Raising the bar for super in retirement

.png?h=360&iar=0&w=640)

Raising the bar for super in retirement

Download the article below.

Over the past 18 months or so the Government has sought to engage Australians in consultation around the retirement phase of superannuation.

In December 2023 the Government released a discussion paper seeking community and industry views on how the superannuation system can best provide the security and income Australians need as they live longer and healthier lives in retirement. This discussion paper can be found here: https://treasury.gov.au/consultation/c2023-441613

The discussion paper increases the focus on the retirement phase by examining three key areas:

- Supporting members to navigate the retirement income system,

- Supporting funds to deliver better retirement income products and services, and

Making lifetime income products more accessible.

In response to this discussion paper the Government received 91 submissions from a wide range of interested parties including the Financial Advice Association of Australia (FAAA) and the Financial Services Council (FSC).

In November 2024, the Government announced a package of reforms in response to the feedback received from the Superannuation in retirement consultation. The reforms are intended to improve the retirement phase of superannuation and help retirees make the most of their superannuation through trusted information, better products and greater transparency. The Government’s announcement can be found here: https://treasury.gov.au/publication/p2024-604912

These proposed reforms are considered further in this article. These reforms will build on the obligations introduced by the Retirement Income Covenant and work in tandem with the Government’s Delivering Better Financial Outcomes package.

Enhanced independent guidance

To ensure retirees have access to reliable and independent information, the Government will expand and refresh resources on the Moneysmart website. These updates will include new guides, calculators, and interactive tools to help Australians understand key decision points when planning for retirement. The interactive tools will allow retirees to test different ways to draw down their superannuation, delivering a secure income stream that aligns with typical retirement expenses and Government support like the Age Pension. The first updates to the Moneysmart website are expected to be rolled out in the second half of 2025 and can be found here: https://moneysmart.gov.au/plan-for-your-retirement.

Additionally, ASIC will launch a consumer education campaign targeted at Australians approaching or already in retirement. This campaign aims to boost engagement with retirement planning and ensure retirees are better equipped to make informed decisions about their financial future.

Better retirement products

The Government has proposed introducing targeted improvements to the existing innovative income stream regulations to support further development in retirement products. These proposed changes will provide superannuation funds with greater flexibility to offer features such as money-back guarantees, purchasing in instalments instead of upfront lump sums, and fairer treatment for couples by considering joint life expectancy retirement income streams where appropriate. The proposed reforms will also clarify the interaction with the transfer balance cap.

To ensure these changes meet the needs of retirees, the Government will consult with industry stakeholders before implementing the regulations, which are expected to come into effect from 1 July 2026, subject to legislative priorities.

These proposed improvements aim to give members more options that meet their needs and help them maximise their superannuation in retirement.

Best practice principles

The Government will introduce a set of voluntary best practice principles to guide the superannuation industry in designing modern, high-quality income products that support Australians’ financial security in retirement. These principles will outline the core characteristics of well-rounded retirement products, helping funds develop offerings that suit retirees’ circumstances.

The best practice principles will complement the Retirement Income Covenant and provide trustees with voluntary guidelines for creating quality superannuation products. Treasury will develop these principles in consultation with an industry working group and the broader community. Draft principles are proposed to be released for public consultation during 2025.

Increased transparency

To enhance transparency and accountability in the retirement phase of superannuation, the Government has proposed to introduce a new Retirement Reporting Framework starting in 2027. This proposed framework will enable consistent monitoring of outcomes delivered to members in retirement, creating a common understanding of success in this phase.

APRA will collect and publish data annually, allowing progress to be measured over time. The design of metrics and the reporting process will be informed through a Treasury-led public consultation beginning in 2025. This framework aims to provide members with greater transparency and ensure superannuation funds are delivering on their obligations.

Additionally, the Government has tasked APRA and ASIC with conducting another Pulse Check report by the end of 2025. This report will monitor trustees’ progress in implementing their retirement income strategies, consistent with their obligations under the Retirement Income Covenant. The findings from the Pulse Check will also inform the design of the Retirement Reporting Framework.

Improving client outcomes in retirement with innovative retirement income streams today

While ‘better’ retirement products are welcome, in 2025, advisers have a wide range of innovative retirement income streams that, when used in combination with other income streams and sources of retirement income, can help improve client retirement outcomes.

Introducing Maira and Marcos

Moira and Marcos are a 67-year-old couple. They have recently retired. They own their own home and are free of debt. They have $550,000 each in superannuation that they are considering transferring to account-based pensions to start funding their retirement income. Their super (and any future account-based pension) is invested in accordance with their 50/50 growth/defensive risk profile. They have $50,000 in cash and term deposits and $20,000 worth of personal assets. Moira and Marcos would like to live comfortably for as long as possible and estimate that $80,000 p.a., indexed each year with inflation, would be sufficient to meet this goal. As part of their total intended annual spend in retirement Moira and Marcos have established that they require at least $52,000 p.a., indexed each year with inflation, to meet their essential spending requirements in retirement.

A partial allocation to market-linked lifetime annuities for Moira and Marcos

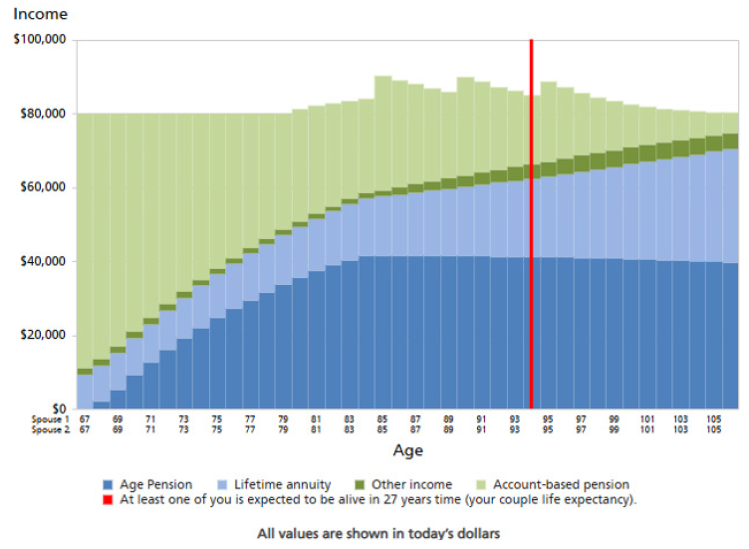

A partial allocation to market-linked lifetime annuities could help improve retirement outcomes for Moira and Marcos. A 20% allocation (consistent with their risk profile and asset allocation) is illustrated in the representation of income over retirement below.

A 20% allocation to market-linked lifetime annuities for Moira and Marcos will provide:

- Market-linked lifetime income for as long as Moira and Marcos live starting at $9,150 p.a. in the first year;

- A 98% chance of meeting income ‘needs’ (an increase of 15% over account-based pensions only);

- An 88% chance of meeting desired ‘needs and wants’ (an increase of 9% over account-based pensions only);

- Total retirement income paid over 27 years (equal to their couple life expectancy) increased by $85,122 (in today’s dollars); and

- An estate value at the end of 27 years (equal to their couple life expectancy) increased by $101,658 (in today’s dollars).

Conclusion

Challenger welcomes the Government’s continued commitment to improving the retirement phase of superannuation.

Challenger will keep advisers abreast of developments in this space.

Assumptions

All projections sourced from the Challenger Retirement Illustrator (16/06/2025) using Social Security rates and thresholds effective 20 March 2025. 67-year-old male/female homeowner couple. $550,000 each available for investment via account-based pension and partial (20%) allocation each to a Challenger Lifetime Annuity (Liquid Lifetime) with immediate market-linked (Conservative Balanced 50/50 indexation option illustrated) payments and no adviser fees. Super asset allocation 50% growth/50% defensive. Assumes returns of 4% p.a. for defensive assets and 8% p.a. for growth assets before fees. $50,000 cash/TDs earning 4% p.a. interest. Personal assets of $20,000. $80,000 p.a. desired income including $52,000 p.a. essential income. Amounts shown are in today’s dollars. CPI of 2.5% p.a. See Challenger Retirement Illustrator for all assumptions. Challenger RIC reference: RIC250616000452. Rates subject to change.

Related content

Stay informed

Sign up to our free monthly adviser newsletter, Tech news containing the latest technical articles, economic updates, retirement insights, product news and events.