Macro Musing: Will Artificial Intelligence revolutionise the economy and financial markets?

Subscribe to Macro Musing

To stay up to date on the latest economic insights, subscribe to Macro Musing on LinkedIn.

AI has the potential to be truly transformative, not only in the tech sector but for the economy and financial markets. Developments in AI are making it more useful for businesses with improved recognition (of text, audio and video) and a broader scope of tasks where AI can match or even exceed human performance. The potential implications for asset returns are enormous.

The impact of AI on productivity

Various studies have measured how AI can boost productivity for a specific job. For example, Brynjolfsson and co-authors (2023) analysed 5,000 customer support agents who were given an AI assistant trained using audio and performance metrics from agents’ interactions with customers. The AI assistant was able to increase agents’ productivity by 14% on average. Newer, less skilled, workers had a 34% improvement. Seemingly the AI assistant enabled all agents to perform as if they had the skills of the best performing agents.

To assess the economy-wide impact of AI requires a broader approach. The impact of AI will vary across different jobs, industries and sectors. It will be greatest on knowledge-based jobs and smallest on more physical jobs. Notably, this contrasts with historical technological advancements (such as mechanisation and IT) which have replaced manual jobs and simpler office jobs such as data processing.

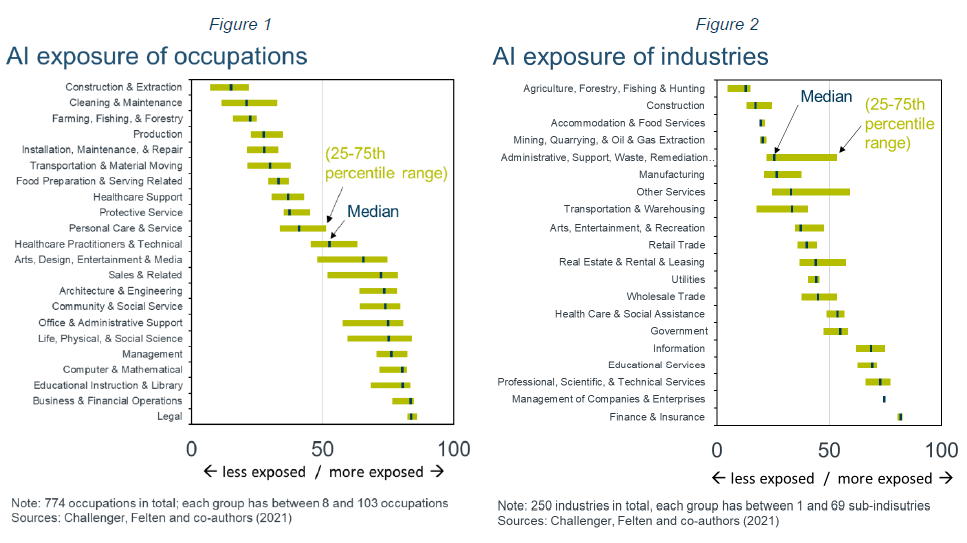

In one extensive study, Felton and co-authors (2021) considered 774 occupations across 250 industries and assessed how well 52 cognitive and physical abilities required in each of those occupations can be performed by 10 specific AI applications (such as image recognition, language modelling, and speech recognition). Aggregating such results can produce economy-wide estimates of the increase in productivity and GDP growth from AI.

There is a wide range of estimates of the impact of AI on aggregate productivity and output.

- At the high end, McKinsey estimates imply AI could increase labour productivity by as much as 6% over the coming decade.

- At the low end, the winner of last year’s economics Nobel prize, Daron Acemoglu predicts that AI will only result in a 0.5% boost to productivity over the decade.

The difference in part depends on timing, whether AI is ready yet to fundamentally changes research, innovation and work practices, or whether such fundamental change requires more time.

The impact of AI on different jobs and industries

AI will reshape the economy as some occupations (Figure 1) and industries (Figure 2) benefit more from AI than others, leading to shifts in relative prices, and importantly rising incomes and consumption.

Knowledge-based jobs are most exposed to AI. Legal jobs are most exposed, closely followed by Business & Financial Operations jobs. The industries with a larger share of knowledge jobs are most exposed to AI. Of industry groupings, Finance & Insurance is most exposed to AI.

Beyond the skills of finance workers, other factors point to the financial sector being a leader in the adoption and use of AI. The financial sector is already tech heavy and so has the capability and experience to be an early adopter. Further, many financial institutions are large and so have the scale to undertake the substantial investment to develop and utilise AI and have vast internal data needed to train AI models.

But the sectors most affected won’t necessarily grow the most

It is important to note that the sectors with the greatest exposure to AI will not necessarily have the largest increase in output. Industries that have an AI-induced productivity boom should experience a decline in their relative price and so see some increase in demand. In addition, higher productivity will increase aggregate incomes and so demand across all sectors. However, this increase in demand will be greater for sectors producing goods and services that people consume more of as they become richer, such as manufactured goods and higher quality food.

The impact of AI on financial assets

As with any significant structural change, AI brings opportunities and risks for investors. The extent of these changes will depend on the speed and breadth of the take-up and its efficacy.

- The aggregate impact is highly uncertain. The boost to productivity and output could be substantial or swamped by factors that have been constraining productivity for years. This significant uncertainty flows through to earnings and profit growth, and so value, of firms that produce and use AI.

- Firms developing AI programs and hardware. Producers of chips, notably Nvidia, have had rapid price growth. But unlike large tech firms, such as Microsoft or Meta, that have an effective ring fence through network effects, firms producing chips or AI programs can easily be overtaken by a new innovator. The fall in the share price of Nvidia with the release of DeepSeek highlighted this.

- Industries affected by AI. In sectors impacted by AI, such as tech and finance, firm performance is likely to be highly varied with both winners and losers. Even if overall output in these industries doesn’t grow faster than the total economy, firms that develop better products and leverage AI more effectively and efficiently (not necessarily using more AI) will see strong returns, while others struggle.

- Other sectors. In sectors such as manufacturing with less AI usage there may be a large increase in output, but as that comes from stronger aggregate demand with a larger economy, rather than an AI boost, the benefits will be more widely spread across firms with fewer big winners and losers.

- Interest rates. Given the combination of stronger productivity growth and significant investment to facilitate AI, e.g. data centres and increased power supply, interest rates are likely to be higher than otherwise.

- Bubbles. Most bubbles start with a genuine fillip to earnings, but then exuberance takes over. Knowing whether AI-boosted valuations are fair is difficult given the revolutionary nature of AI makes it impossible to accurately predict future profitability. But bubbles can take time to burst and so even some sceptical analysts currently advocate maintaining some exposure to AI.

There are many risks to consider from AI and the resulting structural change

AI has great promise, but there are also many risks to consider.

- If AI is trained on information containing biases or misinformation so too will the AI output. That could lead to inefficient outcomes or resistance to the take-up of AI.

- A shortage of skilled workers could slow the adjustment process and delay productivity gains.

- There could be significant resistance to the up-take of AI if the spoils are not shared equally. Acemoglu and Johnson (2023) point to a potentially bleak future where few workers get the spoils. Like other structural change from automation, AI could increase inequality if there are very large returns to innovators and early investors, or from changes in relative wages and employment outcomes.

AI will have the greatest impact on high wage, high education workers doing knowledge-based jobs who historically have been less likely to experience unemployment. As many people with similar skills lose their jobs, reskilling and retraining programs will be critical to share the benefits and maintain social acceptance of AI (see Cazzaniga and co-authors, 2024).- A recent cautionary tale of the negative impact from structural change comes from the United States’ experience from opening to free trade and growth of emerging market economies from the 1980s. Economists expected a strong and flexible domestic economy would ensure that workers would not be left behind. Some manufacturing workers would lose their jobs when their employer could not compete with imports, but export opportunities and stronger aggregate economic growth from greater specialisation would give them new and better paying jobs. However, redundant workers didn’t have the skills for jobs with growing demand and they weren’t in the right locations. What followed was regions with depressed economies and high unemployment.

- AI is likely to lead to more firm concentration. AI requires substantial investment, and large datasets are needed to train AI. That gives large, incumbent firms an advantage.

- Some see an even more existential threat from AI. In 2023 hundreds of AI industry leaders signed an open letter warning that action was needed to mitigate the “risk of extinction” from AI.

- Alternatively, there is a risk of economic stagnation, if as Acemoglu (2024b) notes, there is resistance to the creative destruction of AI. Destruction needs to be acknowledged as a cost of the creation, which is bringing advancements and increased incomes and wealth, at least for some.