Macro Musing: Take the Pressure Down

Subscribe to Macro Musing

To stay up to date on the latest economic insights, subscribe to Macro Musing on LinkedIn.

Recent hostilities between India, the world’s fifth largest economy, and Pakistan raised the prospect of war between these two nuclear powers. While war would be devastating for the Indian and Pakistani people who account for over 20% of the world’s population, the direct implications for financial markets are limited with the exception of the oil market. The indirect effects, through confidence and risk premia, could be more significant but are harder to predict.

The latest hostilities represented a significant escalation in a dispute that is as old as the nations of India and Pakistan. This time targets included military bases and sites in Pakistan outside Kashmir, increasing the potential for the conflict to escalate to war. Fortunately, a truce is currently holding.

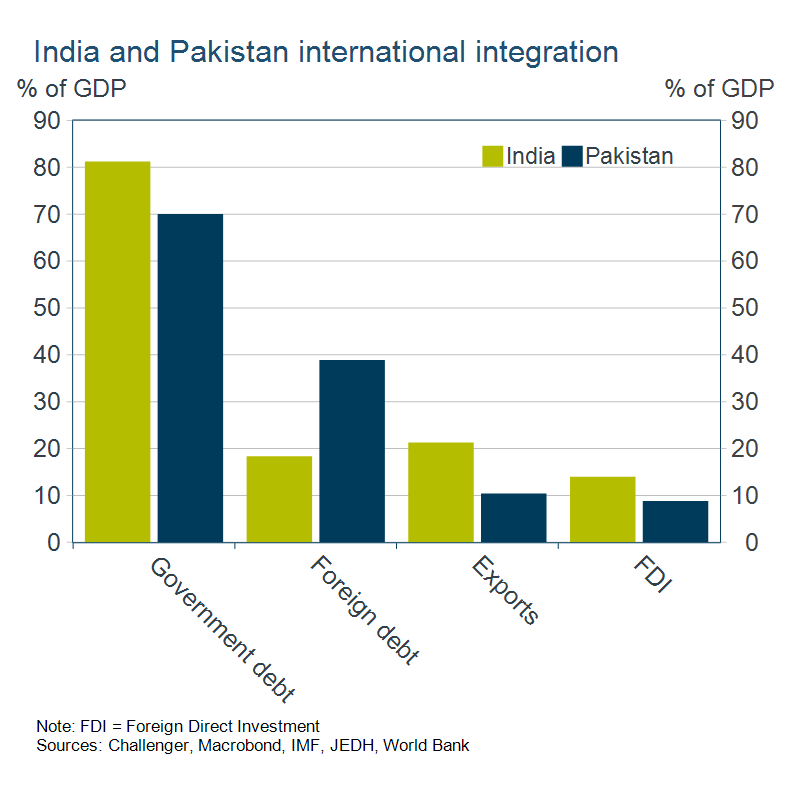

Both countries have limited integration within the global economy and financial system. India is a relatively closed economy, with exports of goods and services accounting for just over 20% of GDP, while Pakistan is even more closed with exports just 10% of GDP.

India and Pakistan also have limited integration in the global financial system. For example, international investment in shares and bonds in India and Pakistan is just 7% and 3% of their own GDP, in contrast to 87% for Australia. Pakistan’s foreign debt is 40% of GDP but given the relatively small size of the Pakistani economy – only the 46th biggest in the world –this debt is significant for Pakistan but not for the international investor community.

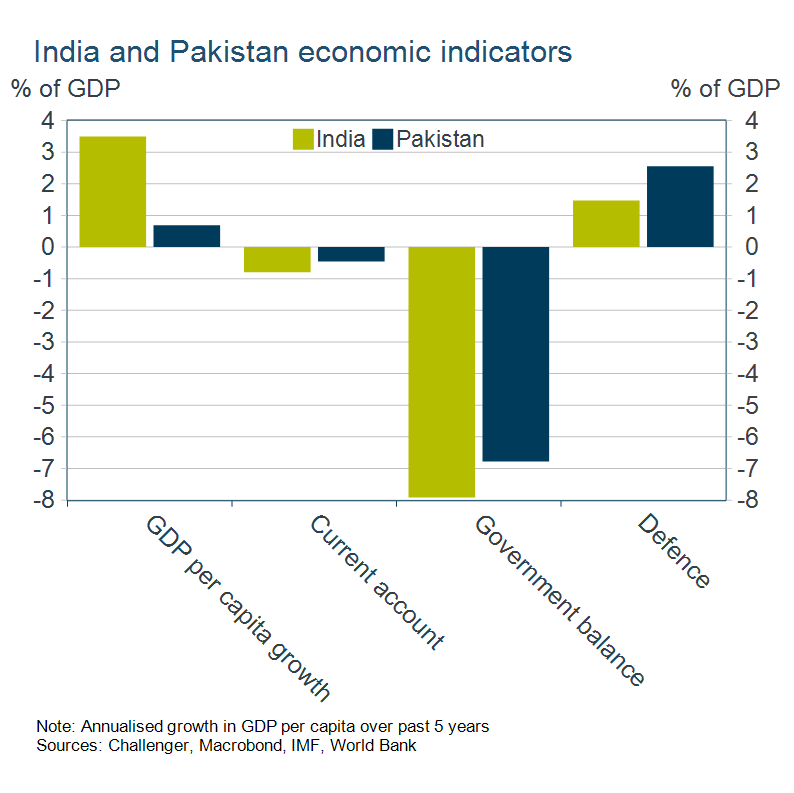

Government debt in both countries is 70-80% of GDP, but most of this is domestically held. Both have large Government budget deficits, demonstrating limited capacity for further fiscal spending.

India’s economy has been growing strongly, with growth in GDP per capita averaging an impressive 5% over the past fifteen years. By contrast, Pakistan’s economic growth has been weaker at 1.7% and it has needed financial assistance from the IMF. Defence spending in Pakistan, as a share of the economy, is double that in India, however the value of defence spending and size of the military in India is substantially larger than in Pakistan given its economy is ten times as large.

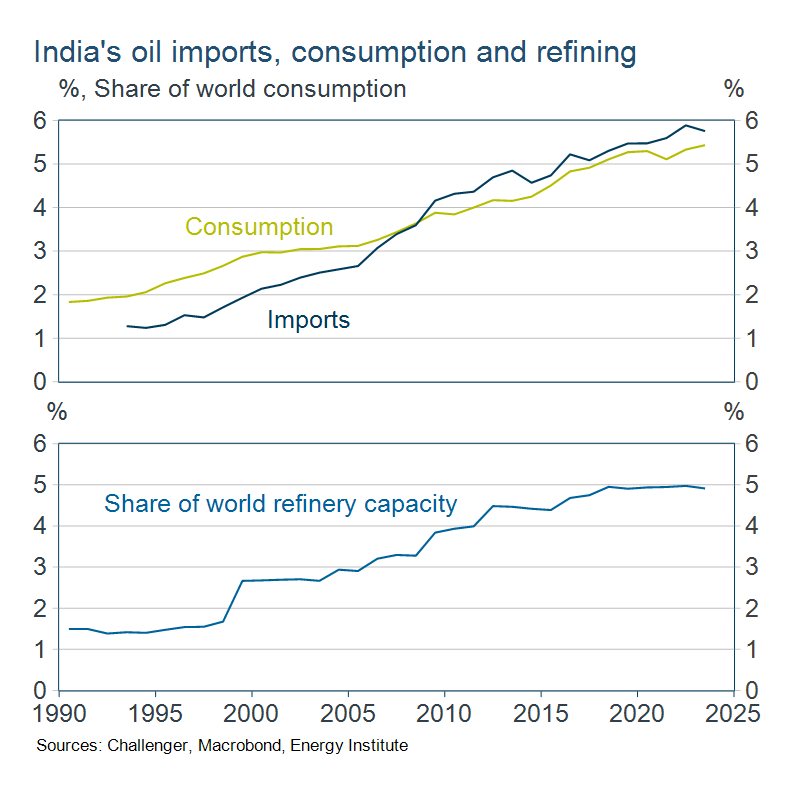

The oil market is one area where a disruption to India’s trade would have a significant global impact. India is the third highest consumer of energy, behind China and the United States. India’s imports and consumption accounts for almost 6% of global consumption. Oil and petroleum is both India’s largest import and export as it imports crude oil and exports refined products. India accounts for 5% of global refinery capacity and so any disruption would impact the market for refined products.

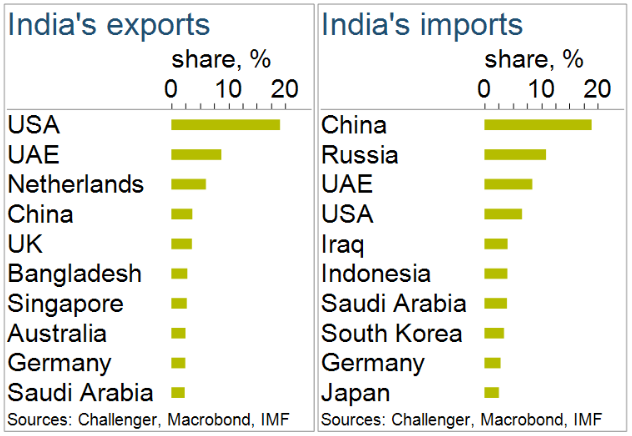

The United States is India’s largest export market, and Australia the seventh largest destination. The largest sources of imports reflect its dependence on foreign oil, coming from China, Russia and the UAE.

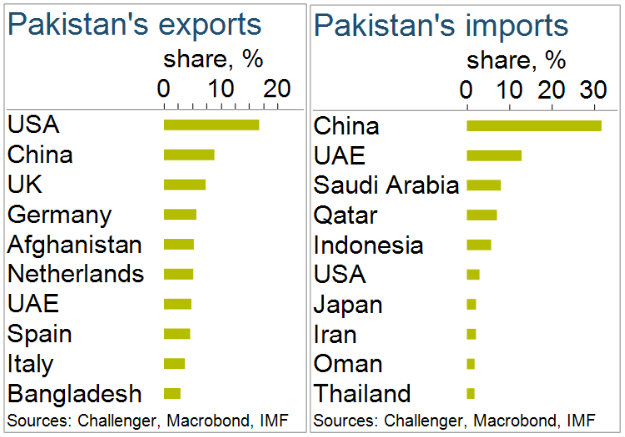

The United States is also Pakistan’s largest export market, and China it’s largest source of imports. Pakistan’s most significant exports are textiles, apparel and food products. This composition, and its small size, mean a disruption to its trade would have less global ramifications.