Macro Musing: Working from home and office property

Subscribe to Macro Musing

To stay up to date on the latest economic insights, subscribe to Macro Musing on LinkedIn.

Working from home and office property

Download the article below.

With the COVID-19 pandemic fading in the rear-view mirror, it's worth taking stock of the lingering effect on working from home (WFH) and the implications for office property. There are three key takeaways.

First, WFH has not proved to be the death knell for the office market that some had predicted. Because WFH is not evenly spread across weekdays, the reduction in office demand is less than the decline in the total time spent in the office. Second, because there is a large reduction in the total number of people in centres across the week, the decline in retail demand is larger than the decline in office demand. Third, differences in the WFH preferences of employees and company leaders means that WFH, and so to some extent office demand, will vary cyclically with the labour market. However, this effect is likely to be small relative to the significant existing cyclicality in the office property market.

The reduction in activity in city centres

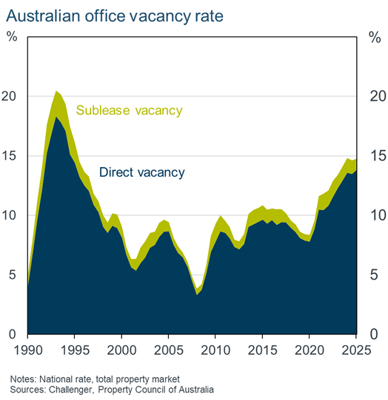

Prior to the pandemic, around one-third of workers in Australia reported regularly WFH. This share jumped to almost half during the pandemic but has now fallen back to around 36%. As WFH has increased, office vacancy rates have also increased to be around 15% nationally at the start of the year (Figure 1). However, most of this increase is not WFH but the result of regular cyclical supply factors. Cities with the largest increase in vacancy rates also had the largest increases in the stock of offices.

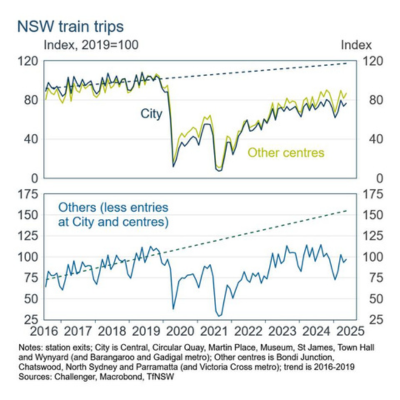

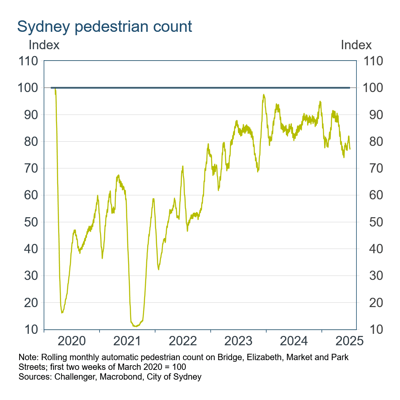

We also see the impact of the pandemic on activity in city centres with public transport usage. Train trips into the city and other centres in Sydney collapsed with the onset of the pandemic and are still around 20% below pre-pandemic levels (Figure 2). WFH and changed behaviour has not just affected city centres. Trips on NSW trains to other destinations have also not recovered after the pandemic. Pedestrian counts show a slightly smaller 15% reduction in people in the city (Figure 3).

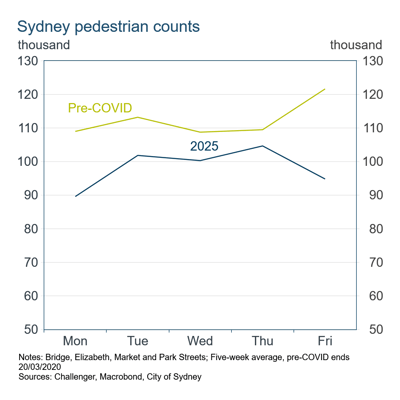

Pedestrian counts show the decline in people in the city is largest on Friday and Monday (Figure 4). Pre- COVID, the pedestrian counts were very similar Monday to Thursday, and higher on Friday when more people were going out in the city. Consistent with anecdotal evidence, pedestrian counts suggest Thursday has the highest office attendance. Notably, while overall pedestrian counts are around 15% lower than pre-pandemic levels, on Thursdays they have fallen by less than 5%.

With the peak number of people in the office on Thursday only a little below pre-pandemic levels, the amount of office space needed has only fallen slightly. But the larger fall in the total number of people in the city over the week means retail spending, and so retail space demand, has experienced a larger fall.

Workers value WFH but there will be a 'tug of war' with employers

Surveys report WFH has a positive impact on mental and physical health, as it improves work-life balance, even though employees report working longer hours when WFH. Data from one virtual meeting company show no fall in activity at lunchtime when WFH, in contrast to the usual pattern seen in office.

Research highlights a range of benefits of WFH including higher job satisfaction, greater commitment to their employer, perceptions of employer support, supervisor-rated performance, and employee retention. WFH is more valued, and more common, among those with caring responsibilities. This contributes to an additional benefit for firms, and the economy, that WFH increases the number of people in the workforce.

However, across countries employers report wanting their staff to be in the office more than they are currently. In Australia, employees on average want to WFH more than two days per week, but employers want them to WFH less than two days.

CEOs' preference for more working in the office reflects their perception of the impact on culture and productivity. It also reflects their personal experience. Higher incomes mean shorter commutes and CEOs tend to be older with less caring responsibilities. They spend more of their day in meetings, where the benefits of being in person are greater, while their workers spend more time doing 'focus work' which can be more productive in a quite home environment.

Given employees have a greater preference for WFH than do employers, in a tight labour market an increase in WFH conditions is likely to be negotiated to attract and retain staff. In contrast, when jobs are harder to get, employers can push for greater attendance in the office. There will be more WFH going forward than we did prior to the pandemic, and the share of WFH could increase in a tight labour market. However, this cyclicality in WFH will be small relative to the regular significant cyclicality in spare capacity with changes in supply and businesses' expansions and contractions.

Related content

Stay informed

Sign up to our free monthly adviser newsletter, Tech news containing the latest technical articles, economic updates, retirement insights, product news and events.