Significance of the MPIR for low means and high means residents

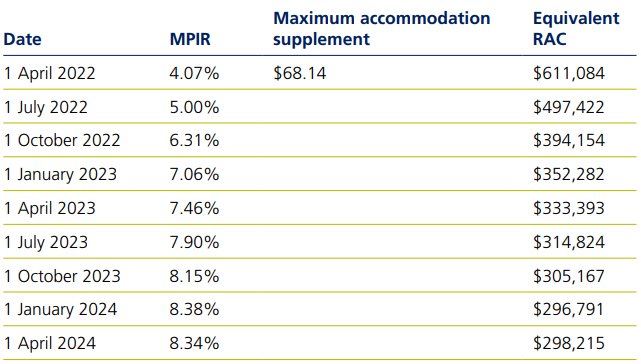

Aged care facilities use the maximum permissible interest rate (MPIR) to calculate accommodation payments for aged care residents. The MPIR is set quarterly by the Government and has increased from 4.07% in April 2022 to 8.34% in April 2024.

In this month’s article we will look at the significance of the MPIR in determining accommodation payments for ‘low means’ and ‘accommodation payment’ (high means) residents. We will use examples to illustrate the impact on accommodation payments as the MPIR has changed.

Accommodation payment options

When a person enters residential aged care, they will be classified as a ‘low means’ resident or an ‘accommodation payment’ resident depending on their means. A person’s means is determined by comparing their means-tested amount to the maximum accommodation supplement.

The maximum accommodation supplement is the maximum supplement payable to an aged care facility to provide accommodation for a ‘low means’ resident. The maximum accommodation supplement is currently $68.14 per day.

A ‘low means’ resident has the option of paying for their accommodation as:

- a fully refundable lump sum referred to as a refundable accommodation contribution (RAC);

- periodic payments referred to as a daily accommodation contribution (DAC); or

- a combination of lump sum and periodic payment.

An ‘accommodation payment’ resident has the option of paying for their accommodation as:

- a fully refundable lump sum referred to as a refundable accommodation deposit (RAD);

- periodic payments referred to as a daily accommodation payment (DAP); or

- a combination of lump sum and periodic payment.

‘Low means’ resident

A person will be classified as ‘low means’ if their means tested amount is less than the maximum accommodation supplement at the time of entry. A person who is classified as a ‘low means’ resident can be asked to pay an accommodation contribution towards the cost of their accommodation however, they cannot be asked to pay the advertised price.

A ‘low means’ resident’s daily accommodation contribution (DAC) will be the lesser of:

- their means tested amount; and

- the accommodation supplement payable to the aged care facility.

The means-tested amount will be recalculated monthly by Centrelink/DVA therefore the resident’s accommodation contribution may change over time depending on their means. An accommodation contribution will not be payable where the resident’s means-tested amount is equal to zero.

The accommodation supplement payable to the aged care facility will depend on when the facility was built or significantly refurbished and whether the facility meets the supported resident ratio. A resident can check with the aged care facility as to the accommodation supplement payable.

A ‘low means’ resident has the option to pay for their accommodation as a DAC or as a RAC or as a combination of DAC and RAC. The DAC is converted to the equivalent RAC using the MPIR.

The DAC is recalculated monthly by Centrelink/DVA therefore the equivalent RAC may change over time depending on their means. The aged care facility may have to refund part of the RAC if there is a reduction or the resident may have to start paying a DAC if there is an increase.

As the MPIR has increased, the equivalent RAC calculated on the maximum accommodation supplement has decreased as follows:

The MPIR is set at the date of entry to the aged care facility. The MPIR for a ‘low means’ resident will remain the same while they remain within the same aged care facility. If the ‘low means’ resident moves to another aged care facility, the MPIR will change to the current rate.

Example

Mary entered residential aged care on 1 April 2022 and was assessed as a ‘low means’ resident. She currently has $150,000 invested in term deposits and $5,000 of personal contents. Her means tested amount is $45.91 per day. The aged care facility receives the maximum accommodation supplement.

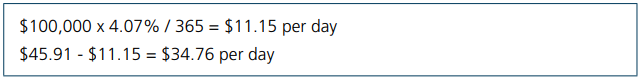

If Mary pays $100,000 as a RAC, how much will she pay as a DAC?

Mary moves to another aged care facility on 1 April 2024 and is assessed as a ‘low means’ resident. Her means tested amount is still $45.91 per day. The new aged care facility also receives the maximum accommodation supplement.

If Mary pays $100,000 as a RAC, how much will she pay as a DAC?

By moving to another aged care facility, Mary’s MPIR changes to the current rate.

As the MPIR has increased, the equivalent DAC on the $100,000 RAC has also increased. Mary reduces her DAC from $34.76 per day to $23.06 per day by moving to another aged care facility.

‘Accommodation payment’ resident

A person will be classified as an ‘accommodation payment’ resident if their means tested amount is equal to or greater than the maximum accommodation supplement at the time of entry. A person who is classified as an ‘accommodation payment’ resident can be asked to pay an accommodation payment for the cost of their accommodation.

The accommodation payment will be determined by agreement with the aged care facility and cannot exceed the advertised price. Aged care facilities are required to advertise accommodation prices on their website and on the My Aged Care website.

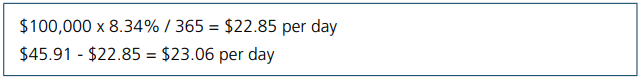

The maximum advertised accommodation price without prior approval from the Health and Aged Care Pricing Authority is currently $550,000.

An ‘accommodation payment’ resident has the option to pay for their accommodation as a RAD or as a DAP or as a combination of RAD and DAP. The RAD is converted to the equivalent DAP using the MPIR.

As the MPIR has increased, the equivalent DAP calculated on the maximum advertised accommodation price has increased as follows:

The MPIR is set at the date of entry to the aged care facility. The MPIR for an ‘accommodation payment’ resident will remain the same unless they subsequently change rooms within the aged care facility. If the ‘accommodation payment’ resident changes rooms within the same aged care facility or moves to another aged care facility, the MPIR will change to the current rate.

If an ‘accommodation payment’ resident involuntarily changes rooms within an aged care facility, they cannot be asked to pay a higher accommodation payment. The current MPIR will be used to calculate the equivalent RAD and DAP for the advertised accommodation price of the new room.

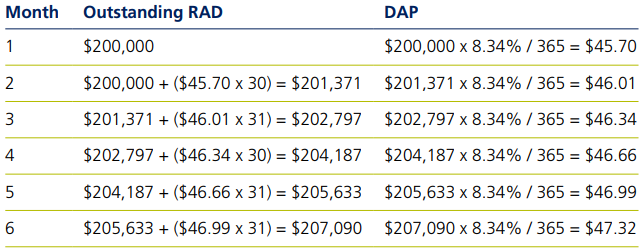

Where an ‘accommodation payment’ resident decides to pay for their accommodation as a combination of RAD and DAP, they can deduct the DAP from the RAD. However, as the DAP is deducted, the outstanding RAD will increase which will subsequently increase the DAP.

Example

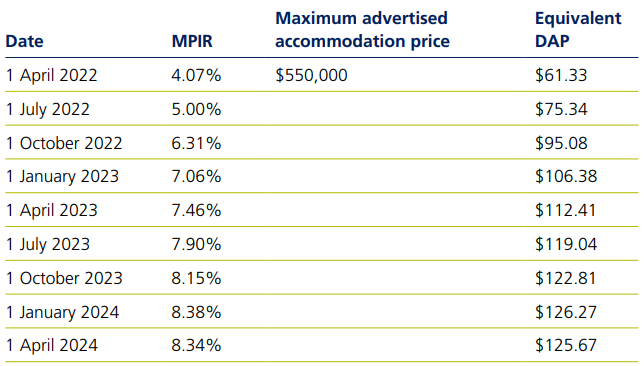

John entered residential aged care on 1 April 2022 and was assessed as an ‘accommodation payment’ resident. He currently has $350,000 invested in term deposits and $5,000 of personal contents. The aged care facility has an advertised accommodation price of $500,000 for the room.

If John pays $300,000 as a RAD and $200,000 as a DAP and deducts the DAP from the RAD every month, how much will be deducted from his RAD in the first 6 months?

John moves to another aged care facility on 1 April 2024 and is assessed as an ‘accommodation payment’ resident. The new aged care facility also has an advertised accommodation price of $500,000 for the room.

If John pays $300,000 as a RAD and $200,000 as a DAP and deducts the DAP from the RAD every month, how much will be deducted from his RAD in the first 6 months?

By moving to another aged care facility, John’s MPIR changes to the current rate.

As the MPIR has increased, the equivalent DAP on the outstanding RAD has also increased. John increases his DAP by moving to another aged care facility.

Related content

Stay informed

Sign up to our free monthly adviser newsletter, Tech news containing the latest technical articles, economic updates, retirement insights, product news and events.