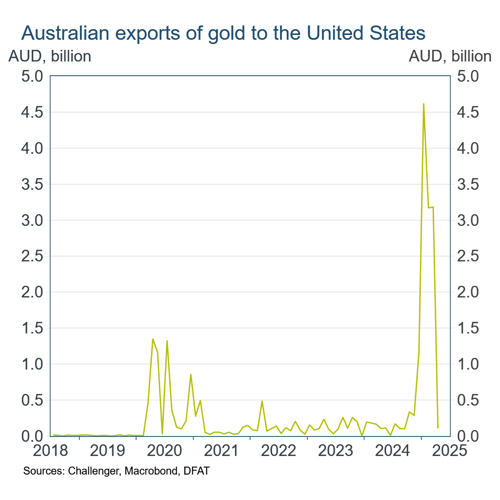

Almost all of the surge in exports was due to gold exports, with shipments peaking at over $4.5 billion in January. US gold imports were driven by the concern that tariffs would apply to gold, driving a wedge between the price of gold in the US and the rest of the world. As Australia typically exports very little gold to the US, there will not be a payback slump in exports. In the end, precious metals, including gold are exempt from US tariffs.

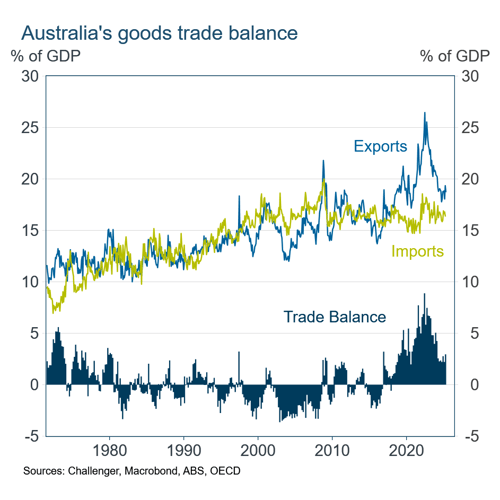

That the surge in exports was all gold removes the risk that Australia’s trade surplus would be reduced in coming months from a payback slump in exports. The goods trade surplus has already narrowed from 6% of GDP in 2022, to around 2% of GDP this year with lower commodity prices, but at least reduced gold exports won’t drive it lower.

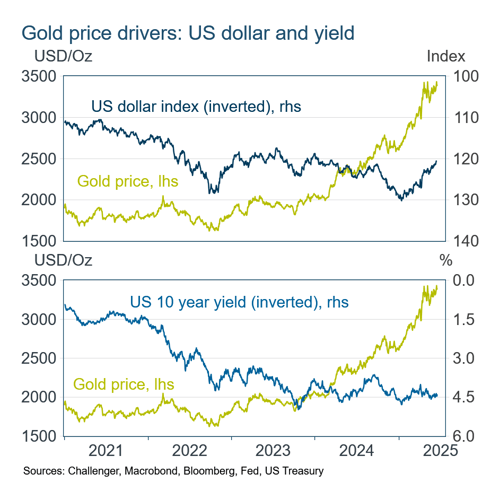

More broadly there has been substantially stronger demand for gold, with its price rising from $US2,500 last September to close to $US3,500.

This has not been driven by a reduction in US interest rates (which reduces the relative cost of holding gold since it does not pay interest). This year the depreciation of the US dollar (which reduces the US dollar price of gold in other currencies, increasing demand for a given US dollar price) has contributed to the run-up.

The strong demand for gold also reflects a hedge against higher inflation, which is expected to be higher given the US fiscal expansion and tariffs, and a flight to a ‘safe asset’ given uncertainty about economic and financial market outcomes. While an increase in US yields is likely to depress the gold price, ongoing US dollar weakness and safe-asset demand are likely to continue to underpin a strong gold price.