Macro musing: Living in America

Subscribe to Macro Musing

To stay up to date on the latest economic insights, subscribe to Macro Musing on LinkedIn.

Rising long-term interest rates in the US will not only increase the US Government’s borrowing costs but will continue to depress the housing sector. Long rates will remain high due to elevated risk and term premia given the US Government’s fiscal and debt position, as well as tariff-boosted inflation limiting the Fed’s scope to cut rates.

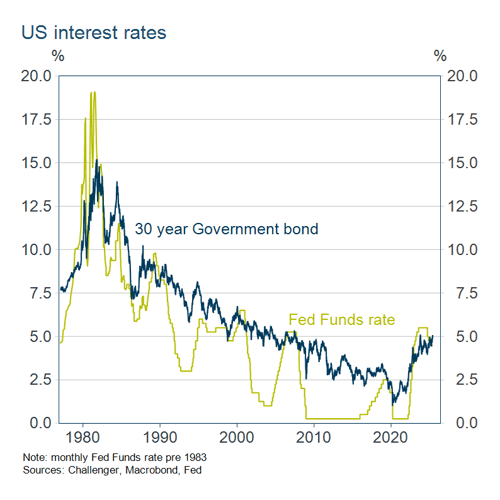

The 30-year US bond yield edged above 5% over the past two weeks, a rate not consistently recorded since 2007. The 30-year yield had been on a 40 year downward trend since the 1980s, and reached historic lows during the COVID pandemic under the Fed’s quantitative easing. Households became accustomed to falling mortgage rates allowing refinancing at cheaper rates, so the increase in rates has significant implications for the housing market.

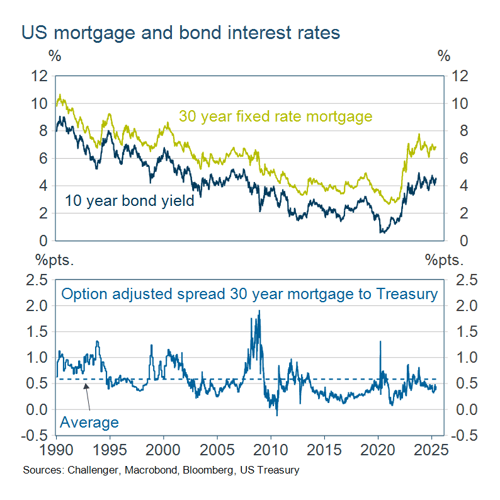

Most housing borrowers in the US have a 30-year fixed mortgage. However, these mortgages can be repaid early without penalty and so borrowers refinancing with a fall in rates means the effective duration of mortgages is significantly less than 30 years. Mortgage rates tend to move more closely with the 10-year yield.

The spread between the 30-year mortgage rate and the Treasury yield, adjusted for the early repayment option, has been around its long-run average. The rise in the level of Treasury yields has been the most important factor in pushing mortgage rates higher.

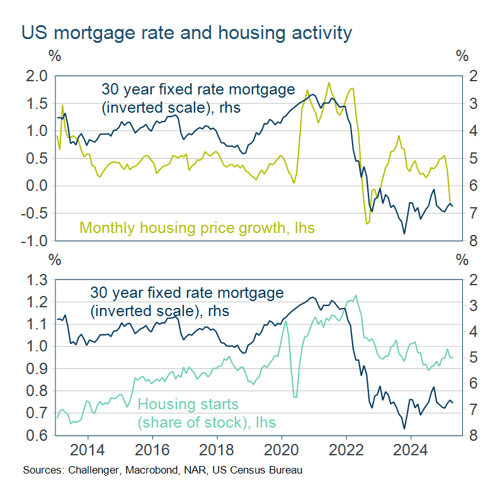

Higher mortgage rates (inverted in the graph below) are reducing housing demand so depressing price growth and construction activity. This is an important channel constraining US economic growth, one that won’t be able to be reversed anytime soon.