Fed cuts: What are you waiting for?

Subscribe to Macro Musing

To stay up to date on the latest economic insights, subscribe to Macro Musing on LinkedIn.

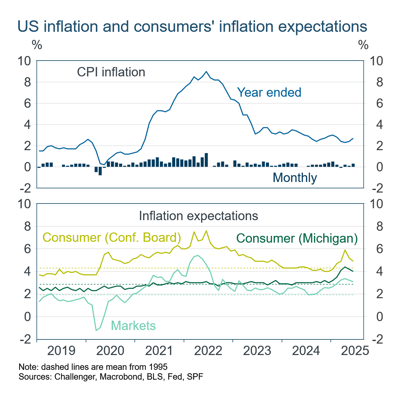

US inflation came in at 0.3% in June to be 2.7% over the year, above the Fed’s target of 2%. However, we are yet to see the expected sharper increase in inflation from tariffs that has kept the Fed from cutting, much to the consternation of President Trump.

The effect of tariffs on consumer prices might be delayed because businesses rushed to import goods before the tariffs took effect and are now depleting their inventories, hoping high tariffs don’t eventuate. Alternatively, maybe President Trump is right and foreign producers (or US importers) will absorb much of the increase in prices. That seems unlikely, but such large and across-the-board tariff increases are unprecedented and so there is significant uncertainty about how quickly businesses and importers reset their prices.

As the wait goes on for the anticipated pick-up in prices of imported goods, inflation expectations remain elevated relative to their historical norms. Inflation expectations had declined in recent months with optimism that implemented tariff rates would be lower than those announced on Liberation Day. However, given recent communication that final tariffs will be around the rates in the initial announcement for many countries, and a new 50% tariff on copper, higher inflation remains likely.

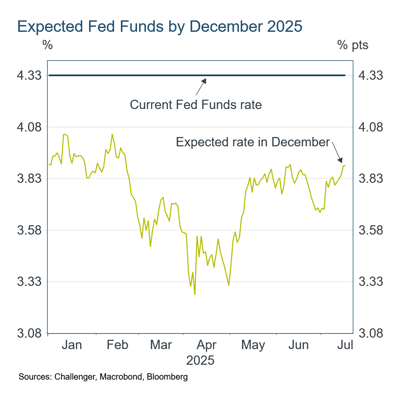

As the Fed waits for greater clarity on inflation, it has held off cutting the Fed Funds rate. The market believes the Fed is pausing, not stopping, and still expects two cuts by the end of the year which would take the Fed Funds rate from its current rate of 4.33% to 3.83% (mid-point). Back in April with the initial shock of announced tariffs the market was even pricing four Fed cuts this year.

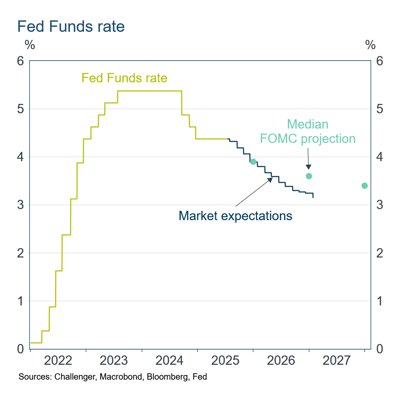

The median projection of the FOMC (the Fed’s rate setting committee) also indicates two cuts in the Fed Funds rate in 2025. Through 2026, however, the FOMC does projects a slower rate of cutting than the market expects.

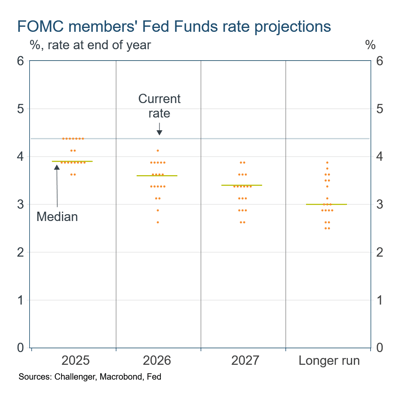

However, it would be unwise to lock-in two Fed cuts this year. There is considerable disagreement among FOMC members about whether Fed will even cut this year.

Two members expect three cuts, eight members expect two cuts, and another two expect just one cut. However, there are seven members who expect no cuts with the Fed Funds rate to remain at 4.33% by the end of the year.

A sharp uptick in inflation from tariffs could easily see a few members switch thinking no cuts are justified, with a majority then voting to hold the Fed Funds rate constant. Given this, the market pricing with high confidence for two cuts seems over-baked. There is a significant chance we do not get any Fed cuts this year.

Related content

Stay informed

Sign up to our free monthly adviser newsletter, Tech news containing the latest technical articles, economic updates, retirement insights, product news and events.