The 'need to knows' of retirement planning

Retirement advice can be challenging, dealing with key questions like how long will the clients income need to last, how much can they afford to spend and how much of their income is required to meet essentials?

Advisers are also required to have an understanding of various technicalities associated with superannuation contributions and retirement income streams so that appropriate strategies can be considered.

This month’s article discusses these key considerations and other ‘need to knows’ when providing retirement advice and how advisers can address them with clients.

How long does income in retirement need to last?

One of the challenges with retirement advice is determining a suitable timeframe for a client’s income to last. This usually requires an estimate of how long clients will live. Traditionally, period life tables from the Australian Bureau of Statistics have been one method used to estimate a person’s life expectancy (LE) and therefore as a base for determining capital adequacy. The 2015-2017 Australian Life Tables currently used for social security and tax purposes are one example, the government will release new life tables that will take effect from 1 January 2025.

Period life tables estimate life expectancy at different ages over a short period of time (typically three years for Australian life tables). During this period, mortality will generally have remained relatively constant and as such, period life expectancies only provide a snapshot of mortality at a particular point in time. In other words, they do not factor in mortality improvements overtime, for example, from healthier living and medical advances.

An alternative measure of life expectancy that takes into account improvements in mortality is ‘cohort’ life expectancy. Furthermore, studies have shown that those in a relationship have longer life expectancies than their single counterparts, an important consideration when determining suitable timeframes for couples.

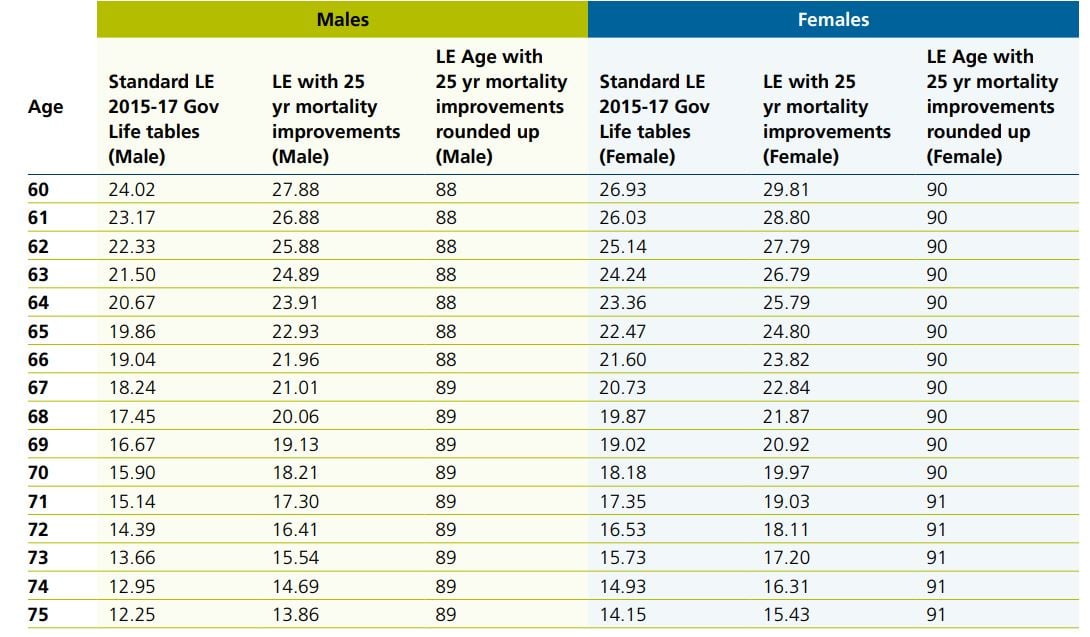

If we apply the Australian Government Actuary’s 25-year mortality improvement factors to the 2015-17 Australian Life Tables, we can estimate cohort life expectancy for individuals (Table 1) as well as couples (Table 2).

Table 1. Period and cohort life expectancy estimates for individuals

Table 2. Cohort life expectancy of couples

For example, a 67-year old male is expected to live for another 18.24 years based on the 2015-17 Australian Life Tables. Factoring the government’s 25-year mortality improvement factors, this increases to 21.01 years (or age 89). If the male was a member of a couple with a 67-year old female, the couple’s life expectancy with the 25-year improvement factors is 26.6 years or age 94.

Challenger’s Retirement Illustrator can be used to determine cohort life expectancies for clients up to age 85 and is accessible to advisers via AdviserOnline.

How much can retirees afford to spend?

“How much can I afford to spend in retirement?” is a question many retirees seek clarity on to help with making spending decisions.

Calculating a ‘safe’ level of retirement spending for a client is a challenging task and requires an understanding of many variables and making several assumptions. For example, how long will clients live, what will investment returns be over the client’s lifetime, will the client be eligible for the Age Pension and how will spending patterns change over time?

It is perhaps a question only possible to answer definitively in hindsight with knowledge of these variables. However, an estimate of a ‘safe’ level of spending can still be useful in assisting with spending decisions in retirement. Challenger’s Retirement Illustrator can be used to estimate a ‘safe’ spending level and is accessible to advisers via AdviserOnline.

The tool works out the probability that a nominated level of income can be achieved until life expectancy (with 25-year improvement factors applied). Probabilities are based on the number of different scenarios (out of 2,000) which successfully provided the nominated level of income, indexed to CPI each year, until life expectancy. Each scenario applies different asset class returns and related market indicators, such as the level of inflation and interest rates, year on year. The market scenarios are provided by Moody’s Analytics and are designed to be representative of how real-world markets could behave in the future.

Whether a particular probability produced by the tool is accepted as ‘safe’ will depend on individual clients and what they consider as ‘safe. Conservative clients will likely look for a probability that is as close to 100% as possible.

Example: Joe and Josephine

Joe and Josephine, both age 67, are recent retirees who own their home and have $1,000,000 each in superannuation savings. They want to be able to spend comfortably but also confidently in retirement. Their challenge to their financial planner was to develop a retirement drawdown strategy that lets them draw the highest retirement income possible each year, so they can enjoy their retirement to the fullest, and with a suitably high level of confidence or probability that this level of income could continue to be achieved throughout a long retirement.

Using Challenger’s Retirement illustrator, their financial planner tested a range of retirement income drawdowns across two strategies:

- Investing their superannuation savings in an account-based pension in line with their ‘balanced’ risk tolerance (50/50 growth/defensive asset allocation).

- Investing their superannuation across two income streams – 30% allocation to a lifetime annuity and 70% in an account-based pension. The lifetime annuity is considered a defensive asset and with the account-based pension invested with a 71/29 growth/defensive asset allocation, their overall portfolio is in line with their ‘balanced’ risk tolerance. Challenger’s Retirement Illustrator can be used to estimate a ‘safe’ spending level and is accessible to advisers via AdviserOnline.

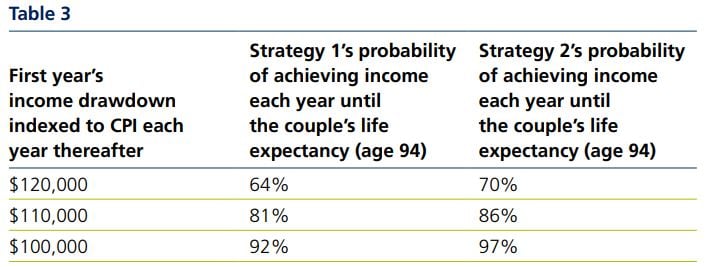

The table below summarises the financial planner’s findings:

The probabilities are based on testing each income drawdown strategy across the 2,000 different market scenarios provided by Moody’s. With a starting drawdown of $100,000, and increasing by CPI each year thereafter, 1,840 of the 2,000 (92%) different market scenarios under strategy 1 allowed Joe and Josephine to achieve this level of income each year until age 94. If Joe and Josephine invested 30% of their superannuation savings into a lifetime annuity, they can increase this probability to 97%.

How much do retirees need and how can it be secured?

Having income that secures the essentials for life can provide retirees with confidence to spend and enjoy their retirement, particularly in the early years when they typically have the health to do so.

Research from National Seniors Australia (NSA) in September 20231 found that 91% of respondents rate having regular income for essentials as very important. 83% of respondents also rate having money that lasts a lifetime as very important to them.

Recent research2 from NSA also found that at least 50% of homeowners thought a basic lifestyle required an annual income of more than $39,000 p.a. for singles and more than $56,000 p.a. for couples. What is considered ‘essential’ can be different for different retirees and can include different expenses.

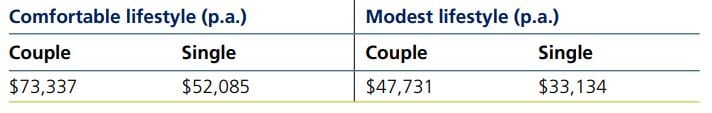

Those with housing costs (rent, mortgages) are likely to have higher essentials than those that don’t. A useful tool that can be used to estimate a retiree’s essentials is the Association of Superannuation Funds of Australia (ASFA)’s retirement standards.

The retirement standards provide a detailed breakdown of expenditure required for both a comfortable and modest lifestyle in retirement, for both singles and couples. The amount identified by ASFA to provide a modest lifestyle can be a useful starting point for what a retiree requires to meet their essentials.

Budgets for various households and living standards for those aged 65-84 (June quarter 2024)

Source: ASFA retirement standards

Retirees wanting to identify their essentials based on their own circumstances can use budgeting tools such as Challenger’s Retirement Spending Planners, accessible here on the Challenger website.

Once essentials have been identified lifetime income streams such as lifetime annuities can be used to complement any expected Age Pension entitlements to help secure these essentials for life.

Example: Charlotte

Charlotte, age 67, is single and owns her own home. She’s worked hard all her life, managing to accumulate $800,000 in retirement savings. She is keen to make the most of her savings to enjoy a comfortable retirement. She believes she’ll need $65,000 p.a. to do all the things she has looked forward to in retirement. However, she also wants to be responsible with her savings and ensure that they can also provide for her essentials for as long as she lives. She estimates that she will need $39,000 p.a. to meet her essentials.

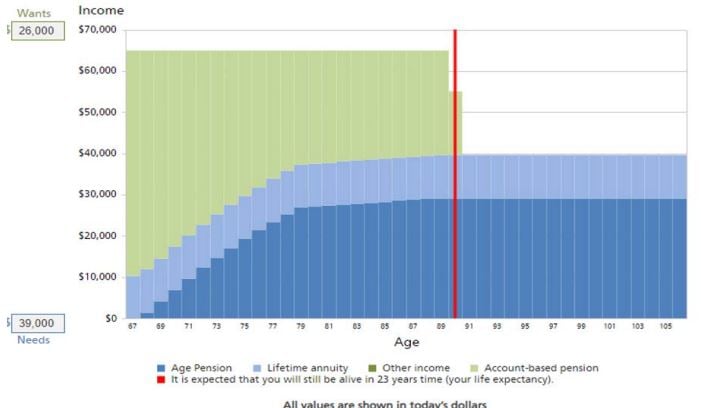

If Charlotte invests her retirement savings across a combination of income streams – 75% in an account-based pension and 25% into a CPI-linked lifetime annuity – she would be able to meet all of her income objectives.

Her account-based pension would provide her with the flexibility to draw the required level of income to meet her lifestyle expenses and the ability to access her capital if required. She would be able to access growth asset classes within her account-based pension to maximise potential longer term returns allowing her capital to last as long as possible.

In the event that she depletes her retirement savings, she would still be able to have at least $39,000 p.a. of income from her lifetime annuity and Age Pension entitlement to meet her essentials for life. The chart below summaries Charlotte’s projected retirement income using Challenger’s Retirement Illustrator.

Projected retirement income

This chart shows the sources of the illustrated retirement cash flow. In any year where income received exceeds the target income, the excess is saved in cash.

Source: Challenger Retirement Illustrator as at 7/11/2024 using the tool’s default assumptions accessible via AdviserOnline.

How are retirement income streams assessed for social security?

Centrelink/DVA classify income streams into the following categories:

- Account-based • Lifetime, life expectancy or term certain

- Market-linked (term allocated pensions)

- Defined benefit, and

- Pooled lifetime (purchased on or after 1 July 2019)

Each of these types of income streams are assessed differently for Centrelink/ DVA purposes, some also have different assessments depending on when they commenced.

Account-based income streams

Under the assets test, account-based income streams such as account-based pensions and allocated pensions have their account balance assessed. Under the income test, account-based income streams have their account balance subject to deeming rules if commenced on or after 1 January 2015. Those that commenced prior to this date and where the income support recipient has been in continual3 receipt of an income support payment (such as the Age Pension) from 31 December 2014, are subject to the deduction method.

Assessable income under the deduction method is calculated as:

Gross annual payment – deduction amount

Where the deduction amount = purchase price (less any lumpsum withdrawals) / life expectancy at the policy commencement4

Lifetime, life expectancy or term certain income streams

Under the assets test, these types of income streams are assessed using the deduction method. The purchase price is assessed initially but is reduced annually by the deduction amount. If regular payments are more frequent than annual, the assessed asset value is reduced every 6 months by half of the deduction amount. For lifetime income streams, the deduction amount is calculated in the same way as account-based income streams above.

For life expectancy and term certain income streams, the deduction amount is calculated as:

Purchase price less lumpsum withdrawals less residual capital value/term

Lifetime or life expectancy income streams that meets the rules for either a 100% or 50% assets test exemption (generally commenced prior to 20 September 2007) have their calculated assessable asset values reduced by the relevant exemption. Under the income test, these income streams are assessed using the same deduction method as account-based income streams above. However, deeming rules apply to term certain income streams where the term at commencement is 5 years or less and is not as long as the investor’s life expectancy. Where deeming rules apply, it is the calculated assessable asset value that is subject to deeming.

Market-linked (term allocated pensions) income streams

Market-linked income streams (or term allocated pensions) have their account balance assessed under the assets test but the assessed value is reduced by 50% if they meet the requirements for the assets test exemption.

Under the income test, assessable income is calculated using the same deduction method as account-based income streams above.

Defined benefit income streams Defined benefit income streams are generally not assessable under the assets test. Under the income test, their gross payment is assessed, reduced by a deductible amount.

The deductible amount for defined benefit income streams is generally the tax-free component of the regular payments capped at 10% of the gross payment. However, the 10% cap does not apply if the defined benefit is one of the following three military schemes or the person is a DVA customer (receiving income support payments under DVA and not Centrelink):

- Defence Force Retirement & Death Benefits Scheme (DFRDB)

- Military Superannuation & Benefits Scheme (MilitarySuper), and

- Defence Force Retirement Benefits Scheme (DFRB)

Pooled lifetime income streams

These are lifetime income streams that commence on or after 1 July 2019 and comply with the government’s Capital Access Schedule (CAS). The CAS limits the amount an investor is able to receive as lumpsum on voluntary withdrawal or death. Lifetime income streams that comply with CAS have only 60% of the purchase price assessed until age 845 (subject to a minimum of 5 years) and then 30% thereafter. Under the income test, only 60% of their regular payments are assessed.

Can a retiree make super contributions?

Superannuation contribution rules have been constantly changing over the last decade affecting the ability of retirees to make superannuation contributions. These rules become particularly important when considering recontribution strategies that help maximise tax efficiency of any death benefits paid to dependants, or when considering maximising deductible contributions to help reduce capital gains tax on the sale of assets to fund retirement.

Details of the current superannuation contribution rules and caps including key considerations and traps can be found in our October edition of Tech News here.

How much can retirees transfer to tax effective retirement income streams?

On 1 July 2017, the government introduced limits on how much individuals can transfer to tax effective retirement phase income streams known as the transfer balance cap.

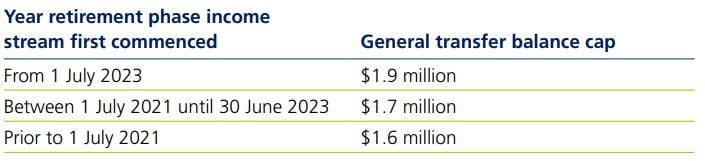

The general transfer balance cap is currently $1.9 million but an individual’s personal transfer balance cap can be different and depends on when they first commenced a retirement phase income stream and whether any partial indexation applied to their cap. When an individual first commences a retirement phase income stream, their personal transfer balance cap will be the general transfer balance cap that applies at that time (summarised in the table below)

An individual’s personal transfer balance cap can be indexed each time the general transfer balance cap is indexed as follows:

- If the individual has used their entire personal transfer balance cap at any point in the past, no indexation will apply. This is the case even if the client currently has remaining cap space (from lumpsum withdrawals for example).

- If the individual has not used up their entire personal transfer balance cap at any point in the past, proportional indexation applies based on the highest ever amount of their cap used in the past.

The exact calculation for the amount of proportional indexation an individual is entitled to is detailed here on the ATO website. Individuals can also find their current personal transfer balance cap and any remaining cap space on the ATO’s online portal via myGov.

Related content

1 The cost of living and older Australian’s financial well being September 2023 - The Cost of Living and Financial Wellbeing - National Seniors Australia.

2 Older people’s financial wellbeing and preferences September 2024 - Older people’s financial wellbeing and preferences - National Seniors Australia

3 If the account-based income stream was a reversionary, the reversionary beneficiary was in receipt of an income support payment at the time of reversion, and to maintain ‘grandfathered’ status, continuously thereafter.

4 Life expectancy factors used by Centrelink/DVA are based on the relevant Australian Life Tables published by the Australian Government Actuary. Where there is a reversionary nominated, the longer life expectancy factor of the two investors is used

5 The rules link this age to the life expectancy of a 65 year old male and is subject to change with the introduction of new life tables in the future

The information in this article is current as at 1 November 2024 unless otherwise specified and is provided by Challenger Life Company Limited ABN 44 072 486 938, AFSL 234670 (Challenger, our, we), the issuer of the Challenger annuities (Annuity(ies)) and Challenger Retirement and Investment Services Limited ABN 80 115 534 453, AFSL 295642 (CRISL). The information in this article is general information only about our financial products and is intended solely for licensed financial advisers or authorised representatives of licensed financial advisers, and is provided to them on a confidential basis. It is not intended to constitute financial product advice. This information must not be distributed, delivered, disclosed or otherwise disseminated to any investor, without our express prior approval. Investors should consider the applicable Annuity Target Market Determination (TMD) and Product Disclosure Statement (PDS) available at challenger.com.au and the appropriateness of the applicable product to their circumstances before making an investment decision. This information has been prepared without taking into account any person’s objectives, financial situation or needs. Neither Challenger and/or CRISL, nor any of its officers or employees, are a registered tax agent or a registered tax (financial) adviser under the Tax Agent Services Act 2009 (Cth) and none of them is licensed or authorised to provide tax or social security advice. Before acting, we strongly recommend that prospective investors obtain financial product advice, as well as taxation and applicable social security advice, from qualified professional advisers who are able to take into account the investor’s individual circumstances. Each person should, therefore, consider its appropriateness having regard to these matters and the information in the Target Market Determination (TMD) and Product Disclosure Statement (PDS) for the applicable Annuity before deciding whether to acquire or continue to hold the product. A copy of the TMD and PDS is available at challenger.com.au or by contacting our Adviser Services Team on 13 35 66. Any examples shown in this article are for illustrative purposes only and are not a prediction or guarantee of any particular outcome. Age Pension benefits described in this article will not apply to all individuals. Age Pension outcomes depend on an individual (or couple’s) personal circumstances and may change over time. This article may include statements of opinion, forward looking statements, forecasts or predictions based on current expectations about future events and results. Actual results may be materially different from those shown. This is because outcomes reflect the assumptions made and may be affected by known or unknown risks and uncertainties that are not able to be presently identified. Challenger and CRISL relied on publicly available information and sources believed to be reliable, however, the information has not been independently verified by Challenger and CRISL. While due care and attention has been exercised in the preparation of this information, Challenger and CRISL gives no representation or warranty (express or implied) as to its accuracy, completeness or reliability. The information presented in this article is not intended to be a complete statement or summary of the matters to which reference is made in this article. To the maximum extent permissible under law, neither Challenger, CRISL, nor its related entities, nor any of their directors, employees or agents, accept any liability for any loss or damage in connection with the use of or reliance on all or part of, or any omission inadequacy or inaccuracy in, the information in this article.

Stay informed

Sign up to our free monthly adviser newsletter, Tech news containing the latest technical articles, economic updates, retirement insights, product news and events.